» Find our latest Facebook ad benchmarks here!

Facebook is a rapidly expanding ad network. In the last 18 months, the number of businesses using Facebook for advertising has increased by over double. If you’re one of the 2 million advertisers who joined Facebook in the last two years, you may have discovered that the platform’s learning curve can be steep. Facebook has a nearly endless number of ad targeting possibilities, and performance varies from client to client. As with Google Ads, performance might vary between industries on Facebook, so what figures should you aim for in your industry?

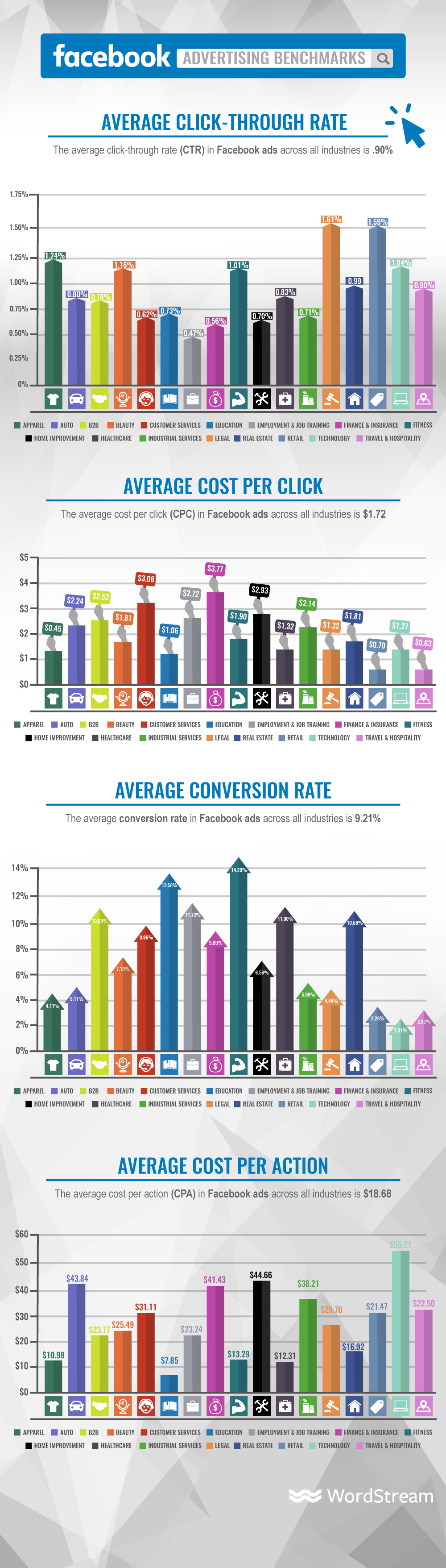

Our team investigated our data to discover the answer! Take a look at the Facebook ad performance benchmarks that our clients are seeing, including:

- Average Click-Through Rate (CTR) by industry

- Average Cost per Click (CPC) by industry

- Average Conversion Rate (CVR) by industry

- Average Cost per Action (CPA) by industry

Averages for these Facebook metrics are provided for eighteen industries: Apparel, Auto, B2B, Beauty, Consumer Services, Education, Employment & Job Training, Finance & Insurance, Fitness, Home Improvement, Healthcare, Industrial Services, Legal, Real Estate, Retail, Technology, and Travel & Hospitality. Let’s get started!

