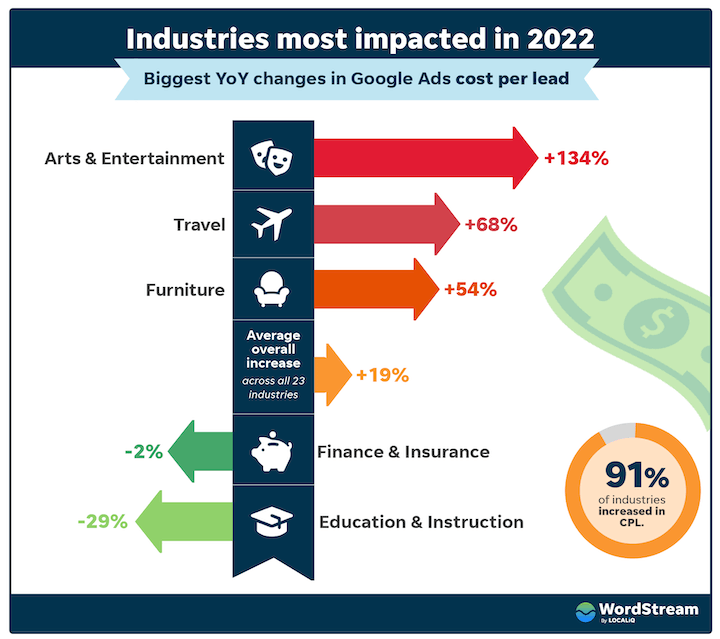

Google Ads boasts an impressive average return on investment of 200%, making it a highly sought-after advertising platform for businesses of all sizes. However, this popularity also breeds competition. A recent study revealed that cost per lead has risen for 91% of industries year over year, making it crucial for advertisers to prioritize performance monitoring.

To stay ahead in the game, particularly with the holiday season approaching and the need to plan for 2023, it’s essential to understand the latest trends and insights. This information will not only guide your holiday campaigns and budget allocation but also equip you to navigate the uncertainties of the current economic climate.

To stay ahead in the game, particularly with the holiday season approaching and the need to plan for 2023, it’s essential to understand the latest trends and insights. This information will not only guide your holiday campaigns and budget allocation but also equip you to navigate the uncertainties of the current economic climate.

Note: We update this data regularly!

Download the PDF of our latest Google Ads Benchmarks report here.

Major Trends in Google Ads

Our latest Google Ads industry benchmarks report offers valuable data on click-through rate (CTR), cost per click (CPC), conversion rate (CVR), and cost per lead (CPL) across 23 industries. It’s important to note that our platform dynamically adjusts budget allocation between search channels for each campaign. On average, Google Ads receives 80-85% of the budget, while Microsoft Ads receives the remaining 15-20%.

Let’s delve into the most significant trends:

