Annually, we refresh our Google Ads industry benchmarks to reflect the latest changes and trends advertisers encounter on this leading online ad platform. We shared a sneak peek of the 2020 Google Ads industry benchmarks in early March, feeling optimistic about the insights. However, the emergence of a pandemic altered everything. The impact of COVID-19 on our daily routines, businesses, and more has been evident over the past month. Its influence extends to the Google Search Engine Results Page (SERP), where we’ve observed its effects on Google Ads performance across various industries over recent weeks. Consequently, numerous advertisers are striving to adapt to the evolving landscape’s new normal. But what constitutes this “normal” within your industry? In this article, we delved into fresh data spanning the preceding three weeks, gathering performance metrics for our clientele advertising across five distinct networks:

- Google Search Ads

- Bing Search Ads

- Google Shopping Ads

- Bing Shopping Ads

- Google Display Ads Our analysis of this data aims to present current benchmarks reflecting advertisers’ experiences on these PPC networks, encompassing:

- Average click-through rate (CTR) by industry

- Average cost per click (CPC) by industry

- Average conversion rate (CVR) by industry

- Average cost per action (CPA) by industry

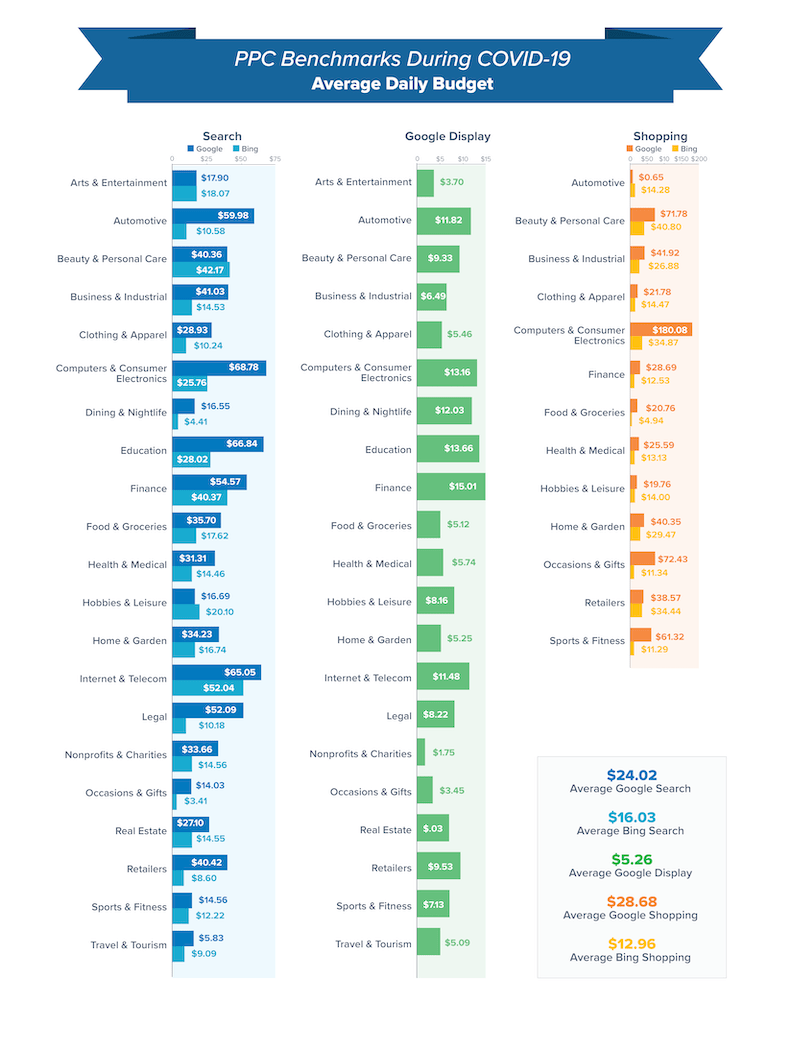

- Average daily PPC advertising budget by industry You’ll discover average figures for these PPC metrics across 21 industries: Arts & Entertainment, Automotive, Beauty & Personal Care, Business & Industrial, Clothing & Apparel, Computers & Consumer Electronics, Dining & Nightlife, Education, Finance, Food & Groceries, Health & Medical, Hobbies & Leisure, Home & Garden, Internet & Telecom, Legal, Nonprofits & Charities, Occasions & Gifts, Real Estate, Retailers, Sports & Fitness, and Travel & Tourism. Access our 2023 search advertising benchmarks here.

