Since the start of the coronavirus pandemic in March, we’ve been monitoring how marketers are adjusting to the significant shifts it has caused. In April, we observed performance variations in PPC campaigns across industries and provided updated Google Ads Benchmarks during COVID-19 to offer a clearer picture of the overall online advertising landscape. However, with regions and regulations constantly changing their approaches to the virus, the situation remains fluid. As the world adapted, so did advertising strategies, and we witnessed a resurgence in PPC campaigns starting in late April. Advertisers reported achieving approximately 89% of pre-COVID-19 conversion levels.

Armed with a month’s worth of fresh data and anticipating further developments, we’ve decided to refresh these widely-used PPC benchmarks encompassing 21 industries. Update: For the latest insights, explore the 2024 search advertising benchmarks here.

To provide a comprehensive view, we’ve analyzed benchmarks for both Google and Bing search and shopping campaigns. This data enables you to compare your ad performance with industry peers and devise strategies to enhance your PPC accounts. Update: If you’re looking to reactivate your Google Ads account, we recommend reviewing our post-COVID audit checklist here. Another update!: We have 2021 advertising benchmark data here:

- 2021 home services advertising benchmarks

- 2021 real estate advertising benchmarks

- 2021 healthcare advertising benchmarks

- 2021 search advertising benchmarks for all industries

8 industries experiencing higher volume during COVID-19

The pandemic has led to increased activity for some businesses, making advertising crucial for connecting with interested customers.

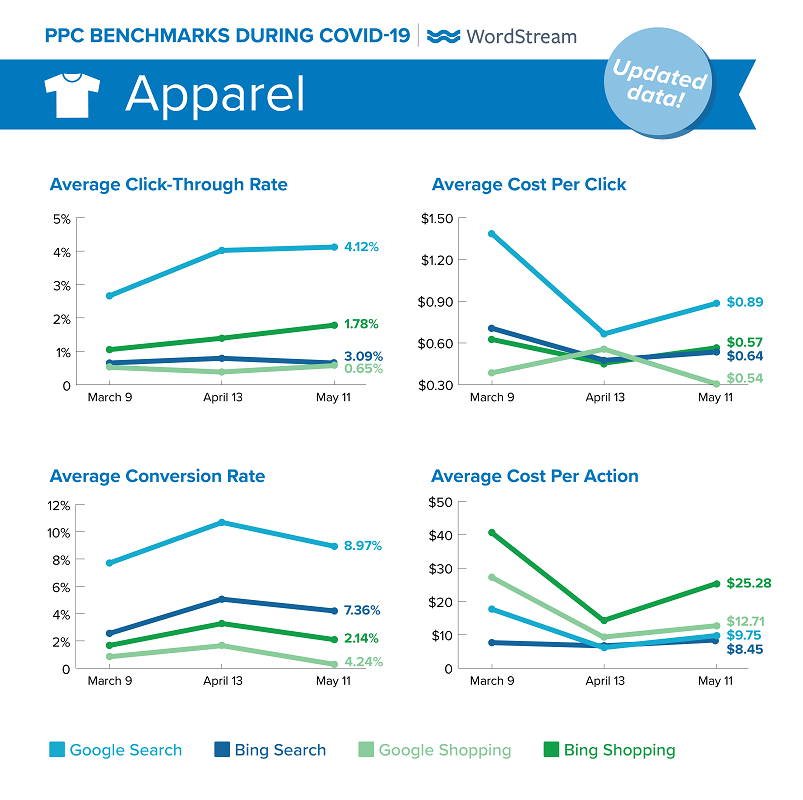

1. Apparel

With traditional retail options limited, online platforms have become the go-to destination for fashion. Since the pandemic’s early stages, we’ve observed a rise in click-through rates (CTRs) and conversion rates (CVRs) as cost-per-click (CPC) values have dipped below their usual levels. Performance surged in April and has maintained this momentum into May.

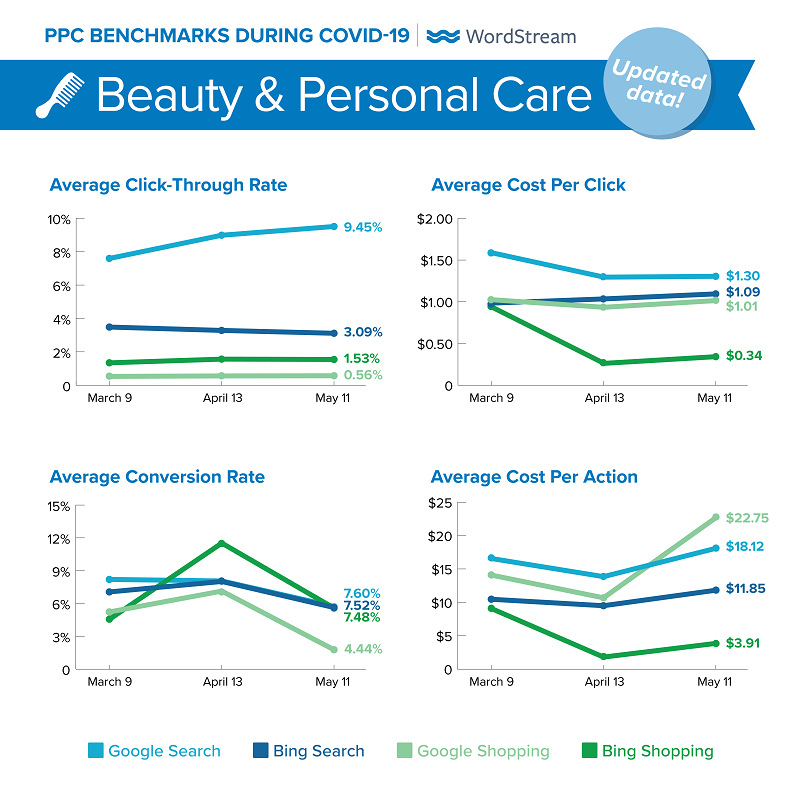

2. Beauty & Personal Care

Quarantine has highlighted the importance of personal care routines. The closure of barbershops, salons, and other beauty services has prompted many to manage their grooming needs independently, leading to a spike in conversion rates for beauty and grooming products in April. This behavior shifted again in May as local services began reopening. While many shopping campaigns saw lower conversion rates and higher cost-per-acquisition (CPA), these were largely balanced by a surge in online bookings for the much-missed hair and nail services.

