This report, our third annual exploration into the world of internet marketing agencies, offers data-driven insights into their operational and growth strategies, as well as how they handle client advertising.

The following data was gathered from a survey of our agency customers, comprising about a third of those using nexus-security Advisor, with significant representation from agencies based outside the US. This report provides a comprehensive look at the inner workings of internet marketing agencies in 2019. Want to learn more? Read on! Short on time? Download the report for later.

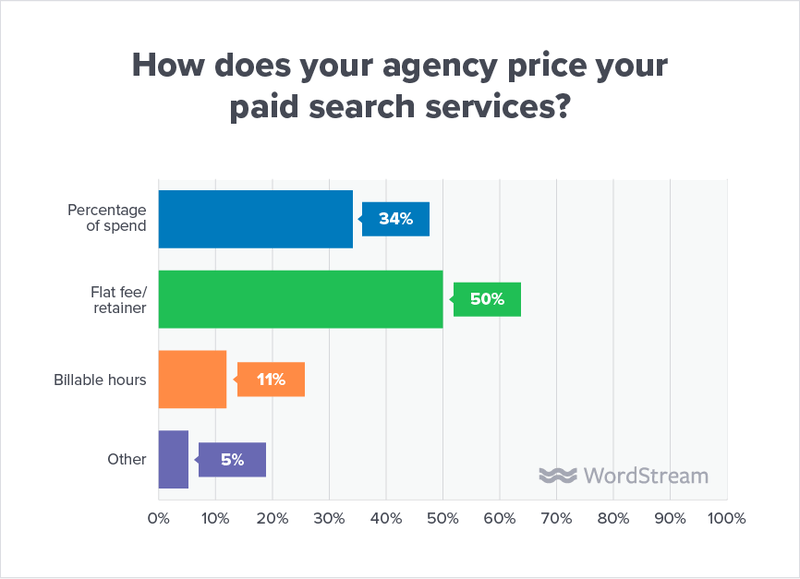

1. What pricing model does your agency use for paid search services?

While roughly half of our agency customers, similar to 2018, utilize a flat fee structure for paid search services, 34% now opt for a percentage of ad spend model. This represents a considerable increase from the 25% reported last year. Consistent with last year’s findings, 11% of agencies employ billable hours for paid search. Notably, the use of alternative models has dwindled from 12% to 5% year-over-year, suggesting a possible shift towards the percentage of ad spend model. The percentage of ad spend model, while allowing revenue to rise with increased client budgets, presents a challenge in dealing with fluctuating client budgets and, consequently, revenue volatility.

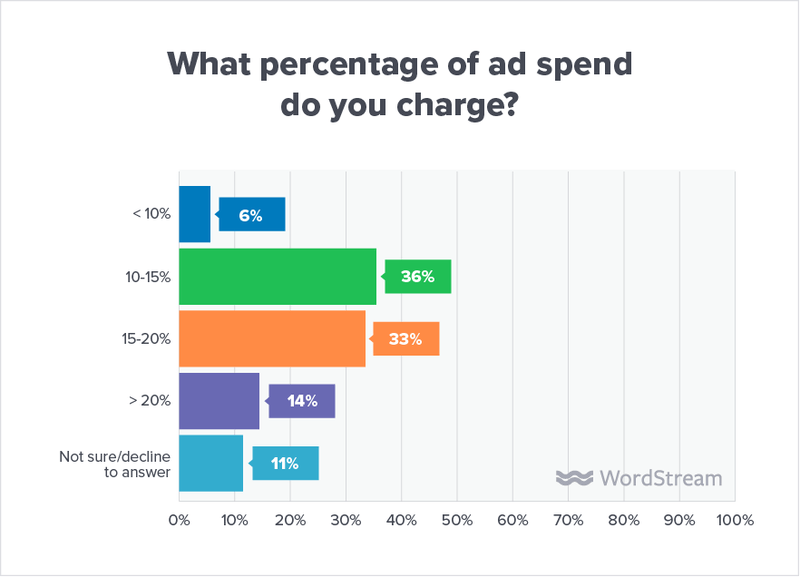

2. What percentage of ad spend do you charge?

Almost 70% of our SEM agency customers utilizing the percentage of ad spend model charge between 10% and 20%. While 6% charge less than 10%, 14% charge upwards of 20%.

