In the mobile internet age, online shopping has surged due to its convenience. Product comparisons are simpler, leading consumers towards online marketplaces that bridge the gap between sellers and buyers.

This benefits eCommerce businesses by simplifying customer acquisition. Customers benefit from easily finding reputable online retailers and service providers, minimizing the chances of encountering scams.

Marketplace Business Model

Two primary business models define this new era of centralized sales.

Marketplaces can function as brokers, receiving commissions for facilitating transactions, or as sellers, adding their markup to vendor prices.

Marketplace Types

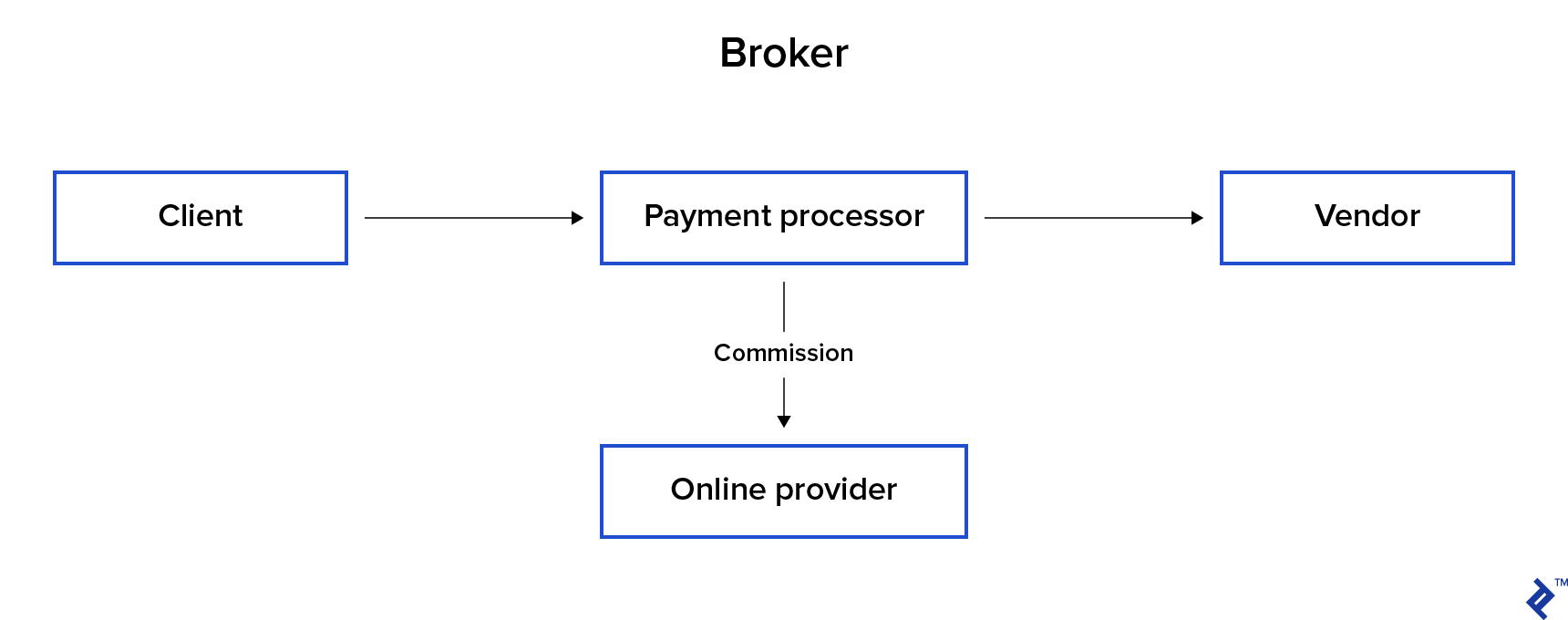

Broker

Broker marketplaces act as marketing platforms, connecting buyers and sellers for a commission on each sale. Payments are either handled directly between parties or through a third-party payment processor.

Direct payment processing by the marketplace might require a specific financial license depending on the country. This often necessitates a third-party payment processor for transactions.

Since the marketplace acts solely as a platform, liability for defective products falls on the seller.

