The end of summer has arrived. In the northeast, vibrant leaf transformations, cool nights, and the aroma of pumpkin spice signal the season’s change. While cozying up might be appealing, the shift from back-to-school to the holiday shopping season offers no respite for PPC advertisers.

In collaboration with Google, we’ve analyzed past search data to anticipate what’s in store for retailers this holiday season. As preparations ramp up, we’ll delve into search patterns across the United States, Canada, United Kingdom, and Australia for 12 key retail sectors:

- Apparel

- Computers

- Electronics

- Food & Groceries

- Hobbies & Leisure

- Home & Garden

- Home Appliances

- Furniture

- Jewelry

- Sports & Fitness Apparel

- Toys & Games

- All retail

Early Bird Shoppers: When Does the Holiday Rush Begin?

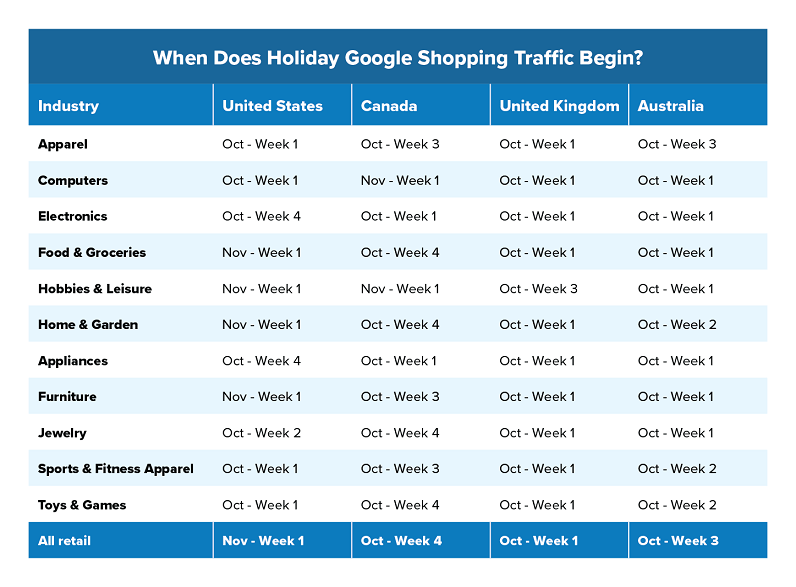

Contrary to popular belief, holiday shopping commences well before Black Friday. Here’s when advertisers can anticipate at least a 10% surge in campaign engagement:

Surprisingly, the holiday shopping frenzy often starts as early as October’s first week, particularly in the UK. North American markets might experience a later surge for categories like Home & Garden, Appliances, and Furniture, picking up in late October and early November. However, by November’s first week, almost all retailers should observe a significant upswing in their campaigns.