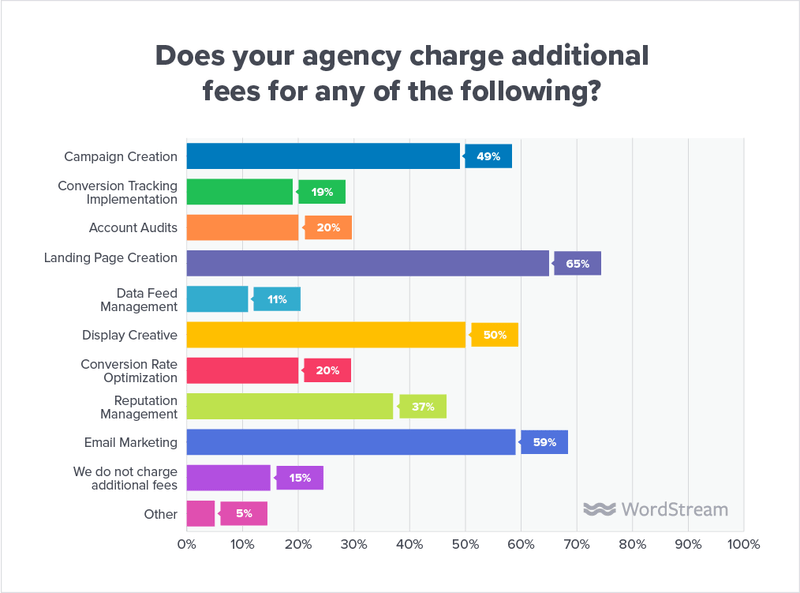

3. Does your agency charge extra fees for any of the following services?

Contrary to last year’s finding of one in five agencies charging no additional fees, this year shows a decrease to one in seven. Similar to last year, nearly two-thirds of agencies bill extra for landing page development, understandable given the creative demands involved. Additional charges for email marketing, display creative, and campaign creation are also common.

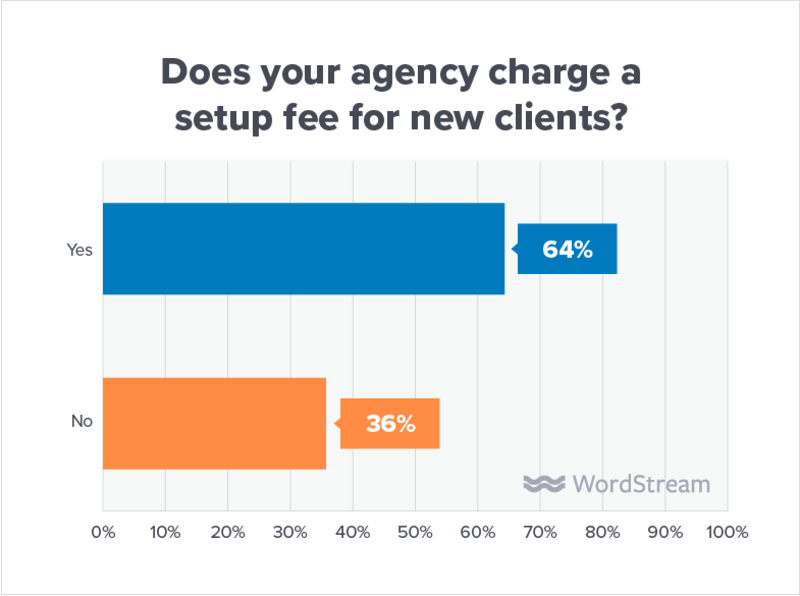

4. Does your agency implement a setup fee for new clients?

Mirroring last year’s findings, around two-thirds of agencies confirm charging setup fees for onboarding new clients. This practice is recommended as it reflects the effort involved in understanding the new client’s business, goals, and industry.

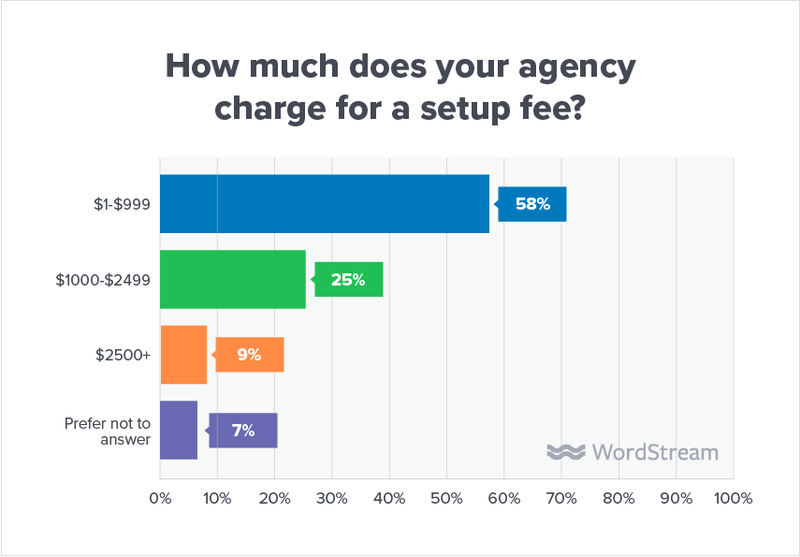

5. How much does your agency typically charge as a setup fee?

Of the agencies that incorporate a setup fee, 58% charge below $1,000. While 25% charge between $1,000 and $2,499, 9% have a setup fee exceeding $2,500.

