In today’s world, people use multiple devices, and as marketers, we often focus on computers, tablets, and mobile devices. However, we shouldn’t forget about other screens that capture our audience’s attention. Recently, Google introduced a new device type for YouTube campaign targeting: smart TV screens!

According to Google highlights that users spend a significant amount of time, over 180 million hours daily, watching YouTube on TV screens, including set-top boxes, gaming consoles, streaming devices like Chromecasts, and numerous smart TVs. This trend is particularly important as younger viewers move away from traditional TV and cable, making streaming services like YouTube a more effective way to reach them.

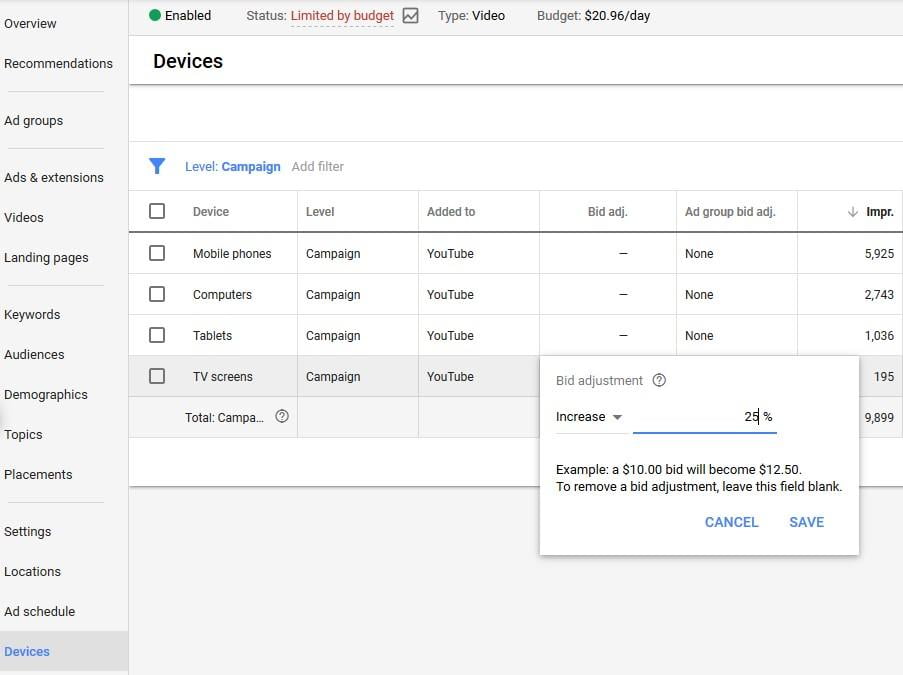

Advertisers can now manage the reach of their video campaigns on smart TV screens just like they do for computers, tablets, and mobile devices. Using Google Ads, they can set device bid adjustments for smart TV screens at either the campaign or ad group level, ranging from positive adjustments (up to +900%) to negative adjustments (as low as -100%, effectively preventing ads from appearing on that device).

How will this affect my campaigns?

While we anticipate that users will engage with their living room TVs differently than other devices, initial results are encouraging. Google reports that YouTube ads displayed on TVs showed an average 35% increase in ad recall and a 47% increase in purchase intent.

This impact is significant but limited to those who actually see your ad on TV screens. Since advertising costs money, it’s crucial to understand the effectiveness of advertising on TV screens. To explore this further, we analyzed data from several hundred advertisers.