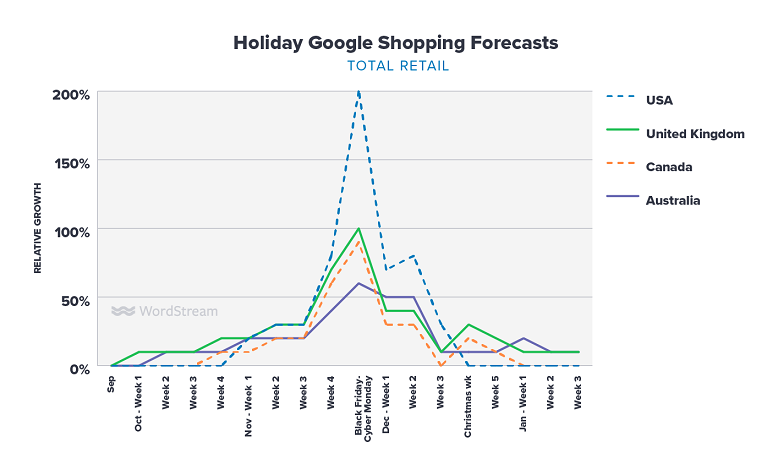

Pre-Black Friday Surge: Google Shopping Trends

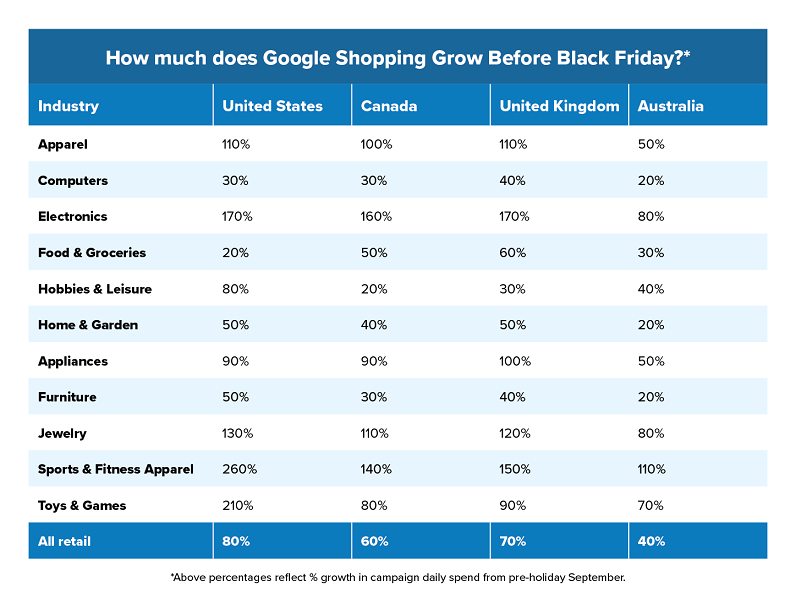

As the holiday season progresses, all retailers will witness a surge in shoppers seeking their products online. While Black Friday and Cyber Monday remain the pinnacle of shopping events, traffic starts to climb considerably earlier.

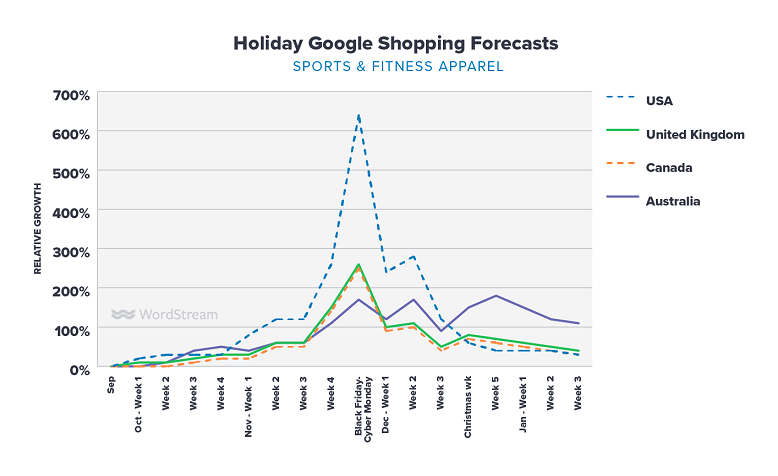

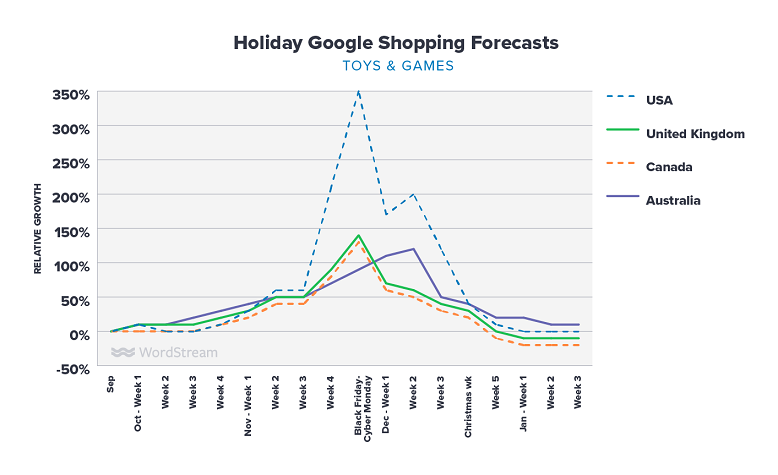

Throughout November, US retailers observe an impressive 80% increase in search traffic. Some sectors, including Sports & Fitness, Toys, Electronics, and Apparel, even experience a doubling of their pre-holiday reach before Black Friday. While growth varies across industries and regions, a minimum 20% lift prior to the holidays is a common expectation.