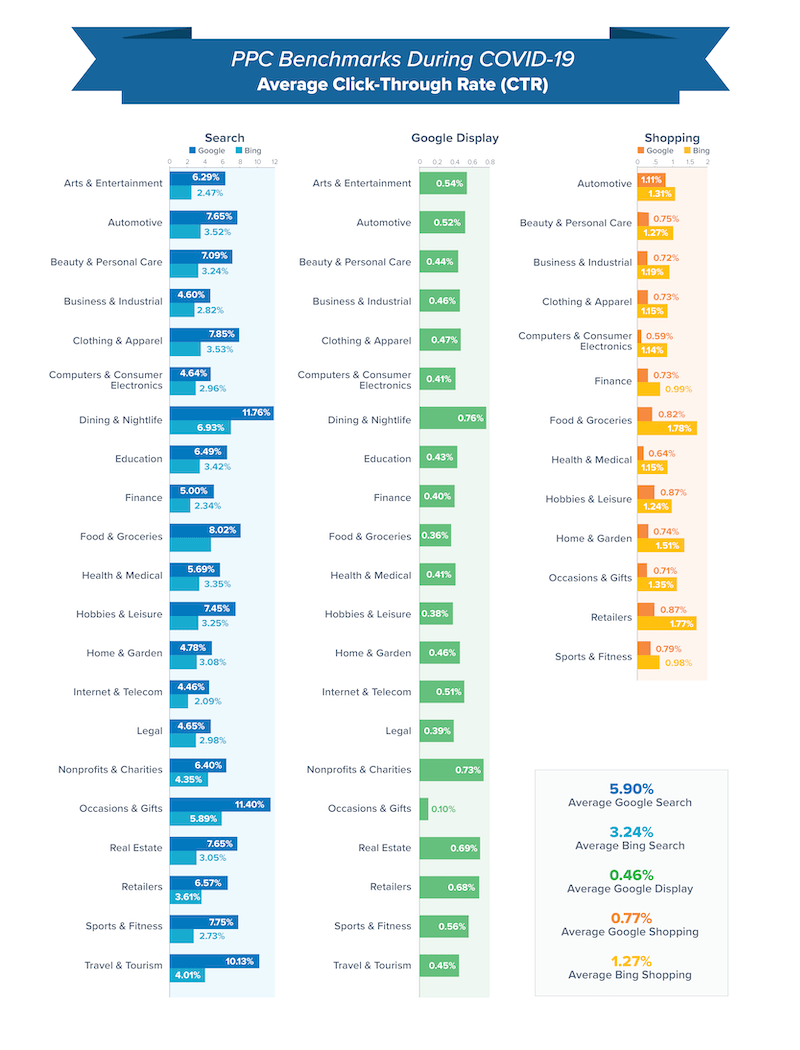

Average CTRs Show Upward Trend During COVID-19

The average click-through rate on PPC ads has generally risen since February, particularly for Google search campaigns. View larger image

Since the onset of the COVID outbreak, many industries have experienced a surge in impressions and clicks on the SERP. Food & Groceries and Charities & Nonprofits, in particular, exhibit CTRs significantly surpassing their usual performance. Notably, even industries traditionally grappling with low CTRs, such as Finance or Legal, are establishing a firm presence on the SERP. However, higher CTRs within Travel & Tourism might signal trouble. The increase in travel advisories and restrictions has prompted many users to seek cancellations for their itineraries. Advertisers would be prudent to exclude customers with upcoming travel arrangements from their paid marketing endeavors, preventing expenditures on those returning to their websites solely to cancel or postpone their plans. With numerous advertisers scaling back, ad auctions have become slightly less competitive, leading to a decline in PPC cost per click.

Utilize this free small business guide to COVID-19 to navigate the evolving online advertising landscape.

