The COVID-19 pandemic has had a profound global impact, affecting not only public health but also the economy. We are navigating uncertain times, and while definitive answers remain elusive, one thing is evident: small businesses are grappling with the sudden shifts in their advertising campaign performance as a direct result of this global crisis.

We’ve witnessed firsthand how global events can significantly influence pay-per-click (PPC) advertising, and COVID-19 is no exception. As businesses adapt their operations, individuals spend more time at home, and the world reacts to a rapidly evolving pandemic, people are turning to online search engines and news outlets for information and solutions. For some advertisers, this surge in online activity is attracting new audiences to their websites, some of whom are converting into customers. However, others are experiencing less favorable outcomes, necessitating strategic adjustments.

At nexus-security, we are analyzing data from tens of thousands of advertisers to understand the effects of COVID-19 on PPC advertising. This article delves into several industries that have witnessed substantial fluctuations in their Google Ads accounts in recent weeks as COVID-19 has disrupted daily life and business operations.

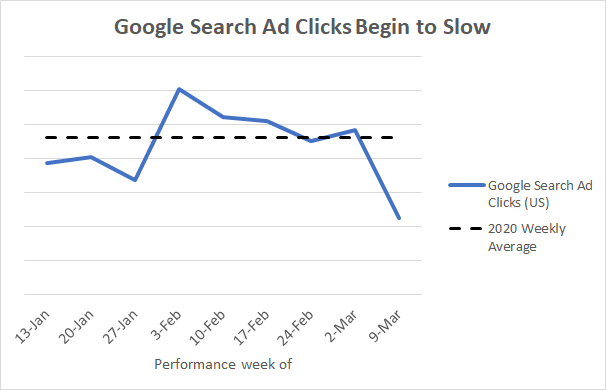

In the United States, Google’s searches have shifted, but remained mostly steady. However, over the past week, we’ve observed a slight decline in Google search ad impressions, dipping 7% below the average. While not entirely unusual, particularly during holiday periods, this trend was unexpected for many advertisers.

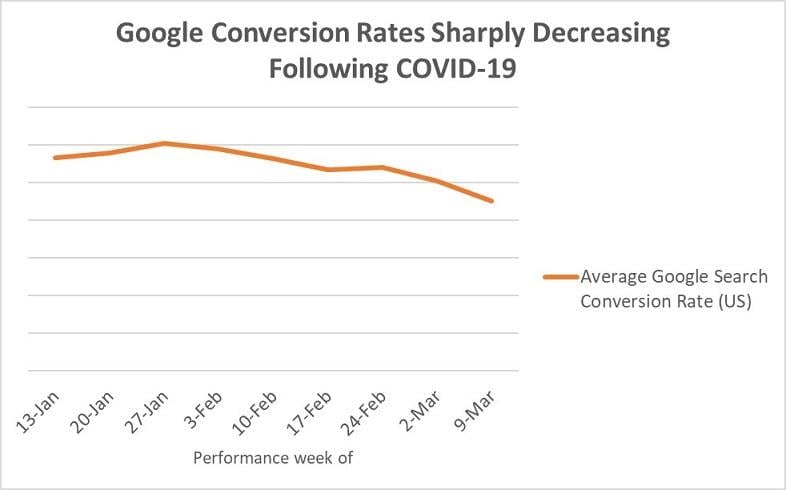

What is atypical is how users are interacting with search results. As they navigate the search engine results pages (SERPs), we’re finding that their search intent might be entirely different, rendering clicks less valuable for your PPC ad spend. Additionally, users are demonstrating increased hesitation to convert. Since COVID-19 reached epidemic proportions in the United States three weeks ago, we’ve seen an average conversion rate decline of 21%.

It’s important to acknowledge that Google Ads performance varies across industries. Therefore, a more granular examination is necessary. Looking for more insights? Don’t miss Mark’s on-demand webinar! Let’s explore seven industries experiencing increased volume, seven exhibiting mixed performance, and seven hit hardest by the pandemic.

7 Industries Thriving During COVID-19

Amidst the challenges, some businesses are witnessing positive trends across key metrics.

