Handling payroll can be a real headache, especially for a company that’s expanding. Using various payroll tools means entering and retrieving data separately and going through countless spreadsheets by hand. This article explains how to make your payroll process easier.

Ensuring payroll compliance involves monitoring and storing important information, potentially leading to a mountain of paperwork if done manually.

Moreover, payroll mistakes can negatively impact your business, like potentially violating tax rules.

Inaccuracies can also harm employee morale if salaries are delayed or incorrect. TL;DR: Staying on top of your payroll is essential.

Fortunately, there are ways to simplify and optimize your payroll process, ultimately helping you run your business more efficiently.

Keep reading to discover how to achieve this.

1. Implement a dependable timesheets app

Time entry and tracking are among the most time-consuming payroll tasks.

These tasks can consume valuable work hours, and manual processes can expose your timesheet data and payroll to human errors. The answer? Utilize dependable timesheets software.

Timesheet apps simplify payroll by offering tools to streamline and automate recording, tracking, and related tasks from a central platform.

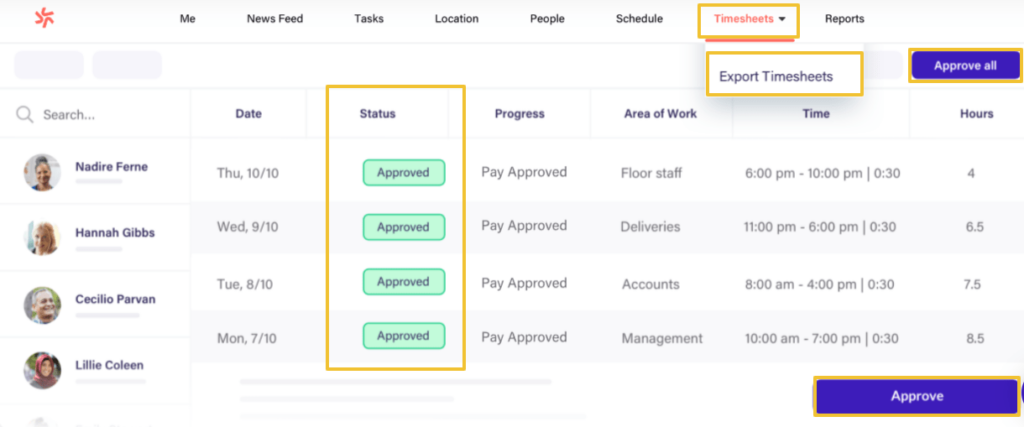

Deputy’s time tracking app is one such solution.

Its timesheets software enables employees to clock in and out easily via computer or mobile device, minimizing errors that lead to payroll inaccuracies.

It includes GPS location tracking and facial recognition, ensuring staff are at the designated location and time for their shift, allowing you and managers to verify timesheets seamlessly.

Managers can swiftly approve timesheets individually or in bulk and export them to your payroll software.

The software can also automatically calculate employee wages (including overtime and penalty rates) based on current awards or Enterprise Bargaining Agreements (EBAs).

You can configure various rates for specific employee roles, and Deputy will handle the calculations.

Reliable software enhances the efficiency and accuracy of your timesheets and payroll processing, significantly reducing administrative work.

2. Centralize your systems and data for a simplified payroll process

Using separate systems for payroll processing and related tasks can complicate your workflows, hindering your payroll team’s efficiency.

Integrating your multiple systems and records into a single resource is a smart approach.

This provides better visibility into your payroll and related data, allowing easy implementation of essential changes and ensuring all records are up-to-date.

Centralizing your payroll system and records also simplifies bulk updates for earnings, benefits, deductions, leave, taxes, and payroll information.

Bulk updates minimize potential errors, ensure data accuracy, and save significant time and effort.

3. Enhance your compliance process

Non-compliance with regulations and legislation can result in costly penalties and harm your company’s reputation.

However, maintaining compliance is often a lengthy and complicated process.

Therefore, implementing strategies and utilizing suitable technologies to streamline payroll and compliance processes is crucial.

