You know the coolest thing about freelancing? Practically everything. You can ditch the pants (well, mostly), your furry friends are way better colleagues, and Kenny G can blast on repeat without judgmental stares from coworkers (just saying). But you know what’s a real downer? Taxes.

Going solo as a freelancer or starting your own business means you’re the captain of your ship, especially when it comes to keeping Uncle Sam happy with his cut. Problem is, the U.S. tax system is like a labyrinth designed by a committee on caffeine, making a simple tax return feel like a mythical quest. Think of me as your guide through this wild world of freelancer taxes. We’ll cover the basics and then dive into the good stuff, like what you can (likely) write off and those sneaky traps to avoid. But first…

Really Important Disclaimer Time

Before we get rolling, remember that this is all about American tax laws. While some tips might apply elsewhere, this guide is mainly for freelancers in the U.S. and could apply to overseas contractors working for American companies.

Entering the tax jungle? Prepare to lose all hope… Just to be clear, I’m no lawyer. I haven’t aced the bar exam (insert your favorite drinking joke), and legal advice isn’t my forte. I’m also not a financial guru. So, don’t even think about using this as a replacement for a real accountant or tax attorney who actually knows their stuff. These are general pointers, not commandments set in stone about what’s cool and not cool with your freelancer taxes. And another thing, to keep things simple, we’re only focusing on federal taxes, you know, the money you owe to the big guys. State taxes? That’s a whole different ball game, varying wildly across the country, which would be a nightmare to unpack here.

Pretty much. Any doubts about anything you read here? contact the IRS (or your state’s treasury office). Contrary to popular belief, most IRS folks are actually pretty cool and helpful. Don’t be shy; reach out if things get too hairy – it happens. Oh, and I’ll be using “freelancer” and “independent contractor” interchangeably throughout, even though they have their subtle differences. Alright, enough chit-chat, let’s get down to brass tacks. See what I did there?

Freelancing and Taxes: What’s the Deal?

The biggest difference between paying taxes as an employee versus a freelancer is that, as an employee, your taxes are typically taken out of your paycheck before you even see it. But as a freelancer, you’re in charge of setting that tax money aside yourself. More on that in a bit.

Not sure which savings account is right for you? Why not stuff your money into a Mason jar instead? Another big difference is the actual tax rate you’ll pay. This depends on how much you make and what deductions you qualify for. Essentially, almost everything about paying taxes as a freelancer depends on a bunch of factors specific to you. Fun, right? Not really.

Quarterly Taxes: Your New Best Friend

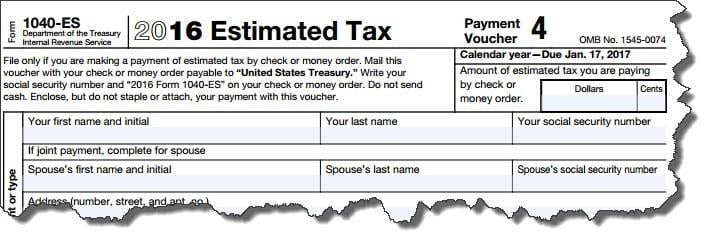

Remember how we talked about freelancers being responsible for setting aside their own tax money? Well, most independent contractors and self-employed folks have to pay something called quarterly estimated taxes to the IRS four times a year. I say “most” because – thankfully! – there are exceptions. For example, if you expect to owe less than $1,000 in taxes for the year (after considering any taxes already withheld from other income, like a salary), you’re off the hook for quarterly estimates. Also, if your withheld taxes are at least 90% of your total tax liability for the year, you can skip the quarterly payments. For more on quarterly estimate requirements, check out this post at the TurboTax blog.

Quarterly estimates are exactly what they sound like – your best guess at how much tax you owe, paid every three months. However, you can’t just send the IRS a check whenever you feel like it. There are strict deadlines for these payments, and each quarter has its own due date:

| Payment Period | Due Date |

|---|---|

| January 1 – March 31 | April 15 |

| April 1 – May 31 | June 15 |

| June 1 – August 31 | September 15 |

| September 1 – December 31 | January 15* of the following year. *See January payment in Chapter 2 of Publication 505, Tax Withholding and Estimated Tax |

| Fiscal year taxpayers | If your tax year doesn’t begin on January 1, see the special rules for fiscal year taxpayers in Chapter 2 of Publication 505 |

| Farmers and fishermen | See Chapter 2 of Publication 505 |

As the IRS page on quarterly estimates states, even if you’re getting a refund at the end of the year, missing these payment deadlines will cost you. Late fees depend on how much you owe and how late you are. Look, I’m not here to micromanage your finances. But personally, I find having two checking accounts works wonders; one for everyday expenses like rent and groceries, and another specifically for those quarterly tax payments.

Freelancer Deductions: What Can You Write Off?