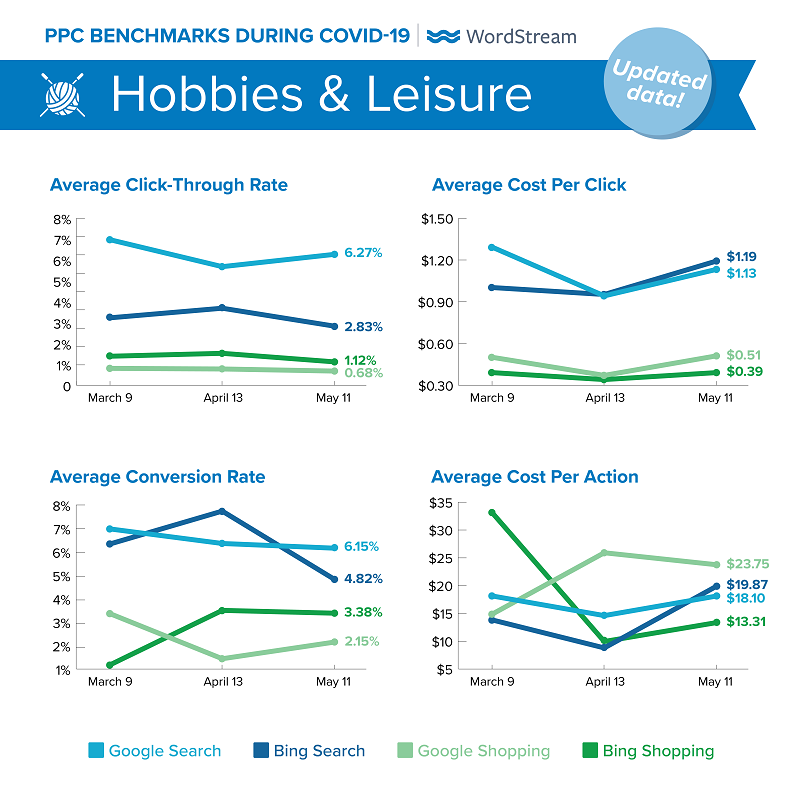

3. Hobbies & Leisure

Extended periods indoors have provided an unexpected opportunity to rediscover hobbies such as puzzles, games, knitting, and painting. This increased leisure time has benefited advertisers in these categories, who have enjoyed relatively stable performance over the past few months.

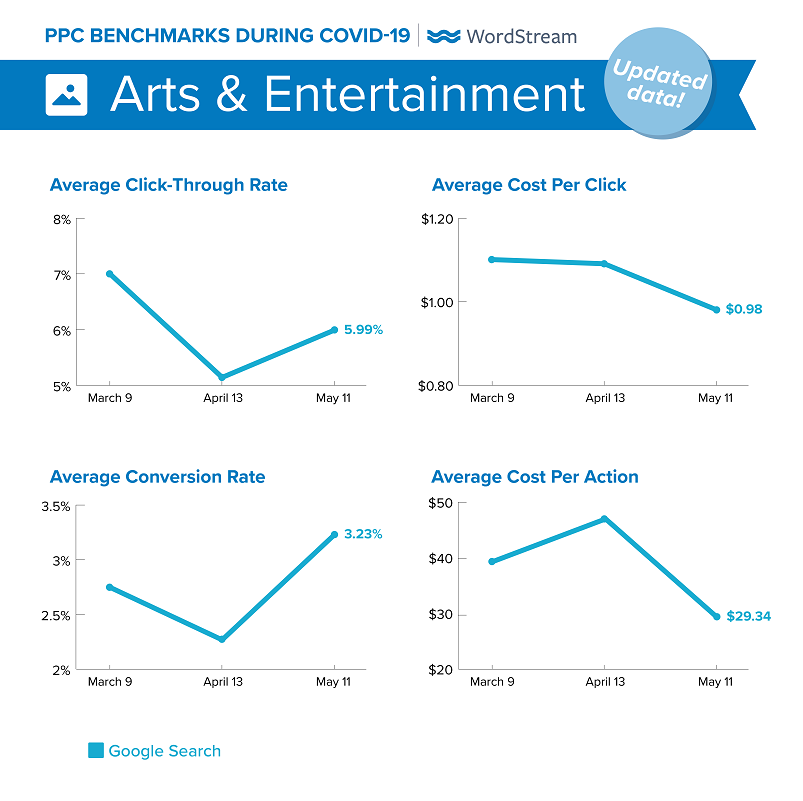

4. Arts & Entertainment

The lockdown had an immediate impact on live entertainment and cultural attractions, presenting challenges for these advertisers as early as April. Fortunately, as these venues gradually reopen, their ads are quickly regaining the attention of eager audiences.

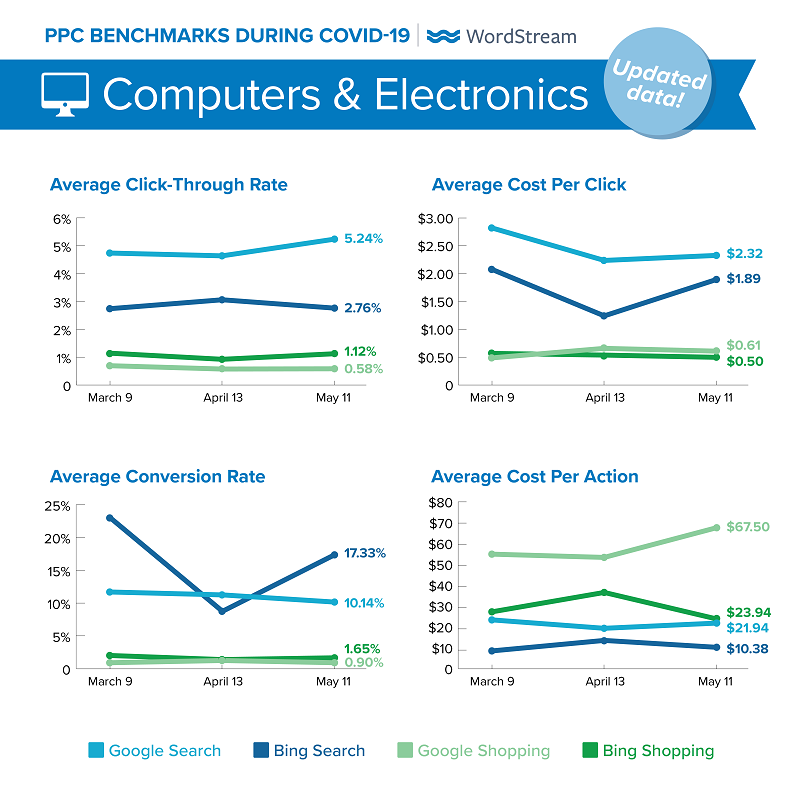

5. Computers & Electronics

As economic stimulus checks reached consumers in April and May, spending on big-ticket electronics quickly rose as well. The search engine results pages (SERPs) accommodated this surge in search interest without significant fluctuations in CPC or CPA. Notably, technology advertisers on Bing, leveraging their unique audience, continued to outperform their counterparts on Google Ads.

