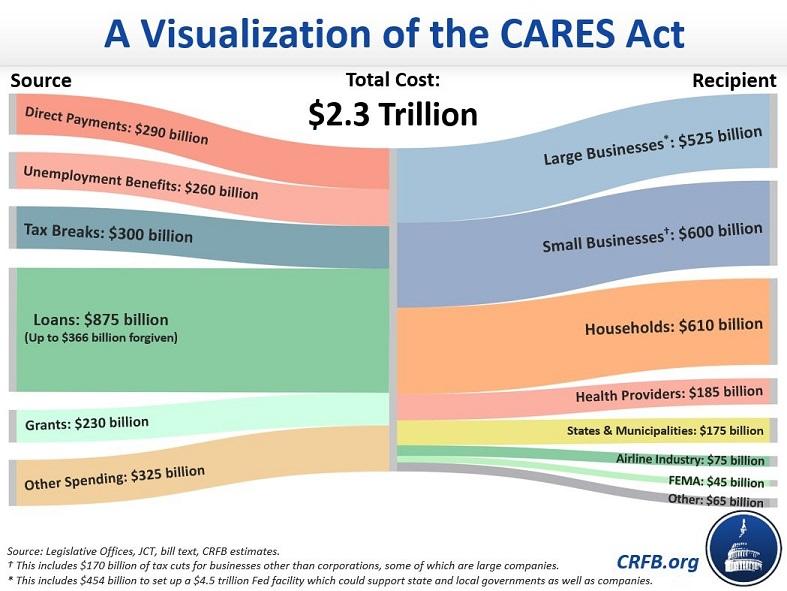

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law on Friday, March 27th. As the largest stimulus package in the history of the United States, the CARES Act initiated a massive effort to offer financial assistance to the many Americans facing economic hardship due to the coronavirus pandemic—especially 3.3 million Americans who’ve filed for unemployment since March 14 and the numerous small businesses that employ them.

While the CARES Act includes various provisions designed for small businesses (including emergency government grants and existing loan payment coverage), the $350 billion allocated to the Paycheck Protection Program (PPP) may be its most crucial component. Characterized by its low interest rates and potential for loan forgiveness, this program strives to help small businesses weather the pandemic without being saddled with significant debt once the crisis subsides. In doing so, it aims to prevent job losses and curb the rise of unemployment across the country.

The program’s implementation has been met with obstacles, causing the initial funding to deplete quickly. Congress recently approved an additional $310 billion in funding on Thursday, April 24th (TechCrunch), although the date when the Small Business Association will start accepting applications again remains unknown. Given how rapidly the first round of funding was exhausted, it’s crucial to be prepared to apply as soon as the application window opens if you’re considering this resource for your business.

Let’s delve into the current information available to equip you with the knowledge to swiftly initiate the application process for your business when the opportunity arises.

Important: We are not legal professionals. Should you have specific inquiries regarding your business or the loan application, please consult with your legal counsel and/or banking institution for clarification.

What is the Paycheck Protection Program?

The Paycheck Protection Program is a Small Business Association (SBA) loan program designed specifically to assist small businesses in maintaining their payroll at existing salary levels while covering essential operating expenses like rent and utilities. Any loan funds allocated to these specific purposes within the eight-week loan period are eligible for forgiveness. In essence, if a small business utilizes the loan as intended, repayment might be entirely unnecessary.

By injecting much-needed capital into struggling small businesses, the Paycheck Protection Program directly tackles what 70% of them identify as their most pressing concern: cash flow management (Forbes). Data reveals that approximately half of small businesses lack the cash reserves to operate for more than 27 days without revenue, while around 25% can only sustain themselves for 13 days or less (JP Morgan). A PPP loan, covering roughly two months of major expenditures like payroll and rent, would enable small businesses to stretch their available funds further - ideally long enough for the crisis to abate and business operations to resume.

This loan could enable small businesses to retain their workforce, maintain their physical locations, and keep their utilities connected. It presents an opportunity for business owners and employees to collaborate on adapting their operations to generate revenue through alternative means during the COVID-19 crisis. Once the situation stabilizes, these businesses would be poised to revert to their regular operations with a fully trained team at their disposal.

Imagine if laying off your entire staff is akin to removing the wheels from a bicycle, rendering it inoperable. The PPP acts as training wheels for small businesses, allowing them to continue moving forward, even if at a slower pace. While encountering obstacles might still pose challenges, the impact is less likely to be catastrophic. The crucial aspect is the ability to remain in motion.

Have questions about the PPP? Join Elaine for a live Q&A!

How can the Paycheck Protection Program benefit my small business?

Having outlined the objectives and potential influence of this program, let’s examine the specifics. I will address common inquiries small business owners might have about the PPP, such as eligibility criteria, application procedures, distinctions from SBA’s EIDL loans, and more.

