In my early days as an SEO professional, working with emerging startups, I considered branded searches the least interesting aspect of SEO and PPC. These searches, often generated by other marketing efforts, seemed like a given in terms of organic ranking and only required minimal effort to “defend” in PPC. This led me to question their significance.

However, as my experience grew and I collaborated with companies of diverse scales and structures, I discovered that branded searches constitute a substantial portion of organic and paid traffic for numerous websites. Moreover, for large-scale brands, this traffic translates into millions of dollars in revenue. I also became aware of the various forms of “branded searches,” including “{brand name} reviews” and “{brand name} coupons,” which hold considerable value but can present unexpected challenges for brands striving to rank and maintain their position.

Recently, a particular realization struck me: branded searches represent a remarkable growth prospect for Google.

While it’s widely known that a significant portion of Google’s (and Alphabet’s) revenue originates from AdWords, specifically paid search, many (though not most, surprisingly) are unaware of the extent of this reliance. The prevalent assumption is that this expenditure stems from the effectiveness of search advertising, with businesses eager to reach users actively seeking specific products or services.

As someone who owns a search marketing consultancy and several web properties primarily driven by search traffic, I firmly believe in the potency and value of unbranded search traffic. However, I also believe that the extent to which Google’s revenue relies on branded search is not fully understood.

Furthermore, I posit that the general shift toward mobile searches presents a significant opportunity for Google to substantially increase revenue from branded searches, at least in the near term.

Let’s explore why.

Mobile and Brand Searches: An Intertwined Relationship

While the proportion of mobile search users varies across industries and topics, data from Google and Hitwise indicate that mobile searches currently account for responsible for more than half of all Google searches of all searches, and possibly even more than 60%. It’s reasonable to anticipate continued growth in this area.

Intrigued by these trends, I decided to delve into two key questions:

- What is the true value of branded searches for Google, the brands involved, and their competitors?

- How do Google search results for high-value branded terms compare on mobile and desktop devices?

This post will examine estimates of the actual worth of branded searches and provide a side-by-side comparison of desktop and mobile search results for billion-dollar branded terms. The goal is to demonstrate why I believe a significant portion of organic search traffic for these terms will transition to paid traffic, generating substantial advertising revenue for Google.

