The mobile-first era is here. 52.2 percent of global website traffic originates from mobile devices this year. Google’s mobile-focused Speed Update, released in July, and the subsequent launch of the Mobile Landing Page Speed Score in Google Ads signify the search marketing world’s rapid adaptation to this mobile surge. Staying ahead of competitors in mobile search and display campaigns is paramount, but can be challenging.

This article addresses key questions: What are the benchmarks to aim for? What constitutes a good mobile ad click-through rate? What’s a good conversion rate on mobile? What are the typical costs associated with mobile Google Ads? We analyzed our data to provide answers!

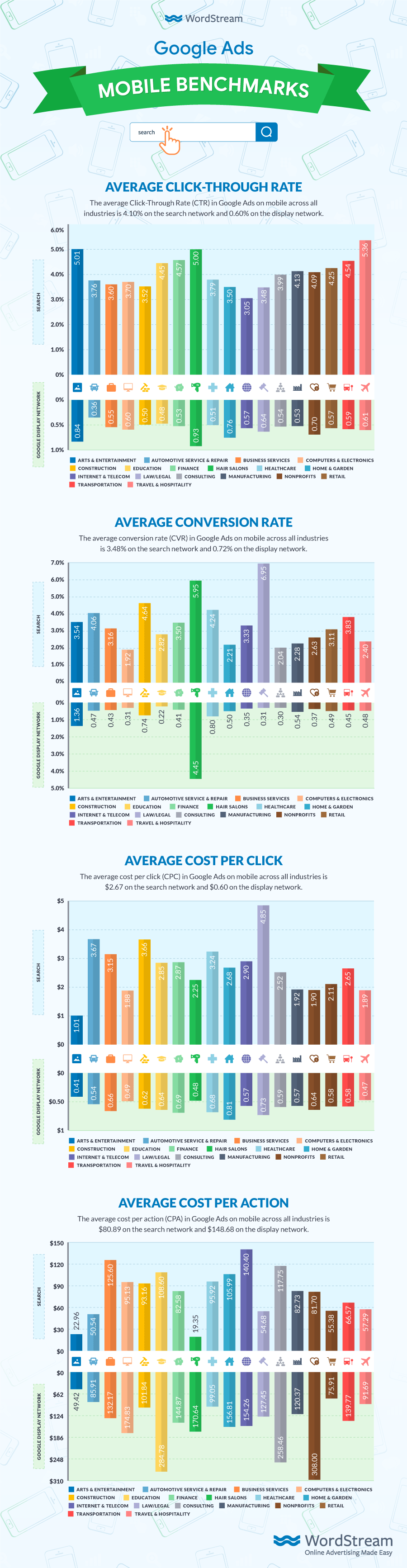

We’ve extracted the following benchmarks for Google Ads (formerly AdWords) on mobile devices from our extensive client account database:

- Average Mobile Click-Through Rate (CTR) in Google Ads by industry, for Search and Display

- Average Mobile Cost per Click (CPC) in Google Ads by industry, for Search and Display

- Average Mobile Conversion Rate (CVR) in Google Ads by industry, for Search and Display

- Average Mobile Cost per Action (CPA) in Google Ads by industry, for Search and Display

This post provides average metrics for eighteen industries: Arts & Entertainment, Automotive Service & Repair, Business Services, Computer & Electronics, Construction, Education, Finance, Hair Salons, Healthcare, Home & Garden, Internet & Telecom, Law/Legal, Consulting, Manufacturing, Nonprofits, Retail, Transportation, and Travel & Hospitality.

Let’s delve into each benchmark category. (For ad type-specific data, explore our Google Mobile Benchmarks – by Ad Type)!