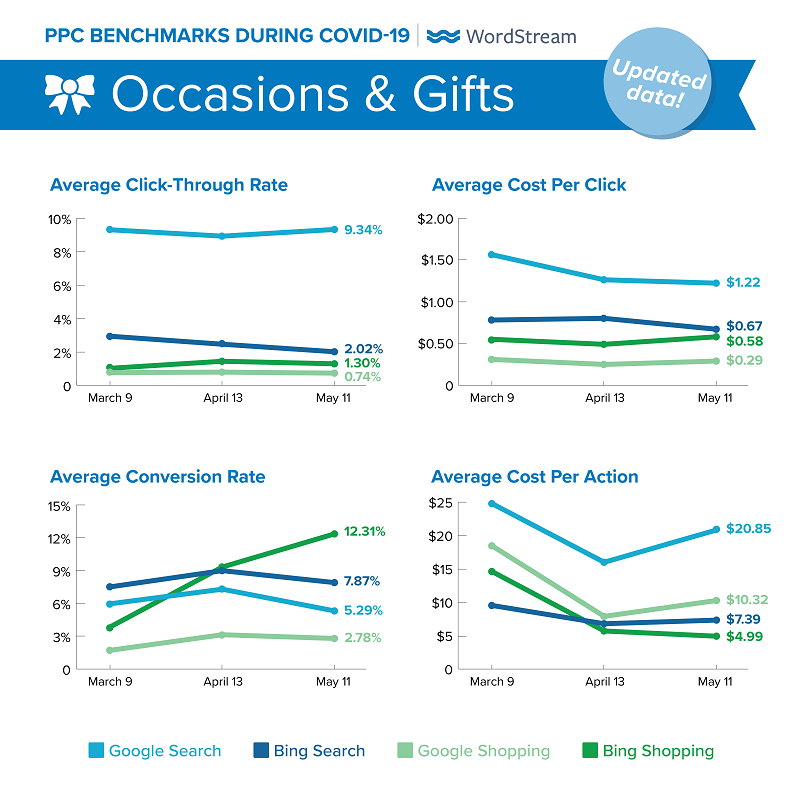

6. Occasions & Gifts

Despite the lockdown, special occasions like birthdays, anniversaries, Easter, Mother’s Day, and graduations continued to be celebrated. While celebrations may have differed this year, the sentiment remained. Online advertisers observed lower costs and sustained customer conversions. Subscription boxes and delivered gift box sales saw a significant rise, replacing traditionally purchased gifts.

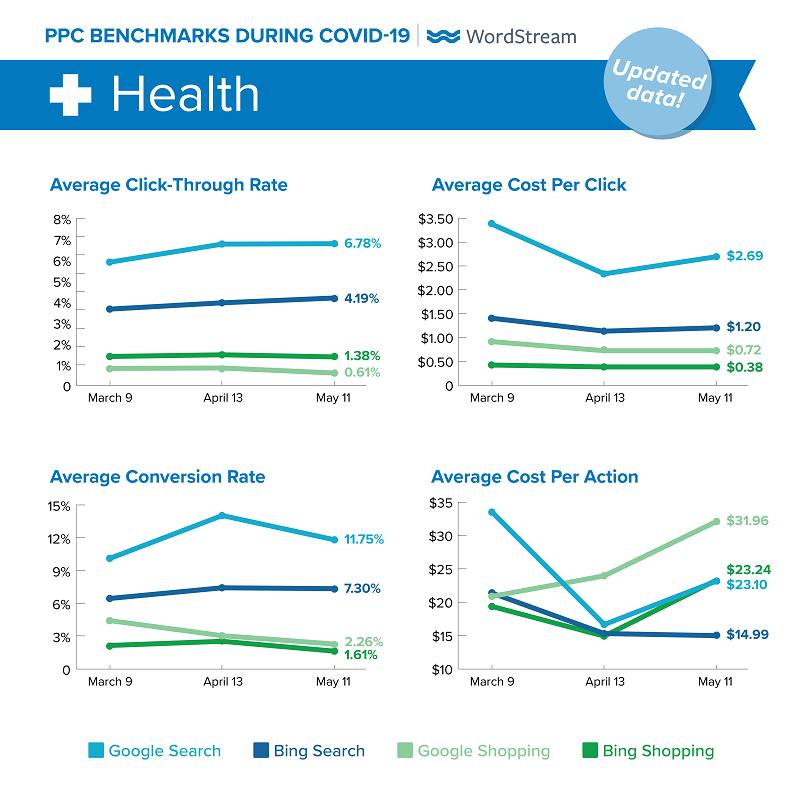

7. Health

With the coronavirus becoming the top search query on Google in April, health has become a primary concern for many. This heightened search volume, coupled with lower CPCs on Google, has enabled health and medical advertisers to attract and convert new customers cost-effectively.

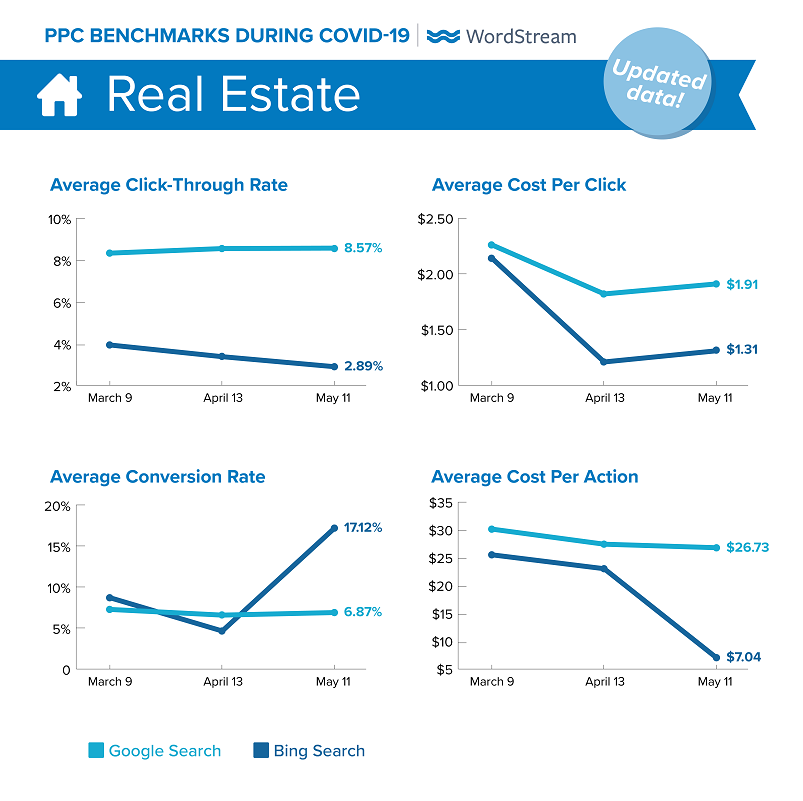

8. Real Estate

The real estate industry adapted to the challenges posed by restrictions on in-person showings and open houses by shifting sales efforts online. With appointments becoming essential for buyers, real estate agents have taken on the roles of trusted advisors and concierges, guiding buyers through the process. The recent reduction in CPCs has further aided real estate advertisers in controlling costs while connecting buyers and sellers online.