Quantifying the Value of Branded Searches

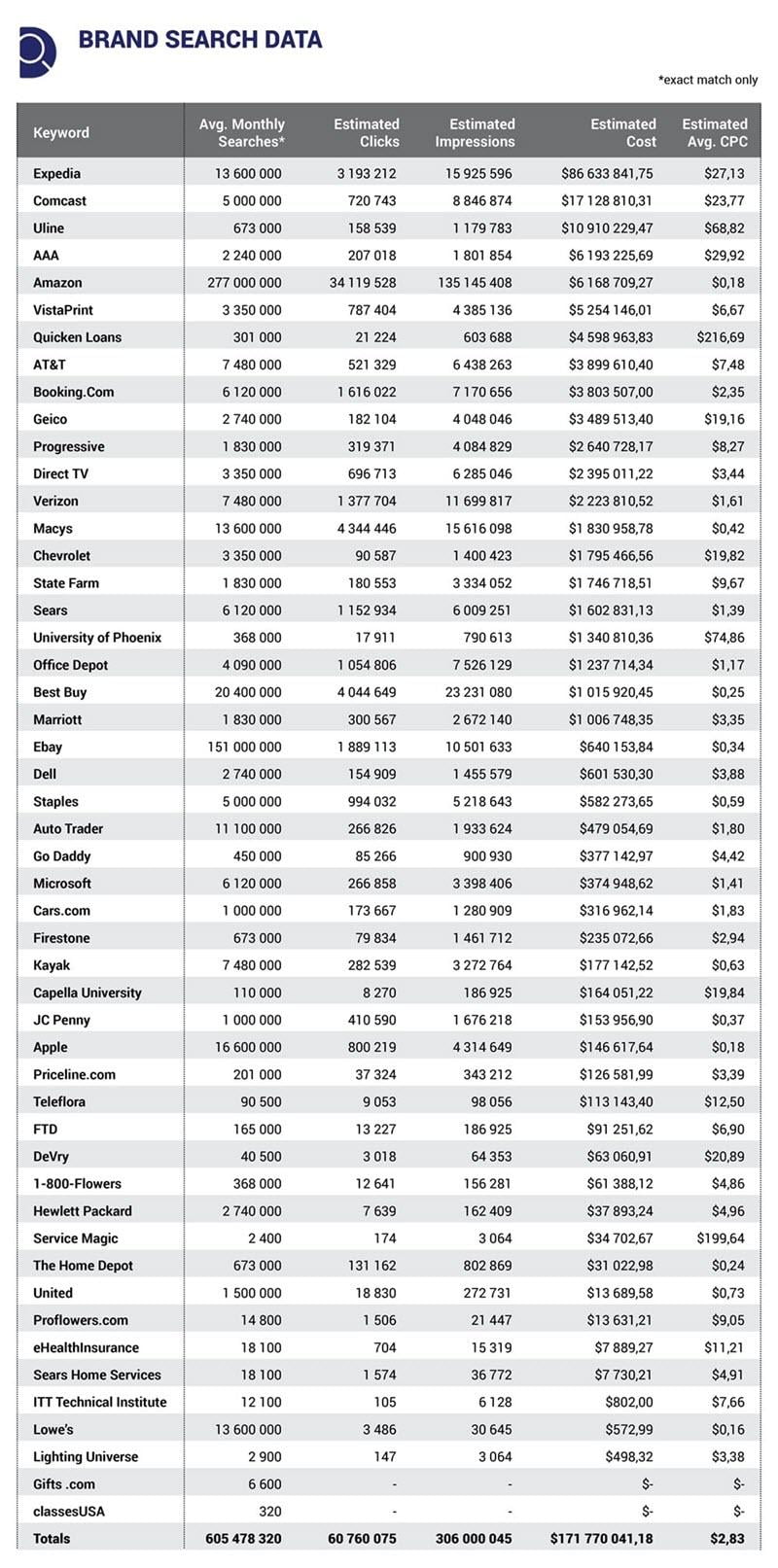

To begin, I examined the branded traffic and clicks for the top five advertisers in Google’s most lucrative industries, referencing a nexus-security study conducted a few years ago. While not an exhaustive representation of all brand searches on Google, and acknowledging the possibility of other brands with higher search volume and costs, I considered it a suitable starting point to gauge the potential opportunity.

Here’s a projection of estimated data for branded searches for these 50 companies:

Estimated costs for top brand searches A few points to note about this data:

- These projections are based on exact match forecasts from Google’s Keyword Planner. Therefore, the global branded search volume for variations of these terms is likely considerably higher.

- The estimates are inherently approximate. For instance, the tool struggled to estimate branded traffic for Gifts.com due to the prevalence of type-in traffic.

- The actual cost per click for these brands would likely be significantly lower due to their high Quality Scores. To provide a sense of the global market, bids and budgets were raised to extremely high levels. Since the brand would capture most clicks, the figures are almost certainly inflated.

Despite these caveats, the numbers were compelling. Over $171 million per month for a mere 50 brands translates to over $2 billion annually. While this represents a small fraction of the total annual revenue for a company like Google, which generates 90 billion, consider the cumulative market for brand searches encompassing all consumer brands, Fortune 500 companies, local businesses, and more. It hints at a potentially substantial slice of a massive pie.

Having established the potential revenue generation of branded searches for Google, let’s explore how users experience them and the implications for brands.

Mobile vs. Desktop: A Tale of Two SERPs

Next, we’ll analyze the SERP layout for the branded search result of the highest-spending company in each of Google’s top-spending industries (again based on the aforementioned nexus-security study). In cases where the brand name was a URL (e.g., Booking.com), the second result was used.

The following screenshots compare the results on my personal laptop and phone. Naturally, some results will be influenced by my search history, and this analysis isn’t meant to be an exhaustive review of every screen size or device.

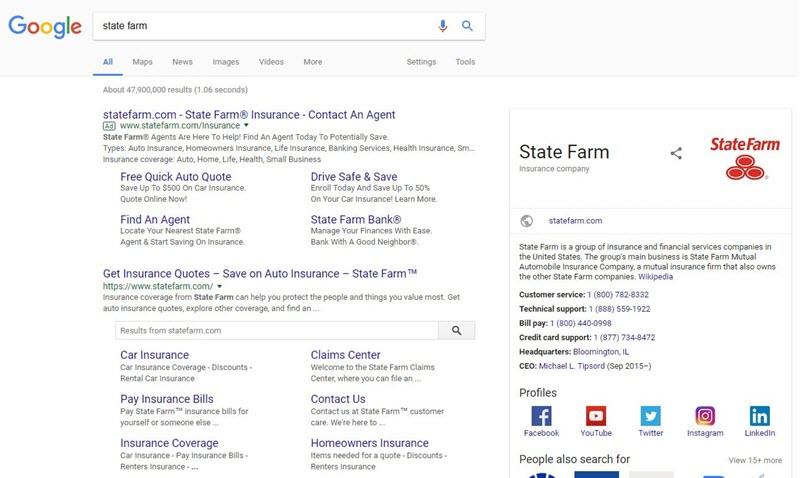

State Farm

Let’s begin with State Farm.