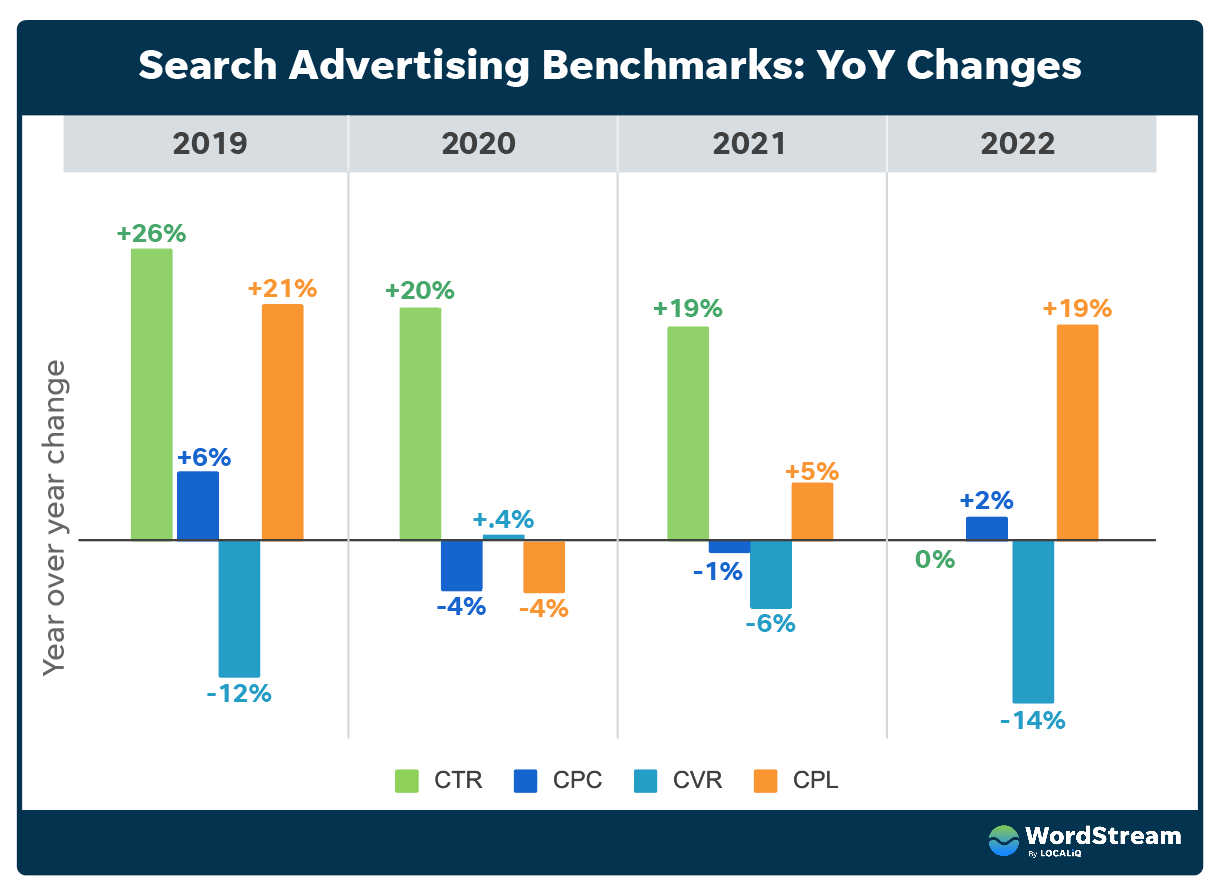

- Cost per lead (CPL) is on the rise. Out of 23 industries analyzed, 21 experienced a year-over-year increase in CPL, with an average surge of 19%. This represents a substantial jump from the previous year’s 5% increase. Interestingly, this trend mirrors the 21% increase observed in 2019, contrasting with the 4% decrease in 2020.

- The most pronounced increases in CPL were observed in Arts/Entertainment (a staggering +134%), Travel (+69%), and Furniture (+54%). Conversely, Education/Instruction (-29%) and Finance/Insurance (-2%) emerged as exceptions, showing a decrease in CPL. Inflation appears to be a driving force behind these fluctuations, a point we’ll elaborate on in the key takeaways.

- Conversion rates are declining. A significant 91% of industries witnessed a drop in conversion rates, averaging a decrease of 14%. While this decline is more substantial than the previous year, it aligns with the 12% decrease observed in 2019.

- Cost per click shows a slight upward trend. Slightly over half (57%) of the industries analyzed experienced an increase in CPC, averaging a 2% rise. This contrasts with the decreases of -4% and -1% observed in 2020 and 2021, respectively, but aligns with the 6% increase witnessed in 2019.

- Click-through rates remain relatively stable. Although 78% of the industries included in our report saw a year-over-year increase in CTR, the overall average remained unchanged. This marks the first time since 2019 that CTR hasn’t shown an increase.

It’s noteworthy that, with the exception of click-through rates, the year-over-year changes observed in 2022 closely resemble those of 2019, before the onset of the pandemic.

It’s noteworthy that, with the exception of click-through rates, the year-over-year changes observed in 2022 closely resemble those of 2019, before the onset of the pandemic.

Interpreting the Trends and Adapting Your Strategies

What factors underpin these trends? Why are small businesses grappling with these impacts, and how can they adapt? The answer likely lies in a confluence of elements, including the prevailing economic conditions and shifts in Google’s advertising platform dynamics.