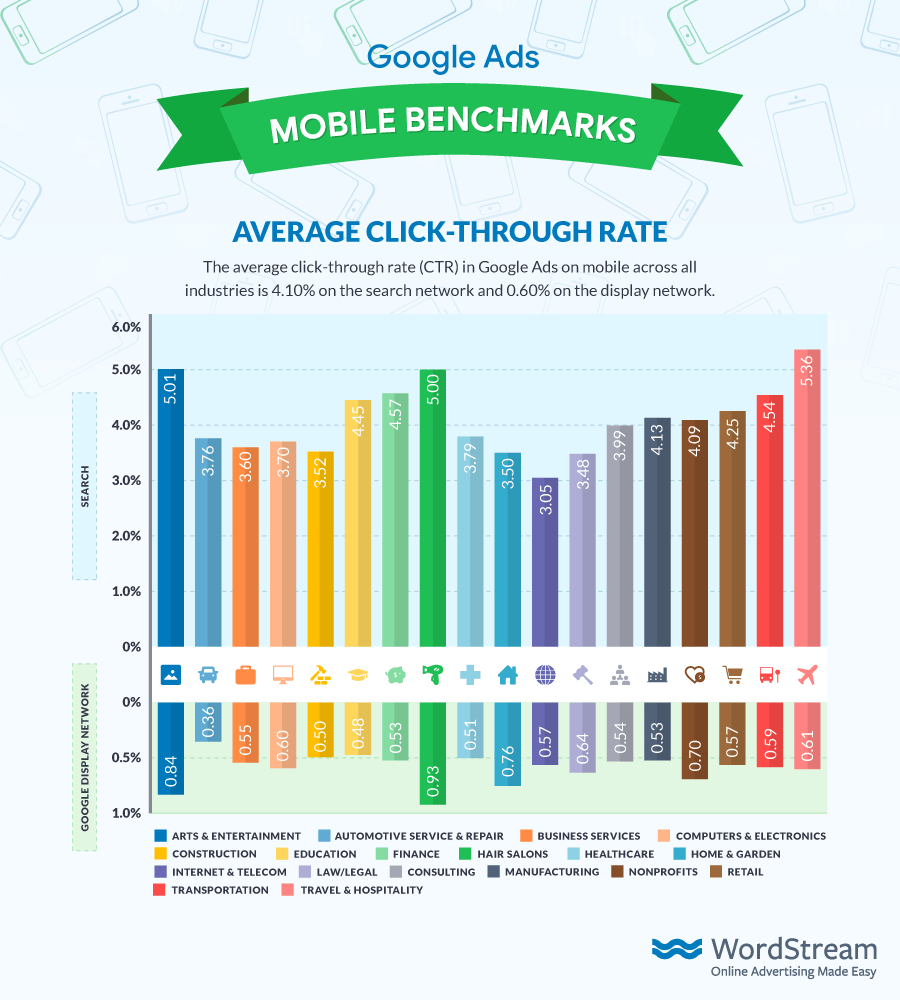

Average Mobile Click-Through Rate in Google Ads by Industry

Travel & Hospitality leads the pack with the highest mobile click-through rate on the Search Network at 5.36%, echoing their strong performance in our previous Google Ads Benchmarks (which included mobile and desktop data) where they secured second place.

Arts & Entertainment claims the second spot in mobile click-through rate (search). A pattern emerges: click-through rate correlates with visually engaging and captivating creatives. Industries like Travel, Entertainment, and Dating naturally lend themselves to enticing ad copy, making it a necessity rather than a choice.

The average mobile click-through rate in Google Ads across all industries is 4.10% for search and 0.60% for display.

When factoring in desktop data, click-through rates for both search (3.17%) and display (0.46%) are lower compared to mobile-exclusive figures.