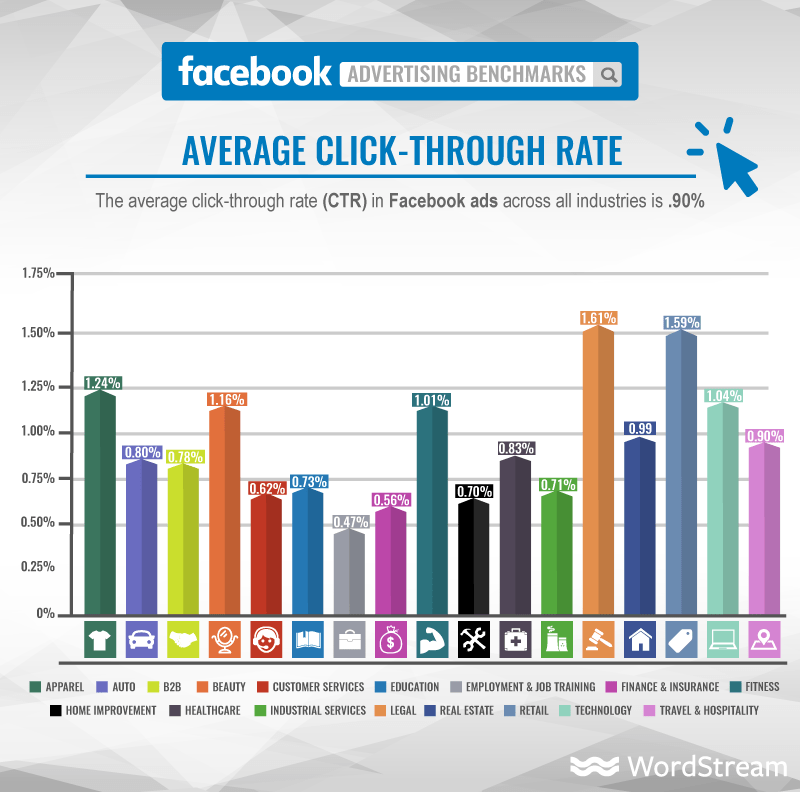

How Well Do Facebook Ads Perform in Terms of Click-Through Rate?

On Facebook ads, what is a reasonable click-through rate?

While legal advertisers may struggle with low click-through rates on the search engine results page (SERP), they benefit from having the highest CTRs on Facebook (1.61%). When your ad is one of seven on the SERP, it can be difficult to impress a potential client seeking a lawyer. However, a lawyer’s high-value offer and call to action stand out more when it appears alone on a prospect’s social feed. Retail (1.59%), apparel (1.24%), beauty (1.16%), and fitness (1.01%) are among the other advertisers with high CTRs. It’s not surprising that these industries frequently employ models and high-quality photographs in their advertisements, which perform especially well on visual platforms like Facebook and Instagram.

It takes a lot of effort to divert potential job seekers away from their social media feeds, and employment and job training services may have low CTRs on Facebook (0.47%). Facebook and Instagram may not be the ideal platforms for job searchers, but LinkedIn may be a good fit for these advertisers. The average click-through rate (CTR) for Facebook ads across all industries is 0.90%.