10 industries with mixed PPC performance during COVID-19

Certain industries are facing new hurdles and shifts on the SERP, creating a scenario where they could either thrive or struggle in the current climate.

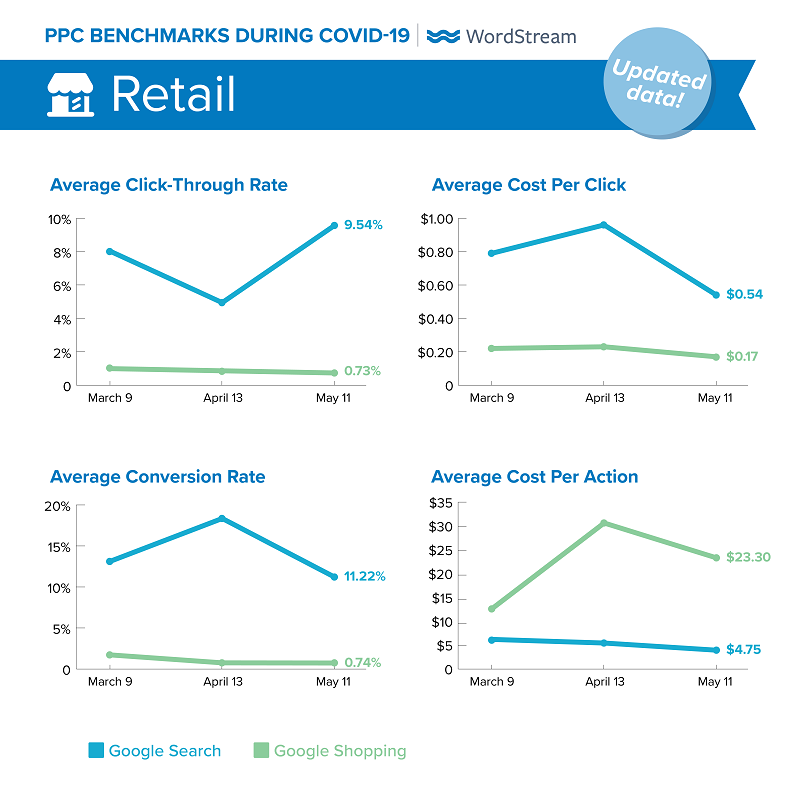

1. Retail

While a 40% surge in shopping traffic throughout April presents a significant opportunity for retailers, the challenge lies in converting online shoppers who are known for their fickleness. With competitors just a few clicks away, crafting compelling product descriptions and devising strategies to convert customers off the SERP through remarketing and social ads is crucial.

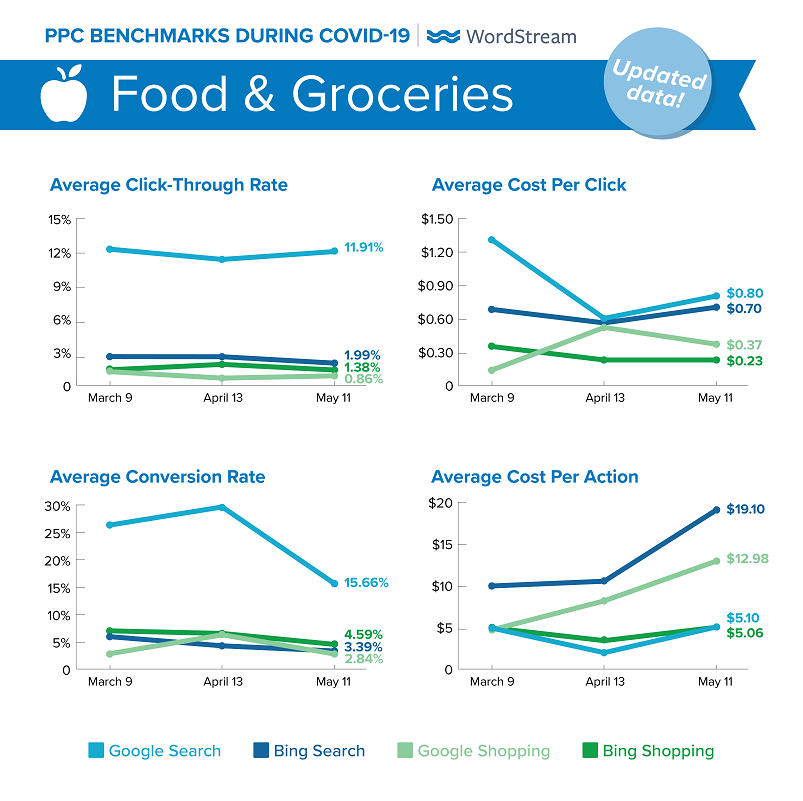

2. Food & Groceries

Despite record-high food and grocery spending, online advertisers in this sector are grappling with the challenges posed by increased traffic. As online grocery delivery transitions from a luxury to a necessity for those avoiding crowded stores, many new searchers remain hesitant to abandon their established habits and are exploring alternatives. This, combined with rising CPCs and increased advertising spending by major services like Instacart, means many online grocery businesses aren’t experiencing the anticipated windfall.

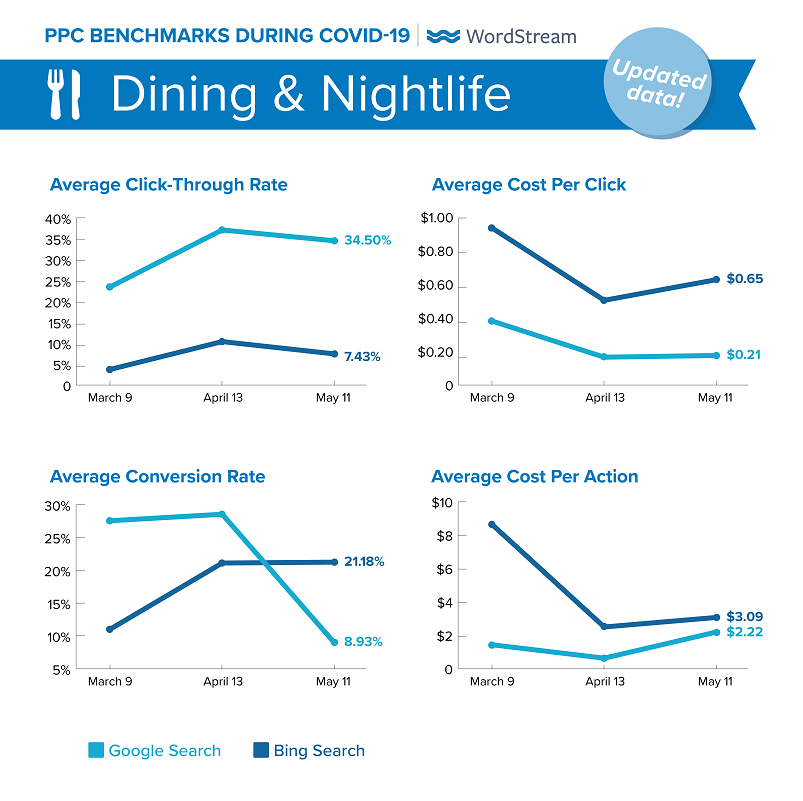

3. Dining & Nightlife

Conversely, with dine-in options largely unavailable, restaurant spending has plummeted. Take-out services offer a lifeline for some, but with many establishments closed, operating on limited hours, or offering restricted menus, more people are turning to search engines for local eatery information. Restaurants that have maintained their advertising efforts during this period are seeing positive CTRs and low CPCs and CPAs. Platforms like Toast and Square are also offering support through Google for Small Business’s partner program., further aiding restaurants.