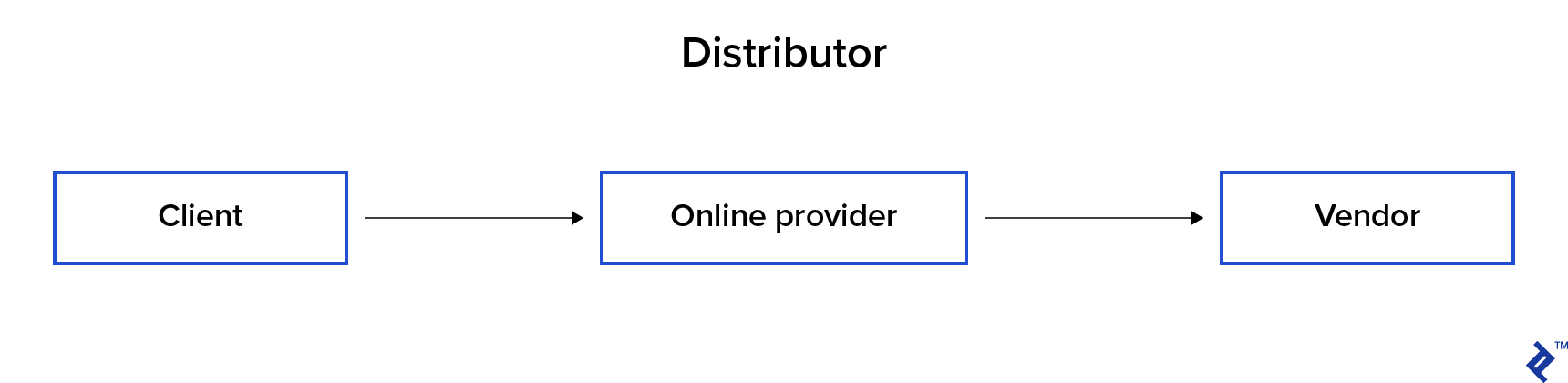

Distributor

Distributor marketplaces purchase goods or services from vendors and sell them to customers at a markup.

This traditional model simplifies payment processing, allowing the platform to manage it directly. Purchases from vendors are deducted from marketplace income, with sales considered revenue. Theoretically, this model yields higher revenue due to direct financial control.

However, online marketplaces operating as distributors assume full responsibility for any defective products.

Most Popular Payment Methods

Payment methods and providers vary across countries. Let’s explore common options based on the marketplace business model.

Overview of Payment Processors

Common payment processors in the broker model:

| Global | USA | EU | UK |

|---|---|---|---|

| Hyperwallet | Dwolla | PayU | Paybase |

| Braintree | WePay | MANGOPAY | Nochex |

| PayPal for Marketplaces | Stripe Connect | Adyen | SafeCharge |

Common pay-in methods in the distributor model:

| Global | USA | EU | UK |

|---|---|---|---|

| Cards | Cards | Cards | Cards |

| Wires | ACH | Wires | Wires |

| Checks | |||

| Wires |

Common payout methods in the distributor model:

| Global | USA | EU | UK |

|---|---|---|---|

| Wires | ACH credit | Wires | Wires |

| TransferWise | Checks | ||

| PayPal | Wires |

Global

Catering to a global audience presents challenges. Diverse currencies, regulations, cultures, languages, and preferred payment methods create complexities.

Some providers offer solutions to bridge these gaps.

Broker

Hyperwallet

Popular among established eCommerce businesses, Hyperwallet offers enterprise-level payout solutions.

Braintree Marketplace

Braintree presents a comprehensive payment solution for marketplace businesses. Catering to major markets, it enables marketplaces targeting North America, Europe, and Oceania.

PayPal for Marketplaces

Widely recognized, PayPal requires little introduction. Built on its association with eBay, it offers near-universal support, easy API implementation, and quick account setup.

Distributor

Pay-in Methods

Wires

SWIFT network bank wires provide global reliability, albeit often at a higher cost.

TransferWise

TransferWise facilitates borderless transactions, enabling local payments and currency conversions across numerous countries with minimal fees.

Stripe

Operating in major countries, Stripe processes debit and credit card payments. It also handles ACH debit transactions within the US, allowing quick account setup and application development.

Payout Methods

Wires

International SWIFT wires offer a widely accessible and straightforward payout option, with cost being the deciding factor.

TransferWise

TransferWise enables cost-effective payouts to various countries using different currencies.

PayPal

Despite its global popularity, PayPal might prove costly over time due to transaction fees.

USA

Broker

Dwolla

Dwolla streamlines ACH payments using bank accounts. Its developer-friendly approach offers versatile implementation options.

WePay

Backed by Chase bank, WePay is ideal for broker marketplaces operating within the US.

Stripe Connect

Tailored for US broker marketplaces, Stripe Connect provides a developer-friendly solution aligned with local market needs.

Distributor

Pay-in Methods

Wires, ACH Credit, Checks

Bank-to-bank solutions like paper checks, ACH credit, and wire payments offer straightforward options, despite potential processing time and costs.

Authorize.Net

Backed by Visa, Authorize.Net processes credit and debit cards alongside ACH debit (eCheck) payments.

Square

Offering comprehensive solutions for online and physical sellers, Square provides a robust API but focuses on debit and credit card payments.

Payout Methods

ACH Credit Transfers

ACH credit transfers through banks within the Nacha network offer a cost-effective solution for large-scale payouts, with a $25,000 transaction limit.

Chase bank provides this through its additional option service.

Wells Fargo offers it as Direct Pay.

Airbnb Co-founder Nathan Blecharczyk previously highlighted this system in his Do-it-yourself ACH direct deposit article.