Non-profits and Charities

Times of crisis often reveal the best in humanity, and this holds true even in the digital realm of the Google SERP. As COVID-19 spreads, non-profits and charities have experienced:

- A 10% rise in search ad impressions.

- A significant 23% surge in search ad conversions.

- An impressive 20% improvement in search ad conversion rate. While Google Ads supports various grant programs enabling non-profits to advertise for free, maintaining compliance can be complex. Fortunately, these organizations are connecting with their target audience more effectively than ever during this crisis.

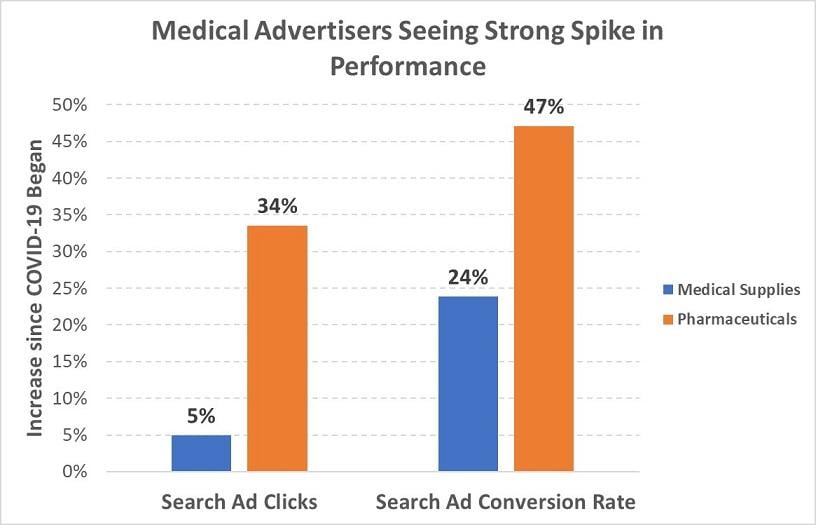

Health and Medical

It comes as no surprise that many are turning to online searches for information on safeguarding themselves and their communities. As individuals seek to purchase products ranging from over-the-counter remedies to essential medications both online and in physical stores, many advertisers in this sector are witnessing increased ease in selling their products online, with ad clicks and conversion rates both notably exceeding their usual levels.

Stay Ahead of the Curve: Download Your Free Small Business Guide to COVID-19 and Online Advertising.

Business Management

Google is providing additional advice and resources to help small businesses manage through these uncertain times, particularly in areas such as transitioning employees to remote work and developing business continuity strategies. It seems many advertisers in this field are well-positioned to offer assistance. Since February 23, searches related to business management have surged by 23%.

- With remote work arrangements becoming increasingly prevalent, office supplies have emerged as an unexpected growth sector. Searches for office supplies have soared by 90%, accompanied by a 35% rise in paid search ad clicks and a 41% increase in search conversion rates.

- As traditional retailers shift their focus to online operations, packing and shipping supplies have experienced a remarkable surge, with search ad conversions more than doubling (up 123%) and search ad conversion rates soaring by 107%.

