This blog often covers advertising metrics like click-through rate (CTR), conversion rate (CVR), and return on investment (ROI) to help you analyze your online campaigns. This post will focus on two business-level metrics: customer acquisition cost (CAC) and customer lifetime value (CLV). These metrics are crucial for understanding business performance, and we’ll delve into their significance, differences, relationship, and calculation methods.

Defining Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) refers to the expenses incurred in converting a prospect into a paying customer. While it might sound similar to cost per action or acquisition (CPA), CAC operates on a broader business level. It encompasses all marketing expenses, including online and offline campaigns, traditional advertising, and even the cost of a physical storefront sign.

Note that CPA differs from cost per conversion, especially for lead generation businesses where actions like downloads or registrations don’t always translate to sales. For e-commerce, CPA might reflect the cost of getting a prospect to purchase from your online store.

Calculating Customer Acquisition Cost

To calculate CAC, divide your total marketing expenses by the number of new customers acquired within a specific period. It’s advisable to calculate CAC for each channel to understand their individual effectiveness. For instance, separating SEO and content marketing costs from paid advertising provides a clearer picture of their long-term impact on customer acquisition.

SEO and content marketing usually take time to yield results. While your initial CAC for these channels might seem high, it tends to decrease as your website gains authority and content continues to attract traffic and conversions over time.

Blogging, for instance, can significantly lower your overall CAC over time.

Regularly optimizing your paid advertising campaigns can also lower your CAC. Tracking channel-specific CAC helps identify areas for improvement and optimize your marketing budget allocation.

Is There a Universal Customer Acquisition Cost Formula?