A while back, I stumbled upon this hilarious story online about a lawyer in Baltimore. Apparently, this guy bought a fax machine and installed it on his (surprisingly modest) yacht. Then, he wrote the whole thing off on his taxes, boat included, claiming it as “office space” because of the fax machine.

My kind of workspace. Honestly, I don’t really care if it’s true or not. It’s more about the principle of the thing. People try this stuff all the time, some with good intentions, some not so much. There have been some seriously funny and strange write-offs over the years, and some even won in tax court after initially being rejected by the IRS. But figuring out what you can and can’t deduct is tricky business.

Freelancer Deductions: How They Work

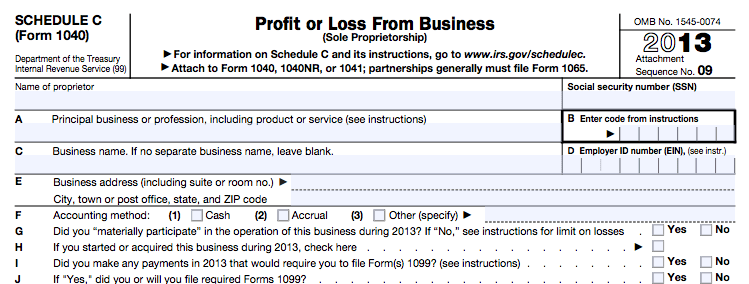

Tax deductions are like music to a freelancer’s ears, and for good reason – but what are they, really? Basically, they’re itemized reductions in the total amount of your income that the IRS can tax. Let’s say you make $40,000 a year and don’t claim any deductions. The IRS expects you to pay taxes on the entire $40,000. Now, imagine you’re a freelancer making the same $40,000 but paying $5,000 a year for your own health insurance. You can deduct (or “write off,” as some people say) those health insurance costs, meaning the IRS only taxes you on $35,000. Here’s the thing about freelancer deductions: most of them are submitted on a form called Schedule C Form 1040.

Schedule C Form 1040 in all its glory. Like most things in the American tax system, deductions come with their own set of rules and exceptions. Take home offices, for example. You can write off certain home office expenses, but there’s a catch: the space must be used exclusively for business. No sneaking in a quick video game session you can’t write off a portion of your mortgage or rent if you work from your kitchen table, unfortunately. And even then, you can only deduct a portion of those expenses, not the whole shebang.

Pro tip: This isn’t a “home office” as far as the IRS is concerned. The same goes for other business expenses. The IRS lets freelancers and self-employed folks deduct up to 50% of their meal costs if they were for legitimate business purposes (like meeting a potential client for lunch). But try to push that limit, and you might find yourself facing an audit.

What Business Expenses Can Freelancers Deduct?

So, we’ve established that everything with the IRS comes with conditions, and not all expenses are deductible. But what can you actually deduct? Here’s a rundown of common expenses you can legitimately deduct as an independent contractor (with the important caveats, of course). For simplicity, let’s assume that all these costs are subject to the IRS’s rules, including how much of each cost you can actually deduct.

- Travel and Accommodation: If your work takes you places, you can usually deduct at least some of your travel and lodging expenses. This covers flights, taxis/ride-sharing, train tickets, car rentals, and hotel rooms.

- Meals: As mentioned earlier, you can often deduct a portion of your meal costs if they were for business-related reasons.

- Website Costs: Keeping your online presence up and running costs money. The good news is that expenses like website hosting fees and domain registrations are deductible.

- Vehicle Maintenance and Mileage: If you use your personal vehicle for work, you can deduct certain car-related expenses like wear and tear, as well as some of your fuel costs (usually calculated based on mileage). There are two ways to deduct these expenses: the standard mileage option and the actual expense option. With the standard mileage option, you can deduct up to $0.535 per mile. The actual expense option lets you deduct a percentage of all your vehicle-related costs, like lease payments, repairs, tires, registration, insurance, and more. For the nitty-gritty on deducting vehicle expenses, head over to QuickBooks’ excellent guide to vehicle deductions.

- Software Costs: Let’s face it, freelancers rely on software. The good news is that these expenses are deductible, whether it’s a one-time purchase or a subscription-based program.

- Utilities: Similar to home office deductions, you can write off some of your utility costs if you work from home. This includes things like electricity, phone bills, internet, and other utilities, depending on your specific situation.

- Unpaid Invoices: Ask any freelancer, and they’ll likely have a horror story about a client who refused to pay. It’s infuriating, but the IRS gets it. They allow independent contractors to write off unpaid invoices as lost income. And you’d be surprised how many freelancers don’t know this.

- Healthcare Coverage: Let’s be real, finding and buying private health insurance as a freelancer is a pain. But hey, at least you can deduct the entire cost of your health insurance premiums on your taxes. Keep in mind, though, that you can’t deduct premiums if you’re covered under your spouse’s employer-provided plan. There are plenty of other things you can deduct, too, such as retirement contributions (ha!), legal fees, and professional development expenses like training programs and courses. When in doubt, a qualified tax professional is your best friend.