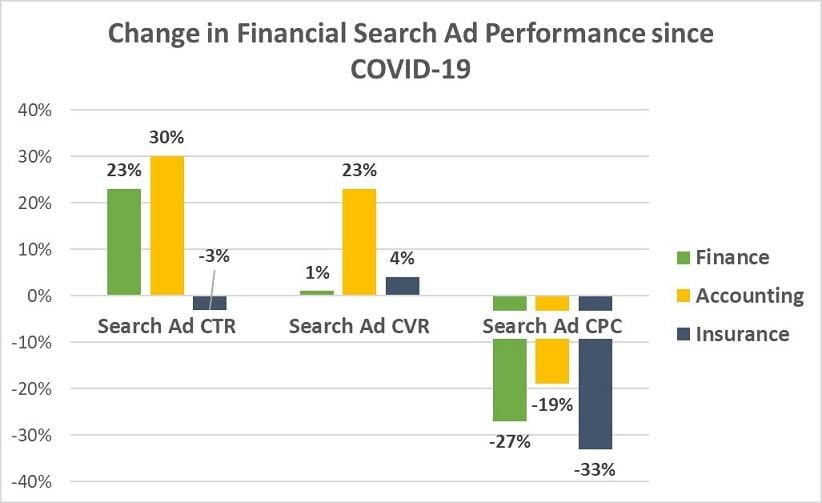

Finance

Despite market volatility, it appears that now, more than ever, individuals are seeking expert financial guidance. In an industry characterized by some of the priciest keywords and high cost-per-click (CPC), we’re observing a decrease in CPCs, providing some relief in a traditionally competitive market. Additionally, many are benefiting from improved click-through rates (CTRs) and conversion rates (CVRs).

Beauty and Personal Care

Fast-moving consumer goods (FMCGs) have witnessed heightened demand in recent weeks. People are actively searching for essential items like soap and hand sanitizer while also prioritizing self-care during these trying times. Searches for beauty and personal care products have surged by 41%. Notably, many verticals within this sector are thriving on the SERP, experiencing lower CPCs and substantially higher CVRs.

| Category | Change in Search CPC | Change in Search CVR |

| Beauty & Personal Care | -14% | +6% |

| Skin Care | -3% | +21% |

| Spa Care | -20% | +41% |

Greetings, Gifts, and Flowers

Social distancing can be isolating, making it challenging to maintain connections while physically apart. Small gestures have taken on even greater significance during the COVID-19 pandemic, and advertisers leveraging Google Ads are reaping the rewards. Since the coronavirus escalated in the US three weeks ago:

- Searches for cards and greetings have witnessed a 15% increase in conversion rate.

- Searches for gift baskets have experienced a 30% rise in conversion rate.

- Floral arrangement searches have seen an impressive 43% jump in conversion rate.

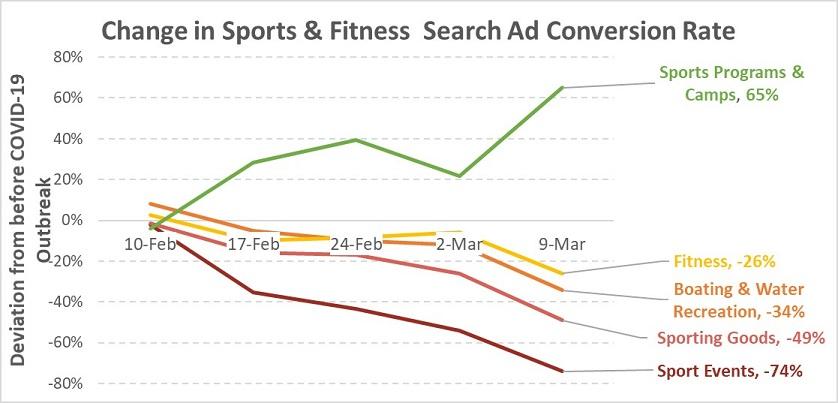

7 Industries with Mixed PPC Results During COVID-19

Certain industries warrant close monitoring as they hold the potential for significant fluctuations in the coming weeks.

Real Estate

Despite low borrowing rates and a relatively stable housing market, the real estate industry is exhibiting signs of uncertainty. On the SERP, search traffic has remained relatively consistent, with minimal changes in search volume, CPC, or conversion rates. However, subtle shifts could have far-reaching consequences for the industry.

- Property development and construction industries are experiencing declining conversion rates (down 53% and 7%, respectively) and lower search volume. A slowdown in these sectors could lead to reduced real estate supply in the future.

- Both real estate listings and real estate agent searches have witnessed an increase in CPC (up 15% in the past month). However, real estate listings have seen a 25% drop in conversion rates, while real estate agents and brokers have observed a 30% increase. As consumers become more reluctant to attend open houses, reliance on professional agents for scheduled appointments is likely to rise.

- Moving and relocation services have seen an 11% increase in search volume while maintaining healthy CTR, CPC, and CVR metrics.