Black Friday & Cyber Monday: The Shopping Extravaganza

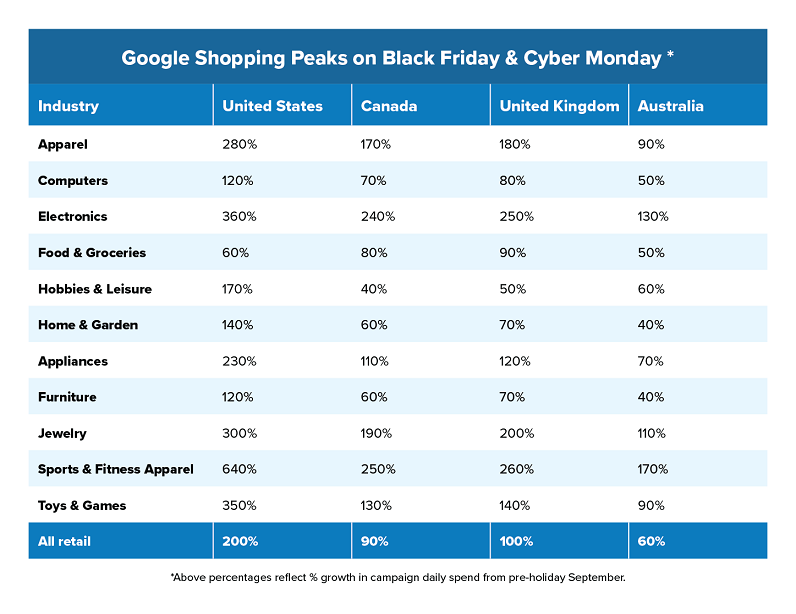

Black Friday and Cyber Monday reign supreme in the world of online retail, and Google Ads trends reflect this. Advertisers can anticipate a staggering 6x surge in their typical daily traffic on these days.

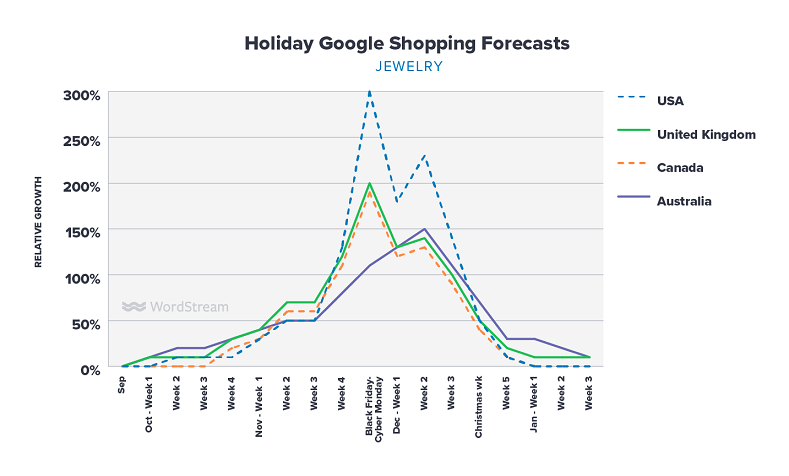

In the US, Black Friday and Cyber Monday mark peak shopping frenzy, with retailers experiencing triple their usual daily traffic, expenditure, and sales. High-value items like Jewelry, Appliances, Electronics, and Computers become hot commodities, leading to an even larger influx of shoppers for these industries. The allure of Black Friday and Cyber Monday extends beyond US borders, with growing global popularity. International retailers can also capitalize on significantly increased opportunities to engage shoppers through Google search, often witnessing a doubling of their usual reach.

December Delights: Google Shopping Trends

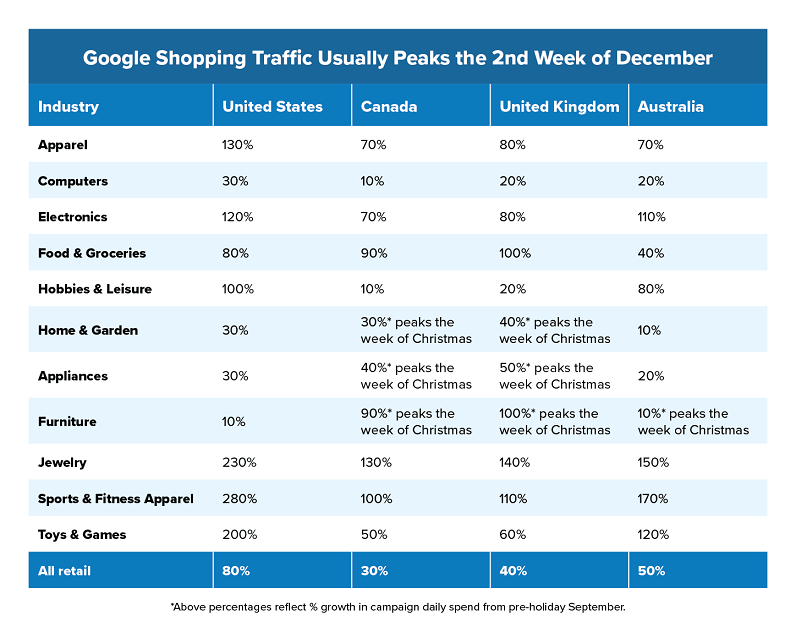

While Black Friday and Cyber Monday mark the shopping peaks, activity continues to climb from November into December. Typically, online holiday shopping traffic on Google reaches its zenith during December’s second week, although regional exceptions exist.