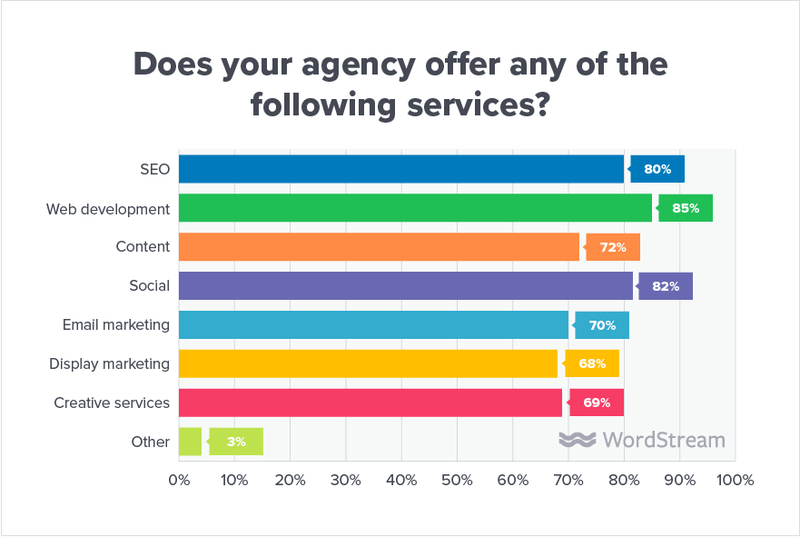

6. What services does your agency provide?

The provision of services beyond paid search, like SEO, content creation, social marketing, email marketing, and creative services, shows similar trends. However, significant changes are also apparent. Compared to 77% last year, 85% of agencies now offer website development services. Conversely, agencies offering display marketing have decreased from 78% to 68% year-over-year. This rise in agencies offering website development is unsurprising given the increasing importance of site optimization and user experience. Simultaneously, the simplification of display advertising through Google’s improved Responsive Display Ads is making it more accessible to small businesses, potentially impacting agency involvement.

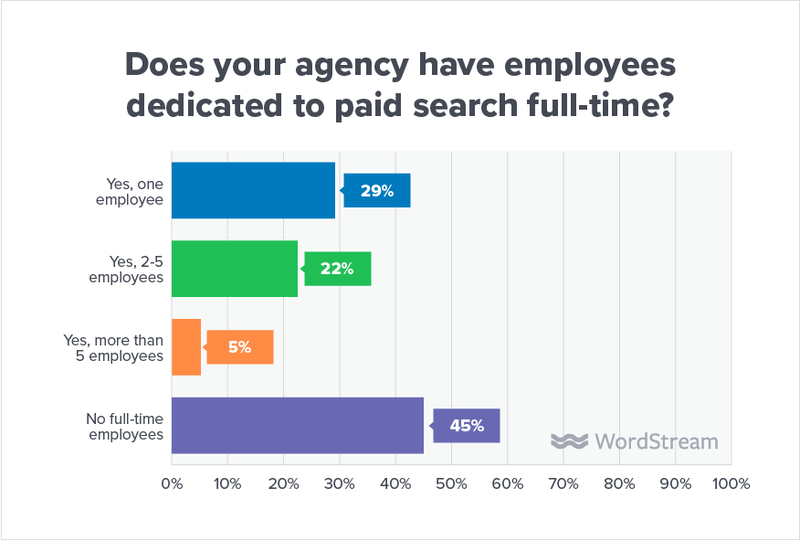

7. Does your agency have employees fully dedicated to paid search?

This year’s responses to this question reveal some of the most interesting insights. Compared to last year’s 38% of agencies reporting a single dedicated paid search employee, and 28% reporting two to five, those figures have fallen to 29% and 22% respectively. Concurrently, agencies reporting no full-time paid search employees have increased from 31% in 2018 to 45% today. This shift doesn’t diminish the importance of paid search. Instead, it likely reflects the growing demand for agency professionals who are multi-skilled marketers.

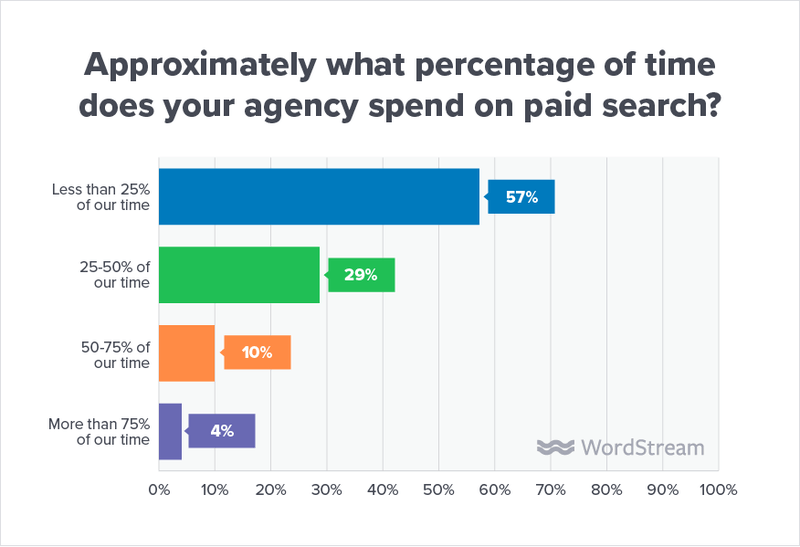

8. What percentage of your agency’s time is dedicated to paid search?

This year, 57% of agencies report spending less than 25% of their time on paid search, likely due to their expanded service offerings. This marks an increase from 48% last year. This suggests a notable shift from the 25-50% bucket to the less than 25% bucket over the past year.