Wires

Despite its simplicity, using wires for electronic transfers can be expensive due to high sending and receiving fees imposed by US banks, making it suitable only for substantial sums.

Checks

While simple, using checks for money transfers in the US is slower and less efficient compared to other methods.

European Union

Broker

PayU

Trusted by major European eCommerce platforms, PayU offers reliable marketplace payment processing.

MANGOPAY

Available across all EU nations, MANGOPAY effectively caters to the demands of EU-wide marketplace platforms.

Adyen

Supporting all EU countries and utilizing local payment methods, Adyen provides an advantageous payment processing solution.

Distributor

Pay-in Methods

Wires

Widely used in the Eurozone and beyond, wires are popular due to being generally free and fast, often providing same-day transfers. Euro payments are sent via the SEPA network network.

PAYMILL

PAYMILL specializes in online card payments, with a primary focus on euro transactions.

PayLane

Catering specifically to the Polish market, PayLane provides access to online card payments and a gateway for bank-to-bank transactions.

Payout methods

Wires

SEPA wire transfers offer a fast and often free solution for payouts within the European Union, facilitating same-day international transfers.

UK

Broker

Paybase

London-based Paybase offers eMoney accounts with unique sort codes and account numbers for marketplace platforms.

Nochex

Nochex provides tailored enterprise-grade marketplace solutions for UK businesses.

SafeCharge

SafeCharge offers payment solutions for UK marketplaces, complete with comprehensive API documentation for developers.

Distributor

Pay-in Methods

Wires

Bank transfers within the UK are free, fast, accessible, and user-friendly, making them the most convenient option for accepting large payments in a distributor model.

Sage Pay

UK-focused Sage Pay supports online and physical merchants but lacks publicly available developer documentation.

Worldpay

Worldpay offers online card payment processing tailored for the UK market, accompanied by accessible developer guides.

Payout Methods

Wires

Free, fast, and readily available, wire transfers are the go-to solution for payouts within the UK.

Potential Risks

Due diligence is crucial when selecting a payment processor, as even established providers can have drawbacks.

For instance, despite its popularity, PayPal has been criticized for abruptly blocking accounts and freezing money stored there for up to six months.

While Stripe boasts advanced technology and a developer-friendly approach, it has also faced criticism for unexpected account closures and without any warning.

Maintaining a flexible payment implementation is recommended to facilitate switching providers if necessary.

Card payments carry the inherent risk of chargeback procedure. Disputes arising from unrecognized transactions or dissatisfaction with products or services can lead to chargebacks. If financial institutions side with the customer, funds are withdrawn from the seller’s account.

Similarly, ACH payments are vulnerable to chargebacks for unauthorized transactions or discrepancies in the debited amount. More information can be found here.

Wire transfers, being less susceptible to chargebacks, offer a potentially safer option for large payments.

Local Is Often Better

Collaborating with local payment processors can be advantageous. They often provide better support, communication, and trust compared to foreign entities.

Furthermore, pursuing legal action against a local company is often simpler than dealing with international organizations if issues arise.

Alternative Crypto Method - USD Coin

While gaining traction, cryptocurrencies aren’t mainstream for online payments. Price fluctuations and volatility make most cryptocurrencies unsuitable for daily transactions.

However, stablecoins offer potential. For example, USD Coin (USDC), an Ethereum-based coin pegged 1:1 to the USD, enables swift, inexpensive global transfers, surpassing slow and costly traditional methods.

Integrating USDC payments is simplified using platforms like Coinbase Commerce.

However, cryptocurrencies face stigma due to their association with illicit activities, potentially inviting scrutiny when converting large amounts to fiat currency. Traditional US banks are known to close bank accounts of people who use cryptocurrencies.

As of now, the standard Ethereum transaction fee hovers around $0.007, with settlements within five minutes, according to the now-defunct ETH Gas Station app. While seemingly attractive for microtransactions, price and processing time variations introduce risk. Additionally, acquiring cryptocurrency can be costly and challenging in certain regions.

Therefore, the widespread adoption of alternative cryptocurrency payment methods might still be premature.

Simple Marketplace Payment Implementation

Let’s build a simple eCommerce marketplace demonstrating these concepts. Using the distributor model and tailored for the US market (adaptable to other countries), it accepts:

- ACH credit transfers

- Wire transfers

- Credit and debit card payments via Stripe

Stripe’s wide availability, excellent developer resources, and quick setup make it accessible for various users.

Payouts are handled through ACH payments facilitated by banks or TransferWise.

The marketplace implementation is publicly accessible available on GitHub.

