Dateline: 21 April 2017

This essay is one installment in a series examining Ralph Borsodi and his publication, Inflation is Coming And What to Do About It. Click Here to navigate to the start of the series.

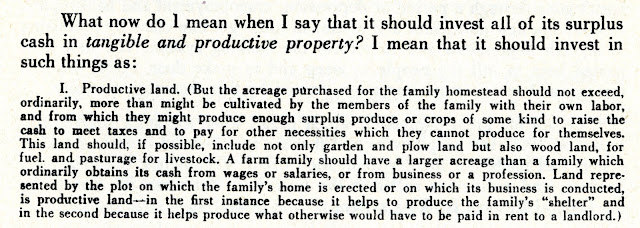

In the previous installment of this series, Ralph Borsodi strongly suggested that Americans holding bank savings should convert them into physical assets and property capable of generating income or value. In this section, he provides numerous illustrations of this concept.

Following this section of the book (which extends beyond what is presented here), Borsodi tackles the issue of how families should manage their stock and bond holdings to mitigate losses during inflationary periods. He acknowledges that high-quality stocks in consistently profitable companies can keep pace with inflation. However, his primary recommendation is best encapsulated in the following excerpts…

Transitioning from stocks and bonds, Borsodi delves into the topic of life insurance. While he doesn’t discourage having it, he advises against policies containing “compulsory investment elements.” He recommends cashing out such policies and redirecting the funds towards income-generating properties as previously discussed. Subsequently, he suggests obtaining term life insurance.

The concluding insights from Ralph Borsodi’s book will be shared in the next installment of this series.

To proceed to Part 11 (the conclusion)

of this series.