No matter what you choose to call it – whether it’s defection, attrition, or turnover – customer churn is a difficult fact of life for every business. Even the biggest, most successful companies experience customer churn, and figuring out why previously loyal customers decide to leave is essential for long-term, sustainable growth.

This post will cover what customer churn is, what qualifies as a “good” rate, and ways to prevent your customers from leaving you for good.

Art installation by Tim Etchells

What Exactly is Customer Churn?

Customer churn happens when current customers stop doing business with a company. This can look different depending on the type of business. Here are some examples:

- A subscription being canceled

- An account being closed

- A contract or service agreement not being renewed

- A customer deciding to shop at a different store or use a different service provider You need to decide how you will measure these types of actions and what customer attrition means for your company before you can determine your churn rate. Once you’ve done this, you can calculate it.

How to Calculate Customer Churn Rate

You can determine your customer churn rate using one or more of these methods:

- The total number of customers lost in a certain time period

- The percentage of customers lost in a certain time period

- Recurring business value lost

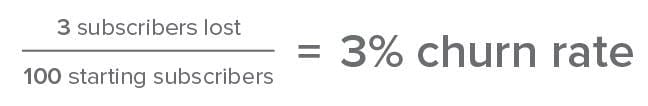

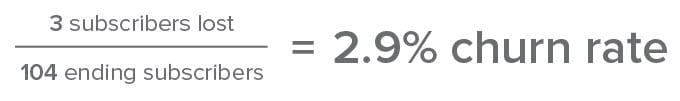

- Percentage of recurring value lost Take a look at this example from Churn-Rate.com, where a company starts the month with 100 subscribers:

You might also decide to calculate your churn rate based on the number of subscribers you have at the end of the month, instead of the beginning:

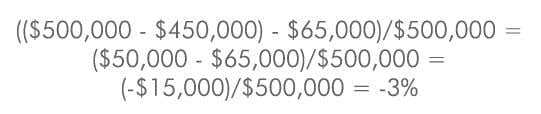

You can also calculate customer churn using revenue. Companies that use this method typically use their monthly recurring revenue (MRR) as a starting point. Now, calculating customer churn with MRR involves a few more steps. In this example, a company had an MRR of $500,000 at the start of the month, and $450,000 at the end of the month. Let’s say this company also made $65,000 from existing customers who purchased upgrades during that month. This is what the churn calculation would look like:

In this example, the churn rate is negative, which means that the company ended up making money despite the $50,000 loss in MRR. This is called negative churn. Regardless of how you calculate it, customer churn is never good. Now, let’s look at “good” churn rates and how you can lower yours.

What is Considered a Good Customer Churn Rate?

In a perfect world (where customers were always happy, cats and dogs lived peacefully together, and no one ever spoiled “Game of Thrones” on Facebook), the ideal customer churn rate would be zero. Of course, this is unrealistic. You will inevitably lose customers, even if your service is excellent and your products are outstanding. But this doesn’t mean you can’t achieve and maintain a “good” churn rate – or, at the very least, an acceptable one. But what is considered a good churn rate? It depends on your industry. Some sectors naturally experience higher customer attrition rates than others. However, it’s hard to pinpoint average customer churn rates by industry because, strangely enough, most companies aren’t eager to share how many customers they lose regularly.

Image © Bethesda Softworks However, there is some available data that can give you a sense of what to expect in certain sectors.

Customer Churn Rates by Industry

These are the average customer churn rates in a few common industries:

- American credit card companies typically have customer churn rates of around 20%

- European cellular carriers experience churn rates of between 20-38%

- Certain American telcos, such as Verizon, have reported very low churn rates – like 0.84% in Q2 2012 (this could be because of service agreements)

- Software-as-a-Service (SaaS) companies usually report client churn rates of between 5-7%

- Many retail banks have churn rates of between 20-25%

- In 2003, the churn rate of daily newspaper subscriptions in the U.S. was 58% Customer churn rates that are considered great for one business might be terrible for another. Why? Not all business models are structured the same way, and even businesses with similar models might define churn differently. Let’s say your business uses a subscription model. How long are your subscription contracts? How does a typical customer’s lifetime value change based on the length of their contract? How long does it take to recoup the initial costs of customer acquisition and for an account to make money? On average, how many new customers do you get per month? The answers to all of these questions will affect your target customer churn rate.

6 Ways to Reduce Customer Churn

So you now have a basic understanding of what an acceptable churn rate might be for your business. But how do you actually reduce customer churn? By making an extra effort from the very beginning.

Make a Positive First Impression

Customers are less likely to shop around if you impress them from the start.

Josh Ledgard, co-founder of KickoffLabs, says the first the first five minutes with a new customer are crucial. If someone using a product or service for the first time sees immediate results, they’re much less likely to leave, because they believe they can be even more successful over time. The better a customer’s initial experience, the stronger their commitment will be, and the lower their chance of churning later on.