Home Improvement

March typically marks a seasonal lull for home improvement projects, so it’s not surprising that searches in this category have been gradually declining in recent weeks. The coming weeks will be crucial for gauging the industry’s resilience. On the one hand, with more time spent at home, homeowners may be inspired to embark on new projects. Conversely, economic uncertainty could discourage discretionary spending. Currently, average conversion rates remain steady but exhibit considerable variation.

Home Furniture

Similar to the home improvement sector, the performance of big-ticket furniture items has been unexpectedly consistent. Search volume, CPCs, and conversion rates have all remained within a +/-2% range in recent weeks. However, smaller-ticket items like home appliances and bedding have experienced an uptick in searches and slight conversion boosts (up 7% and 12%, respectively), potentially indicating a degree of consumer confidence.

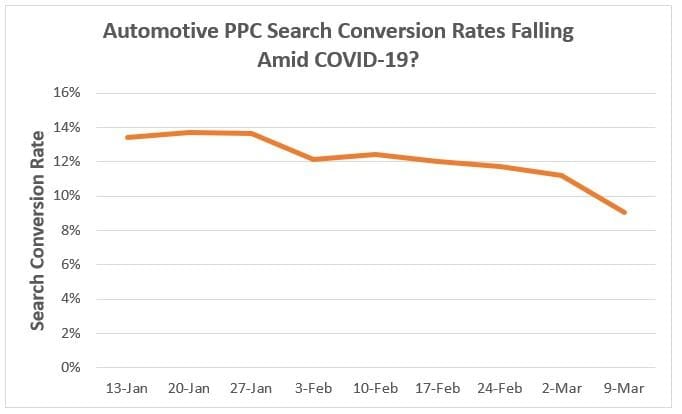

Automotive

The automotive industry is showing signs of strain on the SERP, with a notable 30% decline in the average industry conversion rate over the past few weeks.

While a 30% drop is never a positive sign, attributing it solely to COVID-19 is difficult. Mid-March isn’t typically a peak car-buying season. However, we are observing shifts in user preferences within the automotive space.

| Category | Average Change in Search Conversion Rate Since COVID-19 |

| Vehicle Dealers | -42% |

| Vehicle Auctions | +5% |

| Vehicle Parts & Accessories | -28% |

| Vehicle Repair & Maintenance | +44% |

| Vehicle Window Tinting | +79% |

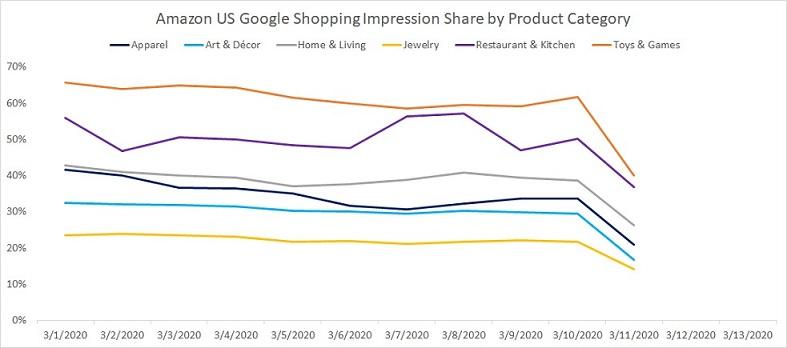

The silver lining? Large retailers, including Amazon, are scaling back their Google Ads budgets, resulting in a 9% decrease in CPC on the platform and helping to stabilize the return on ad spend (ROAS) for most retailers.

Data courtesy of Andy Taylor of Tinuiti Conversely, wholesalers and liquidators seem to be experiencing an opposite trend, with a 14% increase in CPCs but a 9% rise in conversion rates.

Jobs and Education

With schools and colleges across the nation temporarily closed, there’s been a forced shift towards online learning and training. However, despite the transition in educational delivery, there haven’t been any significant short-term changes in the performance of higher education advertisers. With college application deadlines passed and the June SAT yet to be canceled, prospective student behavior on the SERP remains largely unchanged. While there’s been a modest increase in paid search traffic for career advancement and vocational training (up 10% and 8%, respectively) in recent weeks, this appears to be largely aspirational at present, as conversion numbers haven’t shifted significantly.