Let’s break down the primary contributing factors and outline actionable recommendations:

1. The Impact of Inflation on Conversion Rates

With the consumer price index hovering near a 40-year high, it’s no surprise that businesses are feeling the pinch. Rising operational costs have become a significant concern. For instance, numerous restaurants have been compelled to raise menu prices in response to escalating food prices. In this climate of record-high prices, consumers have grown increasingly cost-conscious, particularly when it comes to discretionary spending. A June report in the Washington Post highlighted that consumers were cutting back on travel and restaurants.

These factors likely contribute to declining conversion rates and escalating costs per lead. This explains why industries such as Arts/Entertainment, Travel, Furniture, and Apparel/Fashion/Jewelry, which typically involve discretionary spending, have experienced the most substantial increases in CPC and/or CPL. Conversely, the slight decrease in CPL observed in Education/Instruction and Finance/Insurance might be attributed to their essential nature.

These factors likely contribute to declining conversion rates and escalating costs per lead. This explains why industries such as Arts/Entertainment, Travel, Furniture, and Apparel/Fashion/Jewelry, which typically involve discretionary spending, have experienced the most substantial increases in CPC and/or CPL. Conversely, the slight decrease in CPL observed in Education/Instruction and Finance/Insurance might be attributed to their essential nature.

Furthermore, supply chain shortages could be influencing the rise in Furniture CPL.

The specter of inflation might also be prompting some advertisers to tighten their advertising budgets. According to Search Engine Land, Google’s FY22 Q3 earnings report revealed sluggish growth in ad revenue, which the company attributes to reduced advertiser spending. SEL suggests that this slowdown “could signal potential further budget cuts and higher CPCs on the horizon” for advertisers.

Strategies for Adapting to Inflation

In his insightful article on Marketing During Inflation,, Mitchell Leiman, Sr. VP of Strategy and Operations at LocaliQ, emphasizes that while inflation is a pressing concern for small businesses, it is likely a transient phase. He advocates for proactive adaptation through strategies such as scrutinizing costs and profit margins to identify areas for savings, leveraging cost-effective and free marketing avenues, evaluating cash flow and debt positions, and implementing strategic price adjustments when necessary. Leiman’s article offers detailed guidance, and our price increase letter templates can provide additional support.

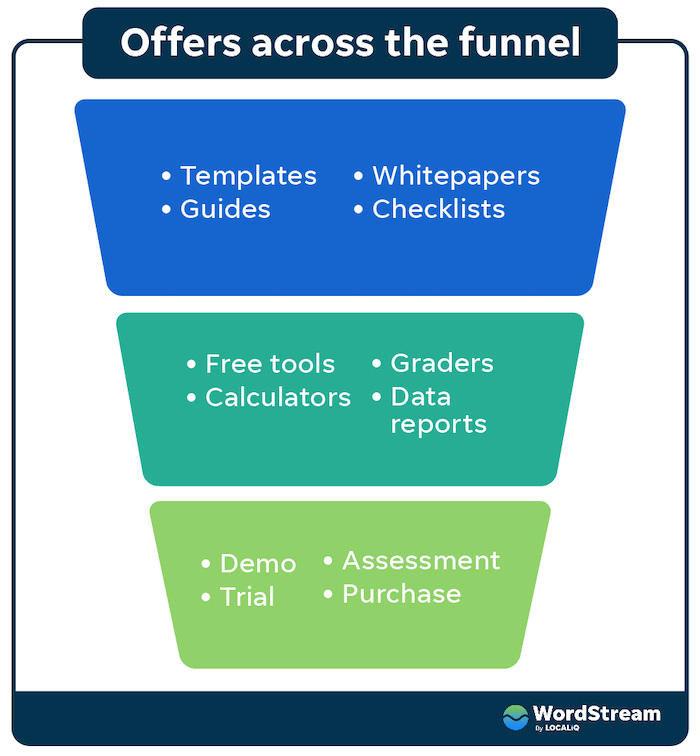

Embracing a full-funnel marketing approach can also bolster conversion rates. Instead of focusing solely on bottom-funnel conversions, consider crafting campaigns that target lower-friction offers to cultivate awareness and engagement higher up the funnel. This allows you to nurture leads through email marketing, building trust and retargeting them with bottom-funnel offers at a later stage.