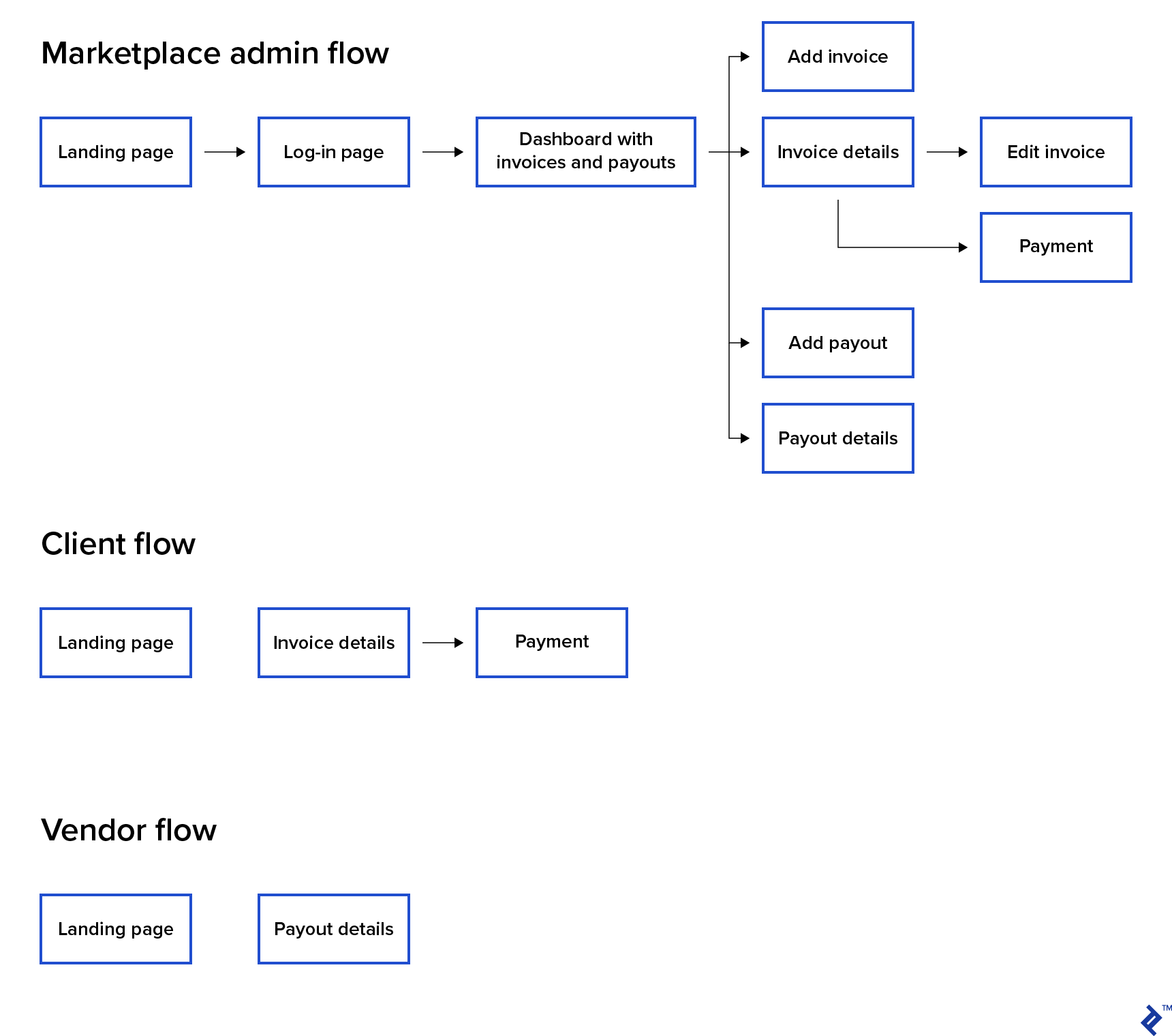

Marketplace Design

The marketplace includes admin users who can generate invoices, manage payouts, and access a dashboard summarizing transactions.

Guest users can view the landing page, view and pay invoices, and see payouts.

Upon setup, users create an administrator account, configure Stripe API keys, and provide bank details for ACH credit and wire transactions.

Transactions can then be initiated.

The administrator creates invoices and payout requests through the dashboard, with notifications sent to designated email addresses. Alternatively, invoice or payout URLs can be shared directly.

Customers pay invoices securely using debit or credit cards, utilizing 3D secure technology to mitigate chargeback risks from stolen cards.

This adaptable marketplace design suits various businesses, including:

- Accounting, marketing, construction, and cleaning services

- B2B operations

- Car and house rentals

- Wholesale businesses

Despite its simplicity, it can significantly benefit small business owners.

Marketplace Walkthrough

Dashboard

The main page displays a transaction list and a financial summary table. Users can add, edit, and manage invoices and payouts.