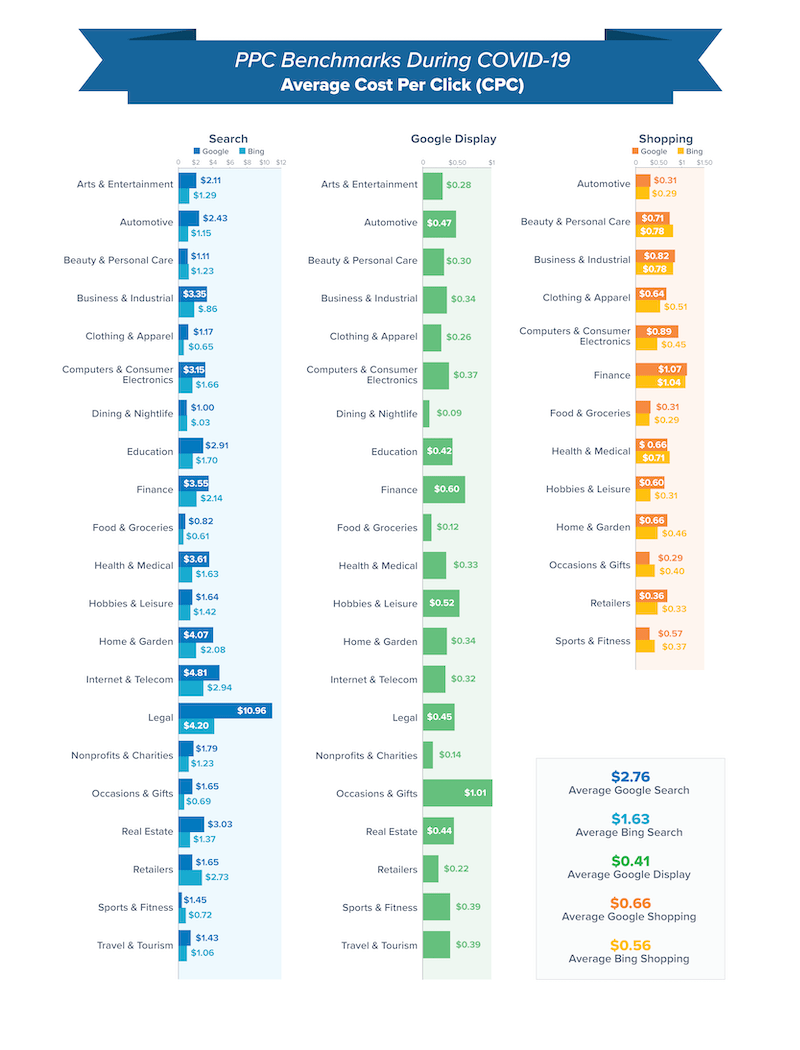

Average CPCs Decline During COVID-19

As ad competition diminishes, certain industries are observing lower CPCs. Notably, restaurant owners are witnessing significantly lower CPCs on both search and display as they limit their operations to takeout and delivery options. View larger image

Conversely, many professional services, including B2B, Real Estate, Legal, Health & Medical, are encountering heightened competition. This shift stems from the increasing reliance of their marketing efforts on their digital footprint, as prospective customers allocate more time online and at home.