2. The Expanding Reach of Broad Match

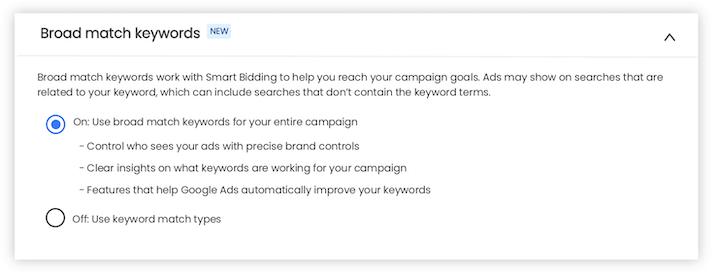

Google’s decision to retire modified broad match keywords last year, coupled with its ongoing push for advertisers to adopt broad match in conjunction with Smart Bidding, has significantly broadened the reach of keywords. The recent introduction of a limited beta test allowing advertisers to eliminate keyword match types at the campaign level further underscores this trend.

This expansion in keyword matching means that ads are now appearing for a wider array of search queries, including those with lower commercial intent. While CTR has remained relatively stable, indicating consistent ad engagement, the lack of purchase intent translates into fewer conversions.

This expansion in keyword matching means that ads are now appearing for a wider array of search queries, including those with lower commercial intent. While CTR has remained relatively stable, indicating consistent ad engagement, the lack of purchase intent translates into fewer conversions.

Strategies for Adapting to Broader Match

In response to Google’s emphasis on broad match with Smart Bidding, international paid media consultant and speaker Michelle Morgan suggests alternative approaches, such as leveraging phrase match, exact match, or dynamic search ads. However, if you opt for Google’s recommended “upgrade,” she emphasizes the importance of starting with sufficient conversion data, diligently reviewing search queries, adopting a conservative budget strategy, and implementing bidding restrictions from the outset.

Devon Anderson, VP of Media Delivery & Automation at LocaliQ, highlights that in addition to the removal of modified broad match, “We are observing a trend of broader matching for both phrase match and broad match keywords. This can lead to ads appearing for competitor searches and irrelevant search terms if proactive measures are not taken.” To ensure your ads reach the right audience, Anderson stresses the importance of closely monitoring keyword performance and diligently maintaining negative keyword lists.

Devon Anderson, VP of Media Delivery & Automation at LocaliQ, highlights that in addition to the removal of modified broad match, “We are observing a trend of broader matching for both phrase match and broad match keywords. This can lead to ads appearing for competitor searches and irrelevant search terms if proactive measures are not taken.” To ensure your ads reach the right audience, Anderson stresses the importance of closely monitoring keyword performance and diligently maintaining negative keyword lists.

3. The Ever-Increasing Competition in Search Advertising

The effectiveness of Google Ads, evidenced by the fact that 89% of buying journeys originate from search engines, has made it a crowded playing field. With PPC campaigns yielding an average ROI of $2 for every $1 invested, it’s no wonder that more advertisers are flocking to the platform.

