Annually, nexus-security releases a “State of the Agency” report that analyzes the driving forces behind digital marketing agencies. This report helps both agencies and marketers understand the broader industry landscape and identify areas for potential improvement.

Similarly, Promethean Research recently surveyed digital agencies regarding COVID-19. However, rather than focusing solely on the pandemic’s negative impacts, this survey aimed to identify agencies or specific functions within agencies that were performing well. The survey responses highlighted agencies not merely surviving but thriving in 2020, revealing common patterns among these successful firms. These findings were compiled into a 72-page report titled The Pattern Report.

This document summarizes the key takeaways from The Pattern Report. It offers a comprehensive overview of agency outlooks for the latter half of 2020 and identifies patterns among resilient firms across three key areas:

- Operations: This includes work environment, available tools, and team structures.

- Management: This encompasses aspects like billing, human resources, and stress management.

- Growth: This examines growth in terms of service offerings, marketing strategies, and capital acquisition.

Agency Outlook for the Second Half of 2020

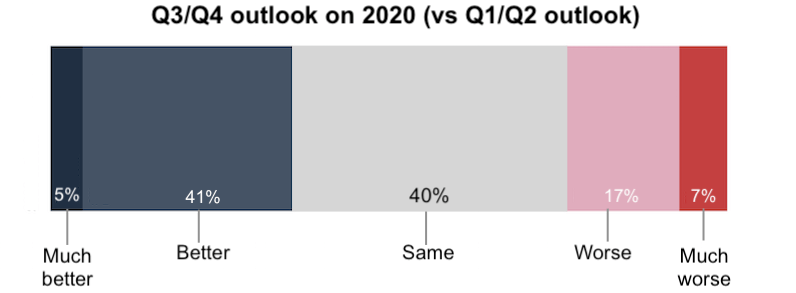

Survey respondents expressed a slightly more positive outlook for the second half of the year, with 36% of firms feeling optimistic and 24% feeling pessimistic. Nearly half of the respondents anticipated business conditions to remain relatively stable.

Smaller firms generally displayed more optimism compared to their larger counterparts. Firms specializing in real estate, consumer goods, government/non-profit, and professional services tended to have the most pessimistic outlook. Notably, nearly 76% of respondents reported a similar or more positive outlook for the second half of 2020 compared to the first half.

Patterns of Success: Optimistic Digital Agencies in 2020

As previously mentioned, smaller firms generally held more neutral or optimistic outlooks compared to larger firms. A closer examination of these optimistic firms reveals that they dedicated a significant portion of their downtime during the second quarter to internal reorganization, repositioning, and restructuring. They also focused on raising or planning to raise capital. Many of these firms were well-equipped for a distributed work environment, having already implemented remote tools and begun to witness increased client demand as early as May. While most firms experienced project cancellations, they generally refrained from renegotiating contract terms, even in cases of breach of contract. Click here to see all results

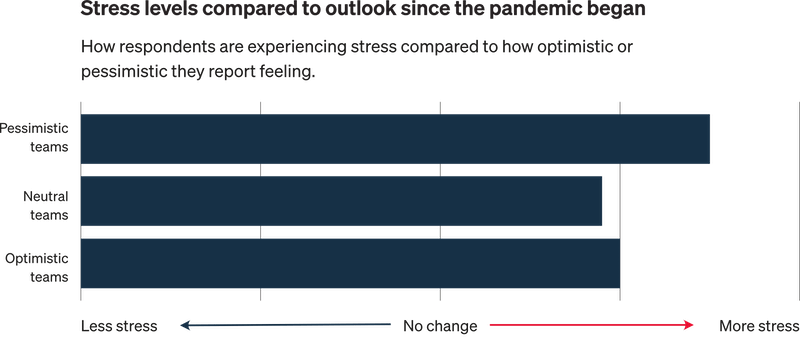

Firms specializing in services like email marketing, ecommerce, and content marketing tended to have more favorable expectations for the remainder of 2020. Similarly, firms catering to B2B services, education, government/public sector, healthcare, financial services, entertainment, or funded startups expressed greater optimism for the second half of the year. Although respondents across the board reported experiencing stress, managers at optimistic firms reported absorbing less stress from their team members and observed either stable or improved productivity levels.

Challenges Faced: Pessimistic Digital Agencies in 2020

Pessimistic firms participating in the survey reported significant declines in monthly recurring revenue, uncertainty surrounding contract renewals, and concerns about the destabilizing effects of COVID-19. Industries severely impacted by the pandemic, such as tourism, hospitality, charity/non-profit, and real estate, generally exhibited a more pessimistic outlook for the latter half of the year. These firms cited challenges such as industry uncertainty, slowing sales pipelines, project postponements, and client budget cuts. Additionally, they found themselves needing to renegotiate project payment terms, facing difficulties in raising capital, and anticipating future expense reductions. Managers at pessimistic firms reported higher stress levels compared to their counterparts at optimistic firms, indicating a greater absorption of stress from their teams. Click here to see all results.