Average Click Through Rate (CTR) for Facebook Ads by Industry

| Industry | Average CTR |

|---|---|

| Apparel | 1.24% |

| Auto | 0.80% |

| B2B | 0.78% |

| Beauty | 1.16% |

| Consumer Services | 0.62% |

| Education | 0.73% |

| Employment & Job Training | 0.47% |

| Finance & Insurance | 0.56% |

| Fitness | 1.01% |

| Home Improvement | 0.70% |

| Healthcare | 0.83% |

| Industrial Services | 0.71% |

| Legal | 1.61% |

| Real Estate | 0.99% |

| Retail | 1.59% |

| Technology | 1.04% |

| Travel & Hospitality | 0.90% |

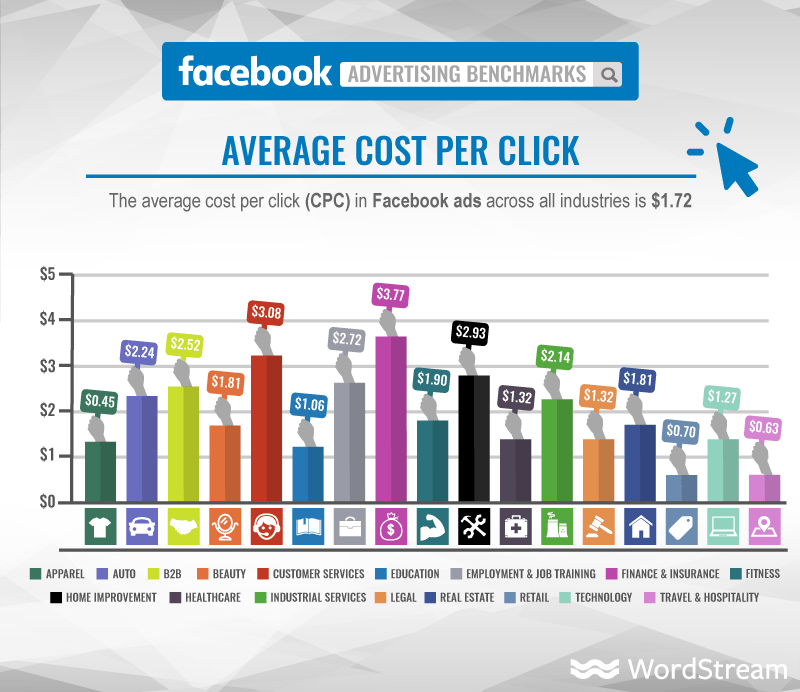

Average Cost Per Click (CPC) for Facebook Ads

What constitutes a reasonable cost per click for Facebook ads?

While financial advertisers pay the most per click on Facebook ($3.77), they may be satisfied with this figure. The terms “Insurance,” “Loans,” and “Mortgage” are the three most expensive keywords on Google, costing roughly $50 per click.

The apparel ($0.45 per click), travel and hospitality ($0.63), and other retail ($0.70) industries have the lowest Facebook click prices, with clicks costing much less than a dollar. Because these industries frequently have the biggest audiences, even at these low CPCs, it’s critical to understand how to manage your budget so that your Facebook expenditures don’t spiral out of control.

The average cost per click (CPC) for Facebook advertisements across all industries is $1.72.

Average Cost Per Click (CPC) for Facebook Ads by Industry

| Industry | Average CPC |

|---|---|

| Apparel | $0.45 |

| Auto | $2.24 |

| B2B | $2.52 |

| Beauty | $1.81 |

| Consumer Services | $3 .08 |

| Education | $1.06 |

| Employment & Job Training | $2.72 |

| Finance & Insurance | $3.77 |

| Fitness | $1.90 |

| Home Improvement | $2.93 |

| Healthcare | $1.32 |

| Industrial Services | $2.14 |

| Legal | $1.32 |

| Real Estate | $1.81 |

| Retail | $0.70 |

| Technology | $1.27 |

| Travel & Hospitality | $0.63 |

Running Google Ads too? Download our latest report:

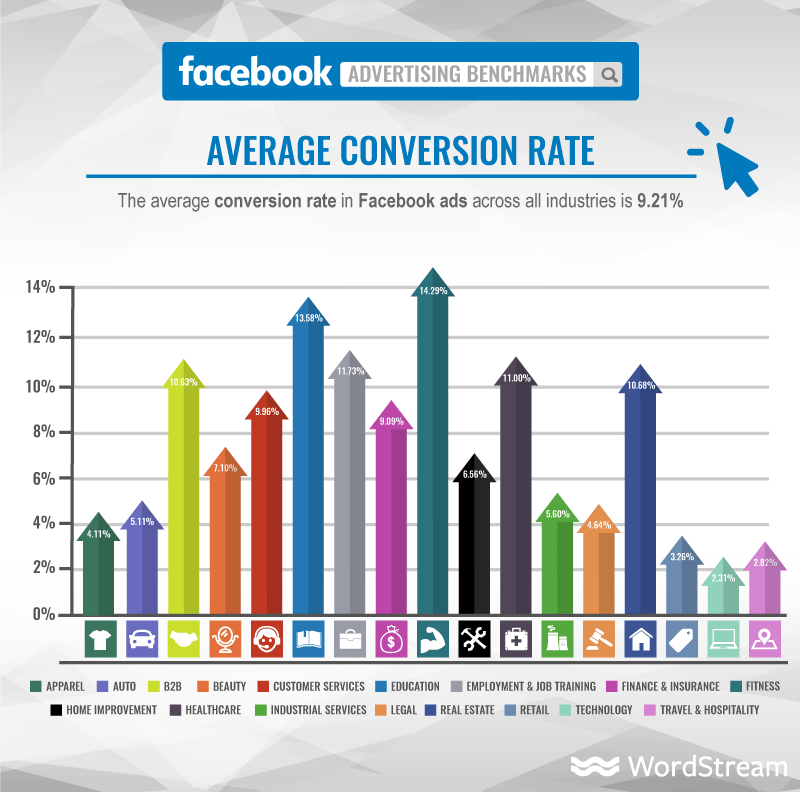

How Well Do Facebook Ads Convert?

What is a reasonable conversion rate for Facebook ads?

Fitness studios have a lot on their plates, but attracting customers on Facebook does not appear to be one of them. Facebook can link motivated prospects with fitness advertisers and assist them in converting at extraordinarily high rates, with an average conversion rate of 14.29% from Facebook ads.

Other industries with high CVRs include education (13.58%), employment and job training (11.73%), healthcare (11.00%), real estate (10.68%), and B2B (10.63%). These industries outperform most other ad platforms thanks to Facebook’s one-of-a-kind lead generation ads.

However, industries such as retail, travel & hospitality, and technology may not benefit as much from Facebook’s lead generation ads, resulting in significantly lower conversion rates (3.26%, 2.82%, and 2.31%, respectively). For these advertisers, Facebook remarketing may be a very effective way to increase conversion rates. As it turns out, being exposed to remarketing ads can help raise conversion rates over time!

The overall conversion rate for Facebook ads across all industries is 9.21%.

Average Conversion Rate (CVR) for Facebook Ads by Industry

| Industry | Average CVR |

|---|---|

| Apparel | 4.11% |

| Auto | 5.11% |

| B2B | 10.63% |

| Beauty | 7.10% |

| Consumer Services | 9.96% |

| Education | 13.58% |

| Employment & Job Training | 11.73% |

| Finance & Insurance | 9.09% |

| Fitness | 14.29% |

| Home Improvement | 6.56% |

| Healthcare | 11.00% |

| Industrial Services | 0.71% |

| Legal | 5.60% |

| Real Estate | 10.68% |

| Retail | 3.26% |

| Technology | 2.31% |

| Travel & Hospitality | 2.82% |

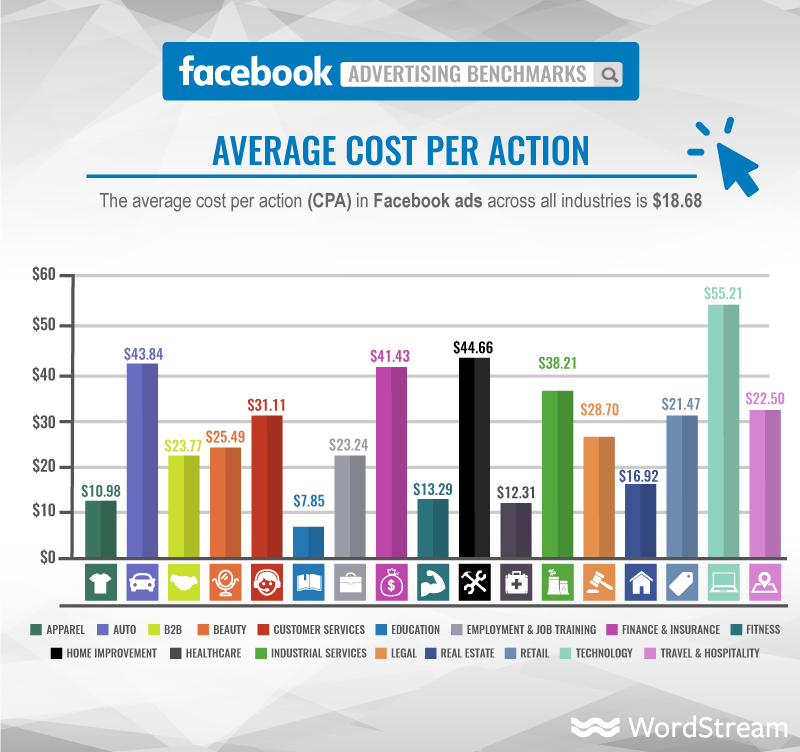

What is the Average Cost Per Action (CPA) on Facebook?