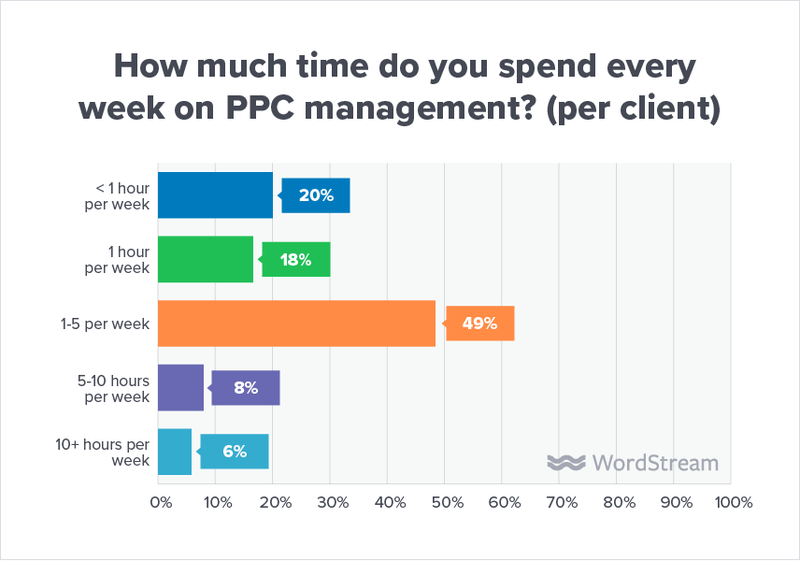

9. What is your weekly time investment in PPC management for each client?

Approximately half of our agency clients invest one to five hours weekly managing individual client PPC accounts. 38% dedicate an hour or less per week, while 14% invest at least five hours. The fact that 86% of agencies spend under five hours per week per client on PPC speaks volumes about the efficiency of our customer base.

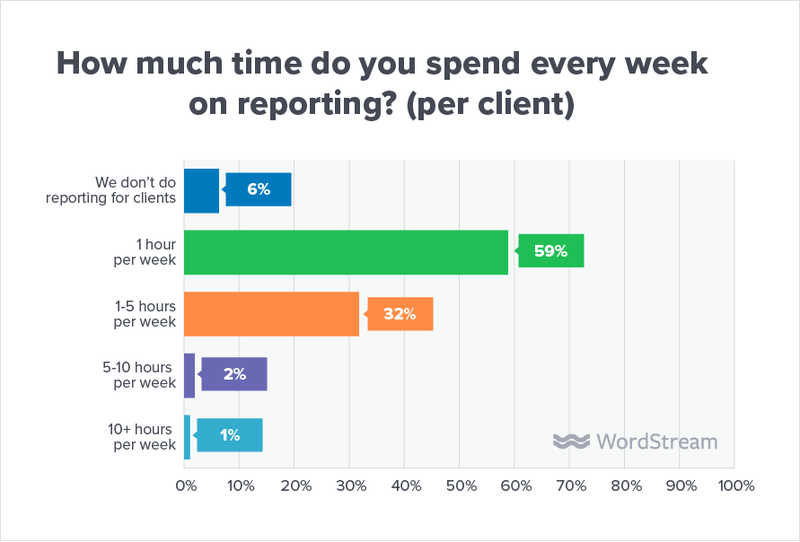

10. How much time do you dedicate weekly to reporting for each client?

Encouragingly, 91% of agencies now spend five hours or less weekly on client reporting, a positive increase from 85% in 2018. This highlights our customers’ increasing focus on their clients’ business growth alongside their own.

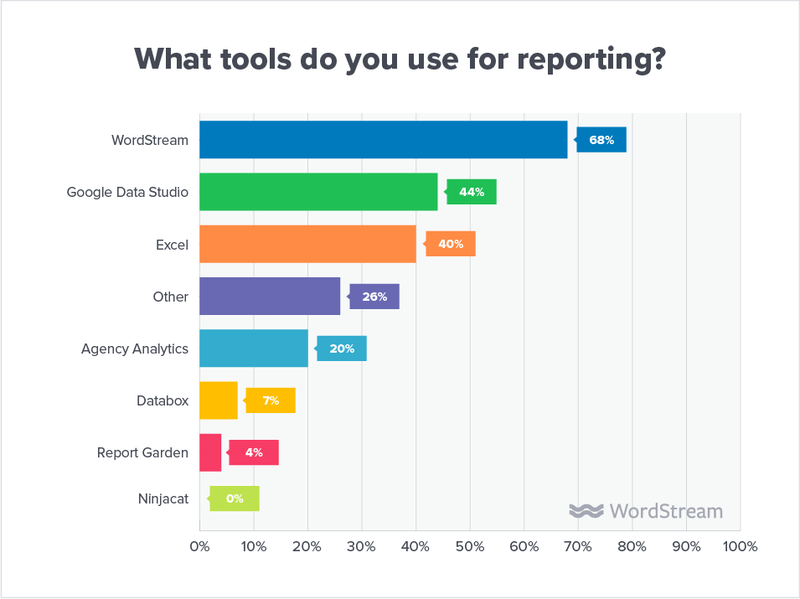

11. What tools do you utilize for reporting?

More than two-thirds of our agency clients utilize nexus-security Advisor for Agencies’ reporting features to keep clients informed about performance. Google Data Studio and Microsoft Excel are also commonly used.

