Smartphones are becoming the ultimate tech multi-tool, letting millions handle tons of their computing needs on the move, and mobile payments are the next big thing. Phones can already handle it, and the software is almost ready, so what’s taking so long?

Well, for mobile payments to really take off, tech companies need to deal with lots of technical and legal hurdles. Plus, they need other industries to catch up. Apple, Google, and Samsung are giants, but they can’t just force banks, credit card companies, and stores to do whatever they want.

Today, we’ll explore the future of mobile payments and the exciting chances for developers. Of course, with each new opportunity, developers face new challenges. But, we are talking about money, so I don’t think we’ll see a shortage of developers wanting to learn new skills and get involved.

Apple Pay vs. Android Pay vs. Samsung Pay

Let’s quickly compare the top mobile payments platforms.

By now, everyone knows Apple Pay, but it’s still the newbie. The initial rollout was limited to North America, so it’ll be a while before people worldwide can buy their coffee with an iPhone.

Samsung countered by announcing Samsung Pay at the Galaxy S6 launch. Like Apple Pay, it only works on Samsung devices, but it has some clever tricks. My favorite is Magnetic Secure Transmission (MST), acquired through LoopPay. This tech lets compatible Samsung phones act like they’re swiping a card, fooling older card readers. In theory, this lets you use Samsung Pay on those old-school card machines that were around long before mobile payments.

Android Pay is currently launching in North America. Since it isn’t tied to specific phone brands, it should work on most Android devices. You’ll need a phone running Android 4.4.x KitKat or later with Near Field Communication (NFC). Google says about 70 percent of compatible phones already have NFC. It took a while to catch on, even though Google first included it in the Nexus S back in late 2011. The latest Android, iOS, and Windows versions also support biometric security, which should help.