One agency specializing in nonprofits, industry organizations, and government services shared, “We went from a $250,000 profit in Q1 to a projected $110,000 loss in Q2. We haven’t seen enough positive change to believe Q3 and Q4 will rebound sufficiently, giving us a forecast of only 1/5 for the second half of 2020.” Here are some additional quotes from the report:

Growth Strategies and Trends Among Resilient Digital Agencies in 2020

This section examines how firms are pursuing revenue growth this year, considering factors like client size and value, profitability, challenges in maintaining a full sales pipeline, and lead conversion rates. Managers were also asked about the tactics they employ to enhance lead generation and sales. Here’s what respondents reported:

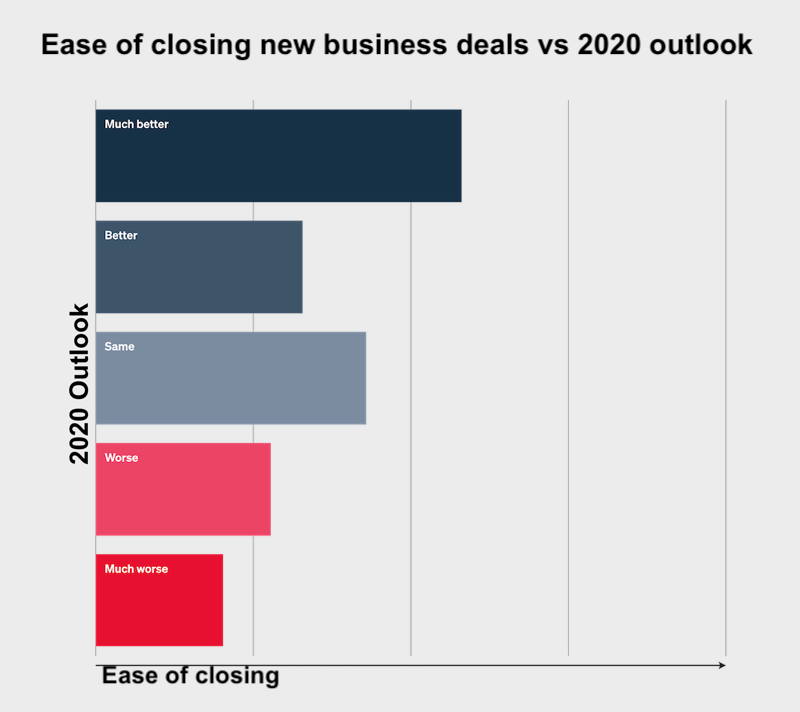

Interestingly, even the most optimistic respondents acknowledged greater difficulty in keeping their sales pipelines full. However, this increase in difficulty was notably less pronounced among optimistic firms compared to their pessimistic counterparts. Pessimistic firms with significantly lower confidence in their outlook reported similar levels of difficulty in filling their pipeline before the pandemic but experienced a much harder time doing so during the current quarter.

Two-thirds of firms focused on upselling to existing clients to maintain their pipelines, while half concentrated on inbound/content marketing to generate leads. The remaining firms explored strategies like cold email outreach and advertising to boost lead generation. Although all firms shared a similar emphasis on upselling and inbound marketing, optimistic firms tended to prioritize cold email outreach more heavily for lead generation. Conversely, pessimistic firms relied more heavily on upselling to existing accounts compared to other tactics, while optimistic firms relied less on this approach.

“It’s crucial for digital agencies to strike a balance in their revenue channel focus, aligning it with their revenue generation timeline. While upselling current accounts offers a relatively quick and easy path to revenue growth, strategies like inbound marketing require time to yield substantial results. Our research indicates that cold outreach is the fastest way to drive business after upselling.” -Nicholas Petroski, Managing Director at Promethean Research

Cash Management Practices Among Digital Agencies in 2020

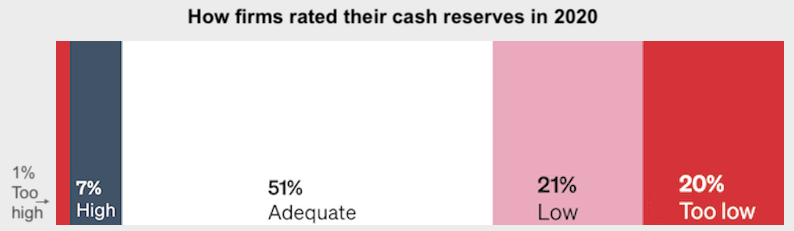

This section delves into firms’ cash reserves, capital raised (including the types of capital) versus their intent to raise capital in the future, and expense reduction measures. Most firms seem to maintain sufficient cash on hand, albeit with a slight tendency towards having “too little.” Only 11% successfully raised capital in recent months, with just 10% anticipating raising capital in the near future. Notably, three-quarters of respondents have already implemented expense reductions, and slightly over half plan to reduce expenses further in the coming months.