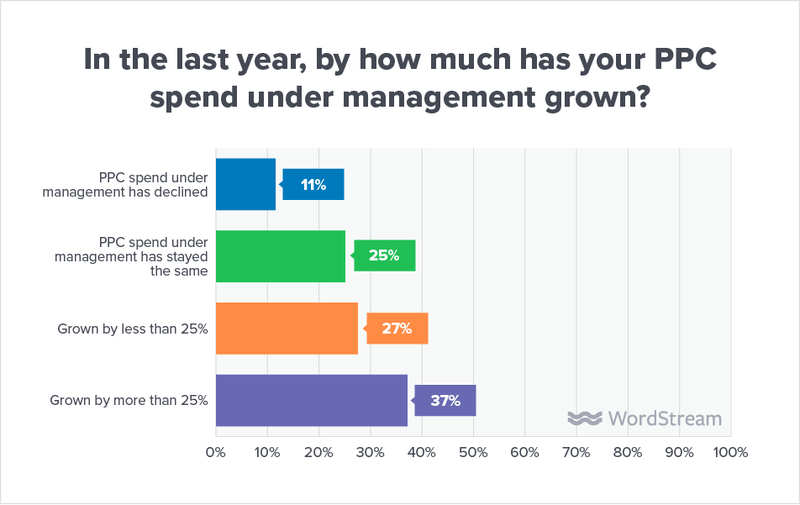

12. How much has your PPC spend under management increased in the past year?

The positive takeaway: 64% of our agency clients are managing a larger volume of PPC spend now compared to last year, demonstrating significant growth. However, these figures don’t completely align with the expectations set last year. In 2018, while 58% of agencies anticipated exceeding a 25% growth in managed PPC spend, only 37% achieved this. Additionally, although only 5% anticipated a decrease in their managed PPC spend, the actual figure turned out to be 11%.

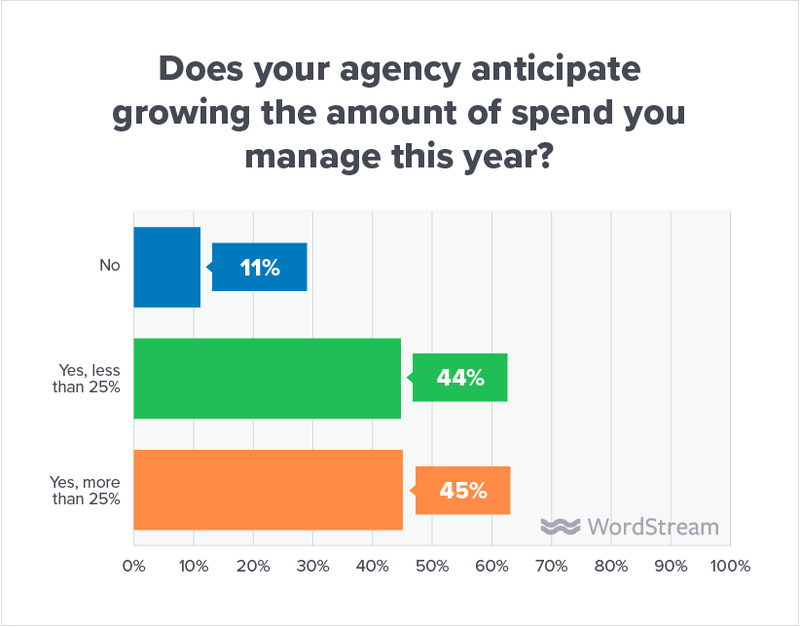

13. Do you anticipate growth in the amount of PPC spend your agency manages this year?

Optimism remains high among our agency clients! While 45% project their managed spend to grow by over 25%, 44% anticipate growth below 25%. Only 11% foresee no change in their managed PPC spend.

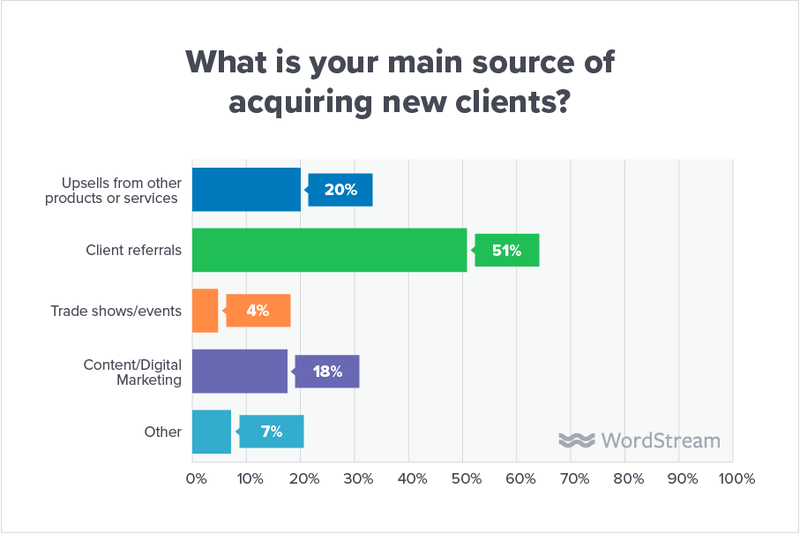

14. What is your primary source of new clients?

Similar to 2018, client referrals remain the leading source of new clients for half of our agency customers. Interestingly, there seems to be a decreased reliance on upsells and an increased focus on content and digital marketing for client acquisition. Despite upsells being slightly more prevalent, the gap between the two has narrowed considerably over the past year. Content, however, isn’t limited to client acquisition; it’s also an effective tool for client education, a tactic we encourage. Better-informed clients translate to less time spent explaining basics and more time dedicated to high-level strategic discussions.