Average Mobile CTR

| Industry | Average Mobile CTR (Search) | Average Mobile CTR (Display) |

|---|---|---|

| Arts & Entertainment | 5.01% | 0.84% |

| Automotive Service & Repair | 3.76% | 0.36% |

| Business Services | 3.60% | 0.55% |

| Computers & Electronics | 3.70% | 0.60% |

| Construction | 3.52% | 0.50% |

| Consulting | 3.99% | 0.54% |

| Education | 4.45% | 0.50% |

| Finance | 4.57% | 0.53% |

| Hair Salons | 5.00% | 0.93% |

| Healthcare | 3.79% | 0.51% |

| Home & Garden | 3.50% | 0.76% |

| Internet & Telecom | 3.05% | 0.57% |

| Law/Legal | 3.48% | 0.64% |

| Manufacturing | 4.13% | 0.53% |

| Non-profits | 4.09% | 0.70% |

| Retail | 4.25% | 0.57% |

| Transportation | 4.54% | 0.59% |

| Travel & Hospitality | 5.36% | 0.61% |

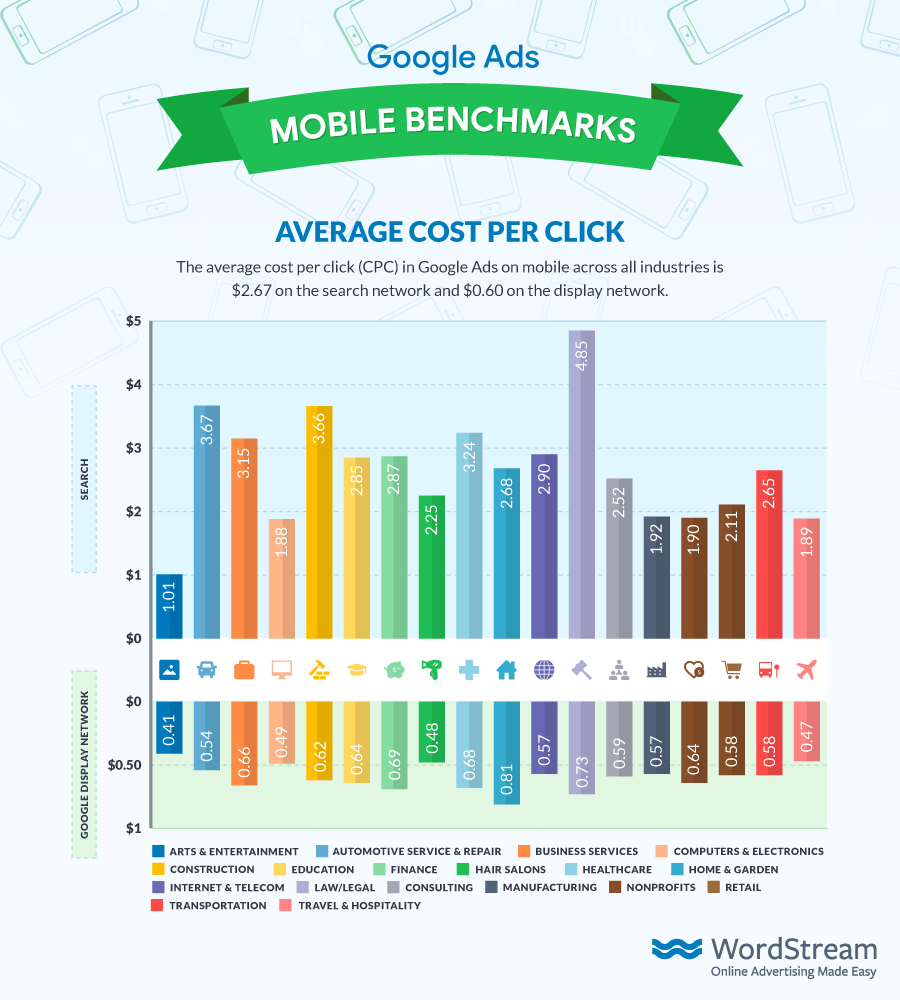

Average Mobile Cost Per Click in Google Ads by Industry

Consistent with our desktop-inclusive benchmarks, Law/Legal has the highest mobile cost per click (CPC) in search. This is unsurprising given that “lawyer” ranks among the priciest keywords in Google Ads. Unsurprisingly, related keywords come with a similar price tag, inflating CPCs across the niche.

In display advertising, Arts & Entertainment boasts the lowest CPC at $0.41. Given the strong CTR-CPC correlation, it’s no shock that Travel & Hospitality follows closely at $0.47, with both industries claiming top spots for low search CPCs.