On desktop, their branded search result is quite favorable. While they do run an ad that occupies significant space, their website, a site search bar, and a company description (including their URL) are prominently featured.

In contrast, their mobile branded result displays only their ad above the fold. For a typical user seeking to contact State Farm or visit their website, it seems improbable they would scroll down to the organic listing without first enriching Google through a paid click. Desktop:

Mobile:

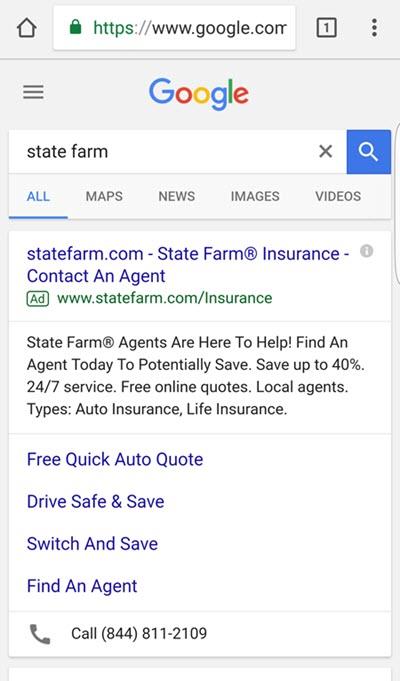

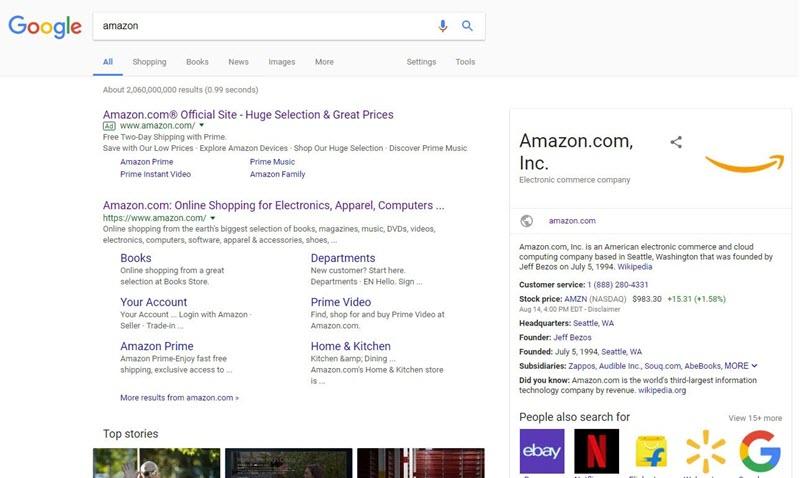

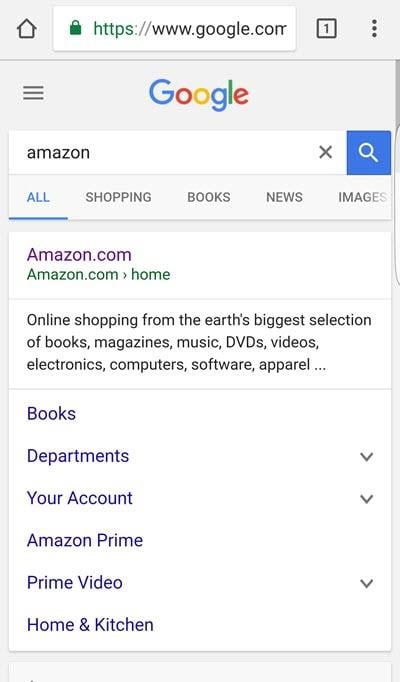

Amazon

Amazon appears to be reaping the most significant benefits from the shift to mobile. Their desktop result is positive, with prominent company information and a readily accessible organic listing. However, their mobile result (at least for me) is entirely organic! As we’ll see, this is far from the norm among the other brands.