The Scary Question: What Happens If You Don’t Pay Your Freelancer Taxes?

We’ve covered quarterly estimates, deductible expenses, and what potential tax reforms could mean for freelancers. Now for the question that keeps everyone up at night – what happens if you don’t pay your taxes?

Maybe don’t go DIRECTLY to jail… Remember those quarterly estimate deadlines we talked about? Well, if you miss them, the IRS will hit you with late payment fees and interest on your total tax liability for that year, meaning the total amount you owe. And these fees apply even if you filed for an extension, so don’t think you’re off the hook – you’re not. There are two main types of penalties the IRS uses:

- Failure to File: This penalty kicks in if you don’t file your tax return by the deadline.

- Failure to Pay: This one applies if you file your return on time but don’t pay the taxes you owe. According to the IRS, the penalty for filing your return late is usually 5% of the unpaid taxes for each month (or part of a month) that it’s late. This penalty starts accruing the day after the filing deadline and can’t be more than 25% of your total unpaid taxes.

It’s funny because it’s true!

The failure-to-pay penalty is typically 0.5% of your unpaid taxes for each month or part of a month that taxes are due. Like the failure-to-file penalty, it starts the day after the payment deadline. That said, there are exceptions to every rule, especially when it comes to taxes. For instance, if you’re getting a refund, the IRS will usually deduct any late filing or payment penalties from that amount. And in some cases, you might not have to pay penalties at all. Again, if you’re unsure, contact the IRS directly or talk to a qualified tax professional.

Striking a Deal: Repayment Agreements with the IRS

So, you filed your return (late or not), calculated what you owe, and – surprise, surprise – you owe more than you can pay. Now what?

One option is to set up a repayment agreement with the IRS. This lets you pay back your tax debt from one or more previous years in monthly installments. You can even have the payments debited directly from your bank account, making it easy to stay on track without dealing with checks every month. The IRS is usually pretty understanding when it comes to repayment, but there are some eligibility requirements for these agreements. Check their website for details on who qualifies and how to apply.

The Hail Mary: Offer-in-Compromise

Another way to tackle back taxes is by making an “offer in compromise.” This is basically a one-time, lump-sum payment that’s typically less than what you actually owe. For example, you could offer to pay $6,000 on a $10,000 tax bill. The good news is that you can sometimes spread out these offers-in-compromise over several payments, which the IRS calls “periodic payments.”

Unfortunately, it’s a little more complicated than this. Important caveat: the IRS doesn’t have to accept your offer. If they think you can swing a regular installment agreement, they’ll probably push for that instead. Plus, the IRS might take other collection actions before even considering your offer-in-compromise. Learn more about offers-in-compromise at the official IRS website.

The Nuclear Option: Bankruptcy

When all else fails, this might be an option, but consider it the last resort. Chapter 13 is the most common type of bankruptcy for people drowning in tax debt. But filing for Chapter 13 is a big deal for everyone involved, including the IRS.

Try to avoid ending up here. Even if you don’t care about the impact on your financial future, there are a few boxes you need to check before filing for Chapter 13:

- You have to have filed tax returns for the past four years before filing for Chapter 13, no exceptions.

- While your bankruptcy case is ongoing, you need to keep filing your tax returns (or at least apply for an extension).

- You have to pay all your current taxes while the bankruptcy case is chugging along.

- If you fail to file your returns or pay your current taxes, your case could be thrown out. Seriously, this is not a decision to be made lightly. Bankruptcy is a huge deal, especially in today’s credit score-obsessed world. But if there’s truly no other way out, it might be something to consider. Whatever you do, talk to a tax attorney first. Actually, if you’re thinking about any of the stuff we’ve discussed, a chat with a tax attorney is always a good idea.

Feeling Lost? Resources for Confused Freelancers

We’ve barely scratched the surface of how complicated freelancer taxes can be. So, to help you navigate this jungle, here are some resources worth checking out:

- US Tax Center at IRS: This IRS website is a gold mine of information on pretty much every tax-related topic you can imagine. Plus, it’s way easier to navigate than the main IRS website.

- Freelancer’s Union: This non-profit is based in New York City, but their Freelancer’s Union is packed with helpful advice for anyone who’s self-employed. They do a great job of breaking down complex topics into plain English.

- Reddit: Yes, Reddit can be a mixed bag, but the /r/personalfinance and /r/tax subreddits can be surprisingly helpful if you know how to ask the right questions (and remember to search for previous posts before asking your own, as dictated by the unwritten rules of Reddit). But just like everything else we’ve talked about, don’t take any advice from Reddit as gospel, even if someone claims to be a lawyer or accountant.