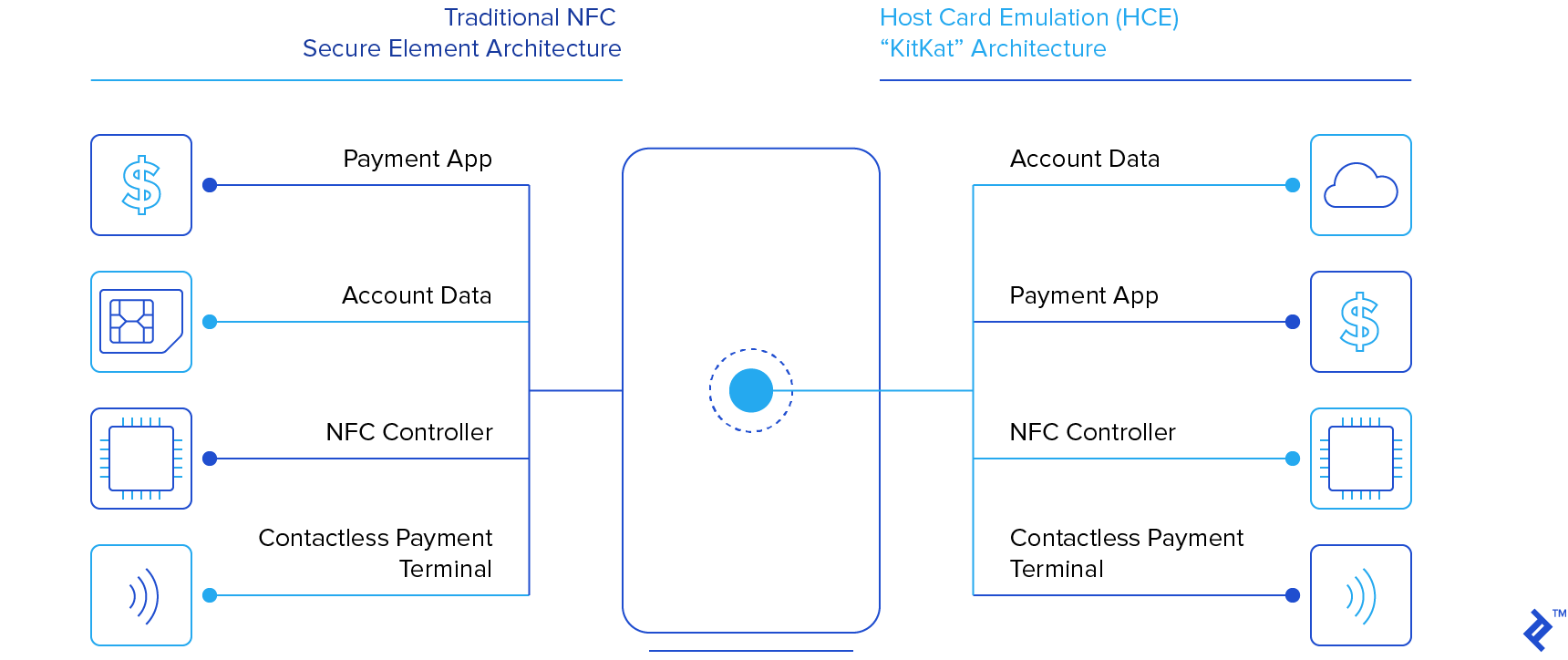

Apple Pay, Android Pay, and Samsung Pay are pretty similar: the idea is the same, they work similarly, and they all aim to be easy enough for almost anyone to use, meaning they have to be super reliable. They all use tokenization so your sensitive data isn’t directly transmitted. If you’ve used Google Wallet, you know it does not use tokenization. But Android Pay still borrows some things from Google Wallet. For example, they both use Host Card Emulation (HCE), while Apple Pay uses a Secure Element (SE) to protect your information. Both HCE and SE have pros and cons, which you can read about this quick comparison for more info.

Looking at features and market support, Android Pay, Apple Pay, and Samsung Pay each have their strengths. Apple Pay has a large, loyal user base with consistent hardware. Samsung’s advantage is MST. Android Pay will work on more devices overall, but it has to deal with lots of different hardware specs. You can see where I’m going with this: one mobile payments standard would likely mean faster adoption.

The Problem with Mobile Payments

So what are the main challenges? Security, privacy, consumer trust, time-to-market, and adoption rates.

People might get new phones every couple of years, but stores don’t replace their card machines that often. This means they’re stuck with old equipment for years. Banks, credit card companies, and payment processors need to push for upgrades. But there’s another problem: A store owner in a tech-savvy city might get enough customer demand for NFC to contact their credit card company and upgrade. To stay competitive, they’ll need the latest equipment. However, what about stores in places where mobile payments aren’t as popular? They won’t see the same demand, and the infrastructure might not be ready for years.

I think the biggest problem is the lack of a unified mobile payments strategy. It might be years before everything falls into place. As usual, developed countries will be ahead, while developing nations will lag behind.

Having three similar platforms from three tech giants is also a problem. It will slow down adoption, and depending on how hard it is to switch between them, some users might get stuck with one just because they don’t want the hassle of changing. Don’t be fooled, mobile payments will be very profitable for whoever controls the market. Google Wallet transactions supposedly didn’t make money, and Google lost money on each one. But imagine a billion people paying for everything with their phones, and you take a tiny cut of each transaction. That’s a lot of money! Analysts are divided, but most are optimistic about Apple Pay. It’s safe to assume competitors won’t let Apple have this potentially huge market, and I expect more players to emerge, especially in big markets like China and India.

Mobile payments will be fiercely competitive, which could be both good and bad.

Security and regulations are other issues. Companies will invest heavily in security, but cybercriminals will eventually find ways to exploit the system and steal from careless users. Let’s be real, mobile payments will never be totally secure, no matter what companies do. Someone will eventually find a way to scam people. However, overall, I don’t think it’ll be a major concern. Credit card fraud is still common, and people still get mugged. Criminals will simply adapt.

Besides, losing $100 to a mobile payment hack is still better than being robbed at knifepoint.

Regulations also need to catch up, which could take a while. Since we’re not lawyers, we won’t dive into that. Let’s let lawmakers and legal experts handle it. It usually works out, kind of.

The Mobile Payments Revolution Is Just Getting Started

What does the arrival of Samsung Pay, Apple Pay, and Android Pay mean for developers? It’s too early to say because these services are barely out yet.

Technically, Apple Pay exists, but it’s limited to certain areas. The list of Apple Pay partners is growing, but global adoption will likely be slow. Samsung recently announced that the Samsung Pay beta is live in the US, but you need a “special invite” to try it. Android Pay hasn’t launched yet, but leaks suggest a launch in the second half of September 2015.