Mobile:

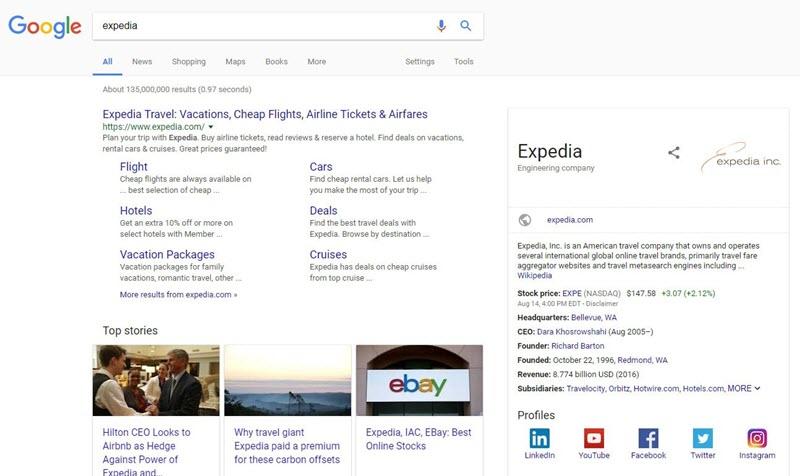

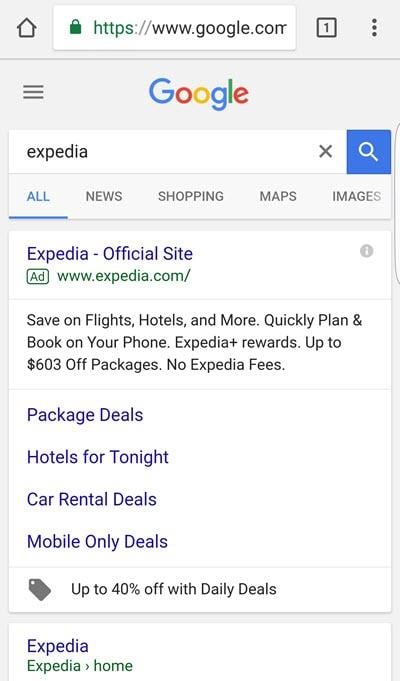

Expedia

Expedia’s experience is the opposite of Amazon’s. Their desktop layout is highly organic-friendly, featuring a large organic result, company information, and related news stories. In contrast, their mobile result consists solely of a large branded ad. Desktop:

Mobile:

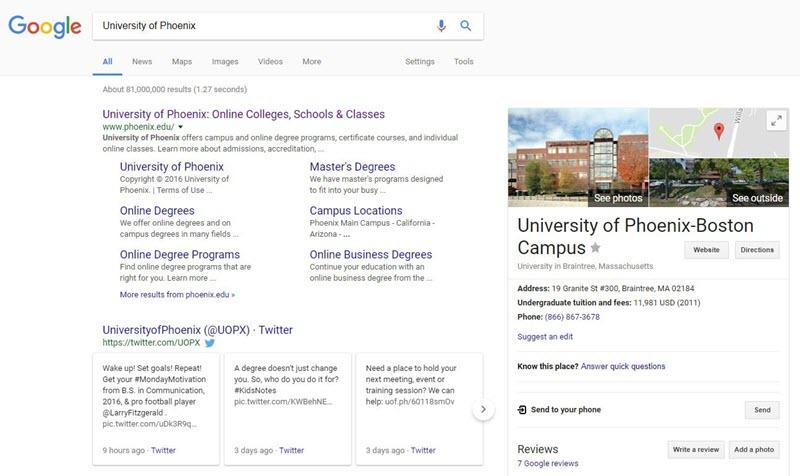

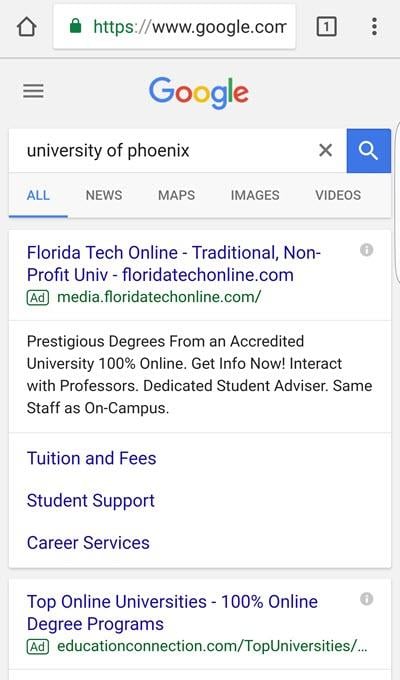

University of Phoenix

The University of Phoenix exhibits perhaps the most dramatic before-and-after transformation. Their desktop result showcases a prominent organic listing, their Twitter account, and a local campus listing. Conversely, their mobile result displays…a competitor’s ad!

