Source: UOB infographic. Statistics gathered from the Financing for Startups and Small Businesses Survey.

A recent study by United Overseas Bank (UOB) revealed that a significant number of startups and small businesses in Singapore lack a comprehensive understanding of the alternative funding options available to them for early expansion. These businesses are also uncertain about how to effectively utilize options such as venture capital, venture debt, and debt and equity crowdfunding.

Mervyn Koh, Managing Director and Country Head of Business Banking, Singapore, UOB, emphasized the critical role of funding in business expansion. He highlighted the importance of startups and small businesses being able to distinguish between the various funding options available to support their growth in the early stages.

Koh explained, “Established companies can easily access funding through traditional methods like bank loans and working capital. However, startups often struggle to raise the necessary funds due to their early stage of development. Since their concepts, products, and services are still evolving into viable business models, they may lack the consistent cash flow required to qualify for traditional loans.”

The survey revealed that a significant portion of startups and small businesses faced challenges in accessing information about funding options. 65% of respondents indicated they were unsure where to seek advice on the range of funding options available, while 62% found the eligibility criteria unclear, making it difficult to determine their suitability. This contrasts with the straightforward guidance provided by banks on traditional financing methods.

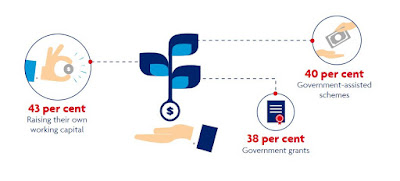

Due to this lack of familiarity, startups and small businesses tend to rely on proven funding sources for their business expansion. These include raising their own working capital (43%), government grants (38%), and government-assisted schemes (40%).

The survey also highlighted a lack of understanding regarding the specific features of alternative funding options. For instance, 34% of respondents believed that venture debt required investors to be involved in business decisions, which is not accurate. Additionally, 25% of small businesses mistakenly thought that debt crowdfunding did not involve interest payments on the funds raised. Furthermore, 23% believed that debt crowdfunding required giving up equity in their business, which is also incorrect.

Koh emphasized that, “Securing additional funding is crucial for startups and small businesses that often face cash flow constraints. However, our findings indicate a need for increased education about these options and their practical application. To determine the most suitable financing option, seeking professional advice from government bodies, accelerators, or other organizations within the funding ecosystem, such as venture capital firms and financial institutions, is highly recommended. A clear understanding of the various funding options available can significantly accelerate the realization of their growth potential.”

To address the funding needs of startups and businesses at all stages of growth, UOB, which serves one in every two small businesses in Singapore, offers comprehensive solutions. These include equity crowdfunding and venture debt through partnerships with OurCrowd and InnoVen Capital, respectively. UOB also provides mentorship and guidance to startups and small businesses on their business models and funding options through its innovation lab, The FinLab. The bank has also equipped its commercial bankers with up-to-date information on alternative funding channels beyond traditional financing.

In addition, UOB is developing a practical guide that explains the different funding options available for startups and small businesses and how to access them.

Interested?

Look for the guide on the UOB Asian Enterprises website. It will be available in December

View the complete Financing for Startups and Small Businesses Survey infographic (PDF)

*The survey was conducted by UOB in October and November 2016 among 250 Singapore-based companies with an annual turnover of under S$30 million. The objective was to understand if startups and small businesses understood the range of financing options available to them.

**This refers to schemes such as SPRING’s Local Enterprise Financing Scheme.