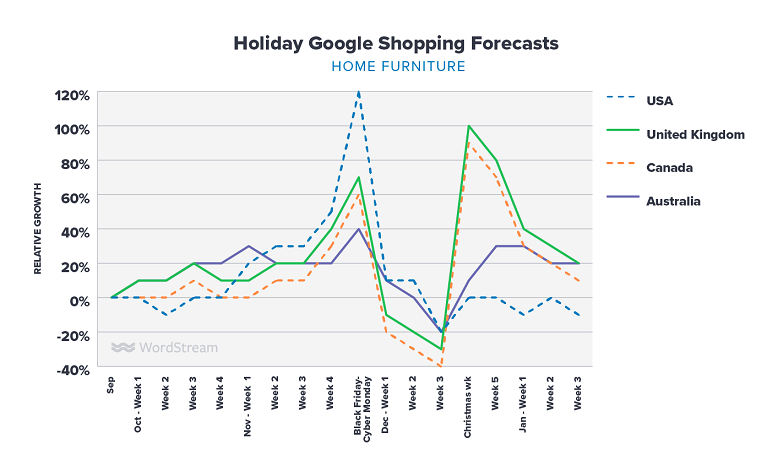

On average, Google Shopping traffic during this period matches the pre-Black Friday surge. However, certain industries peak after Cyber Monday. Food & Grocery shopping, for instance, hits its annual high during December’s second week. Conversely, sectors like Appliances, Home & Garden, and Furniture experience a December slowdown, potentially followed by a small uptick during Christmas week, especially in international markets.

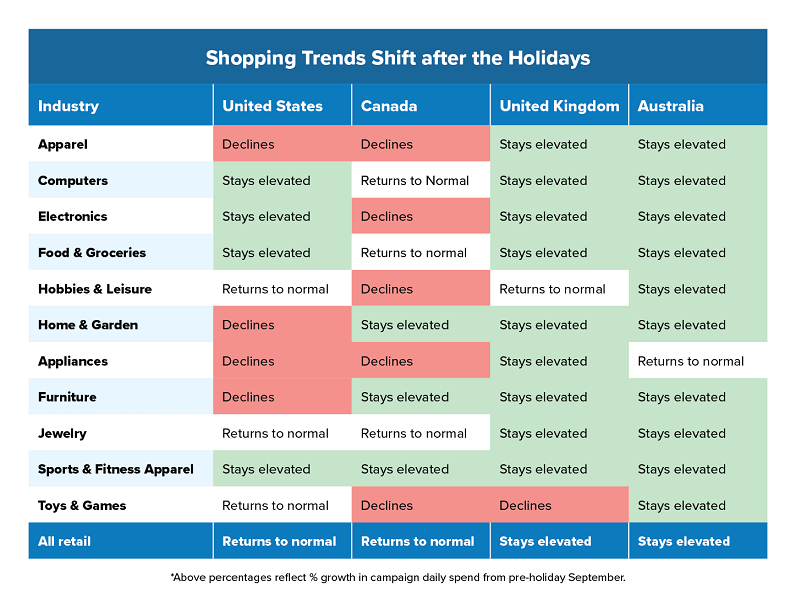

Post-Holiday Shopping: Trends and Opportunities

Even as the festivities wind down, some shoppers remain active on Google, seeking last-minute gifts or indulging in self-gifting.

Although January witnesses a dip in ecommerce compared to December, many industries still see a 10% increase in shopping searches compared to their typical yearly average. In the US and Canada, certain industries experience a winter lull, while Australia welcomes summer. However, a global trend emerges as individuals, energized by the holidays, focus on their New Year’s resolutions. This translates into a significant opportunity for Sports & Fitness Apparel retailers, who can expect at least a 40% surge in Google shoppers.