The average mobile cost per click in Google Ads across all industries is $2.67 for search and $0.60 for display.

Desktop-inclusive CPCs for search ($2.69) and display ($0.63) suggest that mobile CPCs don’t deviate significantly from desktop figures across industries.

Average Mobile CPC

| Industry | Average Mobile CPC (Search) | Average Mobile CPC (Display) |

|---|---|---|

| Arts & Entertainment | $1.01 | $0.41 |

| Automotive Service & Repair | $3.67 | $0.54 |

| Business Services | $3.15 | $0.66 |

| Computers & Electronics | $1.88 | $0.49 |

| Construction | $3.66 | $0.62 |

| Consulting | $2.52 | $0.59 |

| Education | $2.85 | $0.64 |

| Finance | $2.87 | $0.69 |

| Hair Salons | $2.25 | $0.48 |

| Healthcare | $3.24 | $0.68 |

| Home & Garden | $2.68 | $0.81 |

| Internet & Telecom | $2.90 | $0.57 |

| Law/Legal | $4.85 | $0.73 |

| Manufacturing | $1.92 | $0.57 |

| Non-profits | $1.90 | $0.64 |

| Retail | $2.11 | $0.58 |

| Transportation | $2.65 | $0.58 |

| Travel & Hospitality | $1.89 | $0.47 |

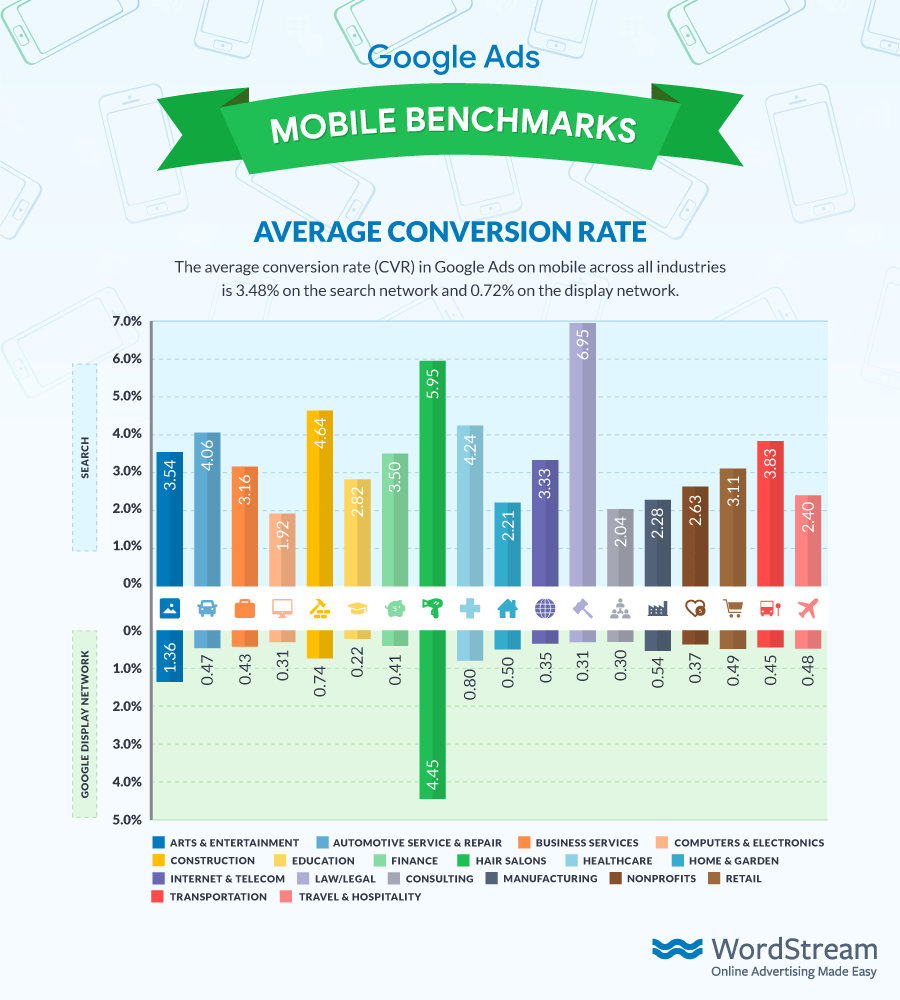

Average Mobile Conversion Rates in Google Ads by Industry

Hair Salons celebrate! Their conversion rates (CVRs) significantly surpassed other industries, with display CVRs more than tripling the next highest (Arts & Entertainment, as expected). In search, Law/Legal exhibited near-outlier conversion rates (6.95%), and Construction also performed well above average (4.64%).

Education, similar to its desktop-inclusive conversion rate, lagged behind in both search (2.82%) and display (0.22%) CVRs, with the latter representing the lowest across industries. Marketing in education presents challenges due to expensive keywords, lengthy sales cycles, and advertising limitations.

Travel & Hospitality’s conversion rates highlight that high CTRs and low CPCs don’t tell the whole story. Customers conduct extensive searches before booking travel, demonstrating that clicks don’t always equate to conversions. Travel advertisers should prioritize bids on high-intent keywords.

The average mobile conversion rate in Google Ads across all industries is 3.48% for search and 0.72% for display.

Desktop-inclusive CVRs for search (3.75%) and display (0.77%) indicate slightly lower conversion rates on mobile devices in general.

