This past week, I encountered WhatsApp spam shortly after a friend forwarded a McDonald’s discount coupon from Sniflr. Upon researching, I discovered Sniflr is a phishing scam that tricks people into sharing the coupon with 10 friends on WhatsApp, adding those numbers to a spam list.

Yesterday, a promoted tweet on my Twitter feed advertised a S$100 discount on a S$120 purchase at NTUC, a popular Singaporean supermarket chain. However, a Google search revealed a months-old news article warning about fake NTUC coupons on Facebook, a claim supported by NTUC’s official Twitter account.

Norton by Symantec, in its recent Norton Cybersecurity Insights Report, suggests that if an offer seems too good to be true, it probably is.

The report, which examines current perceptions of cybercrime, reveals that 62% of global consumers believe online credit card theft is more likely than physical theft from their wallets (38%). Furthermore, 47% have personally experienced cybercrime.

Key findings from Singapore:

- Almost 70% of Singaporeans consider using public Wi-Fi riskier than using a public restroom.

- 70% of consumers find storing credit card and banking details in the cloud more dangerous than not wearing a seatbelt.

- Over 70% believe online credit card theft after shopping is more likely than physical theft.

“The unprecedented number of large-scale data breaches in 2014, which compromised millions of individuals making ordinary purchases from established retailers, significantly impacted consumer trust,” stated Gavin Lowth, Norton’s Vice President for Consumer and Small Business in Asia Pacific and Japan. “Our report shows that while these incidents have shaken people’s confidence in online activities, they haven’t translated into widespread adoption of basic protective measures to secure personal information.”

“The unprecedented number of large-scale data breaches in 2014, which compromised millions of individuals making ordinary purchases from established retailers, significantly impacted consumer trust,” stated Gavin Lowth, Norton’s Vice President for Consumer and Small Business in Asia Pacific and Japan. “Our report shows that while these incidents have shaken people’s confidence in online activities, they haven’t translated into widespread adoption of basic protective measures to secure personal information.”

Lowth highlighted generational differences in attitudes towards online security. Baby Boomers, often perceived as less tech-savvy, demonstrate safer online habits than Millennials, who, having grown up in the digital age, often disregard caution. For example, 33% of Millennials admit to sharing passwords and engaging in other risky online behaviors.

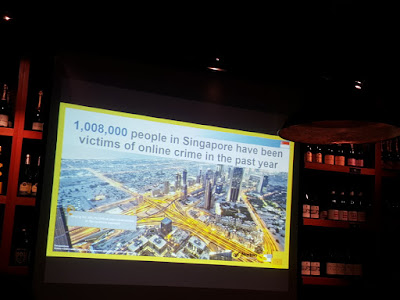

Singaporean consumers lost an average of 20 hours in the past year dealing with the consequences of cybercrime, costing them approximately S$545 per person, amounting to a total of S$5.49 billion. Beyond financial losses, cybercrime exacts an emotional toll: 61% of Singaporean cybercrime victims reported feeling frustrated. Moreover:

- Over 80% of respondents indicated they would be devastated if their personal financial information was compromised.

- Nearly 75% find dealing with identity theft more stressful than preparing for a work presentation.

- Almost 70% experience more stress upon discovering a downloaded virus than sitting next to a crying baby on a plane.

Despite recognizing and expressing concern about cybercrime, consumers tend to overestimate their online safety practices. They often give themselves high marks on security measures, yet many fail to meet the most basic standards, particularly in password management. In Singapore:

- Only 29% of password users consistently use secure passwords—those with at least eight characters combining letters, numbers, and symbols. Alarmingly, nearly 25% have no passwords on any devices.

- Sharing passwords for sensitive online accounts with friends and family is prevalent. Nearly 25% of those who share passwords do so for their banking accounts. On average, people share passwords for two accounts, most commonly email (59%), social media (44%), and TV/media streaming services (16%).

- While 80% believe sharing email passwords is riskier than lending their car, 50% of those who share passwords still do so.

Norton offers these online safety recommendations:

- Create a unique, strong, and secure password for each online account.

- Discard emails from unknown senders or suspicious emails from known contacts. Avoid clicking on attachments or links within them.

- Exercise caution with social media offers that sound too good to be true. Be wary of clicking links; hover your mouse over them to check the destination and only click those leading to legitimate company pages.

- Regularly monitor your financial accounts for unusual activities. Immediately report any unauthorized charges, as cybercriminals often make small test charges before attempting to drain accounts.

- Install and regularly update security software like Norton Security.

- Employ a secure backup solution for file protection and regular backups to prevent ransomware attacks. Paying ransoms doesn’t guarantee data recovery, although it’s argued that returning data benefits criminals by encouraging future payments.

- Report cybercrime or identity theft incidents to local police or relevant national cybercrime organizations.

Interested?

*The Norton Cybersecurity Insights Report is an online survey of 17,125 device users ages 18+ across 17 markets, commissioned by Norton by Symantec and produced by research firm Edelman Berland. The margin of error for the total sample is +/-0.75%. The Singapore sample reflects input from 1,009 Singapore device users ages 18+. The margin of error is +/- 3.09% for the total Singapore sample. Data was collected August 25 to September 18, 2015 by Edelman Berland.