Industry-Specific Google Holiday Forecasts

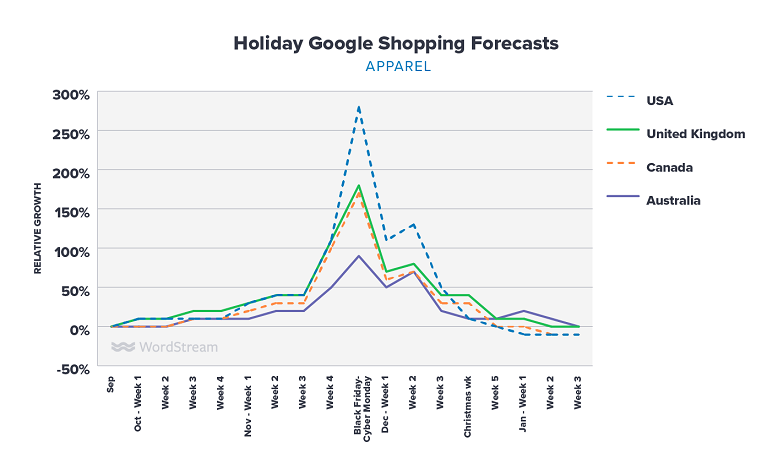

Explore detailed Google holiday forecasts for various industries in the United States, Canada, United Kingdom, and Australia below: Apparel: Holiday Google Shopping campaigns gain traction early in October, maintaining growth throughout November and mid-December. While North America (US and Canada) see a slight post-holiday dip, the UK and Australia experience modest growth.

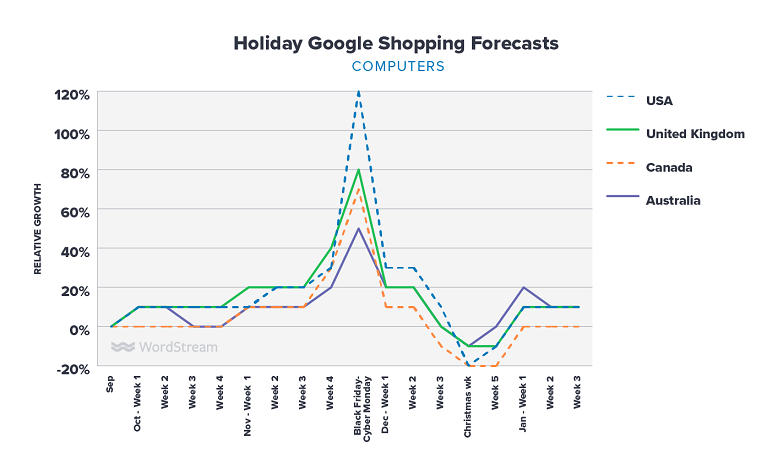

Computers: Holiday Google Shopping campaigns for computers see modest early growth, followed by a significant spike in the weeks surrounding Black Friday and Cyber Monday. Post the second week of December, reach tends to decline.

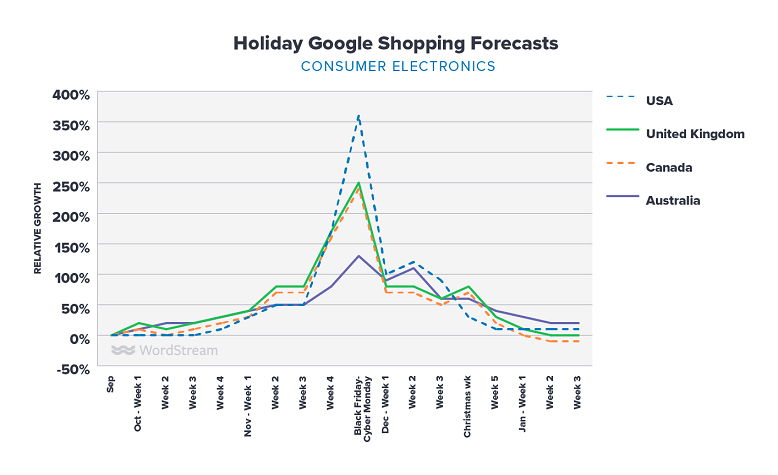

Electronics: Google Shopping campaigns for electronics exhibit consistent growth until two weeks before Black Friday, followed by substantial spikes during the Black Friday and Cyber Monday period. A smaller secondary spike might occur during Christmas week, particularly outside the US. Expect slightly elevated performance in early January.