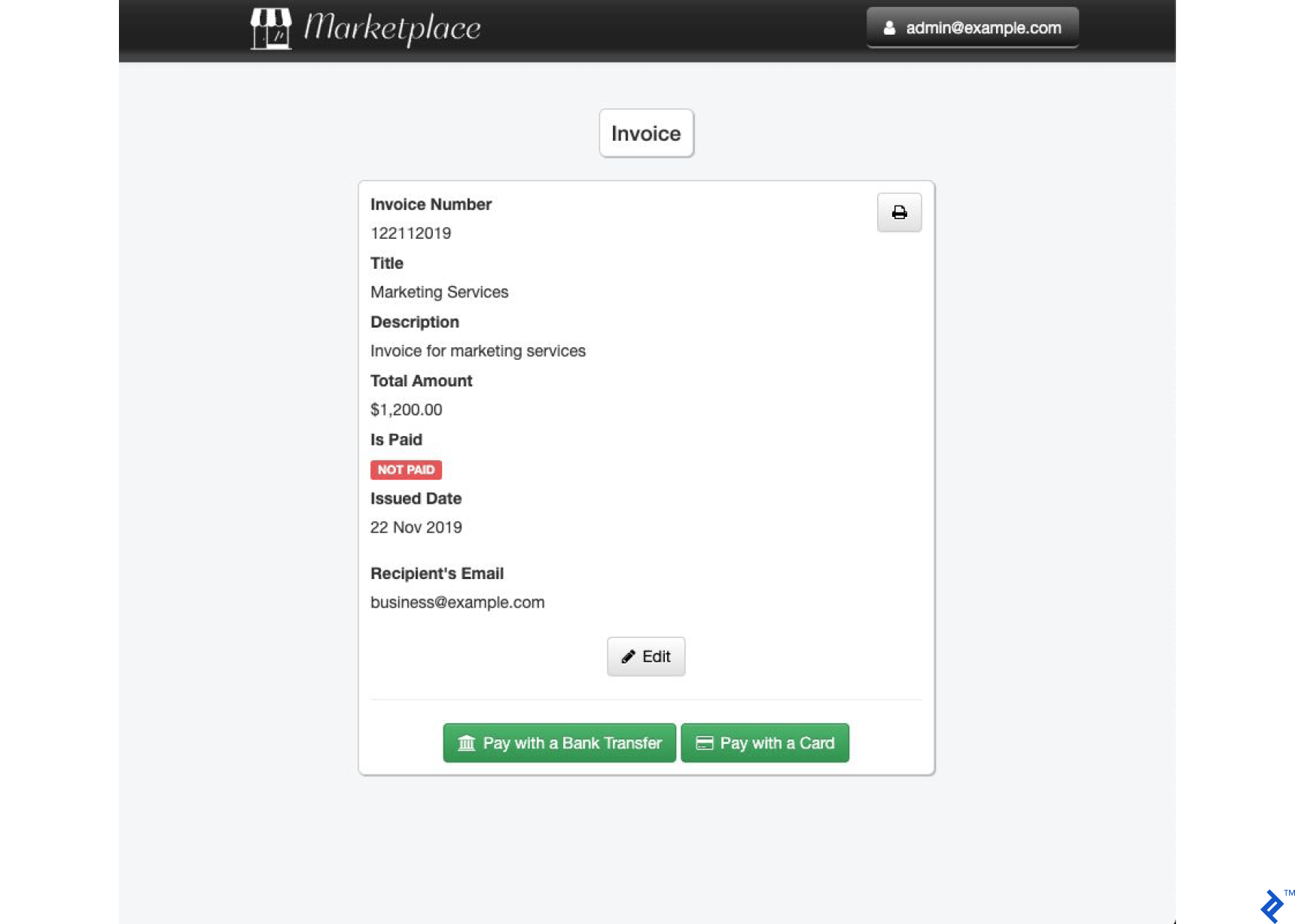

Unpaid Invoice

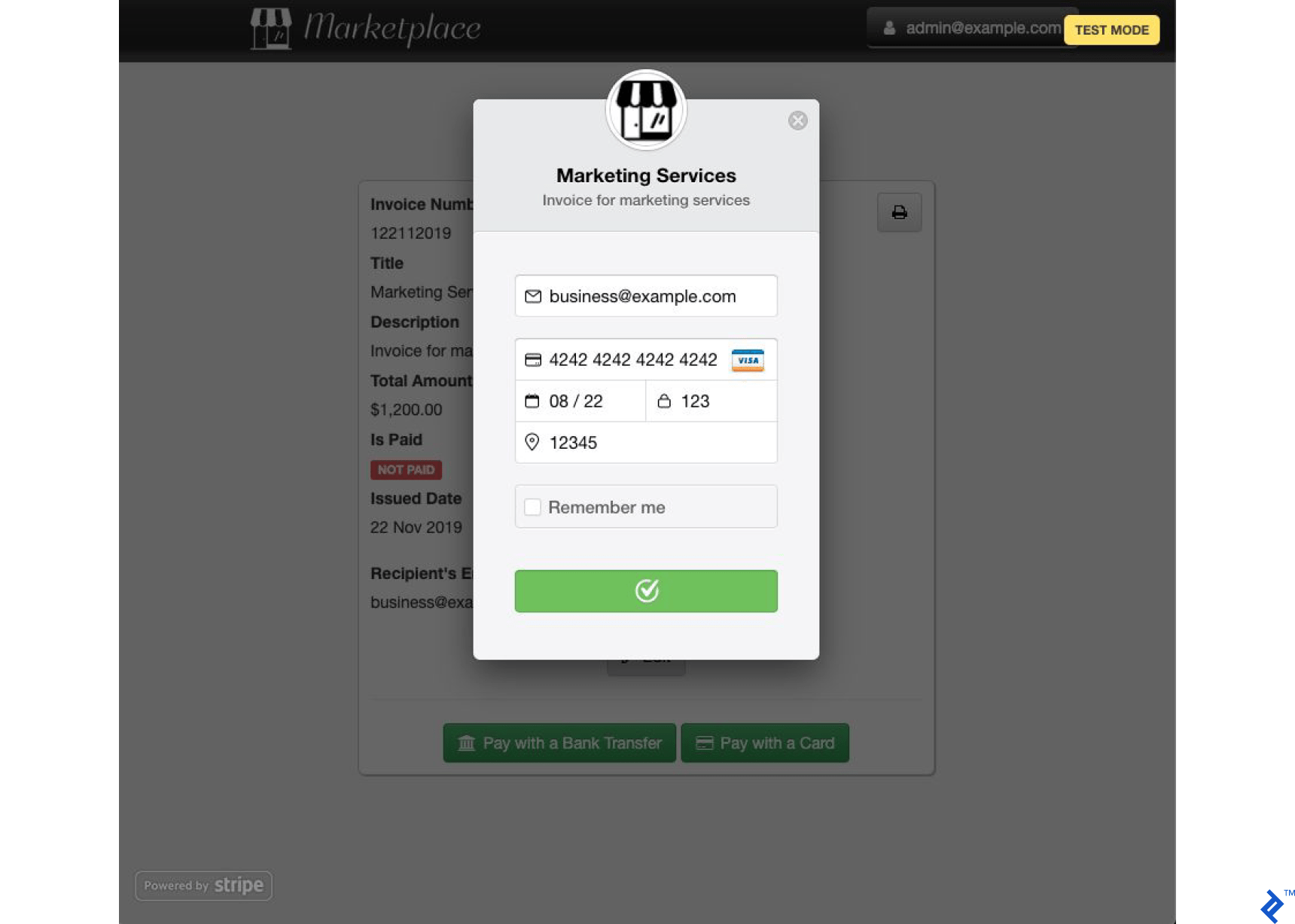

Upon creating an invoice, clients can choose between card payments or bank transfers.

Card Payment

Choosing card payments prompts a dialog for entering payment details and confirming the transaction.