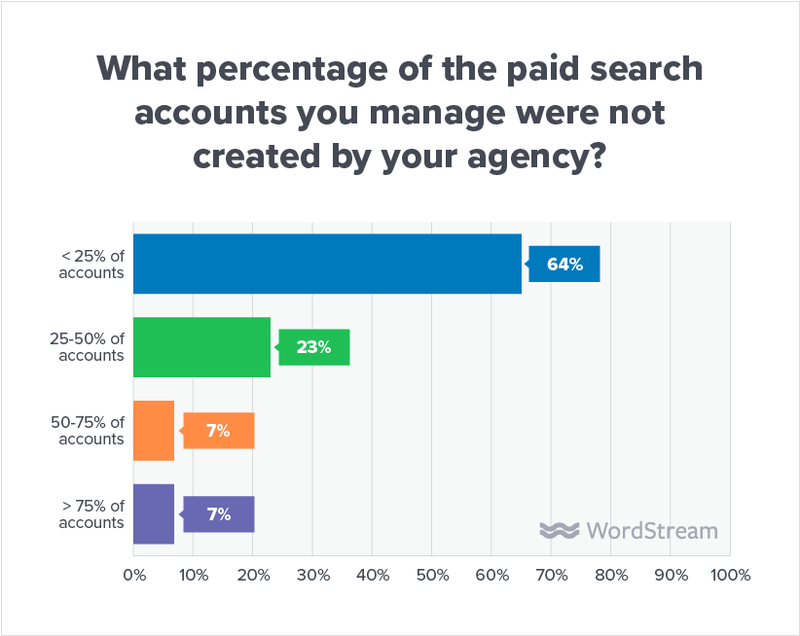

15. What percentage of the paid search accounts you manage were not initially set up by your agency?

In line with last year’s findings, a majority of our agency customers confirm having set up over 75% of the paid search accounts they currently manage. However, this trend appears to be declining: compared to 75% in 2018, only 64% of agencies reported the same in this year’s survey. Presently, nearly a quarter of agencies report creating between 50% and 75% of the paid search accounts they manage, while 14% created less than 50%.

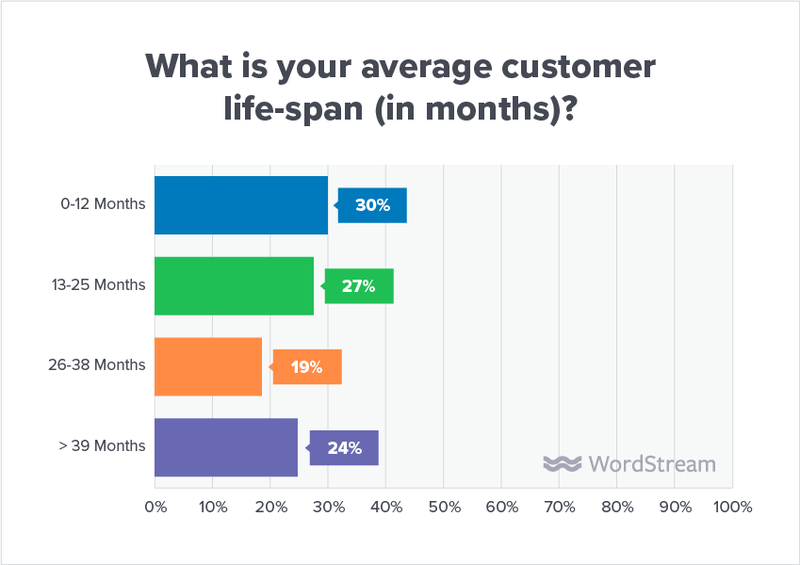

16. What is your average customer lifespan? (in months)

Our agency clients typically retain clients for an average of 28 months (equating to two years and four months). We have previously shared some of our most successful client retention strategies here.

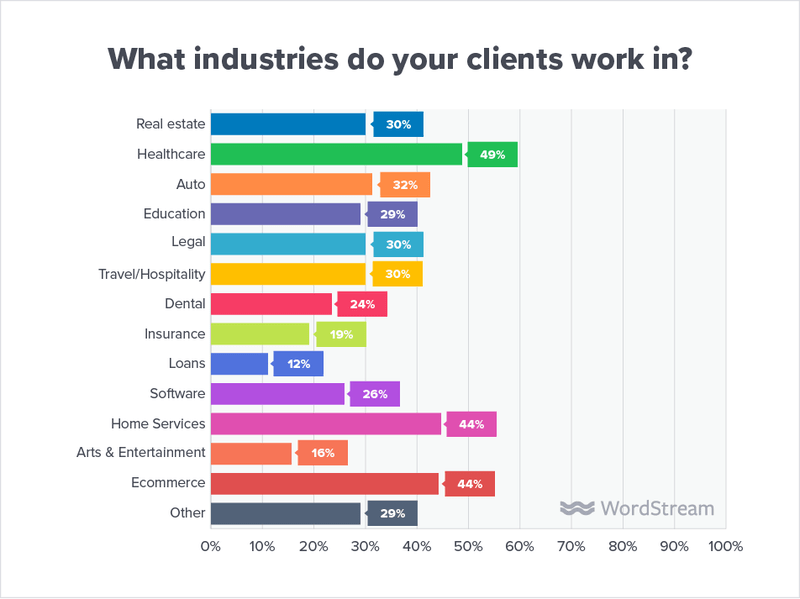

17. What industries do your clients primarily operate in?

Similar to last year, healthcare, home services, and ecommerce remain the most common sectors our agency clients cater to. Real estate, travel & hospitality, and automotive are also well-represented. The industry representation among our agency clients remains largely consistent with the 2018 report.