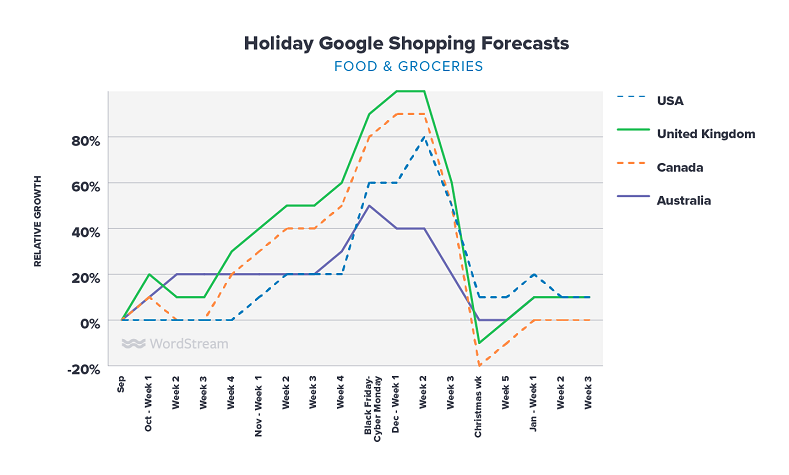

Food & Groceries: Google Shopping campaigns in this sector demonstrate steady growth throughout the season. While Thanksgiving triggers significant growth, the upward trend continues until the week before Christmas, followed by a sharp decline.

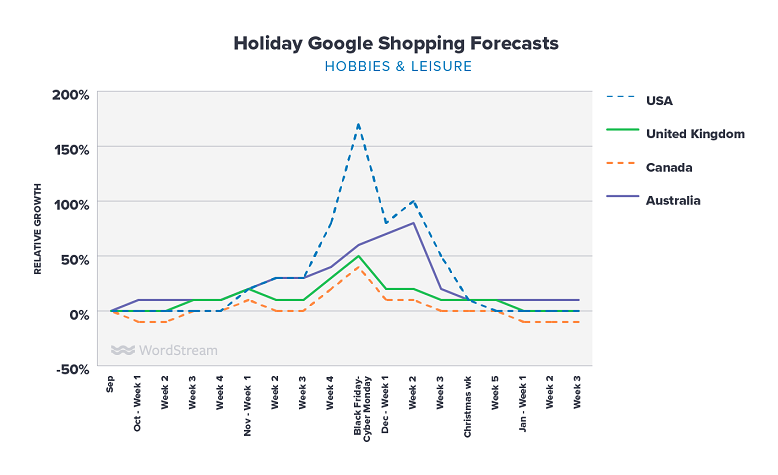

Hobbies & Leisure: Google Shopping campaigns in this industry show limited growth until November. Black Friday, Cyber Monday, and the second week of December witness notable spikes, primarily concentrated within late November and December. By January, campaign performance returns to pre-holiday levels.

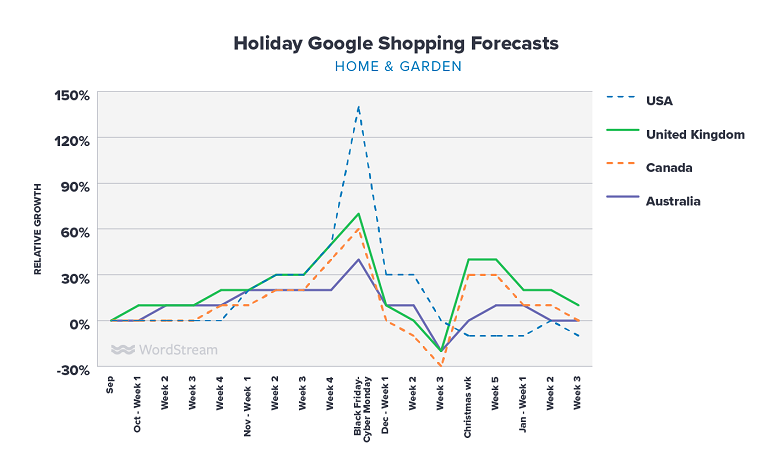

Home & Garden: Google Shopping for Home & Garden tends to see a later start and earlier end, often reverting to pre-holiday levels before Christmas. However, markets outside the US may experience a second, smaller shopping surge post-Christmas.