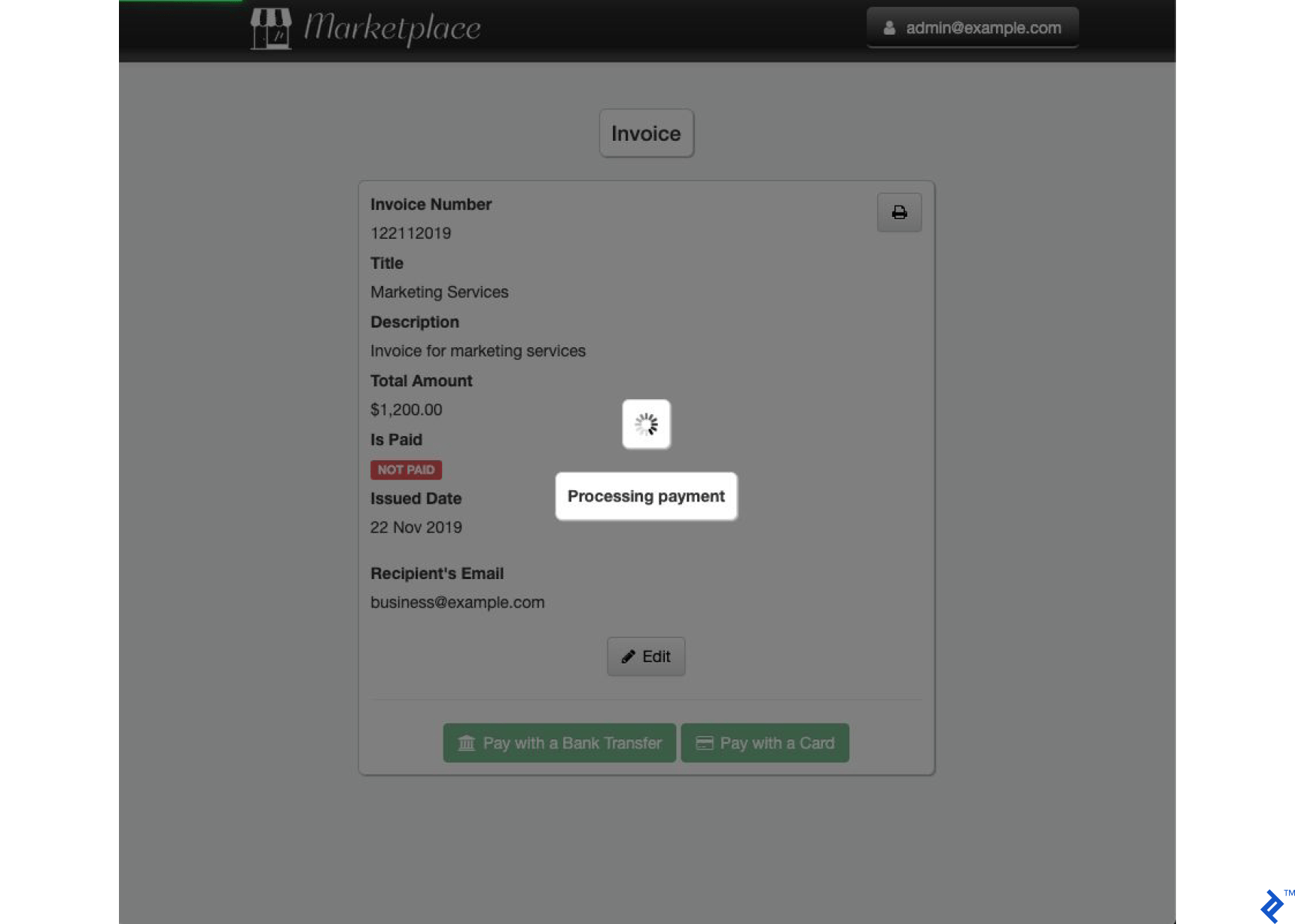

Processing Card Payments

A spinner loader appears during payment processing, indicating that the transaction is underway.