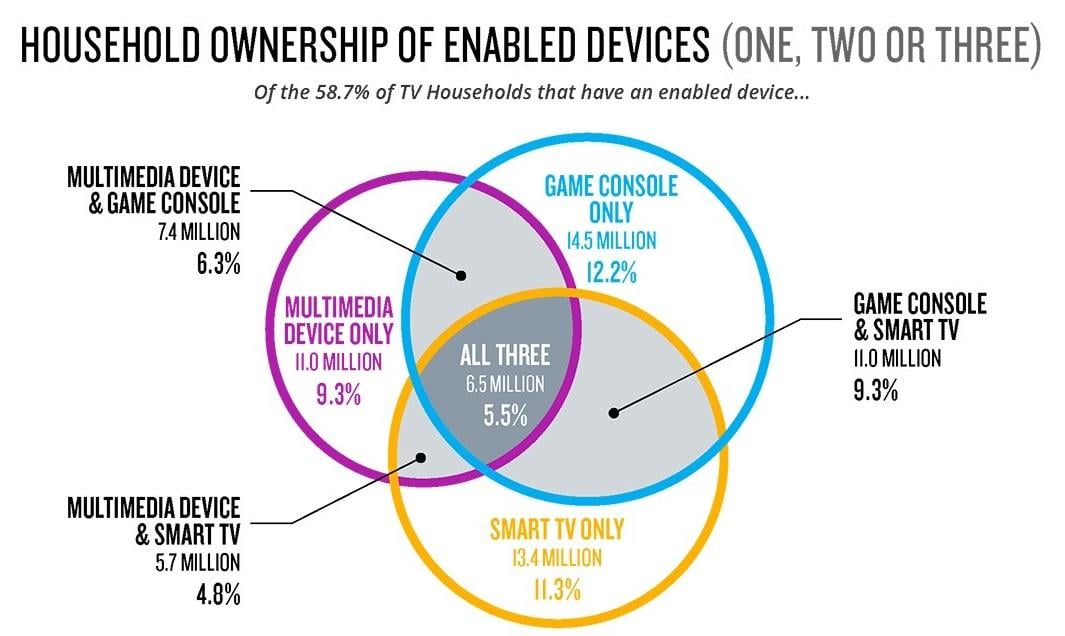

Let’s start by acknowledging the prevalence of internet-connected TVs. According to Nielsen, over half (58.7%) of US households possess at least one internet-enabled device capable of streaming to a TV. This aligns with Pew’s research indicating that most Americans own a smartphone (77%), tablet (55%), or computer (73%).

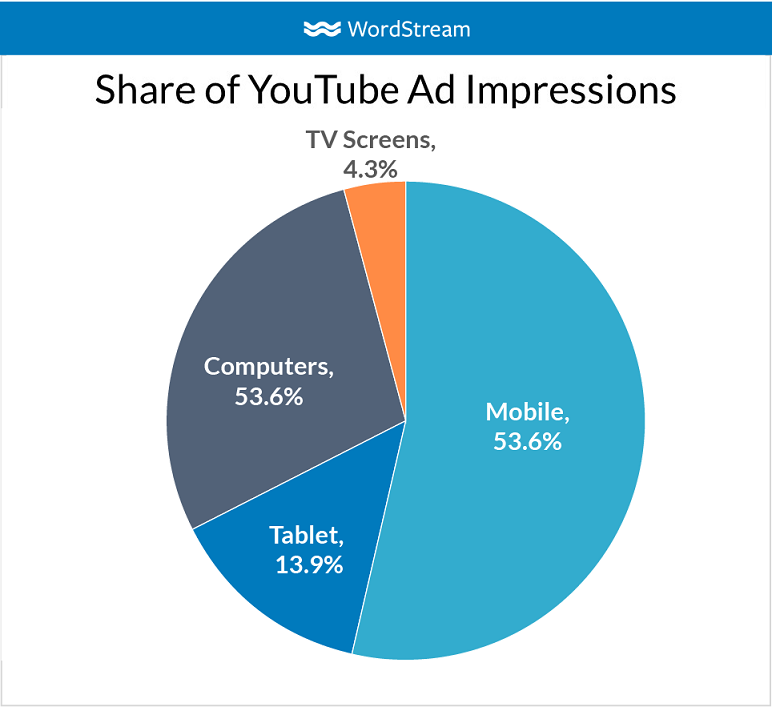

However, not all internet connections are equal when it comes to the reach of YouTube ads. Only about 30.3% of households specifically have a smart TV, resulting in TV screens representing a smaller portion of YouTube campaign reach, with only 4.3% of all impressions. Similar to mobile search, mobile devices account for the majority of impressions on YouTube (53.6%).