Below this ad lies another listing from an affiliate site comparing different colleges. This is hardly the ideal destination for users who have been exposed to their extensive TV and radio campaigns. Desktop:

Mobile:

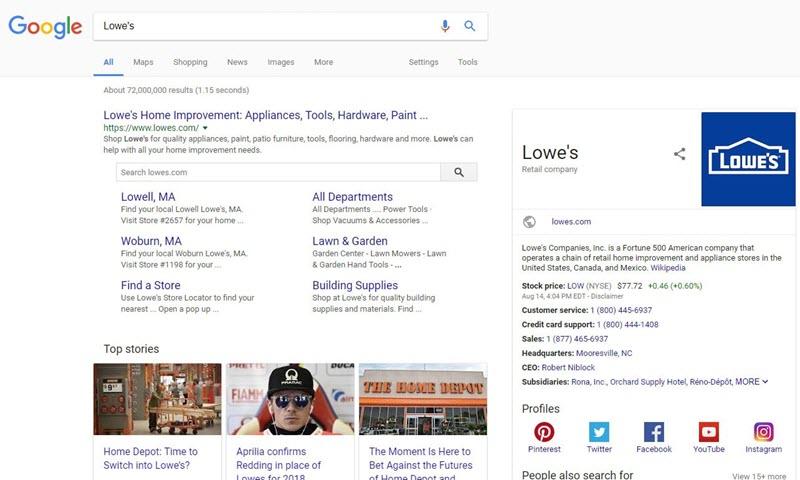

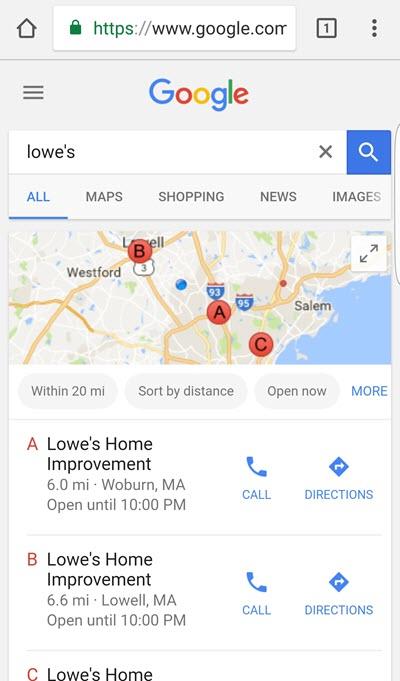

Lowe’s

Lowe’s emerges as one of the more fortunate brands in the transition to mobile. While their desktop result is already strong (abundant organic real estate, comprehensive company information, and a collection of news stories), their mobile result exclusively features a map and nearby Lowe’s locations. Desktop:

Mobile:

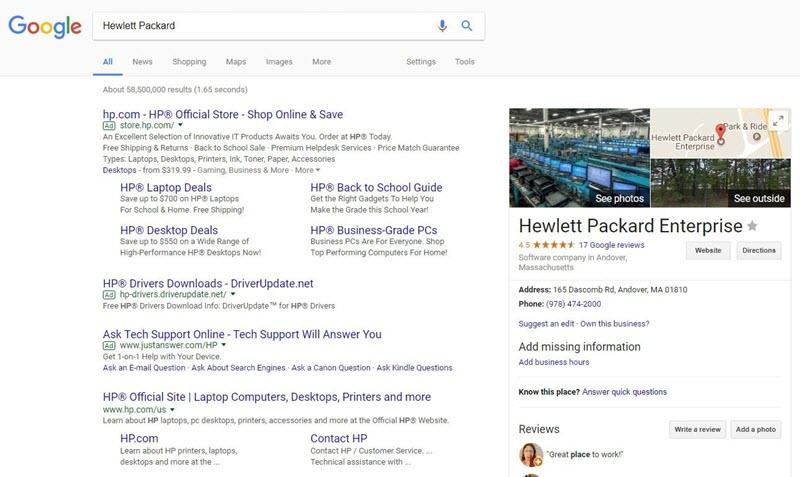

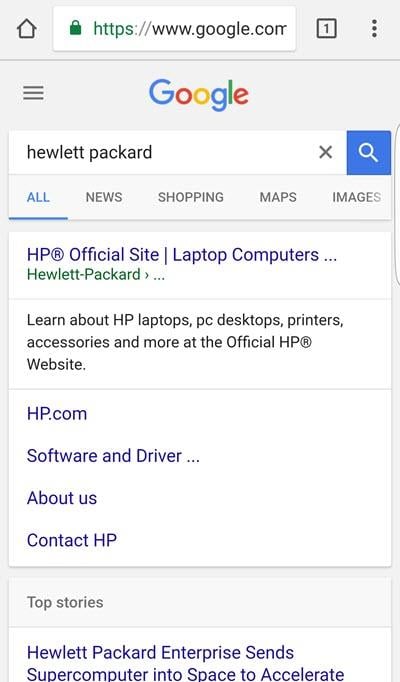

Hewlett Packard

HP’s desktop result, while displaying a significant number of ads, including two from resellers/competitors, still presents the organic listing and some general company information. However, their mobile result is dominated by ads, with only a glimpse of news results peeking through. This suggests a high probability of mobile users reaching their site via paid search clicks. Desktop:

Mobile:

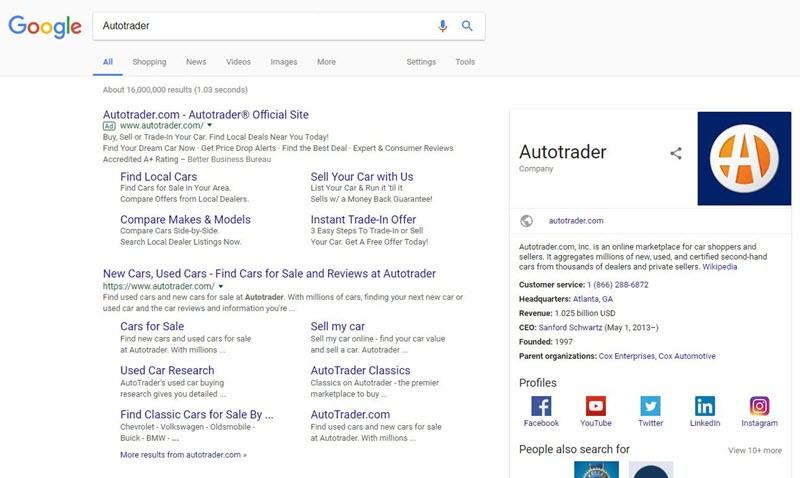

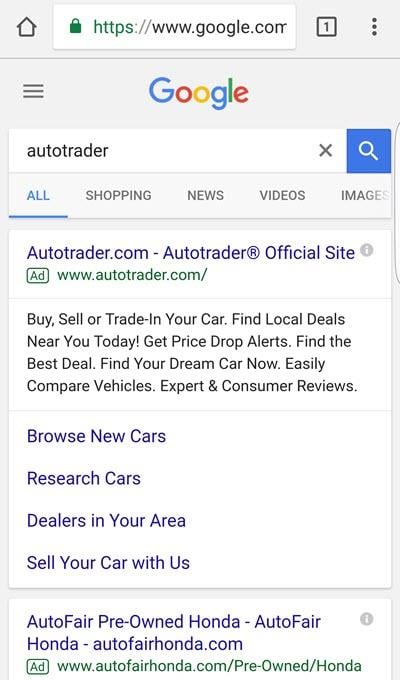

Autotrader

Autotrader’s desktop search results prominently display their organic listing, complete with multiple site links, company information, and a noticeable ad. On mobile, however, the immediately visible portion of the SERP consists entirely of ads. Desktop:

Mobile:

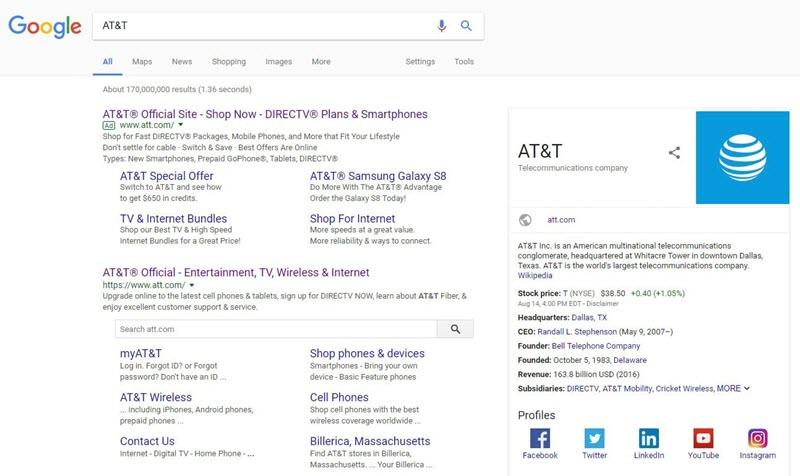

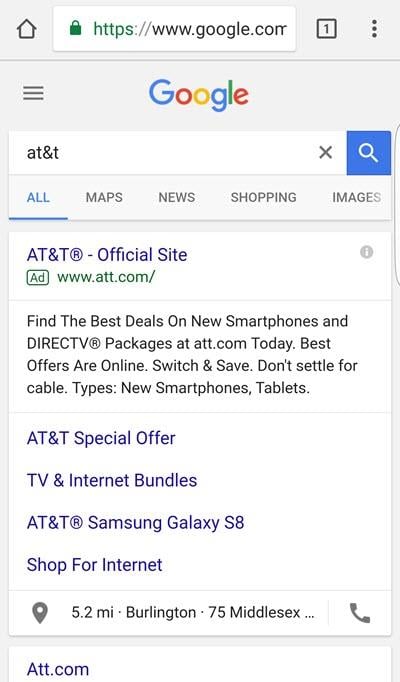

AT&T

AT&T’s desktop search, while featuring a large branded ad, allows for quick access to their organic listing, a site search box, sitelinks, and general company information in the right navigation.

