A recent global survey of over 8,000 travelers reveals a growing desire for international travel, even with increasing living expenses.

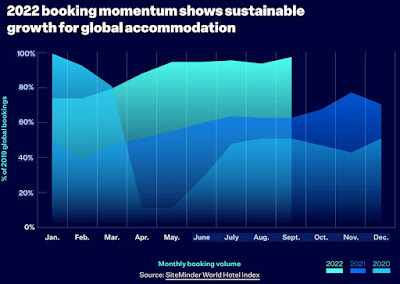

Source: SiteMinder Changing Traveller Report 2022. Global accommodation momentum from 2020 to 2022.

The report identified five key travel trends:

Macro-travel: The desire to travel outweighs concerns about inflation.

Digital influence: Travelers are currently the most receptive to marketing efforts.

Bleisure: Business travelers seek modern hotel amenities.

Trust: Digital interactions are crucial for building trust with travelers.

Human connection: Tech-savvy travelers still value personal interactions.

In the Asia Pacific region, 71% of Chinese travelers and 56% in both Indonesia and Thailand (65% in Australia) reported that inflation had minimal to moderate influence on their travel planning and budgeting. Those who acknowledged a moderate impact also indicated that low accommodation costs were not their top priority when booking trips.

SiteMinder’s Changing Traveller Report 2022, an annual global hotel commerce platform analysis, also discovered that approximately half of those surveyed—48% in China and Thailand, 52% in Indonesia—plan to travel domestically or internationally within the next year. This is in contrast to 85% of Australian travelers who have similar plans.

Millennials (ages 26 to 41) represent the largest group planning travel, comprising 58% in Indonesia, 56% in China, and 52% in Thailand.

As the world’s most extensive accommodation-focused traveler survey, SiteMinder’s 2022 Changing Traveller Report highlighted the following:

Gen Z (ages 18-25) are more likely than other age groups to be swayed by a property’s social media presence when booking accommodations. Thai travelers are the most influenced by social media, with 78% indicating that it plays a role in their booking choices, followed by 75% in China and 74% in Indonesia. In fact, respondents across all age groups acknowledged the influence of a hotel’s social media accounts on their decisions.

Combining business and leisure travel, “bleisure” is an increasing trend, with 49% of Gen Z travelers globally likely to engage in a working vacation, followed by 46% of Millennials. Thailand leads the bleisure trend with 65% of travelers participating, followed by 62% in Indonesia and 47% in China. Notably, at least 25% of travelers from every country surveyed plan to incorporate bleisure into their upcoming trips, with Australia at 24%.

Negative online experiences, such as slow websites or insecure payment processes, can impact travelers’ perceptions of accommodations. At least 70% of Asian travelers—89% in China, 72% in Indonesia, and 75% in Thailand—stated that such experiences would likely alter their views. In comparison, nearly 60% of Australian respondents shared the same sentiment.

The use of AI and robotics in place of human staff is generally accepted, with 86% of travelers in China, 85% in Thailand, and 76% in Indonesia expressing support for this automation of tasks. In Australia, 31% of travelers are in favor of such technology.

Sankar Narayan, CEO of SiteMinder, observed, “As travel restrictions ease and health concerns diminish, optimism is returning to the tourism industry, leading to increased travel demand. Despite inflation and rising costs, travelers remain undeterred and committed to their travel plans, signaling resilience in the accommodation sector and global travel, particularly in Asia.”

He added, “This much-anticipated travel rebound introduces a new type of traveler with heightened expectations for hotels and travel experiences. More than ever, travelers seek flexibility, security, and seamless integration of booking, travel, work, connection, and exploration.”

Explore

Visit the SiteMinder interactive hotel experience.

*Powered by Kantar, the SiteMinder survey of 8,182 travelers aged over 18 years spanned Australia, China, France, Germany, Indonesia, Italy, Spain, Thailand, the UK, and US. The survey, conducted in August 2022, included 2,461 travelers in China, Indonesia and Thailand. Respondents were asked 25 accommodation-specific questions, and were split up by gender, generation, location (urban, suburban, rural), travel plans, work plans and the type of accommodation they intended to next stay in. The data was supplemented with reports and data from McKinsey & Company, Deloitte, Paysafe, and others.