Of course, there are other services besides Apple Pay, Samsung Pay, and Android Pay. We see new ones from established players like MasterCard and PayPal, and we see supporting services from startups like Square.

It might take a few months, or even a couple of years, for these three services to mature and become mainstream. But I believe developers need to start thinking about the implications of this mobile payments revolution.

Here’s what will drive mobile payment adoption:

- Convenience

- Once people try contactless payments, they’re hooked

- Speed will lead to new uses

- Reduced risk

- Widespread availability

Convenience is key. Why bother with cards when you can pay with your phone? Plus, you could integrate other cards, like store loyalty cards, into digital wallets. Who wants to carry a bulky wallet?

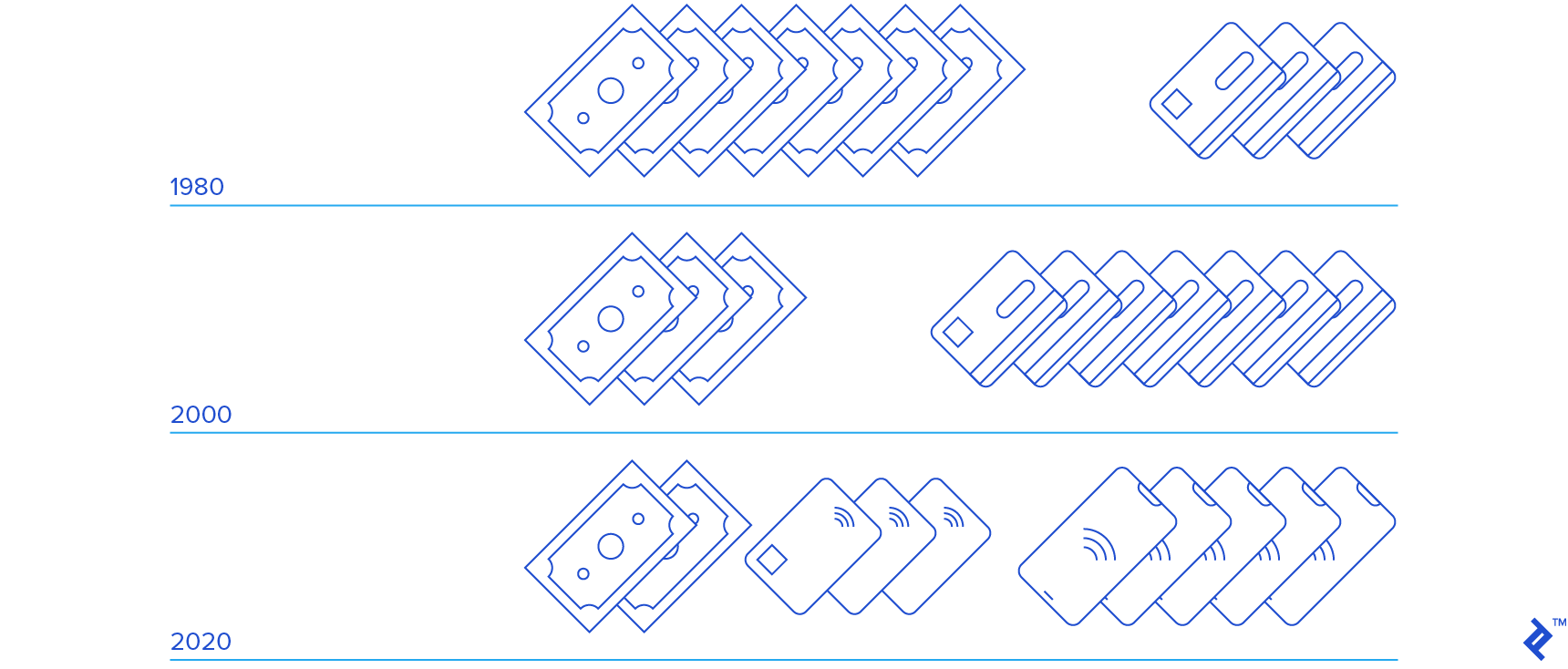

While contactless payments are new, people who use them tend to stick with them. In a recent interview with Fortune, MasterCard’s head of emerging payments, Ed McLaughlin, said that people who tap to pay more than two or three times “don’t go back” because it’s so quick and easy.

