By July 31st of this year, financial technology (fintech) ventures in the Asia-Pacific region, especially in China, secured US$9.62 billion in investments. This represents more than double the US$4.26 billion invested across the entire region throughout 2015, as reported by Accenture.

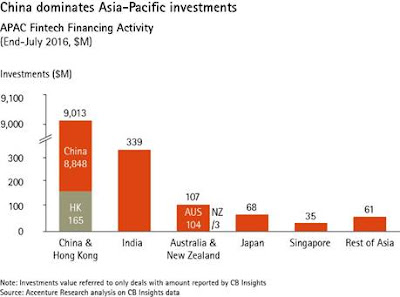

Data from CB Insights reveals that Asia-Pacific leads in fintech investments, surpassing both North America and Europe. As of July 31st, North America attracted US$4.58 billion, while Europe received US$1.85 billion.

However, North America and Europe experience a greater number of investment deals overall. Accenture highlights that the Asia-Pacific’s impressive figure stems from significant investments in a select group of Chinese fintech companies. This year, the Asia-Pacific region has witnessed 192 deals, compared to 509 in North America and 230 in Europe.

Significantly, the top 10 investments in Asia-Pacific fintech ventures, totaling US$8.75 billion, were concentrated in mainland China and Hong Kong. These investments represent 90% of the region’s total. As of now, in 2016, fintech ventures in China and Hong Kong have successfully attracted US$9 billion in investments.

Beat Monnerat, Accenture Senior Managing Director for Financial Services in Asia-Pacific, observes, “Established Chinese companies, rather than new startups, are driving the fintech surge in the region.” He adds, “Fintech companies backed by giants like Alibaba and JD.com prioritize delivering seamless and positive customer experiences, encompassing payments and lending. This is revolutionizing China’s financial services sector and aligns with the global ‘Fourth Industrial Revolution,’ which sees non-traditional players bringing innovation to financial services.”

Ant Financial Services Group, the financial arm of e-commerce titan Alibaba Group Holding, which manages China’s online payment platform Alipay, concluded a US$4.5 billion funding round in April. Lufax, supported by Ping An and now operating as Lu.com, secured US$1.2 billion in funding back in January. That same month, JD.com, China’s second-largest e-commerce player, raised US$1 billion for its consumer finance division, JD Finance.

In recent years, prominent Alibaba subsidiaries and Tencent, China’s leading social network company, have diversified their investments by supporting smaller startups. These include Fenqile, a micro-loan platform translating to “happy installments,” Qufenqi, an electronics retailer allowing customers to pay in installments, and India’s One97 Communications, a mobile internet firm.

Albert Chan, Managing Director of Financial Services for China at Accenture, states, “The fintech trend in China continues to favor online payments and lending, including peer-to-peer (P2P), leading to market share erosion for traditional banks.” He advises, “Chinese banks, irrespective of developing their own platforms, should explore investing in collaborative fintech ventures to maintain their competitive edge.”