Consistently Exceed Customers’ Expectations

Not following through is one of the quickest ways to lose a customer. In fact, many companies report that dissatisfaction and unmet expectations are some of the top reasons for customer churn. Making a great first impression isn’t enough – you also need to consistently meet your customers’ expectations, and go above and beyond whenever you can.

You might assume you don’t need to start meeting and exceeding customer expectations until they are already regularly using your products or services. However, the process begins much earlier than that: during the first sales call. Don’t let sales representatives who are trying to meet their quotas oversell your business or make promises you can’t keep. If you do, you’ll likely struggle to meet your customers’ expectations, let alone surpass them. Be truthful about what your customers can expect, and always follow through on your promises.

Provide Excellent Customer Service

This one might seem obvious, but some companies simply don’t put enough effort into customer service.

Image © Scott Adams A recent survey by Zendesk revealed the most common customer service complaints. Some key findings include:

- 42% of respondents reported that having to repeat their issue to multiple representatives was the most frustrating part of dealing with customer service departments

- 35% of customers said they would stop doing business with a company altogether after just one negative customer service experience

- 16% of angry customers said they would share their frustrations on social media after a negative customer service interaction (this number seems very low to me) – but only 8% would do the same to praise good customer service

- 60% of consumers reported being significantly influenced by social media comments about companies It’s also important to think about being proactive when it comes to customer service, rather than reactive. Don’t wait for customers to come to you with complaints; have an outreach program in place to check in with them long before any problems come up. Remember: it costs much less to keep an existing customer than to acquire a new one.

Listen Carefully to Customer Feedback

Some business owners think that no one knows their business better than they do. But they’re wrong – their customers do. Listening carefully to feedback from customers is one of the best ways to identify those who may be considering leaving.

For instance, if a customer says they’re going to close their account because your service costs too much, they might actually be saying they haven’t had a chance to fully explore your product yet, and don’t understand its value as a result. Or, they might actually be saying your prices really are too high. Regardless of what your customers tell you, listen to what they have to say. Consider how sales professionals overcome a prospect’s objections: many people give “fake” objections that may not actually be legitimate concerns simply because they don’t like being sold to. Be prepared to make your customers’ lives easier by offering real solutions based on what they’re actually telling you, not what you think they’re telling you. Of course, sometimes you don’t have much choice but to…

Accept That You Will Lose Some Customers

This is another concept that some business owners find difficult to accept, but sometimes, you have to let customers go. This doesn’t mean you should ignore customer churn rates, accept that you’ll provide poor service, or constantly bring in new customers. It means you need to know when to admit defeat and let a customer walk away. So how do you know when to cut ties with a customer? Consider the situation in terms of profitability. Let’s say you notice a group of customers who are at risk of switching to a competitor. You’d immediately offer them a generous incentive to stay, right? Not necessarily. First, determine if it’s even worth the effort to retain those at-risk customers.

Many businesses have trouble with this concept because they wrongly assume that all customers are equally valuable. This might be true for some companies, but most have a core group of customers who spend more, talk about their products on social media, and stay with the business longer. However, even the most loyal customers might still leave if they feel like their needs aren’t being met, or that the company is taking them for granted. Because of this, these are the customers you should focus your efforts and money on retaining. Sunil Gupta, a professor of business administration at Harvard Business School, says that in addition to figuring out a customer’s likelihood of churning, businesses should also figure out:

- How much money each customer spends

- How likely a customer is to respond positively to a retention incentive offer

- How much an incentive offer will cost the business in terms of overhead or lost revenue Gupta argues that businesses should only reach out to at-risk customers after considering all of this information. Don’t just aim to reduce customer churn rates – focus on reducing churn and increasing profits. For more information on this, you can read “Managing Churn to Maximize Profits,” a research paper that Gupta co-authored with Aurélie Lemmens from the Tilburg School of Economics and Management.

Find Out Why Customers Cancel, Then Fix It

Remember all the math we did to calculate churn rates? You need to know what your churn rate is, but you also need to know why your customers are leaving. Many businesses struggle with this because it involves asking difficult questions, and admitting that they aren’t actually perfect. However, identifying the most common reasons for customers leaving – and addressing them to improve things – can significantly reduce customer churn rates.

Make sure you provide your customers with plenty of opportunities to tell you why they’re leaving. This could be through a (short) survey, a multiple-choice question, a comment box in a “We’ll miss you!” email – the possibilities are endless. Just make sure you can figure out why you’re losing customers, then work on improving the most common reasons for people leaving. Hopefully you can apply some of these customer churn tips to your own business. Unless you have a churn rate of zero, of course. In that case, you’re doing something right.