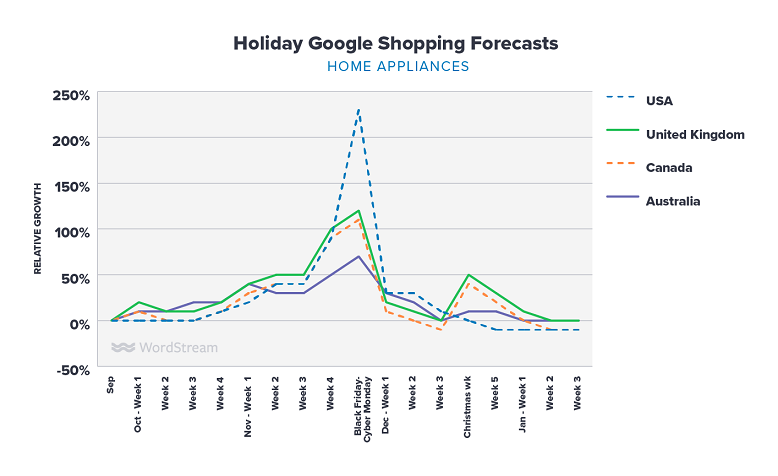

Home Appliances: High-value appliance purchases often involve pre-sale planning, making the weeks leading up to Black Friday crucial for this industry. Most Holiday Google Shopping activity concludes by December’s first week. International markets might observe a small spike during New Year’s week.

Furniture: November reigns supreme for Furniture on Google Shopping, with December potentially being the weakest month. Early campaign setup and ample budget allocation are crucial to capitalize on the November surge. International markets should anticipate a second significant spike in January.

Jewelry: Google Shopping campaigns for jewelry exhibit consistent, predictable growth throughout the holiday season, peaking around Black Friday, Cyber Monday, and the second week of December. Even after the holidays, jewelry shoppers remain active, ensuring consistent performance exceeding pre-holiday figures.

Sports & Fitness Apparel: While the motivation for fitness often arises in winter, shopping begins as early as fall. Throughout the season, these campaigns enjoy significantly higher reach, peaking at a remarkable 640% above pre-holiday spend! Even post-Christmas, anticipate at least a 40% increase compared to September figures.

Toys & Games: Google Shopping campaigns show modest growth in October, followed by a surge in November and December throughout the holiday season. However, January typically sees a dip below pre-holiday spending levels.

Total Retail: By November’s first week, all markets should experience double-digit percentage growth in Google Shopping campaigns. US advertisers should prepare for a 200% spike on Black Friday and Cyber Monday and an 80% spike during December’s second week. International advertisers can expect similar trends, albeit at approximately half the magnitude.