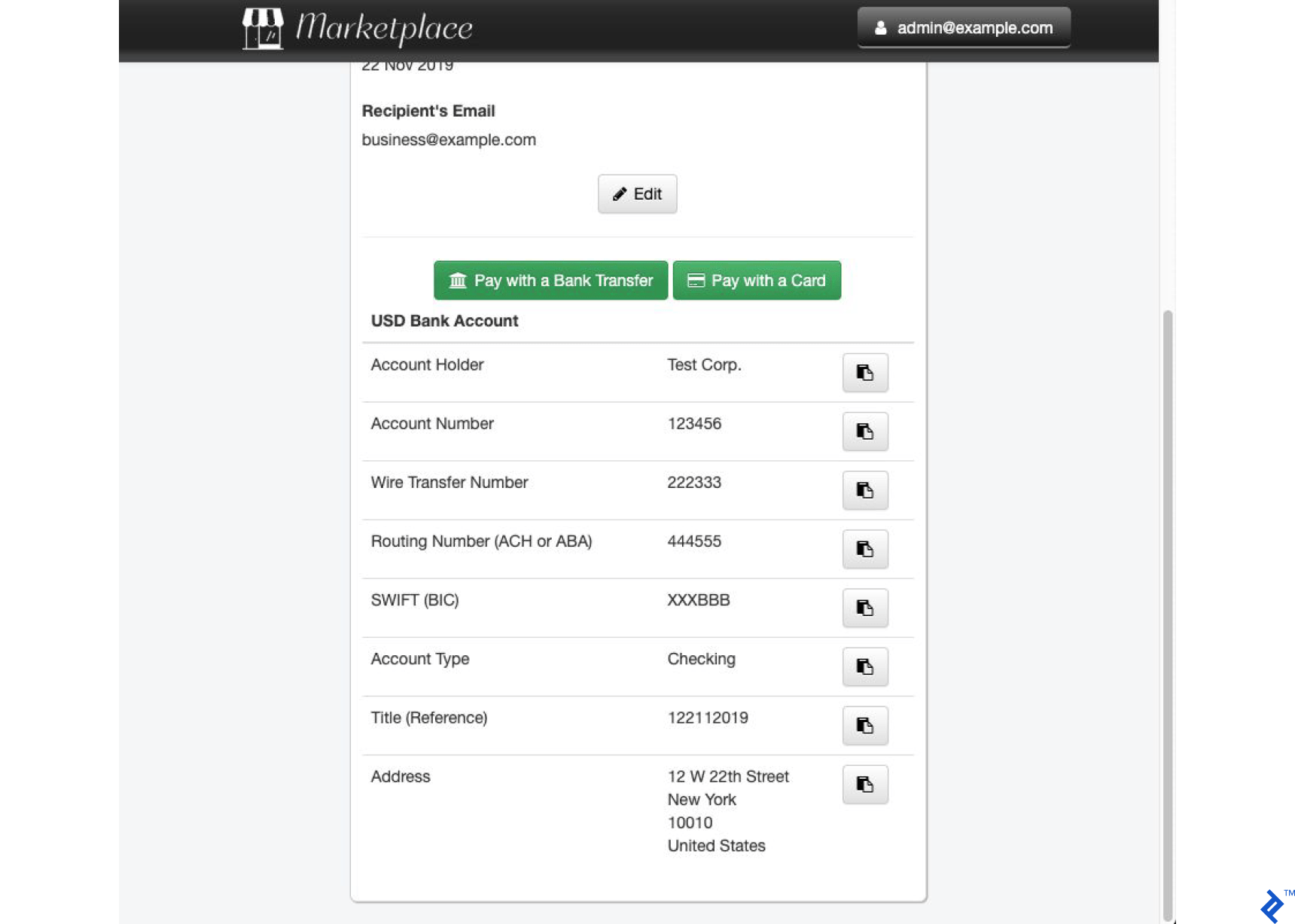

Payment via Bank Transfer

Selecting bank transfers requires bank account details for ACH or wire transfers, conveniently