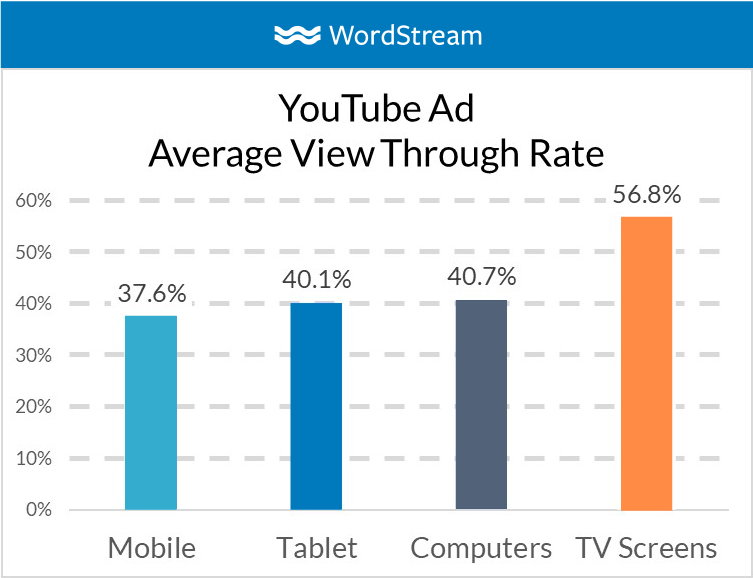

Despite their smaller share, the YouTube audience on TV screens may be the most engaged. Our findings suggest that while users watching YouTube on mobile devices are more prone to skipping TrueView ads, those on larger screens tend to watch them. Remarkably, users watching YouTube on TV screens have an impressive average view-through rate of 56.8%, exceeding other devices by over 50%!

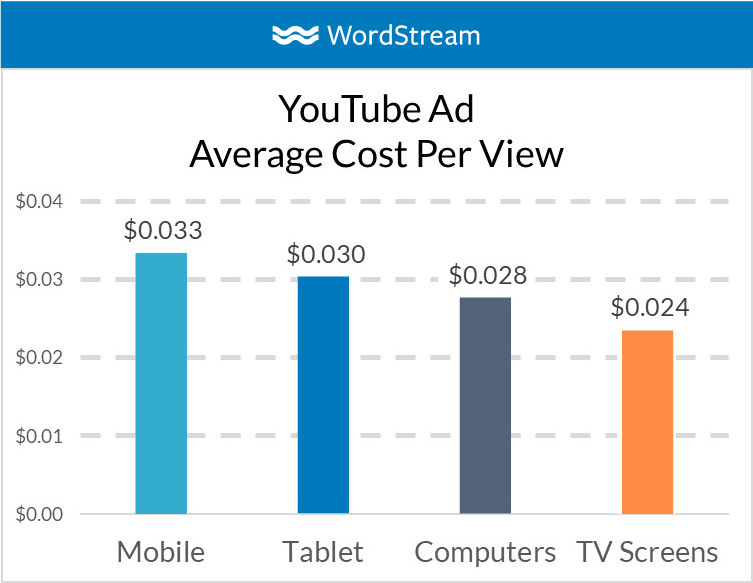

While these views come at a cost, advertisers will be pleased to know that these ads are budget-friendly. On average, YouTube ads cost a few cents per view across devices, with the newest ads on TV screens having the lowest cost per view (CPV). These new ads cost slightly over 2 cents per view, almost a full cent less than what we observe on mobile screens.

Advertising on smart TVs offers several benefits. However, marketers need to adapt their approach to engage viewers on this platform. While YouTube advertisers have various different campaign strategies or methods to encourage users to respond directly to their video ads and drive conversions on their websites through computers, tablets, and mobile devices, viewers on TV screens might be less inclined or even unable to click through to a website on that device. Therefore, while advertisers on TV screens may not see immediate conversions from these ads, they should recognize the valuable role these ads play in a multi-channel conversion journey.

Data sources

This post’s aggregated data comes from a sample of 644 nexus-security client accounts advertising on YouTube between October 24 and 31, 2018. Only USD clients were considered when calculating CPV.