Legal Services

The legal industry is witnessing minor fluctuations on the SERP, with modest (under 5%) changes in search volumes and conversion rates. Fortunately, this is counterbalanced by a similar decline in CPC, keeping search conversions and cost-per-acquisition (CPA) relatively stable. However, a larger proportion of these conversions are now coming through phone calls rather than website submissions. Unfortunately, over 30% of these calls are going unanswered. If COVID-19 is affecting your firm’s operations or hours, consider the following:

- Adjust your campaign dayparting to reflect your current availability.

- If you’re working remotely, ensure that your website, call-only ads, and ad call extensions display the most appropriate number for reaching your team.

- Implement keyword-level tracking to monitor phone calls generated by your PPC campaigns.

- Update your Google My Business account is up to date to accurately reflect your firm’s current operations. Consider creating a post to assure potential clients that your firm remains active during this challenging period.

7 Industries Facing the Biggest Challenges

Public health is undoubtedly the paramount concern during the COVID-19 pandemic. Unfortunately, certain industries are particularly vulnerable, and those employed in these sectors are significantly impacted both on and off the SERP. 2021 Update: If your account was paused during the peak of the pandemic and you’re planning to reactivate it, refer to these steps to audit your account post-COVID.

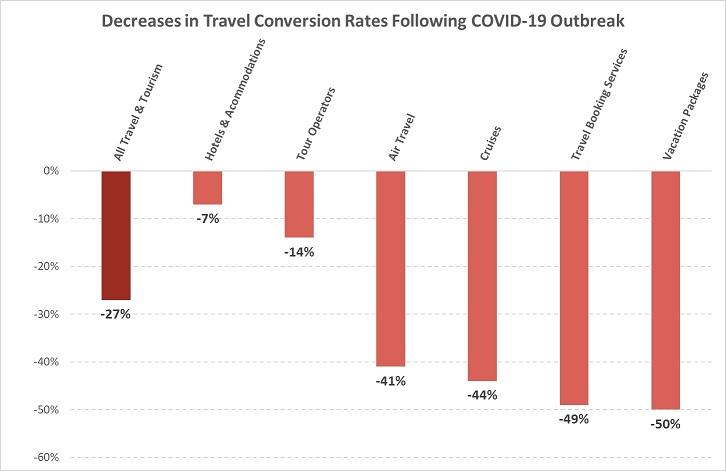

Travel and Tourism

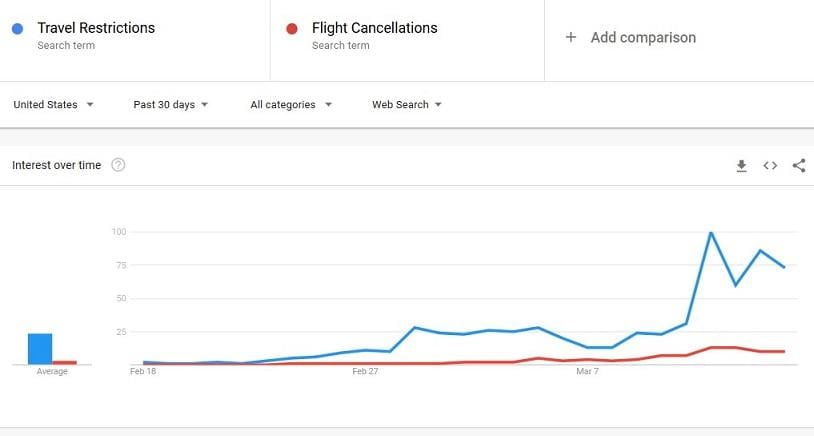

With businesses, governments, and individuals avoiding non-essential travel, it’s unsurprising that travel bookings have plummeted. Consequently, many travel advertisers are struggling to convert potential customers.

Adding to the difficulties, searches related to flight cancellations, delays, and travel restrictions are at an all-time high, increasing the visibility of their ads to users who may not be ready to book.

To mitigate disruptions, consider these strategies:

- Expand your negative keyword lists to include COVID-19, advisory, and cancellation-related terms.

- Promote affordable fares, flexible cancellation policies, and easy rebooking options for future travel.