Average Mobile CVR

| Industry | Average Mobile CVR (Search) | Average Mobile CVR (Display) |

|---|---|---|

| Arts & Entertainment | 3.54% | 1.36% |

| Automotive Service & Repair | 4.06% | 0.47% |

| Business Services | 3.16% | 0.43% |

| Computers & Electronics | 1.92% | 0.31% |

| Construction | 4.64% | 0.74% |

| Consulting | 2.04% | 0.30% |

| Education | 2.82% | 0.22% |

| Finance | 3.50% | 0.41% |

| Hair Salons | 5.95% | 4.45% |

| Healthcare | 4.24% | 0.80% |

| Home & Garden | 2.21% | 0.50% |

| Internet & Telecom | 3.33% | 0.35% |

| Law/Legal | 6.95% | 0.31% |

| Manufacturing | 2.28% | 0.54% |

| Non-profits | 2.63% | 0.37% |

| Retail | 3.11% | 0.49% |

| Transportation | 3.83% | 0.45% |

| Travel & Hospitality | 2.40% | 0.48% |

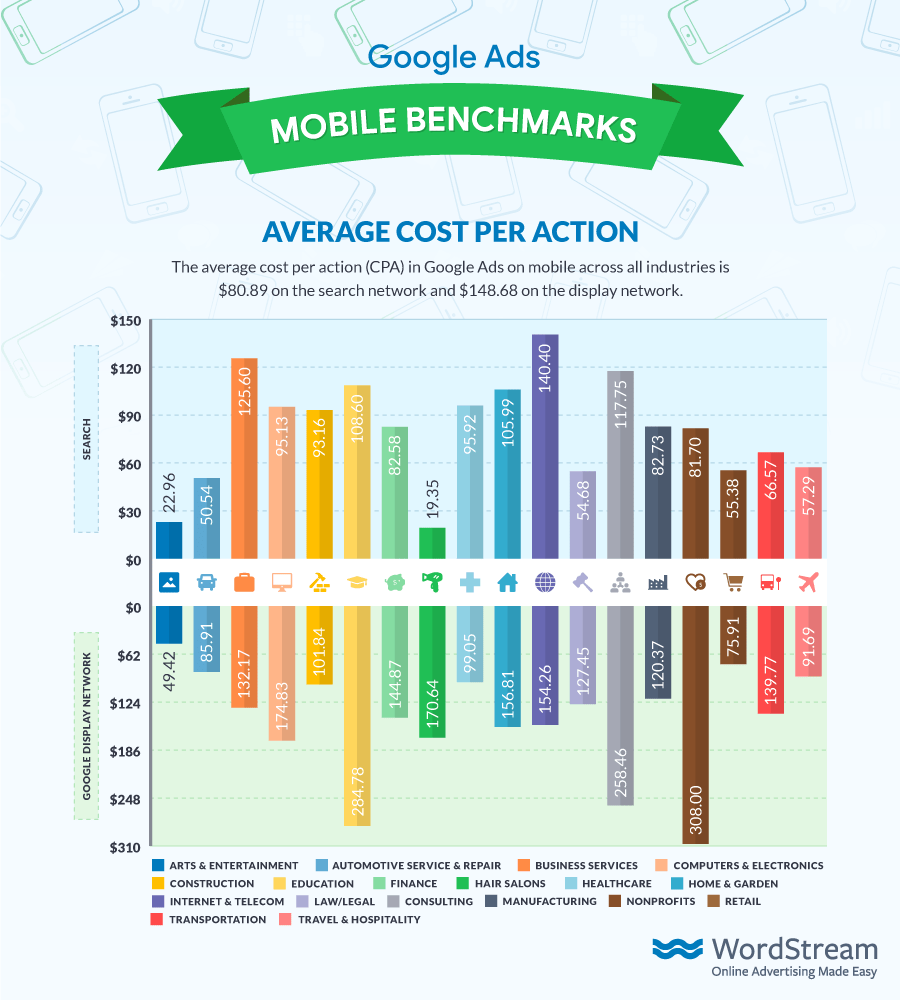

Average Mobile Cost Per Action in Google Ads by Industry

An inverse relationship exists between CVR and cost per action (CPA). Industries with lower-than-average CVRs tend to experience higher-than-average CPAs.

Higher display CPAs in Consulting and Education could stem from less visually compelling ads promoting specific actions. This trend in Education CPAs was also observed in our desktop-inclusive benchmarks.

The average mobile cost per action in Google Ads across all industries is $80.89 for search and $148.68 for display.

Desktop-inclusive CPAs for search (48.96%) and display (75.51%) suggest significantly higher CPAs on mobile devices. If you utilize CPA bidding, monitor your campaigns closely to avoid excessive mobile ad spend.

Average Mobile CPA

| Industry | Average Mobile CPA (Search) | Average Mobile CPA (Display) |

|---|---|---|

| Arts & Entertainment | $22.96 | $49.42 |