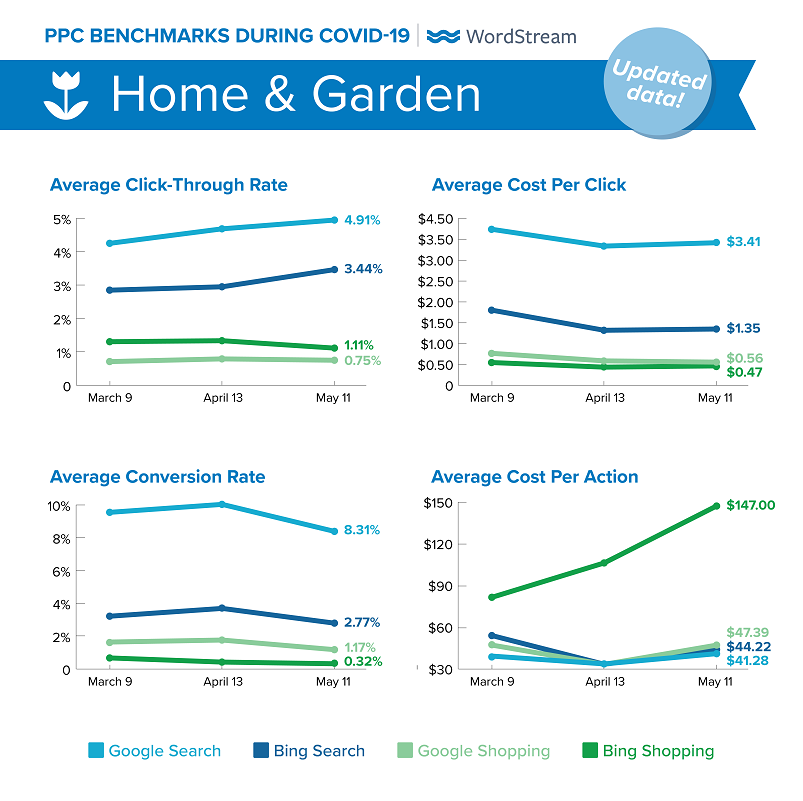

4. Home & Garden

April saw many home and garden advertisers benefit from increased conversions and conversion rates as people confined to their homes embarked on home improvement projects, resulting in improved PPC ad performance with lower CPCs and CPAs. However, as stay-at-home orders ease, this upward trend is showing signs of waning, leaving uncertainty about the sustainability of this improved performance.

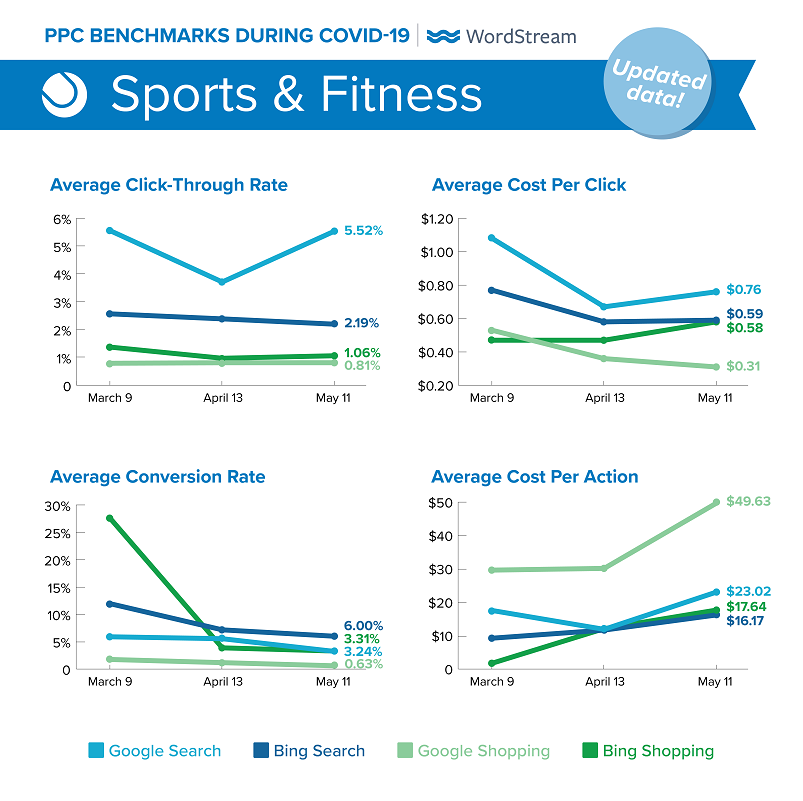

5. Sports & Fitness

The absence of organized sports and gym closures has drastically altered the landscape of sports and fitness advertising. Late March and April witnessed a sharp decline in CPCs alongside search conversion rates as advertisers reduced their budgets. However, with governments outlining plans for the reopening of gyms, studios, and sporting events, optimism is returning, leading to a resurgence in ad CTRs and conversion rates.