Navigating Payments and Cancellations in 2020

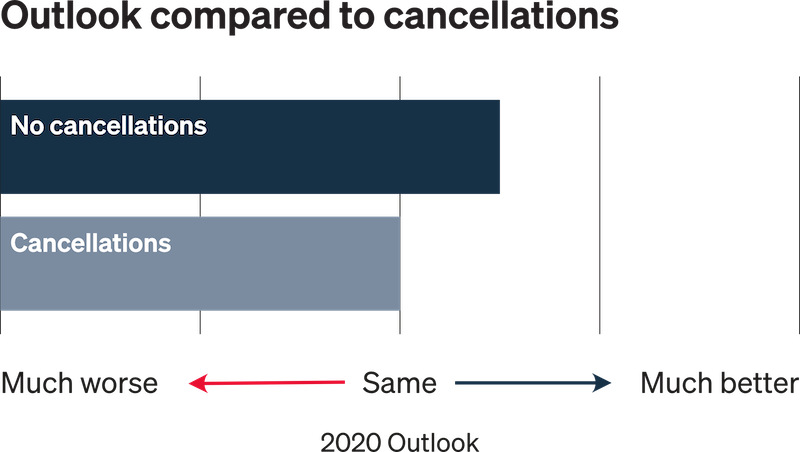

Firms provided insights into project cancellations, contract renegotiations, slow-paying clients, and adjustments to payment terms. Although most firms experienced project cancellations, only 35% of respondents reported a breach of agreement, and slightly under half refrained from requesting anything in return for the cancellation. Nearly two-thirds of firms reported experiencing payment delays, but only a small fraction encountered clients refusing to pay altogether. In response to these challenges, firms are modifying their pricing plans, opting for more frequent billing cycles or requiring larger upfront deposits. Notably, firms that hadn’t experienced cancellations generally held more positive outlooks compared to those that experienced partial or complete project cancellations.

Operations and Project Management During Uncertain Times

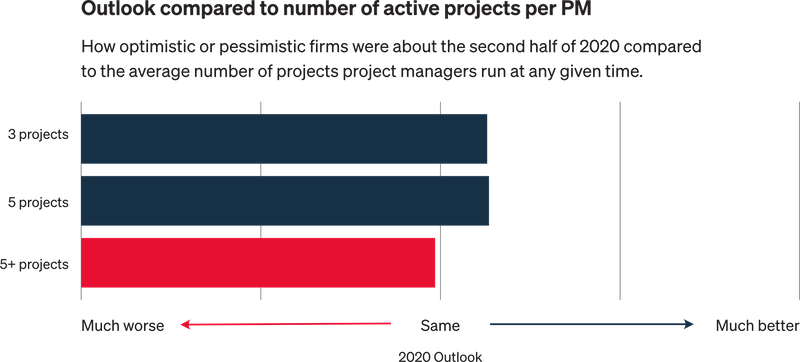

This section examines firms’ operational aspects, inquiring about the ratio of active projects to active project managers, project adherence to timelines and budgets, and productivity levels during the pandemic. Optimistic firms appear to have more robust project management systems and demonstrate a higher likelihood of delivering projects on time and within budget compared to their pessimistic counterparts. Teams that limited active projects to 3-5 per project manager also reported a more positive outlook compared to firms where project managers handled more than five projects simultaneously. Interestingly, most firms maintained or even exceeded pre-pandemic productivity levels.

“Systematizing your project management and avoiding divided focus leads to stronger client relationships and higher-quality project deliverables. It also facilitates on-time project launches. This not only enhances profitability but also mitigates the need to overload your sales pipeline with a higher volume of lower-value projects.” -Rachel Gertz, Digital PM Trainer, Cofounder at Louder Than Ten

The survey also explored remote work policies, company distribution before and after the pandemic’s onset, clarity in internal communication, and the effectiveness of team tool utilization. Many respondents anticipate that distributed work environments will persist through the first half of 2021. Those with more optimistic outlooks project a more significant increase in remote work (54% growth from pre-pandemic levels) compared to those with pessimistic outlooks (36% increase from pre-pandemic levels).

Managing Stress in Trying Times

This section examines stress levels among firms before and after the pandemic and whether respondents have access to necessary support networks. Pessimistic firms tended to report slightly higher stress levels than optimistic firms, and business owners with less favorable outlooks appeared to absorb slightly more stress from their teams. A valuable stress management strategy highlighted by most respondents is having a dedicated community to lean on. Communities like the Bureau of Digital provide ideal support systems for digital marketing agencies.

Research Methodology: The Pattern Report

This survey was conducted between May 19th and May 26th, 2020, three months into the global coronavirus pandemic and amidst a growing civil rights movement in the United States. Approximately 96% of respondents were owners, C-level executives, and other executives from 84 digital service companies across Canada, the United States, Mexico, the United Kingdom, and South Africa.

Nearly all respondents held senior management roles within their respective firms. The majority of respondents offered web design and development services, and the top three industries they served included government/non-profit, business and professional services, and retail/commerce. Two-thirds of participating companies employed fewer than 20 individuals.