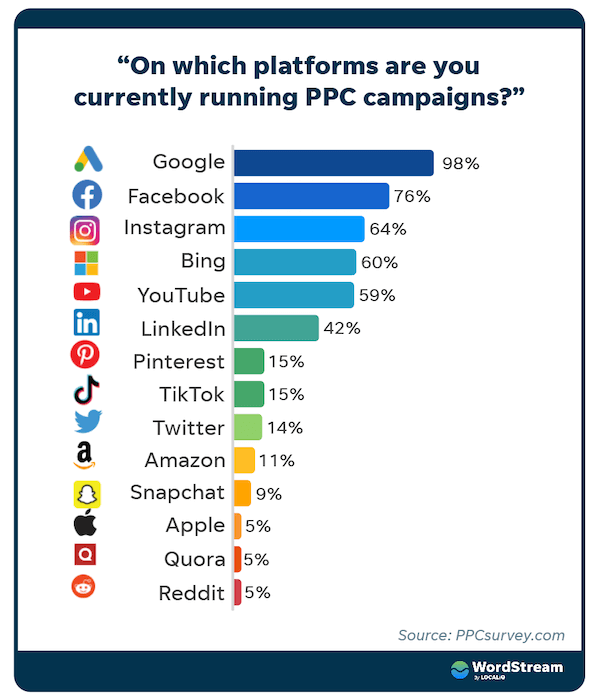

PPCsurvey’s 2022 State of PPC report reveals that 98% of respondents utilize Google Ads, compared to 76% for Facebook and 64% for Instagram. This surge in advertisers inevitably intensifies competition, driving up bids and reducing clicks per advertiser.

Strategies for Thriving in a Competitive Landscape

Maintaining your share of traffic and leads in this competitive environment might necessitate a budget increase, not just in the coming year but also during the current holiday season. If a budget increase isn’t feasible, our article on “Eight Ways to Compete in Google Ads Without Raising Bids” provides guidance on enhancing ad relevance and Quality Score, optimizing keywords, analyzing competitor strategies, and more.

Additionally, we recommend embracing a cross-channel marketing approach. Paid search often delivers optimal results when integrated with other marketing channels. For instance, in her article on the top four advertising channels, international paid media consultant and speaker (and nexus-security alum!) Navah Hopkins advocates for utilizing display advertising to cultivate audiences, video ads for demand generation, and social media for “impulse” purchases. Michelle Morgan also offers valuable insights into cross-channel advertising strategies.

If you’re not totally satisfied with your search ad results, try the Free Google Ads Performance Grader to get a report card with tips on how to improve.

A Deep Dive into Search Advertising Benchmark Data

Armed with the understanding that costs are rising and the factors driving these increases, the question becomes: What constitutes a “high” cost? What benchmarks should you aim for in your cost reduction efforts?

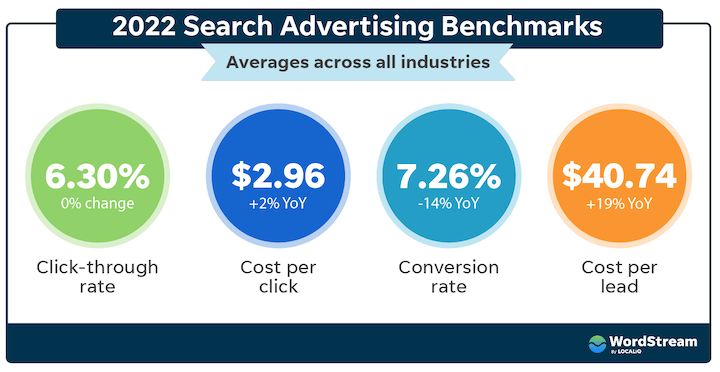

Let’s start with the overall averages for Google Ads in 2022:

- Average click-through rate: 6.30%

- Average cost per click: $2.96

- Average conversion rate: 7.26%

- Average cost per lead: $40.74

While overall averages provide valuable insights into broader trends, it’s crucial to recognize that each metric can vary significantly across different industries. To gain a more nuanced understanding, we’ll delve into industry-specific data, offering insights and tips to help you gauge and enhance your performance relative to your competitors.

Navigate to specific metrics:

You can find all the charts from this report consolidated in our Online Advertising Benchmarks hub page.

Average Click-Through Rate in Google Ads, 2022

Click-through rate represents the percentage of ad impressions that result in a click, serving as an indicator of your ad’s relevance to its target audience. A CTR of 1% signifies that one out of every 100 people who view your ad click on it.

CTR plays a pivotal role because it influences your expected click-through rate, a factor considered in your Quality Score, which in turn impacts your cost per click.

The average click-through rate for Google Ads in 2022 stands at 6.30%.