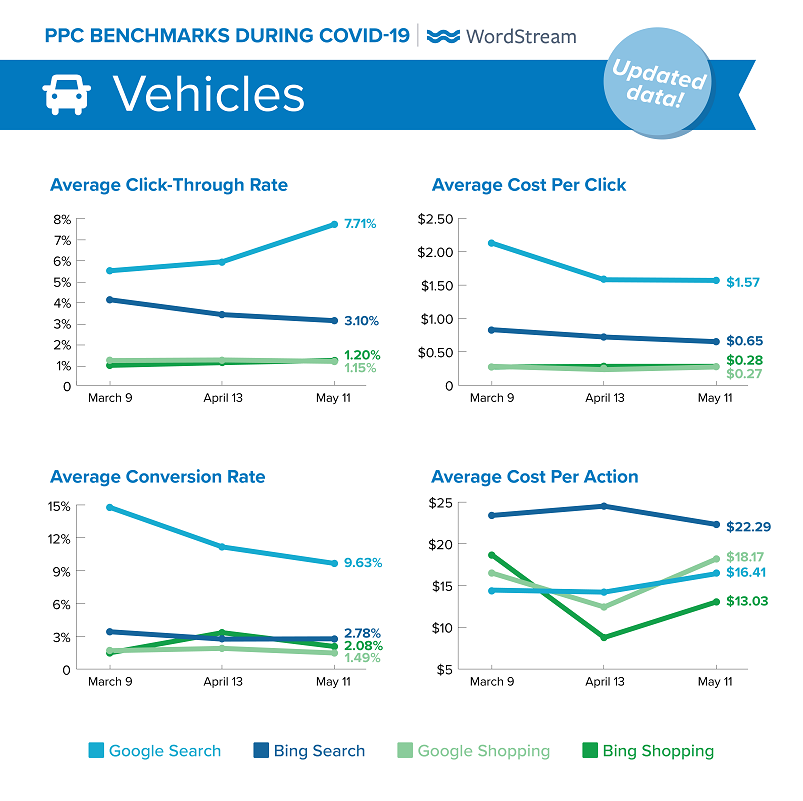

6. Vehicles

Supply chain disruptions, import issues, economic downturns, and reduced mobility have plagued the auto industry since the onset of the COVID-19 outbreak. However, demand persists on the SERP, and with showrooms closed, online vehicle searches have increased. This has translated into a healthy increase in CTRs for advertisers, accompanied by lower CPCs, as major original equipment manufacturers (OEMs) have scaled back their advertising expenditures. Notably, there’s a shift in search preferences, with more users considering pre-owned vehicles over new models.

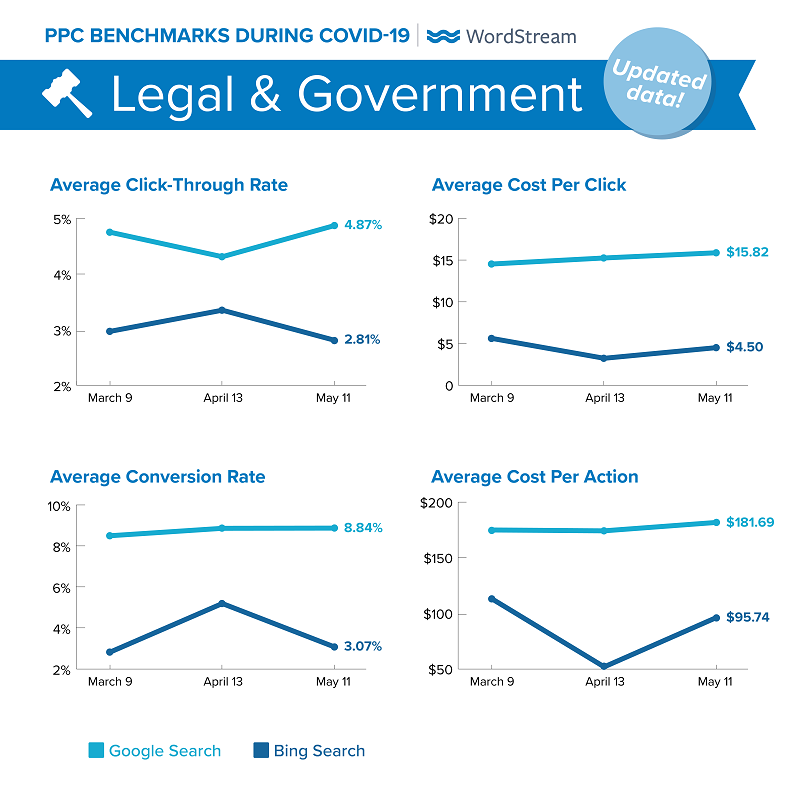

7. Legal & Government

Legal PPC advertising has remained relatively steady during the pandemic, despite being one of the most expensive verticals. With fewer personal injury and criminal cases due to stay-at-home orders, some practices are adapting their focus. Conversely, demand for general counsel and civil cases, such as divorce, wills, and business contingency planning, has increased.

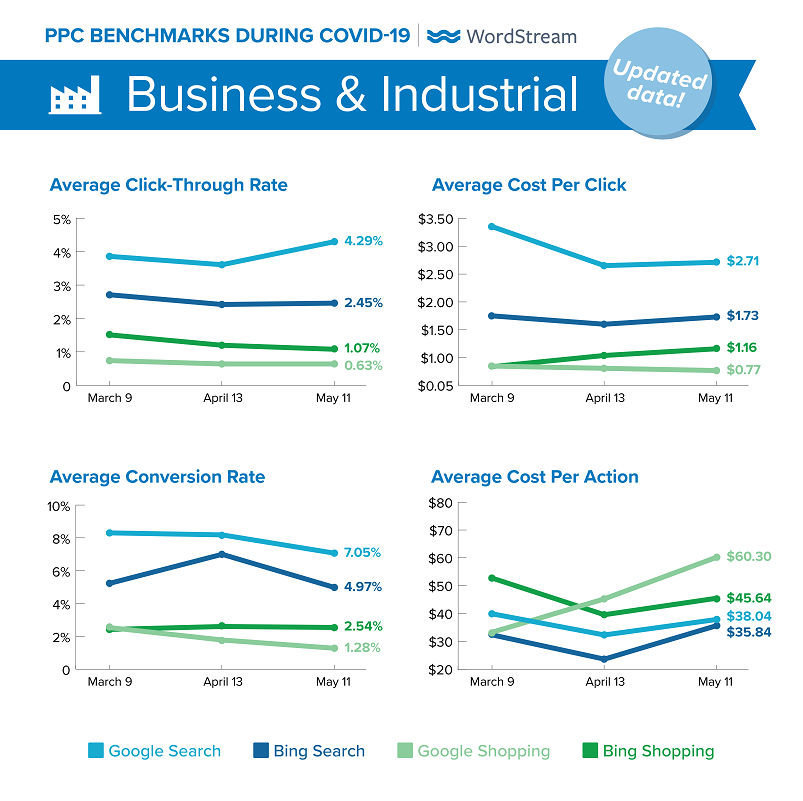

8. Business & Industrial

While B2B advertisers appear to be performing well, with growth in CTR and moderate declines in CPC and CPA, there’s underlying hesitation to increase budgets due to economic uncertainty. Businesses are also more cautious about engaging with new partners or vendors, leading to a slight dip in conversion rates as prospects take longer to make purchase decisions and require more brand interactions.