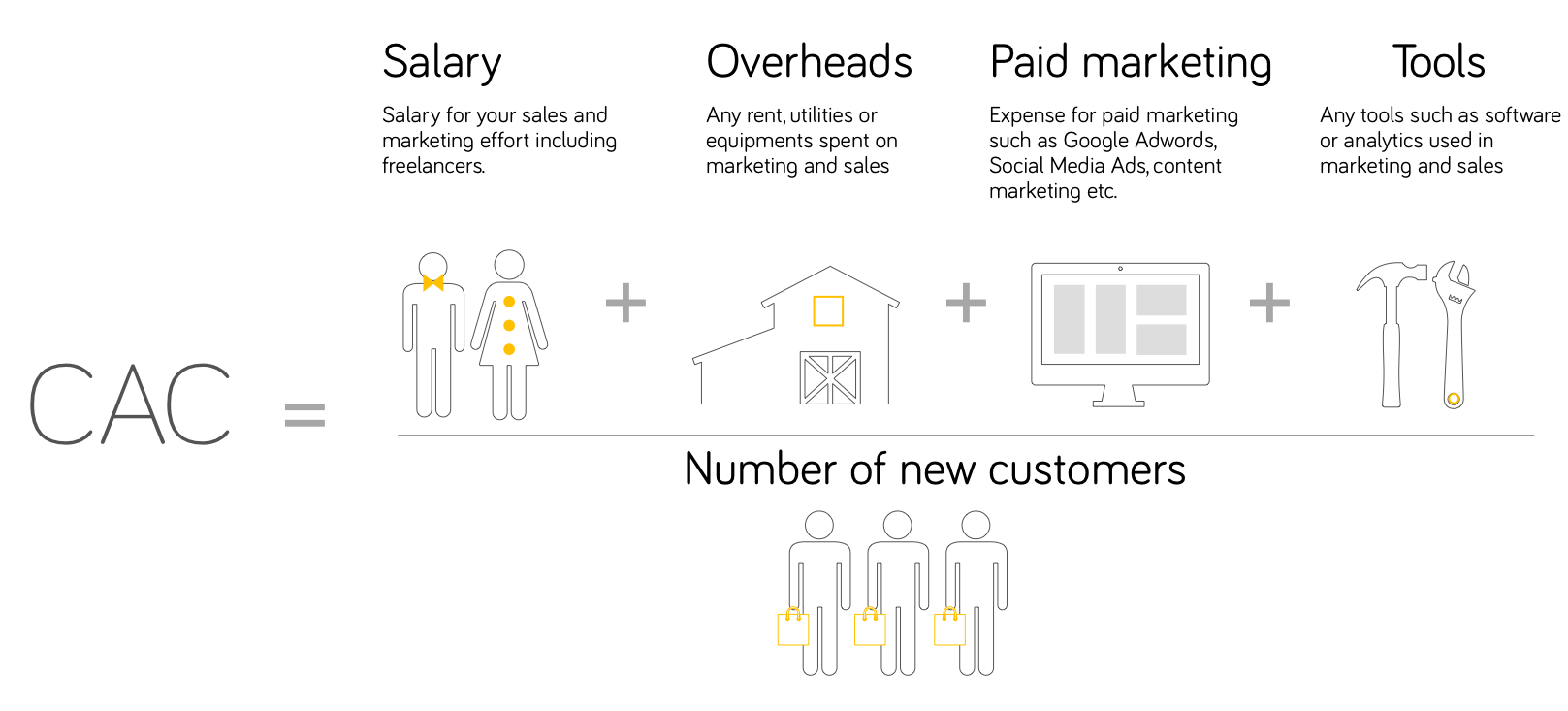

While a simplified CAC calculation is useful, presenting a comprehensive figure to stakeholders often requires considering all marketing costs, including team salaries, overhead, tools, and other operational expenses.

Therefore, a universally applicable CAC formula doesn’t exist. The calculation is adaptable and depends on the specific aspects you’re evaluating. Factors like sales team expenses, marketing tools, rent allocation, and online store maintenance all contribute to the overall cost of customer acquisition.

Understanding Customer Lifetime Value (CLV)

CAC alone doesn’t reveal the complete picture. Customer lifetime value (CLV) complements CAC by considering the long-term profit generated by each customer. It factors in customer retention, cross-selling, and upselling strategies.

Subscription-based businesses aim for prolonged subscriptions, while businesses with diverse offerings focus on cross-selling. Upselling encourages customers to upgrade to premium products or services. All these contribute to calculating the average CLV. Notably, CAC is an integral part of the CLV equation.

The Relationship Between CAC and CLV

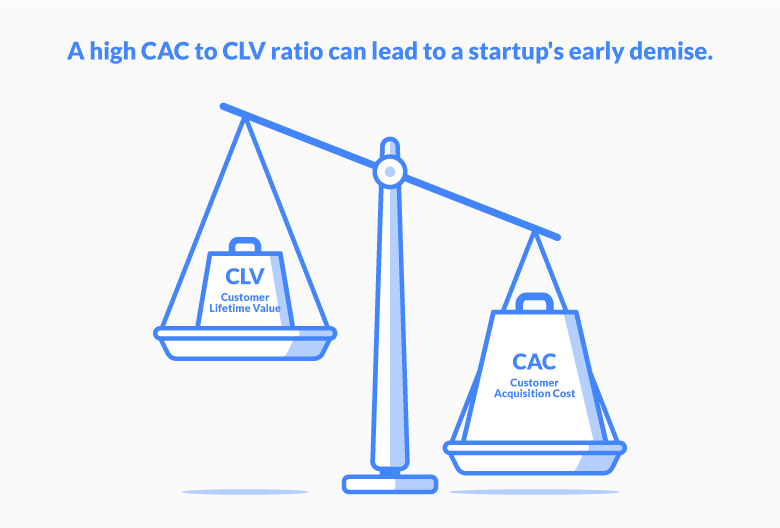

Ideally, you want your CLV to be significantly higher than your CAC. While a large difference is desirable, it’s more practical to establish a baseline and work towards widening the gap over time. A shrinking gap between CLV and CAC can impact your business’s financial stability.

A simplified CLV calculation involves multiplying the annual revenue per customer by the average customer relationship duration (in years) and then subtracting the initial CAC. Remember, this formula emphasizes profit (earnings) over revenue (total sales).

Similar to CAC, CLV can be segmented based on customer behavior, product variations, or other relevant factors. This granular approach allows for a deeper understanding of customer value distribution across your product or service portfolio.

CLV and CAC: Determining Importance

Both metrics are crucial for business analysis. CLV provides insights into profitability, while CAC is essential for understanding the cost of acquiring each customer.

Leveraging these metrics together offers a comprehensive view of business performance, pinpointing areas for improvement and optimization. Don’t hesitate to break down these metrics further to analyze specific aspects of your business and gain valuable insights.