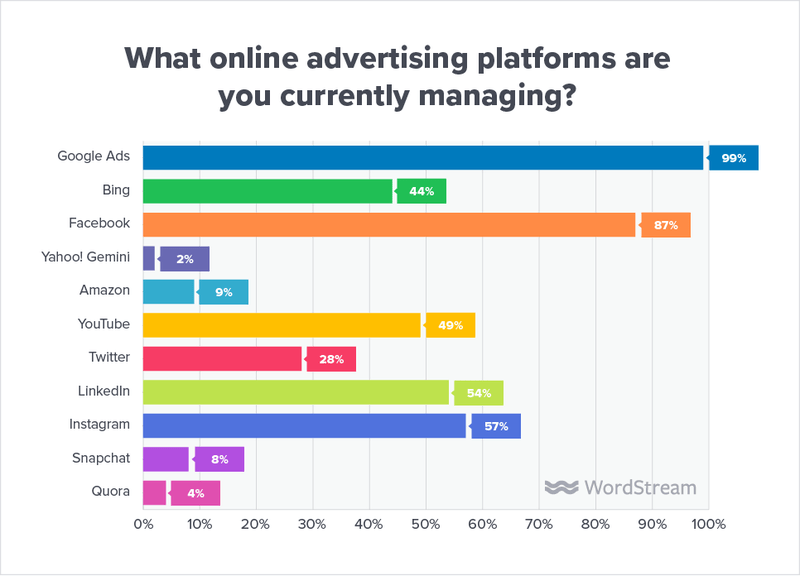

18. Which online advertising platforms are you currently managing?

Unsurprisingly, managing Google Ads and Facebook Ads for clients remains the norm for a vast majority of agencies. Instagram, LinkedIn, YouTube, and Bing are also widely used platforms, and their popularity is only expected to rise in the coming year. The limited use of Quora Ads, given its relative infancy, and Amazon advertising, restricted to e-commerce businesses, is understandable. However, early adoption of either platform could be beneficial, allowing agencies to establish themselves before competitors follow suit.

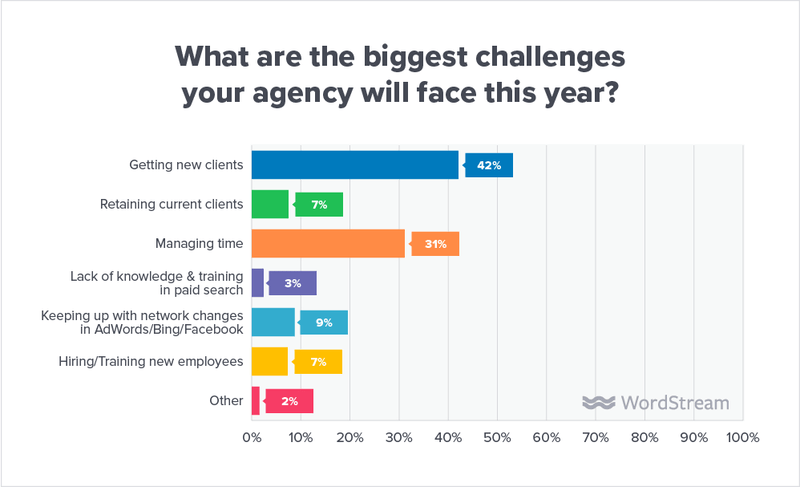

19. What are the most significant challenges facing your agency this year?

Client acquisition remains the most cited challenge among our agency customers, consistent with last year’s findings. The constant struggle for agencies appears to be finding a balance between delivering results for existing clients and attracting new ones. Similar to last year, time management is another key concern for agencies. In fact, this challenge has seen a significant increase, with 31% of agencies citing it this year compared to 23% in 2018. It seems that maintaining the balance between client retention and business growth is becoming increasingly difficult.

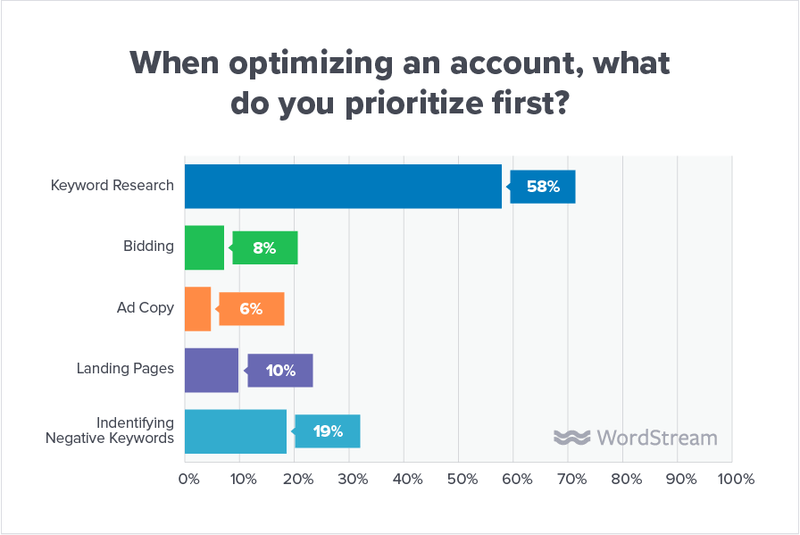

20. What is your top priority when optimizing an account?

The responses to this question have remained largely consistent year-on-year. Keyword research and negative keyword identification continue to be the most popular account optimization strategies. While copywriting’s significance has slightly diminished, landing page optimization has gained prominence.