Consider these tips to improve payroll compliance efficiency:

- Maintain accurate employee records. Employee information changes frequently, and some details likely affect payroll.

Stay updated on personnel records to ensure accurate data and avoid mistakes that significantly impact compliance.

- Utilize audit trails. Audit trails enable you to link each transaction like payroll, invoices, and purchase orders, providing supporting information. This helps justify any payment that might appear unusual during audits or investigations.

Audit trails also help prevent fraud, gain insights into your company’s financial health, and ensure corporate account accuracy.

- Stay current on payroll legislation updates. Regulations and legislation change constantly. Staying informed about the latest news and changes is crucial to maintain payroll compliance.

Streamlining payroll compliance makes the process less daunting for your HR and administrative teams.

4. Consolidate your pay schedules for a simpler payroll process

Managing payroll, especially with multiple pay schedules, can be challenging.

You might pay salaried employees monthly and hourly employees weekly or bi-weekly.

While seemingly insignificant, juggling multiple pay schedules can be disastrous, increasing the chances of missed deadlines.

It can also lead to errors or non-compliance, resulting in hefty penalties.

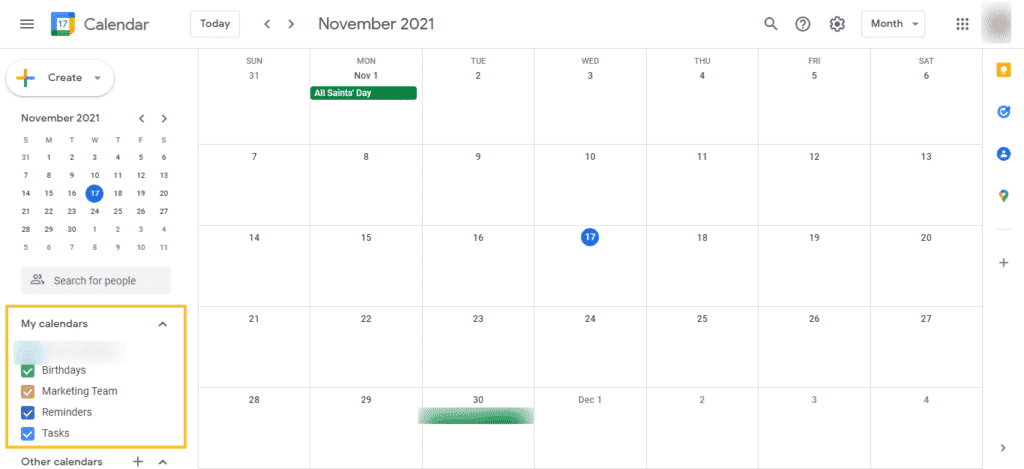

The solution is consolidating all pay schedules using a calendar, template, or software.

For instance, free tools like Google Calendar can help set up payment schedules.

This tool allows easy creation of individual calendars for multiple pay schedules, managing them seamlessly from one platform. You can also share the calendar with your administrative and HR teams.

Set reminders for important dates, such as payroll tax reporting deadlines, to avoid missing anything and ensure timely compliance.

Consolidating and using the right scheduling tool helps manage pay schedules efficiently, enabling timely salary payments and minimizing potential errors.

5. Embrace digital workflows

Paper-based methods hinder workflow efficiency.

Digitizing critical aspects of your payroll process speeds up task handling and streamlines workflows.

Some strategies include:

- Implementing direct deposits. Opt for sending employee salaries directly into their bank accounts instead of using cash or checks.

Direct deposits through Automated Clearing House (ACH) save time, money, and effort.

- Filing taxes electronically. Electronic tax filing simplifies payroll tax filing, eliminating the need to print and mail forms. Instead, use a payroll system to pull necessary information instantly and file everything online with ease.

Boost your payroll process today

A simple and efficient payroll process translates to smoother workflows, saving significant time, money, and resources.

Utilize the tips in this guide to learn effective strategies for streamlining your payroll processing.

This simplifies the process, enabling your payroll, HR, and administrative teams to work more efficiently.