On mobile? Only an ad is visible above the fold. Desktop:

Mobile:

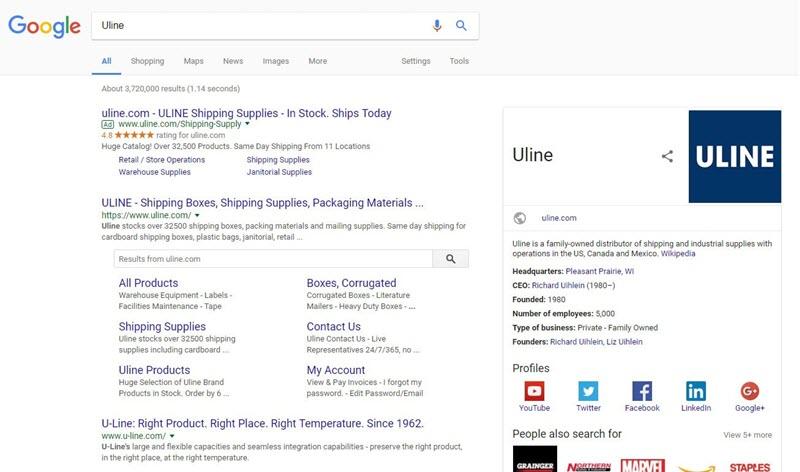

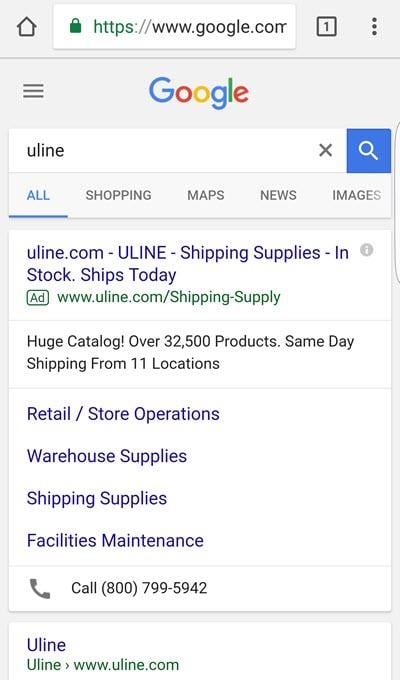

Uline

Continuing the trend, Uline’s desktop result presents a prominent organic listing beneath the paid listing, organic site links, a site search bar, and company information.

However, the visible portion of the mobile SERP reveals only their ad. Desktop:

Mobile:

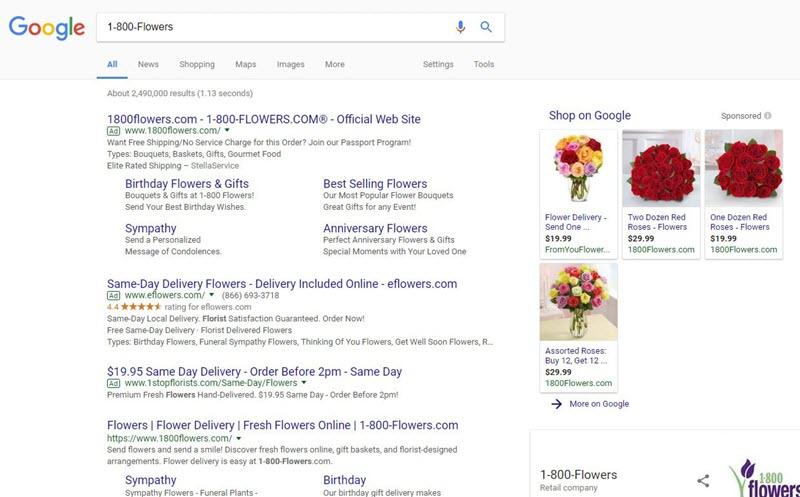

1-800-Flowers

1-800-Flowers suffers another setback in the move to mobile. Their ad-heavy desktop SERP, while cluttered with shopping results and competitor ads, offers a glimmer of hope with a sliver of organic presence above the fold. In contrast, their mobile experience above the fold showcases nothing but a competitor’s ad. Desktop:

Mobile:

While ten sets of screenshots cannot provide a comprehensive view of all branded searches on desktop versus mobile, considering the substantial revenue generated by these searches, the following observations are noteworthy:

- Only one brand (Amazon) experienced a decrease in ad density for their above-the-fold branded result.