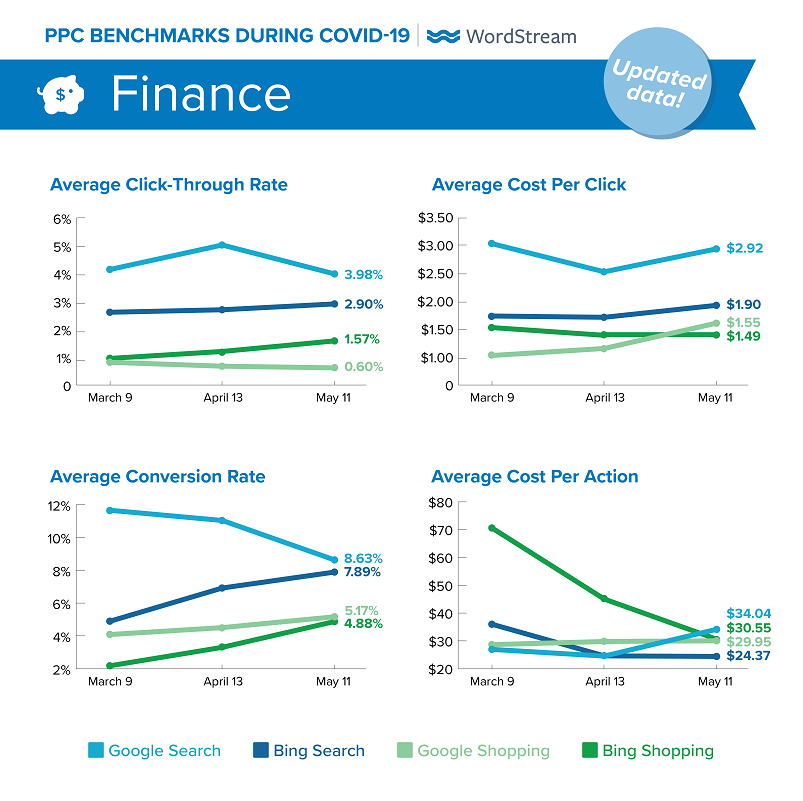

9. Finance

Economic uncertainty has driven a surge in users seeking answers on financing, loans, insurance, and business protection on search engines. Finance, known for having some of the highest CPCs, hasn’t seen much change in this regard. On Google, CVRs and CPAs are trending negatively, but Bing presents a contrasting picture with positive trends in these metrics.

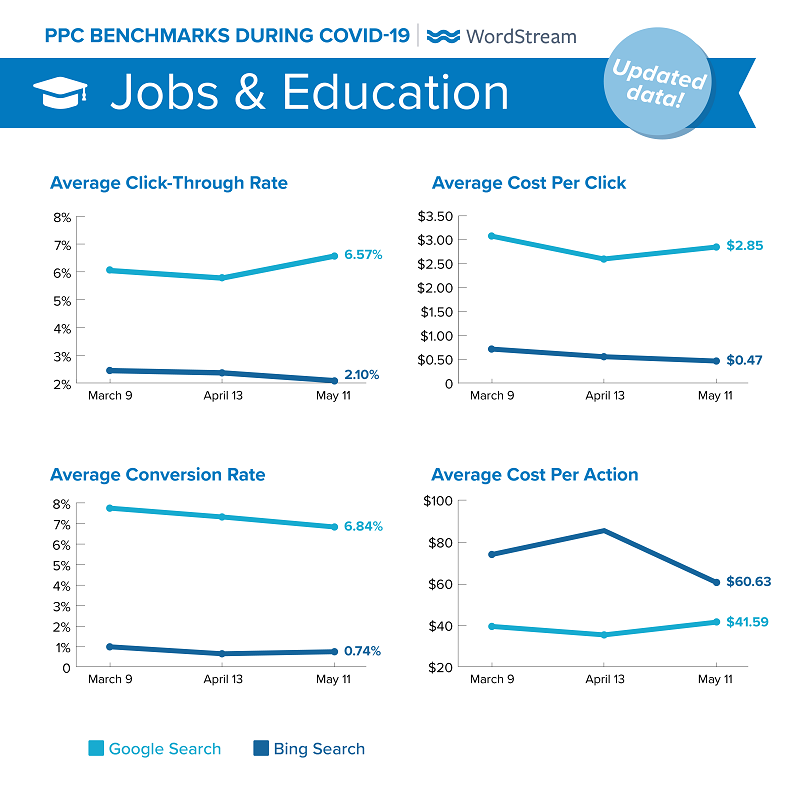

10. Jobs & Education

Despite record unemployment and uncertainty surrounding fall operations for many educational institutions, education advertisers haven’t witnessed significant fluctuations in ad performance over the past month. While e-learning alternatives have experienced a surge in popularity, it remains to be seen how these trends will evolve as the fall semester approaches.

3 industries most affected during COVID-19

Under the weight of a public health crisis and temporary restrictions, several major industries continue to feel the impact of COVID-19 on their PPC campaigns.

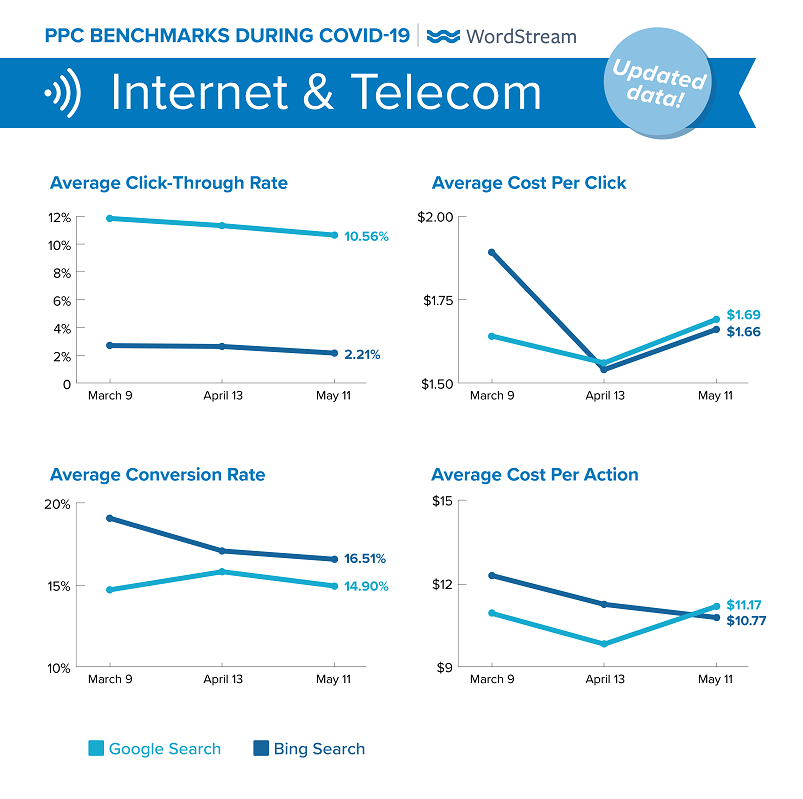

1. Internet & Telecom

Despite being essential services, internet and telecom providers are facing challenges as businesses and consumers alike look for ways to reduce expenses and scrutinize available plans. Since March, conversion rates have plummeted by nearly 30%, and this downward trend shows no signs of abating. Larger advertisers are increasing their marketing budgets, which is pushing CPCs higher for smaller competitors.