What constitutes a reasonable CPA on Facebook?

With an average CPA of $7.85, almost all education advertisers agree that targeting Facebook and Instagram’s relatively young audience is a wise decision. While Facebook may be a terrific location to find new students, it can be costly to find a new car, architect, or IT specialist — average Facebook CPAs for auto, home improvement, and technology services are $43.84, $44.66, and $55.21, respectively. Of course, the lifetime value of a new customer in these industries is extremely high, making it all worthwhile in the end.

The average cost per action (CPA) for Facebook ads across all industries is $18.68.

Average Cost Per Action (CPA) for Facebook Ads by Industry

| Industry | Average CPA |

|---|---|

| Apparel | $10.98 |

| Auto | $43.84 |

| B2B | $23.77 |

| Beauty | $25.49 |

| Consumer Services | $31.11 |

| Education | $7.85 |

| Employment & Job Training | $23.24 |

| Finance & Insurance | $41.43 |

| Fitness | $13.29 |

| Home Improvement | $44.66 |

| Healthcare | $12.31 |

| Industrial Services | $38.21 |

| Legal | $28.70 |

| Real Estate | $16.92 |

| Retail | $21.47 |

| Technology | $55.21 |

| Travel & Hospitality | $22.50 |

So, What Does This All Mean?

Facebook advertising is rapidly gaining popularity since it provides a plethora of options for advertisers in practically every industry.

If your results are on the low end of the spectrum, there is opportunity for improvement! To discover how to enhance your Facebook ads, go to PPC University or contact us today to talk with a Facebook expert. Don’t rest on your laurels if you’re meeting these standards! Strive to be a unicorn by producing the finest ad copy and landing page unicorns that convert better than anyone else!

You might also be interested in:

- 2021 search advertising benchmarks

- 2021 home services advertising benchmarks

- 2021 real estate advertising benchmarks

- 2021 healthcare advertising benchmarks

Take a look at the complete infographic below:

Are you looking for even more Facebook statistics? Check out our collection of 75 fascinating and useful Facebook data points.

Data Sources

This study is based on a sample of 256 US-based nexus-security client accounts in all industries (representing $553,000 in total Facebook spending) who advertised on Facebook between November 2016 and January 2017. Because Facebook campaigns can have a variety of goals, only campaigns aimed at driving conversions were included when calculating average CVR and CPA figures. To account for outliers, average data are median figures. USD is used for all monetary values.

Frequently Asked Questions (FAQ)

Q: Is there any information available on search advertising? A: Take a look at our 2022 Search Advertising Benchmarks.

Q: Is there any information available for non-profits? A: Interestingly, we didn’t come across many non-profit advertisers on Facebook (and we looked!). Because Facebook does not provide the same free advertising grants to non-profits and charities as Google does, we see far more non-profits on Google.

Q: Do you have any benchmarks for Facebook Lead Gen ads? A: All ad types, including Lead Gen advertisements, are included in the benchmarks above.

**Q: I’m a little perplexed by your conversion rate percentage. It appears to be far too high. What exactly do you mean by conversions? Was it a form that was filled out, and the Facebook pixel counted once the submission led the visitor to a thank you page, or was it as simple as a page view? **

A: Conversions are determined by the goals of the advertisers — for some, this could be a sale, supplying contact information, filling out a form, or making a phone call.

**Q: When you say “clicks,” are you referring to link clicks or all ad clicks? In my perspective, it’s critical to distinguish between CTR (All) and CTR (Link Click-Through Rate). To complicate matters further, Facebook metrics include Unique CTRs. The percentages could be vastly different. Of course, any marketer can learn about all of this through Facebook’s Help Center, but because your post provides averages, it should be obvious which metric you’re referring to. **

A: For clarity, we’re using the Clicks (All) statistic, which includes link clicks, other media interactions, app downloads, lead fills, and so on.