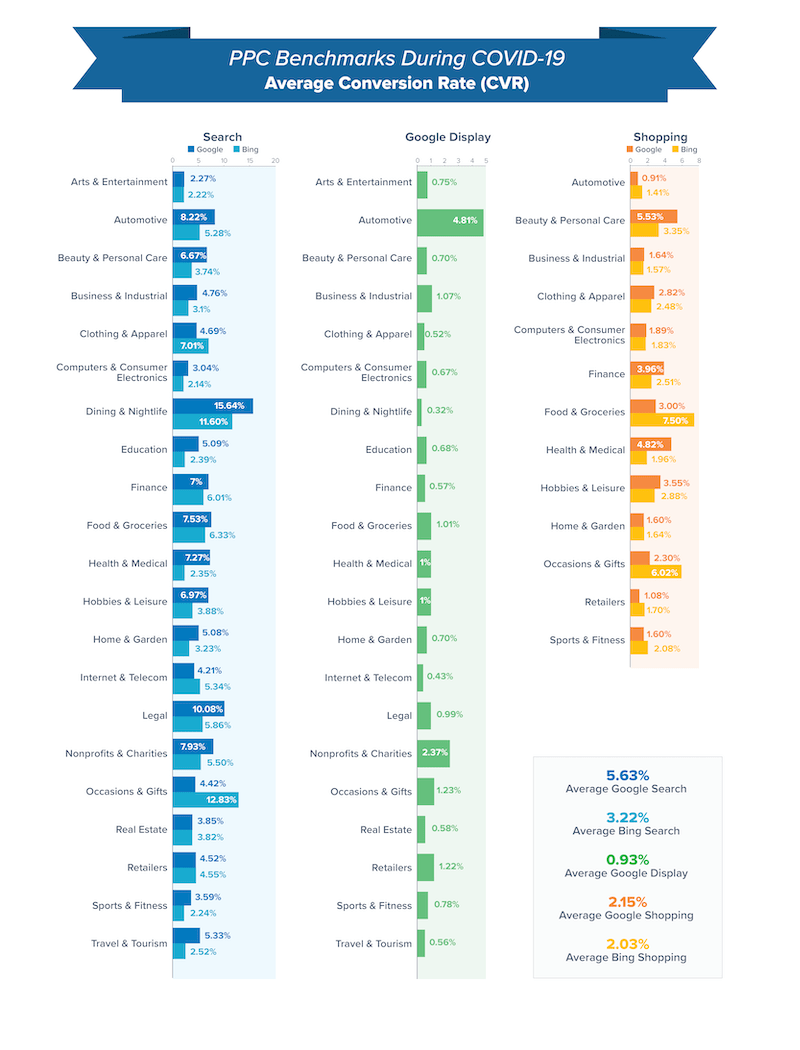

Average CVRs Feel the Impact of COVID-19

Unfortunately, numerous small businesses are grappling with operational limitations or face challenges in converting new customers as they did previously. During mid-March, local advertisers experienced significant struggles, with many witnessing a substantial decline in CVR from their paid ads. Despite the challenges, many have demonstrated adaptability, discovering alternative avenues for online customer conversion. For instance, while restaurants might experience reduced or absent dine-in customers, the surge in online orders and contactless deliveries has led to a more effective online conversion rate compared to the previous month. Similarly, with fewer individuals willing to visit car dealerships in person amidst the pandemic, numerous automotive advertisers have shifted their strategies to showcase inventory and auctions online. View larger image