Am I eligible to apply?

Your eligibility for application is likely if you meet the following criteria:

- You are a small business, a 501(c)(3) non-profit organization, or a 501(c)(19) Veterans Organization located within the United States.

- Your workforce comprises fewer than 500 employees.

- You are self-employed or operate as a sole proprietor.

- The COVID-19 pandemic has negatively impacted your business, and the current climate of uncertainty poses difficulties in running your operations.

- Securing this loan is essential for the survival of your business.

- Your business was fully operational with employees on payroll as of February 15, 2020.

What is the maximum loan amount available through the PPP?

For small businesses: The maximum loan amount you can obtain is up to 2.5x your average monthly payroll costs for the previous 12 months (up to $10 million total). It’s important to note that small businesses cannot include payments made to independent contractors in their “payroll costs” as independent contractors can apply for their own loans. (SBA) (Updated on April 3rd).

For sole proprietors and self-employed individuals (e.g., running a one-person marketing agency): While you may not have conventional payroll expenses, your loan eligibility is still determined by your payroll costs over the past 12 months. The total loan amount you can receive may reach up to $100,000, which is the maximum amount a small business can claim as payroll costs per employee. Refer to the “What qualifies as payroll costs” section of this US Treasury resource for further clarification. Please note: This information is current as of April 1st, 2020. Updates will be provided as more details become available for sole proprietors and self-employed individuals. We recommend consulting with an attorney if you have any questions.

What is the duration of the loan period?

The loan period spans eight weeks, commencing from the loan origination date, which is the date the borrower officially receives the funds. Interest payments are deferred for the initial six months. Repayment of the loan is due in 2 years, and there are no penalties for early repayment. (US Treasury)

Update as of June 10th: The loan period has been extended up to twenty-four weeks.

How can the loan funds be utilized?

The primary purpose of the loan is to ensure the continuity of business operations and employee retention. Based on the latest guidance from the SBA, it’s recommended to allocate at least 75% of the loan towards covering staff salaries during the eight-week loan period if you intend to pursue loan forgiveness. The salaries of employees who were laid off are not factored into the loan amount calculation. However, if you rehire them after submitting your application, it’s believed that you can utilize loan funds for their salaries. Keep in mind that laying off more employees after applying for the loan or reducing employee salaries will affect the amount eligible for forgiveness.

The remaining portion of the loan (up to 25%) can be allocated towards:

- Rent payments

- Interest payments on your mortgage principal

- Utility bills

By adhering to these guidelines - 75% for payroll and no more than 25% for rent, mortgage interest, or utilities - you should be eligible for 100% loan forgiveness (updated on April 3rd). For more comprehensive details, refer to the SBA here.

Update as of June 10th: The requirement to allocate 75% of funds towards payroll costs has been adjusted to 60%. Further information on this update can be found here.