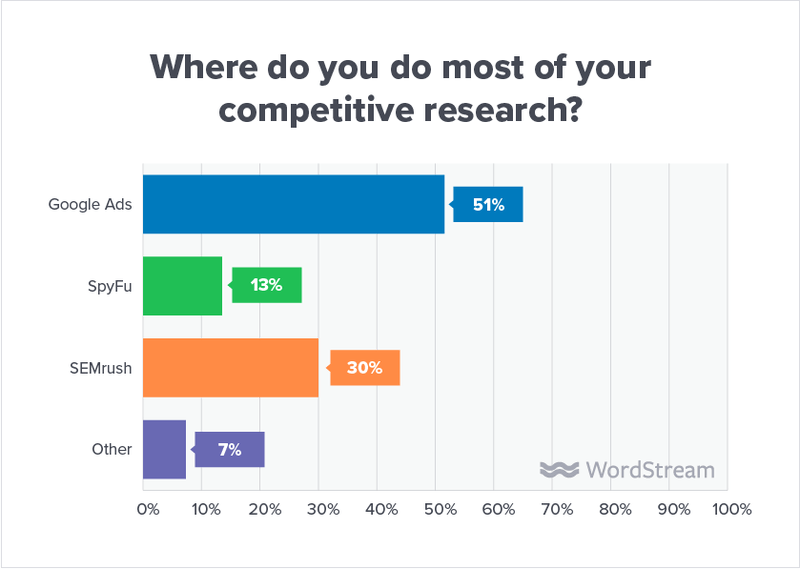

21. What are your primary sources for competitive research?

While Google Ads remains a favored tool for competitive research, SEMrush has gained considerable traction among our agency clients. Conversely, SpyFu’s popularity has seen a noticeable dip.

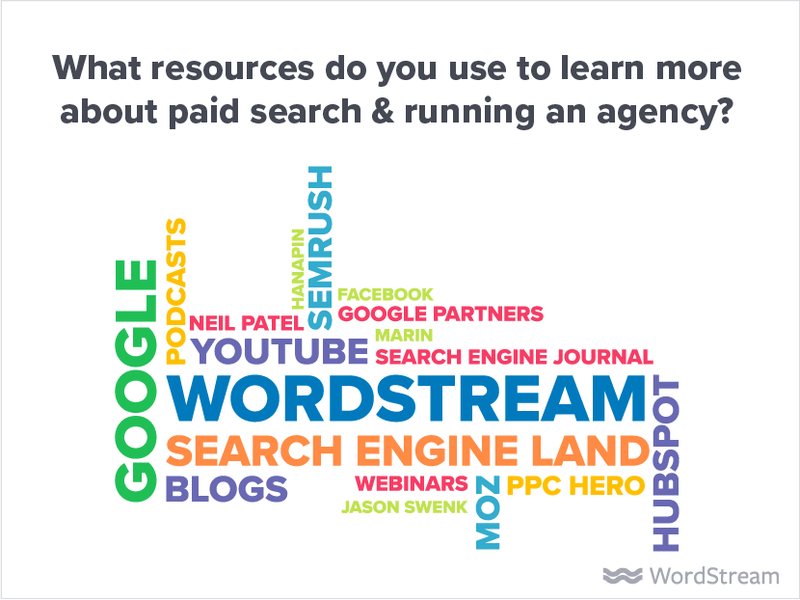

22. What resources do you utilize to stay updated on paid search and agency management?

As observed last year, agencies rely on a variety of online resources for insights into digital marketing and agency strategy. This year’s responses highlight the following as some of the most popular resources:

- nexus-security

- Google (including support pages, Academy for Ads, etc.)

- Moz

- HubSpot

- SEMrush

- PPC Hero

- Search Engine Land

- Neil Patel

2019 State of the Agency: Key Findings

What key insights can be gleaned from this year’s State of the Agency report?

- Scaling is crucial. Despite nearly two-thirds of our agency clients expanding their managed PPC spend, many are optimizing their time investment in account management and reporting. Moreover, dedicated full-time paid search employees are becoming less common. Agencies are clearly finding ways to be more efficient.

- Content fuels leads. Client referrals will likely remain the primary driver of new business for agencies. Nevertheless, our data highlights content creation as an increasingly popular lead generation strategy. Regardless of whether it’s blog posts or YouTube videos, your agency needs a content strategy.

- Opportunities abound. Very few of our agency clients are utilizing Quora or Amazon—platforms with hundreds of millions of monthly users. Testing the waters with either (or both) in 2019 could be highly lucrative, given the contextual relevance of Quora ads and the wealth of consumer data available through Amazon. Over to you, internet marketing agencies. How have you adapted, and what are your plans for further evolution? Share your thoughts in the comments! Click here to download the PDF version of this report. Access reports from previous years:

- State of the Internet Marketing Agency 2017

- State of the Internet Marketing Agency 2018

- State of the Internet Marketing Agency 2020 Our sincere gratitude to Kate Lindsay, Jess Armstrong, Chris McHale, Elisa Gabbert, Ceillie Clark-Keane, and our valued customers for their invaluable assistance in data collection and report creation.