- Only one brand (Lowe’s) maintained a relatively neutral result.

- The remaining eight brands witnessed their organic listing, visible on desktop, being replaced by an entirely ad-dominated above-the-fold experience on mobile. Shockingly, two brands even had competitors occupying nearly the entire above-the-fold space for their branded searches on mobile!

This signifies an equal number of brands losing their branded search visibility to competitors as those experiencing a neutral or positive change in ad real estate from desktop to mobile.

Implications for Brands Navigating the Mobile Shift

The analysis paints a clear picture:

- Branded searches are increasingly migrating from desktop to mobile.

- These searches represent significant revenue for Google and are highly valuable to brands (and their competitors).

- Some of the world’s largest brands face considerably more ad-saturated mobile results for branded searches compared to their desktop counterparts.

Beyond the disadvantage of less favorable search results as branded traffic shifts to mobile, another critical issue emerges: even if brands manage to safeguard their branded queries and attract mobile visitors, the monetization aspect may pose a challenge. This is because many websites have mobile versions that are inferior to their desktop counterparts, both in terms of design and maintenance. As a result, mobile traffic often monetizes less effectively than desktop traffic, even for high-intent searches like branded queries.

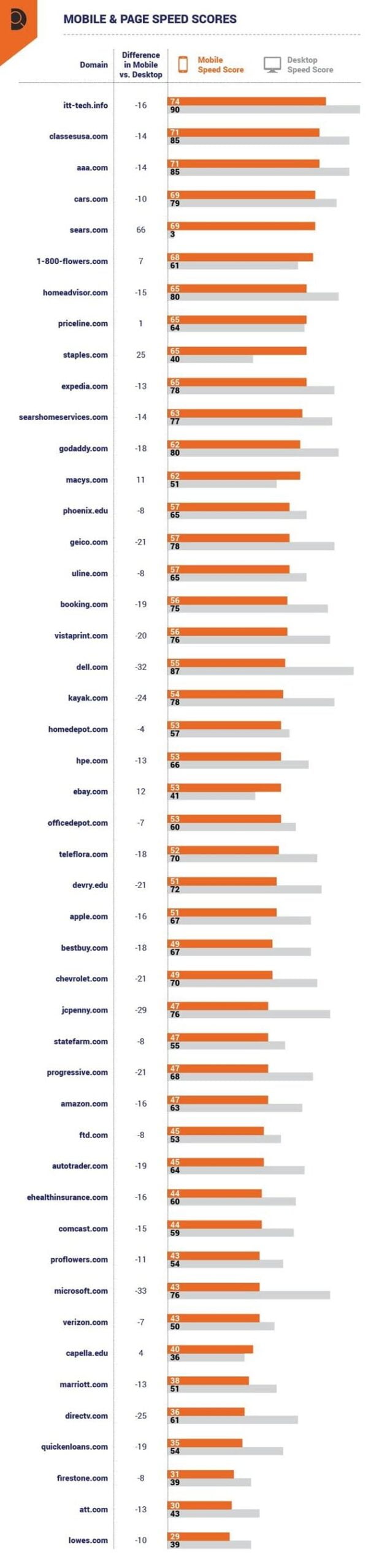

While we lack access to the intricacies of each company’s monetization strategies for different traffic sources, examining how Google’s own tools assess their mobile and desktop performance can offer some insights. I analyzed each site using one of my favorite’s SEO tools, URL Profiler, and obtained Google PageSpeed Insights scores for both mobile and desktop experiences.

Mobile vs. desktop page speed scores for top brands While these scores aren’t definitive proof of mobile monetization efficiency (and Google Speed Scores generally are an imperfect measurement), Google has undeniably emphasized impact of page speed and usability.

Notably, 40 out of the 48 sites listed (excluding those acquired or moved to new URLs) had lower page speed scores on mobile than desktop, with some exhibiting significant discrepancies.

In Conclusion: What Can Brands Do?

Unfortunately, most companies have limited recourse against Google’s aggressive ad placement in mobile SERPs. However, one area where affected brands can focus their efforts is on enhancing the performance and user experience of their mobile sites.

Begin by analyzing your website analytics to understand device-based traffic trends over the past 12-24 months. Examine profit/revenue per user by device, identify any low-hanging fruit for improving page speed, and evaluate the allocation of time, resources, and budget dedicated to desktop versus mobile development. Based on this data, reallocating resources might be a prudent course of action.