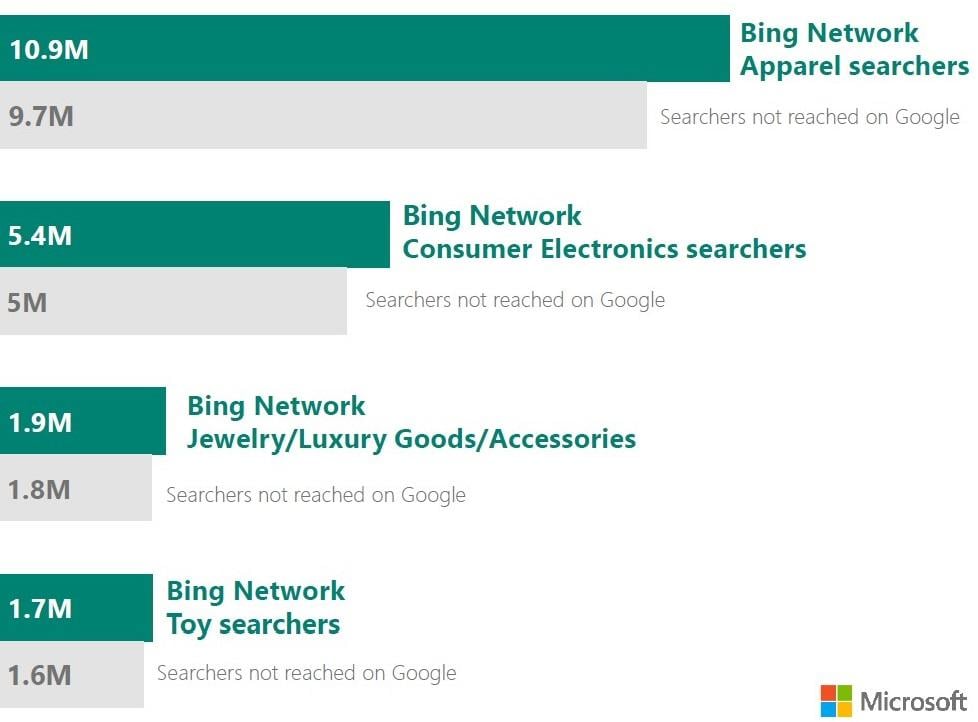

Google Shopping Campaign Checklist: Holiday Readiness

The holiday season presents a prime opportunity for ecommerce advertisers. Ensure your campaigns are primed for success by following these essential steps: 1. Launch Now: Even if you’re new to Google Shopping, it’s not too late! However, setting up feeds, organizing products, and launching campaigns can be complex. Starting early allows your campaigns to capitalize on the entire season. 2. Budget Wisely: Seasonal shifts in demand necessitate budget adjustments, particularly during the holidays. Depending on your industry, consider increasing or even doubling your daily budgets. For Black Friday and Cyber Monday, some sectors might need to allocate over six times their usual budget! 3. Explore Bing Shopping: Holiday shopping trends extend beyond Google. Bing Shopping handles over 744 million retail searches during this period. Beyond Bing’s search engine, shopping ads reach users on platforms like Yahoo, AOL, DuckDuckGo, Amazon, OfferUp, and numerous other popular publishers. Bing Shopping also offers a cost advantage, with clicks averaging 30% cheaper than Google Shopping.

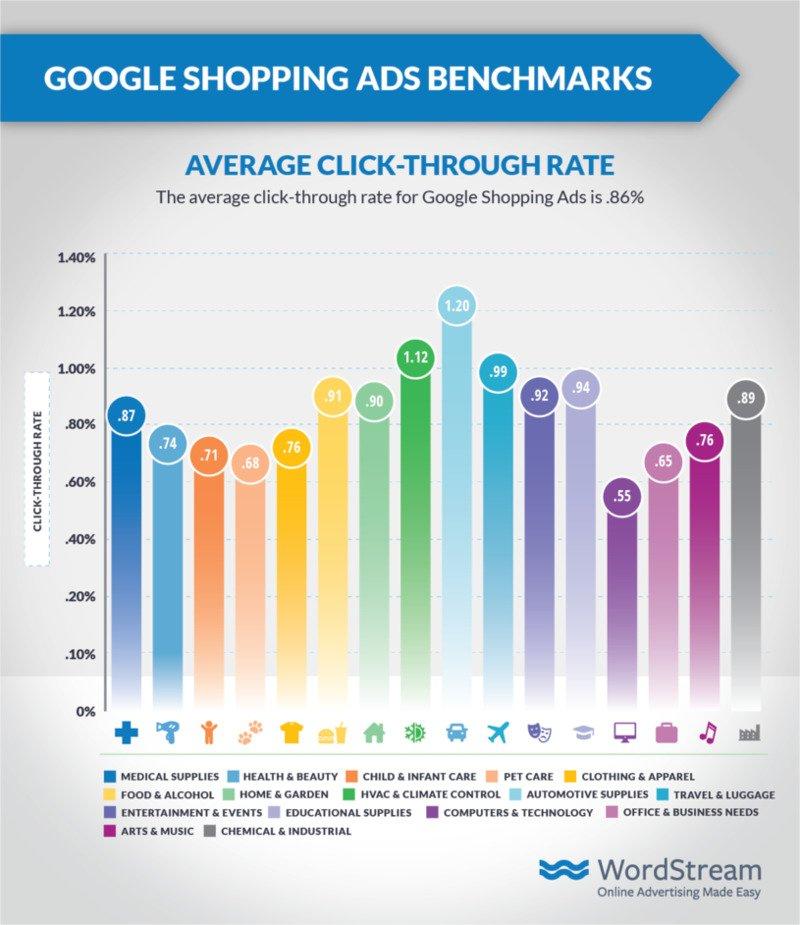

4. Evaluate Your Google Ads Shopping: Whether you’re just starting or are a seasoned Google Shopping advertiser, there’s always room for optimization. Our new and improved Google Ads Grader provides a comprehensive analysis of your campaigns’ performance, highlighting opportunities and benchmarking against similar advertisers within minutes! 5. Benchmark Against Your Industry: In the flurry of the holiday season, understanding your campaign’s performance relative to competitors is crucial. We recently analyzed hundreds of Google and Bing Ads Shopping campaigns across 16 popular industries to establish benchmarks for average budgets, click-through rates (CTR), cost-per-click (CPC), conversion rates (CVR), and cost-per-acquisition (CPA). This post allows you to compare your shopping campaigns’ performance against industry standards.

For advertisers on other platforms like search or social, similar benchmarks are available for:

- Google Ads Benchmarks for YOUR Industry

- Google Shopping Ad Benchmarks for YOUR industry

- Google Ads Mobile Benchmarks for YOUR Industry

- Bing Ads Benchmarks for YOUR Industry

- Facebook Ad Benchmarks for YOUR Industry Data Sources: This post utilizes data collected and shared by Google. Historical industry and market performance trends inform the 2019 predictions.