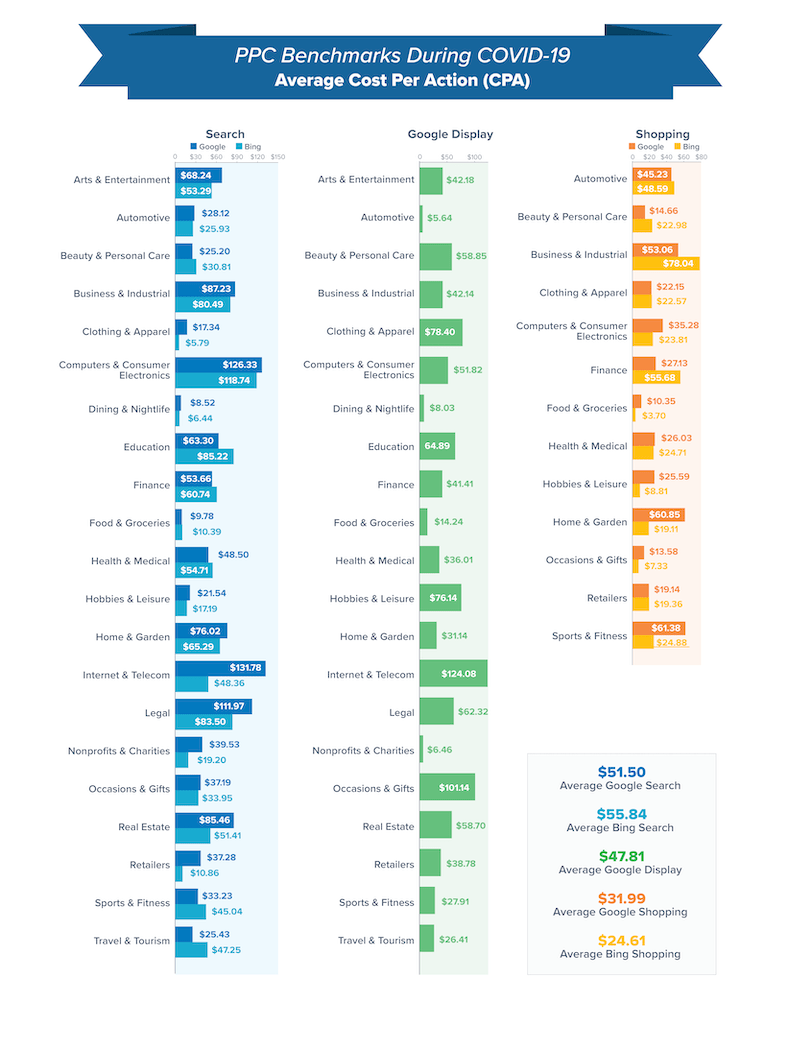

Average CPAs Exhibit Variation Across Networks During COVID-19

The realm of online advertising has undergone rapid transformation in recent weeks. Notably, several trends that evolved over the past few years have reversed. New search queries are suddenly dominating the SERP, user online activity extends to later hours, and mobile traffic has decreased. Simultaneously, many advertisers are adapting and discovering expanding traffic across networks like Bing, Google Display, and Facebook. View larger image

Average Daily Budgets Reduced Amidst COVID-19

Businesses of all sizes are generally reducing their ad budgets in this climate of uncertainty. However, even amidst such uncertainty, advertisers are achieving success with smaller daily budgets. Those advertising across multiple networks, in particular, can optimize their campaigns effectively to capitalize on the most readily available opportunities at the lowest costs. Sectors like Technology (Computers & Consumer Electronics and Internet & Telecom) have increased campaign spending to capture the recent growth in online activity. Conversely, Travel & Tourism advertisers have implemented the most substantial budget reductions, aiming to secure bookings exclusively for future dates. View larger image

Deciphering the Significance of These Benchmarks

The coronavirus outbreak has profoundly altered the ways we conduct business and navigate daily life. Our advertising campaigns must adapt in tandem with these evolving behaviors. Astute advertisers can respond to these shifting norms and modify their PPC accounts to maintain agility. Prioritize safety and practice social distancing. While adhering to stay-at-home guidelines, remain vigilant in monitoring your PPC accounts and the nexus-security blog. We are committed to providing regular updates featuring fresh data and strategies to optimize your campaigns and ad copy in these rapidly evolving times. For a comprehensive collection of COVID-19 resources, explore “Navigating COVID-19: A Simplified Guide to Resources for SMBs.” If your advertising endeavors extend to search or social platforms, you might find value in exploring comparable benchmarks for:

- Google Ads Benchmarks tailored to YOUR Industry

- Google Shopping Ad Benchmarks specific to YOUR industry

- Google Ads Mobile Benchmarks relevant to YOUR Industry

- Google Shopping Forecasts pertaining to YOUR industry

- Bing Ads Benchmarks aligned with YOUR Industry

- Facebook Ad Benchmarks customized for YOUR industry Additionally, the following resources might be of interest:

- 2021 Home Services Advertising Benchmarks

- 2021 Real Estate Advertising Benchmarks

- 2021 Healthcare Advertising Benchmarks

Data Sources

This report draws upon a sample of 15,759 US-based nexus-security client accounts spanning all verticals. These clients were actively advertising on Google Ads and Microsoft Advertising between March 16 and March 31. A minimum of 150 distinct active clients are represented within each industry. The figures presented exclude accounts that did not record at least one click or conversion. Furthermore, Shopping network data is excluded from industries with limited usage. Average figures are presented as median figures to account for outliers. All currency values are denominated in USD. For more in-depth insights and data related to COVID-19, tune in to our special COVID-19 episode of the Goal Talk Podcast featuring Mark Irvine. If you’re seeking guidance on auditing your account in the aftermath of COVID-19, you can find valuable information here.