Industries with the lowest CTRs include Apparel/Fashion/Jewelry, Shopping/Collectibles/Gifts, and Furniture, ranging between 2-4%. Notably, Furniture and Apparel consistently rank among the lowest CTRs, while Shopping/Collectibles/Gifts has moved up the list.

Conversely, the industries boasting the highest average CTRs remain consistent with the previous year: Arts/Entertainment, Sports/Recreation, and Travel, all exceeding 10%.

This variation in CTRs can likely be attributed to the differences in user intent and decision-making processes across industries. For example, someone searching for a specific show or venue in the Arts/Entertainment category is more likely to click on a relevant ad. In contrast, individuals shopping for apparel might engage in more browsing before clicking.

Moreover, product searches tend to yield a higher number of ad results per page (up to 30 Shopping ads on desktop and a maximum of 15 on mobile), potentially leading to lower CTRs per ad. Additionally, product images allow users to assess the product’s suitability without clicking.

Year-Over-Year Analysis of Average Click-Through Rate

Analyzing the year-over-year trends, 78% of the industries in this report experienced an increase in CTR. However, when considering all industries collectively, there was no significant change in CTR.

Among the industries experiencing the most substantial decreases in CTR were Shopping/Collectibles/Gifts (-51%), Apparel/Fashion/Jewelry (-23%), and Arts/Entertainment (-17%). It’s worth noting that Arts/Entertainment, despite a significant drop, historically maintains the highest CTR among the industries analyzed.

Conversely, industries witnessing the most notable increases in CTR include Career/Employment (+56%), Attorneys/Legal (+32%), and Sports/Recreation (+32%).

Strategies to Enhance Your Click-Through Rate

If your CTR falls short of your industry average, it’s time to review your ad copy and targeting strategies. Consider these questions:

- Can you experiment with different features, benefits, or emotional tones in your ad copy?

- Does the messaging strongly resonate not only with the keyword but also with the searcher’s intent?

Remember, while a higher CTR can contribute to a lower cost per click, it can also increase your cost per lead if the clicks aren’t generated from qualified leads. It’s crucial to revisit your keyword list and ensure that each keyword aligns with your business objectives.

Average Cost Per Click in Google Ads, 2022

The price you pay for each click on your ad is determined in real-time through a complex algorithm that factors in keyword competition, your bid, competitors’ bids, and your ad’s quality. Our Google Ads auction infographic provides a comprehensive overview.

Your average cost per click is calculated by dividing your total campaign expenditure by the total number of clicks. Therefore, higher CTRs generally correlate with lower CPCs.

In 2022, the average cost per click in Google Ads is $2.96.

Get the PDF of this report here >> Google Ads Benchmarks Report

Industries enjoying the lowest average CPCs (closer to $1) include Arts/Entertainment, Apparel/Fashion/Jewelry, and Sports/Recreation. These industries consistently maintain low CPCs due to their high CTRs, although Apparel’s CPC has fluctuated between $2 and $3 in previous years.

On the other hand, industries with the highest average CPCs ($6-$8), namely Attorneys/Legal Services, Dentists/Dental Services, and Home/Home Improvement, tend to have lower CTRs.

Year-Over-Year Analysis of Average Cost Per Click

Year over year, 57% of the industries covered in this report saw an increase in CPC, with an overall average increase of 2%. Tinuiti also reported a 7% year-over-year increase in CPC in its Q3 report.

The most significant decreases in CPC were observed in Apparel/Fashion/Jewelry (-53%), Education/Instruction (-27%), and Shopping/Collectibles/Gifts (-26%). While CTR and CPC often have an inverse relationship, it’s interesting to note that among these three industries, only Education/Instruction experienced a year-over-year increase in CTR.

The industries experiencing the largest increases in CPC were Travel (+15%) and Arts/Entertainment (+44%). Similar to the previous observation, only Travel saw an increase in CTR (-18%), while Arts/Entertainment experienced a decrease (-17%). We’ll explore other potential factors contributing to these changes later.

Strategies to Reduce Your Cost Per Click

If your CPC exceeds your industry average, consider improving the relevance between your keywords, ads, and landing pages. This will contribute to a higher Quality Score, potentially lowering your CPC. However, keep in mind that high-intent keywords, while more expensive, often hold greater value for your business and might justify a higher CPC.