**Q: I was also curious about your definition of Actions. Is it the total number of actions taken by users as a result of the advertisements? The metric includes any action that was recorded and attributed to the ads, which includes engagement actions (such as post reactions and video views), link clicks, and conversions (such as website adds to cart or offline purchases). **

A: In this case, we’re using the action metric as defined by Facebook, which usually refers to conversions but also includes related interactions like lead submissions and app downloads.

Q: What countries/regions are included in this data? A: Only advertisers based in the United States are included in this data.

Q: In this context, how do you define a conversion and an action? A: Conversions are defined by the goals of the advertisers — for some, this could be a sale, providing contact information, filling out a form, or making a phone call.

**Q: I’m curious if this data includes both prospecting and retargeting advertisements. Obviously, we see significantly higher performance with retargeting, so these figures would be higher if you included both types of campaigns. ** A: This data set includes all ad targeting categories. Because we see similar excellent results with remarketing advertisements on Facebook, the majority of our clients utilize them more frequently than other types of targeting, therefore data may skew remarketing-heavy above, but it includes everything.

**Q: I was just curious what your definition of CPC is on Facebook. Are you referring to CPC (All) or CPC (Cost per Link Click)? ** A: We’re looking at CPC (all) in this case.

Q: Do you have any information on the average cost per impression or CPC for this year? A: Not as of yet.

Q: Thank you for your investigation! Have you conducted a similar analysis for LinkedIn and Bing? I’m excited to see those as well! Thank you once more! A: This information is available for Bing.

**Q: Do you know what the average product price was per industry for those rates? It would be quite beneficial in understanding how to use the data, for example, if a Technology product was based on the average price of a $1500 laptop and the CPA was $55.21, compared to, say, a $25 Phone charger with a CA of $55.21. ** A: We don’t, and that information isn’t available via the API, so it’d be tough to come by.

Q: I don’t see any mention of which attribution settings are utilized. Is it a 1-day view or a 28-day click? Or? Please tell me more! A: Yes, the data was collected using Facebook’s standard attribution window.

Q: Could you clarify how you define industries, or do you have a link to how they are defined? A: This was done manually because there were only a few hundred clients.

**Q: Excellent article! I’d like to know the formulas you used to come up with the figures in your charts so I can apply them to my own calculations. ** A: Click through rate= Clicks / Impressions Cost per click = Cost / Clicks Conversion rate = Conversions/ Clicks Cost per Acquisition = Cost/ Conversions

**Q: So you’re spending $200 per click to a website on Facebook (1% average CTR and $2 average cost per click)… And that’s before you factor in conversion rates. It’s a difficult situation out there. ** A: No — a $2 cost per click indicates that you would pay $2 to direct a visitor to your website.

**Q: Why is the conversion rate so much higher than the CTR? Is it all due to lead advertisements? 10% on average is… I’m at a loss for words. ** A: Facebook advertisements can be highly targeted, ensuring that you only reach the audiences and demographics that are most likely to convert on your website. Although CTR and CVR are frequently linked, it is acceptable to have an ad with a higher CVR than CTR.

**Q: Could you provide some more information about the brands/companies you examined to determine industry metrics? Are they well-known brands, startups, or large/mid-sized businesses? ** A: The businesses in this sample varied in size, although they were more likely to be small to medium-sized businesses than large, well-known brands.

**Q: Is the definition of Action the same in your Facebook and Google Benchmark studies? If that’s the case, should I assume that Facebook’s ROI is significantly higher than Google’s for the majority of industries when measured by CPA? Thank you. ** A: Yes! Many of our clients are successful on both platforms! 🙂

**Q: Have you conducted any Google Ads comparisons? ** A: Yes, indeed! Here it is.

**Q: Does this data reflect advertisements placed solely on Facebook (newsfeed, desktop right column, instant articles), or does it also include ads placed through Facebook on Instagram and the Audience Network? ** A: This data only pertains to Facebook and the Facebook app, and does not include Instagram or the Audience Network.