| Automotive Service & Repair | $50.54 | $85.91 |

| Business Services | $125.60 | $132.17 |

| Computers & Electronics | $95.13 | $174.83 |

| Construction | $93.16 | $104.84 |

| Consulting | $117.75 | $258.46 |

| Education | $108.60 | $284.78 |

| Finance | $82.58 | $144.87 |

| Hair Salons | $19.35 | $170.64 |

| Healthcare | $95.92 | $99.05 |

| Home & Garden | $105.99 | $156.81 |

| Internet & Telecom | $140.40 | $154.26 |

| Law/Legal | $54.68 | $127.45 |

| Manufacturing | $82.73 | $120.37 |

| Non-profits | $81.70 | $308.00 |

| Retail | $55.38 | $75.91 |

| Transportation | $66.57 | $139.77 |

| Travel & Hospitality | $57.29 | $91.69 |

Some Context

While our client data may not be universally applicable, these benchmarks offer valuable insights into the mobile Google Ads landscape. Don’t panic if your metrics don’t perfectly align with industry benchmarks. Our free AdWords Performance Grader tool analyzes your account and pinpoints areas for improvement.

See the complete infographic below.

Data Sources:

This report is based on a sample of 20,297 US-based nexus-security client accounts across all industries (representing over $139 million in total Google Ads spending) who advertised on Google’s Search and Display networks during the 2017 calendar year. Each industry includes at least 35 unique active clients. “Averages” are technically median figures to account for outliers. All currency values are in USD.

A huge thank you to our Data Analyst Patrick Henry Carrera for compiling this data!

You may also be interested in:

- 2021 search advertising benchmarks

- 2021 home services advertising benchmarks

- 2021 real estate advertising benchmarks

- 2021 healthcare advertising benchmarks