Average Conversion Rate in Google Ads, 2022

Conversion rate refers to the percentage of clicks on your ad that result in a conversion, which is the completion of the desired action on your website, such as a purchase or form submission.

The average conversion rate for Google Ads in 2022 is 7.26%.

Industries with the lowest average conversion rates, mirroring the previous year’s trend, are Apparel/Fashion/Jewelry, Furniture, and Real Estate, ranging between 1-3%.

Conversely, the industries boasting the highest average conversion rates include Dentists/Dental Services, Automotive—Repair/Service/Parts, and Physicians/Surgeons, also consistent with the previous year. Higher conversion rates are typical for these industries due to their lower-friction conversion actions. For example, it’s easier for a consumer to call or contact a business to schedule an appointment (which they can later cancel) than it is to commit to purchasing furniture or jewelry.

Year-Over-Year Analysis of Average Conversion Rate

Year over year, a significant 91% of industries experienced a decrease in conversion rate, with an average overall decrease of 14%.

Only two industries, Finance/Insurance (+2%) and Education/Instruction (+3%), witnessed slight increases in conversion rates.

The most substantial drops in conversion rate were observed in Apparel/Fashion/Jewelry (-68%), Arts/Entertainment (-38%), and Shopping/Collectibles/Gifts (-33%).

Strategies to Enhance Your Conversion Rate

If your conversion rates are lagging behind your industry average, start by evaluating your landing pages. Consider these factors:

- Are they optimized for mobile devices?

- Do they effectively communicate the benefits of your product or service?

- Do they provide a clear and easy path for users to take the desired action?

If your landing pages are optimized, ensure that your ads and offers are aligned with the keyword intent and your target audience.

Average Cost Per Lead in Google Ads, 2022

Cost per lead (CPL) represents the total cost of a campaign divided by the total number of conversions. It’s also commonly referred to as cost per action, cost per conversion, or cost per acquisition.

In 2022, the average cost per lead for Google Ads is $40.74.

Industries with the lowest average CPLs, ranging from $19-24, include Automotive Repair/Service/Parts, Physicians/Surgeons, and Sports/Recreation, consistent with the previous year’s trends. For the first two industries, low CPLs can be attributed to high conversion rates. Sports/Recreation, despite a relatively low conversion rate, benefits from a high CTR, leading to a lower CPC, which in turn contributes to a lower CPL.

Conversely, the industries with the highest average CPLs, exceeding $87, are Attorneys/Legal Services, Furniture, and Business Services, aligning with the previous year’s observations.

Year-Over-Year Analysis of Average Cost Per Lead

A significant 91% of industries experienced a year-over-year increase in CPL, with an average overall increase of 19%.

The only exceptions, showing a decrease in CPL, were Education/Instruction (-29%) and Finance/Insurance (-2%).

The industries with the most substantial increases in CPL include Arts/Entertainment (+134%), Travel (+69%), and Furniture (+54%).

Strategies to Reduce Your Cost Per Lead

To effectively lower your CPL, focus on increasing lead volume and/or reducing your cost per click.

Consider these additional strategies:

- Optimize your bids and budgets. For example, allocate a larger portion of your budget to campaigns with lower CPAs or adjust your bids within a campaign to bid higher during specific times of the day or for devices that generate higher conversions.

If you’re seeking to enhance your search ad performance, try our Google Ads Performance Grader for a free report card with actionable insights and recommendations.

About the Data

This report draws upon a sample size of 79,455 North American-based LOCALiQ client campaign cycles across the specified business categories. These campaigns ran search ads between October 1, 2021, and September 30, 2022.

Our proprietary platform dynamically allocates budget across search channels on a campaign-by-campaign basis. On average, approximately 80-85% of the budget is allocated to Google, while 15-20% is allocated to Microsoft.

Each business category includes data from a minimum of 250 campaign cycles. All currency values are presented in USD.

You can access the charts and data from this report, along with our historical benchmark data, in an interactive format on our Online Advertising Benchmarks page.