- Offer travel insurance to alleviate concerns and potentially increase your average order value.

Bars and Restaurants

With many communities implementing dine-in restrictions or closures, bars and restaurants are among the hardest hit businesses during this period of social isolation. While many are adapting by offering delivery and takeout options, they face an uphill battle on the SERP.

| Category | Change in Search Ad Impressions | Change in Search CVR |

| Restaurants | -18% | -59% |

| Bars & Nightclubs | -26% | -57% |

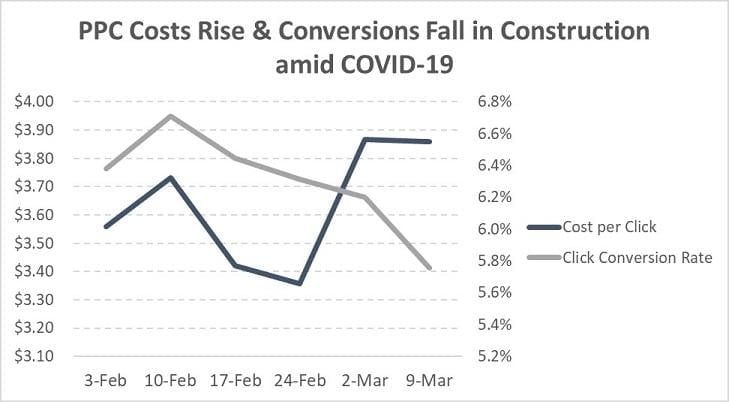

Building and Construction

The economic downturn and worksite closures have brought the building and construction industry to a standstill. With projects stalled or delayed, potential clients are less likely to convert. This timing is particularly unfavorable as seasonal advertising costs in this sector are already on the rise.

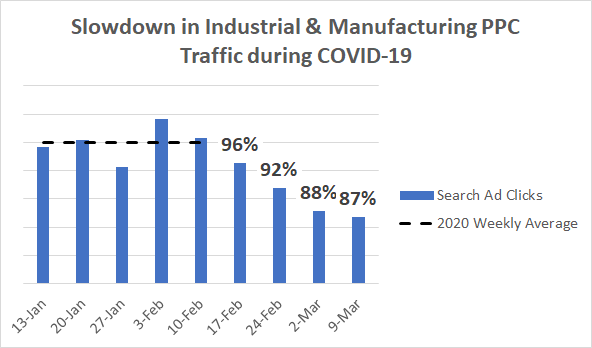

Industrial and Manufacturing

As manufacturing operations slow down, PPC campaigns for industrial and manufacturing goods are feeling the impact. While CPCs have increased by 5% and conversion rates have decreased moderately, advertisers are grappling with a 13% decline in search traffic.

The coming months will undoubtedly bring further change, both in the online and offline worlds. Stay safe, prioritize your health, and practice social distancing. While you’re at home, keep a close eye on your PPC accounts and stay tuned to the nexus-security blog. We’ll continue to provide regular updates on emerging trends and strategies to help you maintain your account’s performance during these challenging times.

Data Sources

This report is based on an analysis of 15,759 US-based nexus-security client accounts across all verticals that were actively advertising on Google Search throughout 2020 to date. Each industry segment includes a minimum of 30 unique active clients. For indexing purposes, we’ve assessed weekly account performance since February 24th against the preceding six-week average.

Additional Resources for SMBs and Online Advertising During COVID-19

- How the Coronavirus (COVID-19) Pandemic is Affecting Small Businesses & Marketers

- 6 Strategies for Facebook and Instagram Advertising During the COVID-19 Pandemic

- The CARES Act Paycheck Protection Program: What You Need to Know

- Marketing During COVID-19: 4 Essential Copywriting Guidelines

- Navigating COVID-19: A Simplified Guide to Resources for SMBs

- [4 Major Trends Caused by COVID-19 and How to Respond [Data]]

- Updated Google Ads Benchmarks for Your Industry During COVID-19 [Data]

- How COVID-19 Is Shaping Google Search Trends & Patterns [Data]

- 4 Smart Ways to Get to Know Your Post-COVID-19 Customers