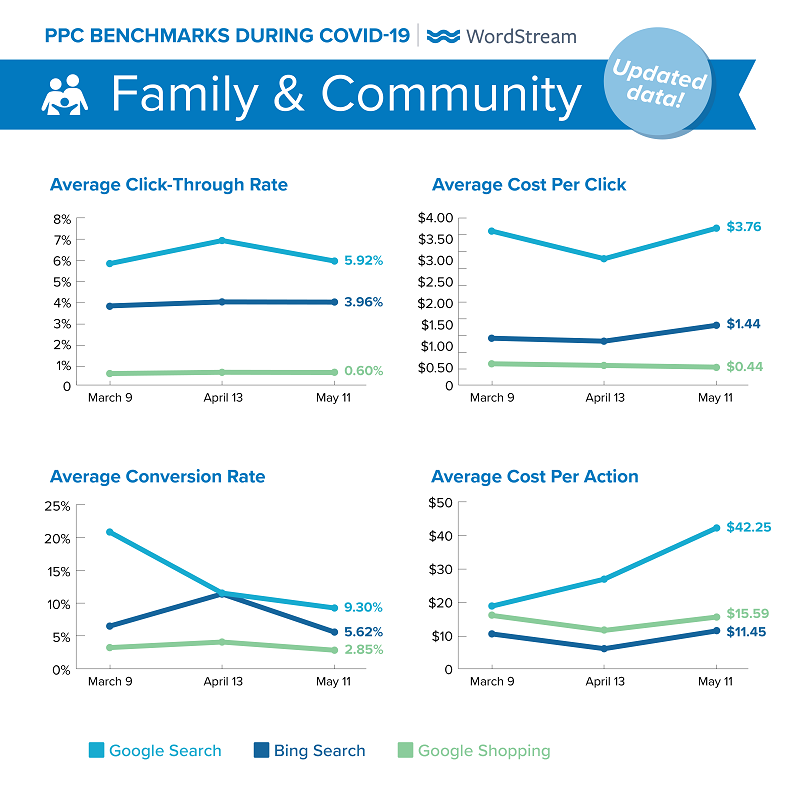

2. Family & Community

While some nonprofits and charities have benefited from increased donations through search ads, other family and community organizations are struggling. Despite consistent clicks and CPCs, these organizations have experienced a significant drop in conversions from Google Search, with numbers less than half of what they were pre-pandemic, resulting in a doubling of their CPA.

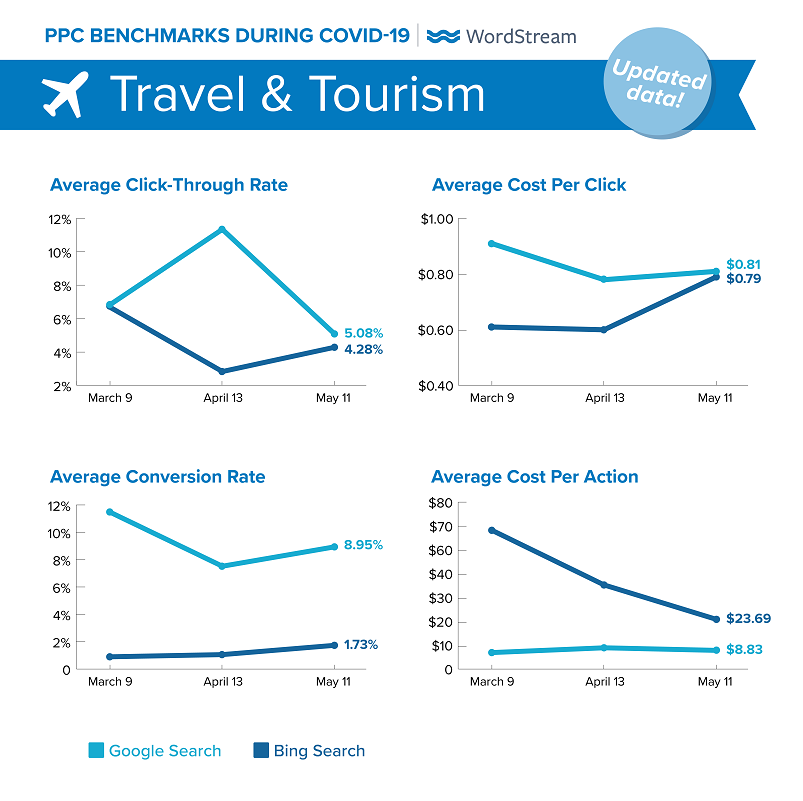

3. Travel & Tourism

Travel, one of the earliest and most severely impacted industries by COVID-19, continues to grapple with the pandemic’s effects. While performance indicators on the SERP might appear relatively stable, this is largely attributed to conservative campaign objectives and budget allocations. It will be interesting to observe how marketers respond as restrictions lift and the industry gradually recovers.

What do these benchmarks mean?

These benchmarks offer valuable insights into your performance relative to your competitors, especially as the situation evolves. However, there are crucial takeaways to consider:

- The coronavirus outbreak is reshaping our lives. This inevitably impacts how business is conducted. As behaviors change, so must advertising strategies. Adaptable advertisers who can respond to these shifts and adjust their PPC accounts accordingly will be best positioned for success.

- Overall, CTRs are generally up across Google and Bing. This is likely due to advertisers swiftly tailoring their PPC ads and campaigns to resonate with evolving searcher needs during the pandemic, a flexibility not easily replicated in SEO listings.

- While CVR is declining in many sectors, CPC is largely falling in tandem. This can be attributed to Google’s (and Bing’s) Smart Bidding algorithms, which dynamically adjust bids in real-time as ad performance fluctuates across segments. This has been instrumental in maintaining or even improving ROI for many advertisers, despite reduced budgets. Stay safe, practice social distancing, and keep a close watch on your PPC accounts and the nexus-security blog while navigating these challenging times. We’ll continue to provide regular updates with fresh data and strategies for optimizing campaigns and ad copy in this rapidly changing environment. For additional resources related to COVID-19, refer to Navigating COVID-19: A Simplified Guide to Resources for SMBs. You may also be interested in:

- 2021 home services advertising benchmarks

- 2021 real estate advertising benchmarks

- 2021 healthcare advertising benchmarks

Data sources

This report is based on a sample of 15,759 US-based nexus-security client accounts in all verticals who were advertising on Google Ads and Microsoft Advertising between March 2 and May 17. Each industry includes at minimum 150 unique active clients. Accounts not recording at least one click or conversion are omitted from these figures. Shopping network data is omitted in industries with low usage. Average figures are median figures to account for outliers. All currency values are posted in USD.