But this doesn’t mean mobile payments will simply replace cards. The convenience will likely create more situations where we use digital payments, potentially replacing cash in many cases.

This brings up another point unrelated to technology. If you lose your phone with all your digital cards, just disable the security tokens, and they’re useless. No need to replace physical cards. Tokenized mobile payments also reduce the need for retailers to heavily protect data, lowering costs and reputational damage from breaches (think Ashley Madison).

There’s more. Less cash in wallets and registers means less crime. Why steal a wallet with just some change, an ID, and a gym card? Why rob a store if there’s hardly any cash? Sure, someone could hack into the system and steal your money digitally, but that’s a much bigger challenge for the average criminal.

Widespread availability will be tricky. It might be slow, especially in developing markets, but once the infrastructure is there, we’ll see rapid growth. Deloitte predicts that 2015 will be a turning point for the industry.

In a report, they stated:

Deloitte expects that 2015 will be an inflection point for the usage of mobile phones for NFC-enabled in-store payment, as it will be the first year in which the multiple prerequisites for mainstream adoption – satisfying financial institutions, merchants, consumers, technology vendors and carriers – are sufficiently addressed.

Mobile Payments for Developers

What do Apple Pay, Android Pay, Samsung Pay, and other platforms mean for the average developer?

Mobile payments will become part of our lives in several ways:

- Integrated into existing apps and services

- Evolution of “click-and-mortar” businesses

- New services built on top of mobile payments platforms

- Totally new uses for mobile payments

The first point is the most obvious and will likely have the biggest impact on software development. I won’t discuss the technical details of integrating mobile payments; it’s well-documented. Just search online for the official Android API tutorial. Google provides info on user flows, diagrams, integration overviews, UI guidelines, and best practices. Apple also has a number of resources covering Apple Pay with the Apple Pay Programming Guide, app review guidelines, identity guidelines, iOS UI guidelines, and more.

The question is, how many businesses will integrate mobile payments into their apps in the next few years? The process should be straightforward thanks to industry leaders, so I don’t think there will be major technical roadblocks. Get the APIs, follow the guidelines, and you’re good to go; it’s like adding any other payment option.

This integration will cover online and offline retail, and sometimes in-app payments. The hope is that seamless, one-tap payments will boost sales, at least that’s what tech companies are promising businesses.

But unlike online shopping, which already has many digital payment options, traditional retail stands to gain more. We already use PayPal online, but what about local stores, furniture shops, gas stations, etc.?

The trend of blending physical and online retail is called “click-and-mortar.” It covers things like buying online and picking up in-store, comparing prices on your phone while in a store, or browsing in a mall before buying online. Sure, we buy books, gadgets, and electronics online, but what about shoes, clothes, or office chairs? Most people want to try those first. This usually means cash or card, but mobile payments make it a digital transaction.

We’ve seen how mobile payments will change existing businesses, but what about new uses? What about completely new services built around mobile payments on our phones and wearables? This is likely the next big thing: a space for innovation and a new generation of amazing apps using this new infrastructure. It’s still early to say what could be built on top of Apple Pay, Android Pay, etc. Besides, if I had any good ideas, I’d be busy making them a reality, not writing about them.

Who Will Win the Mobile Payments Race?

Everyone.

They all want a piece of the pie, but it’s a huge pie, and there’s enough to go around. Apple Pay, Android Pay, Samsung Pay, and others should easily gain market share and make money (unlike Google Wallet).

This is good news for everyone, from consumers who want a safer and faster way to pay to tech and financial giants who will profit.

The software industry will need to cater to all needs and support all successful platforms in each region. For example, an app for North America should integrate all the popular platforms. But an app targeting China might need to include local options (like those from Xiaomi, Huawei, Meizu, and Alibaba’s Alipay).

I doubt anyone, even Google or Apple, could dominate this market. There’s too much at stake, so entrepreneurs and governments will push for region-specific solutions. Why should Apple profit from transactions in China? Why should Brazilians give Google a cut of their payments? Politicians and regulators will have to figure this out, but it could affect adoption and lead to fragmentation.

The takeaway is clear: Start exploring mobile payments and prepare to integrate them. Progress is slow, but research suggests significant growth ahead, meaning developers need to get on board. Stay informed, read the official documentation, and be ready to integrate mobile payments; it’s that simple.