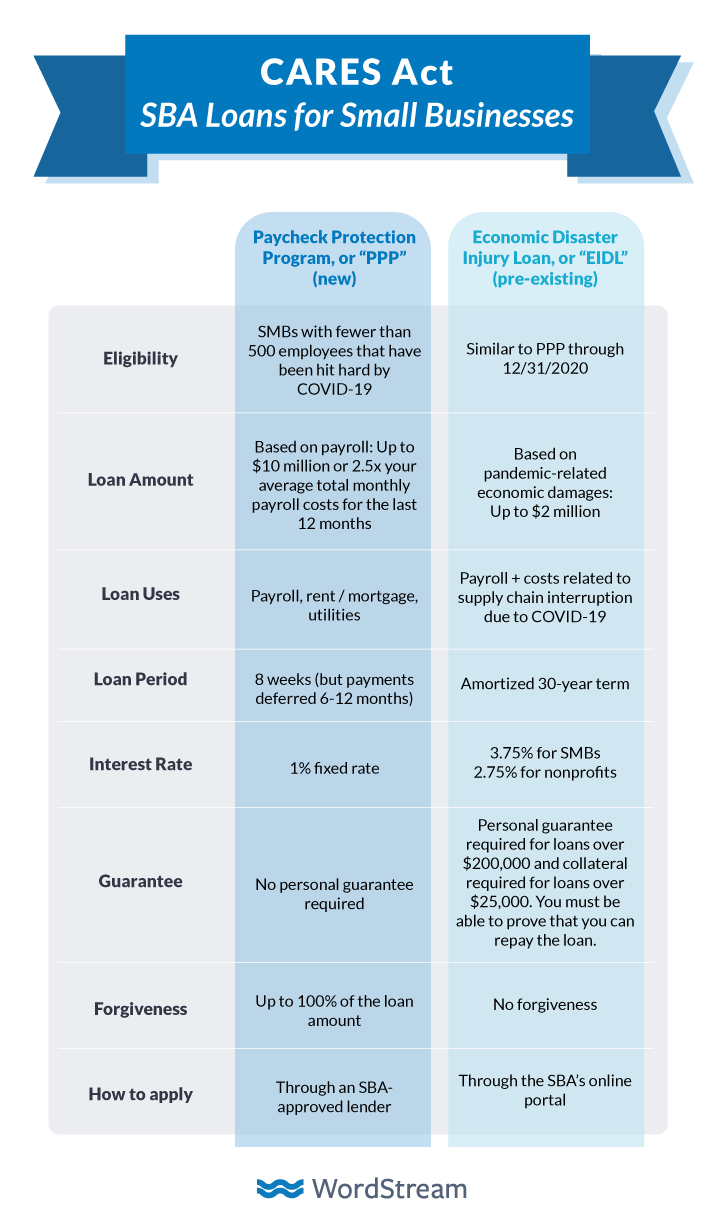

What are the differences between this loan and the SBA’s Economic Disaster Injury Loan (EIDL)?

The PPP builds on the existing framework of the SBA’s 7(a) loan program for small businesses. Both the Paycheck Protection Program loans and the SBA’s Economic Disaster Injury Loans are available options, so it’s advisable to assess both programs to determine which, if any, aligns better with your business needs.

If you’ve already secured an EIDL to address challenges arising from COVID-19, refinancing your existing loan into a PPP loan might be an option. (Foley)

What is the application procedure?

Start by compiling the necessary documentation, then proceed to complete the PPP loan application (download the final application form here). Once completed, submit your application through an SBA-approved lender (locate one here), preferably your business’s existing bank. Additional information can be obtained from the US Treasury and the SBA (updated on April 3rd).

When can I submit my Paycheck Protection Plan loan application?

Update as of April 24th: The reopening date for applications once the new round of funding is officially approved is currently unknown. However, it’s anticipated that the available funds will be depleted rapidly. Prospective applicants should contact their banks immediately to initiate the process if they haven’t done so already. For further details, refer to this the US Treasury.

Update as of June 10th: The final day to obtain approval for Paycheck Protection Program loans is June 30th.

When can I expect to receive my Paycheck Protection Plan loan funds if my application is approved?

Update as of April 24th: As of now, this information is unavailable, and updates will be provided as they become available. Based on the initial round of funding, the disbursement timeframe may vary. Some businesses received their loan funds promptly, while others encountered delays.

Where can I access additional information?

The complete text of the CARES Act can be found here.

Below are additional resources:

- “Paycheck Protection Program (PPP)” is the official SBA webpage dedicated to this program.

- “Paycheck Protection Program (PPP) Information Sheet: Borrowers” from the U.S. Treasury Department.

- “Coronavirus Response Toolkit” from the U.S. Chamber of Commerce.

- “Coronavirus Aid, Relief, and Economic Security Act: What Small Businesses Need to Know” from the U.S. Chamber of Commerce.

- “What’s Inside The Senate’s $2 Trillion Coronavirus Aid Package” from NPR, outlining provisions within the CARES Act for SMBs.

- “Getting Cash for Your Small Business through the CARES Act” featured in Forbes.

- “SBA Loans Under the CARES Act” from the law firm Foley & Lardner, which clarifies the distinctions between PPP and other SBA loan options.

- “How Paycheck Protection Loans Are Different Than Traditional 7(a) SBA Loans” from Inc.

- “Coronavirus Emergency Loans Small Business Guide and Checklist” from the U.S. Chamber of Commerce.

- “How to Submit Your SBA PPP Loan Application and Calculate the Loan Amount”, a helpful article from Entrepreneur.com.

- “3 Steps (and a Calculator) to Help Determine Forgiveness for Your PPP Loan,” from Nutter McClennen & Fish LLP.

What if I require further clarification?

New details about this program are constantly emerging, so it’s possible we haven’t addressed all your inquiries. While we’ll continue to update this article with the latest information, we strongly advise you to stay informed about any relevant developments as well.

Additional resources for SMBs and online advertising during COVID-19:

- The Impact of the Coronavirus (COVID-19) Pandemic on Small Businesses & Marketers

- 6 Strategies for Facebook and Instagram Advertising During the COVID-19 Pandemic

- Marketing During COVID-19: 4 Essential Copywriting Guidelines

- Navigating COVID-19: A Simplified Guide to Resources for SMBs

- How COVID-19 has Impacted Google Ads Results for 21 Industries [Data]

- 4 Major Trends Caused by COVID-19 and How to Respond [Data]

- Updated Google Ads Benchmarks for Your Industry During COVID-19 [Data]

- How COVID-19 Is Shaping Google Search Trends & Patterns [Data]