copied using provided buttons.

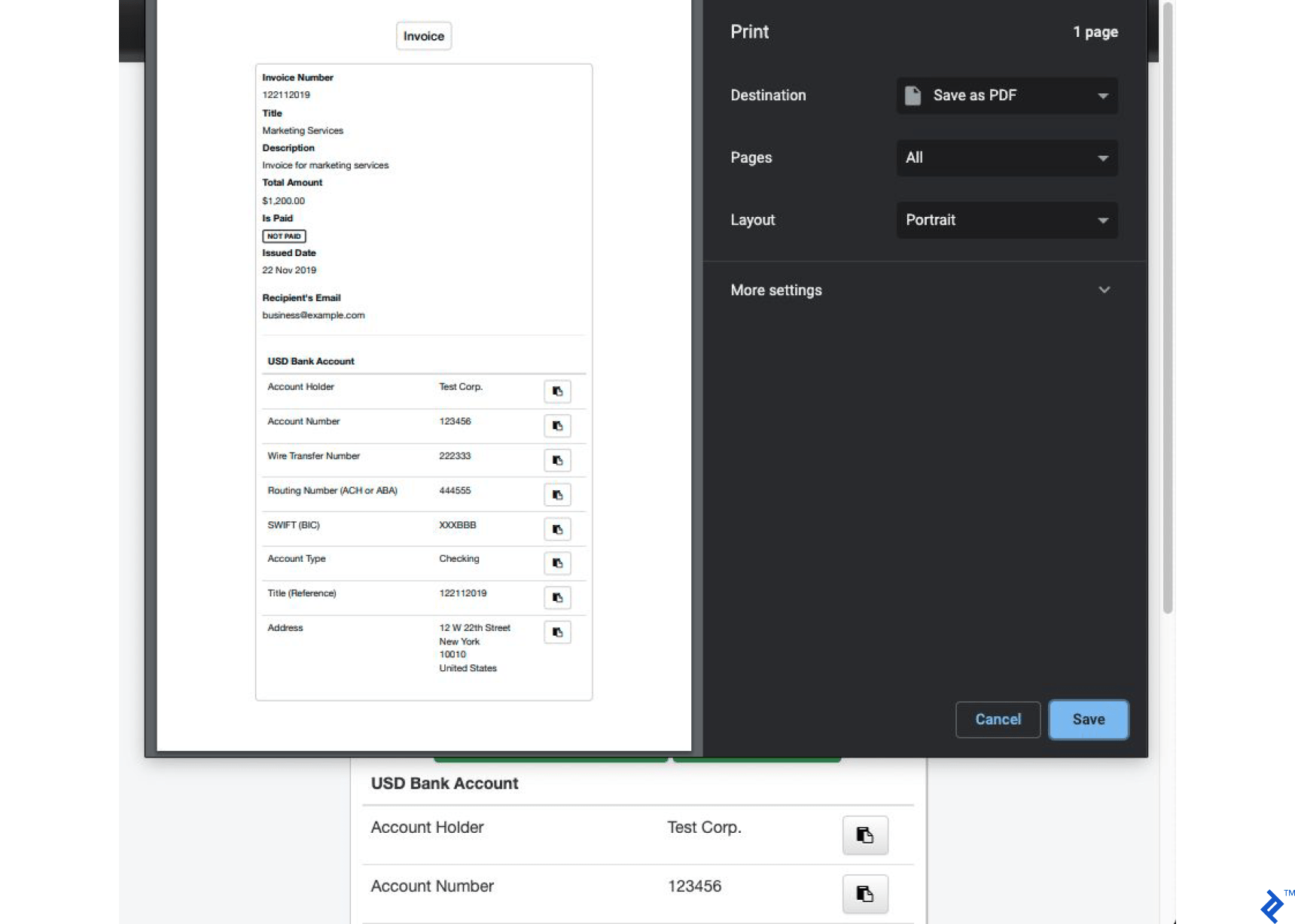

Invoice Printout

Invoices can be printed for accounting or manual bank transfers.

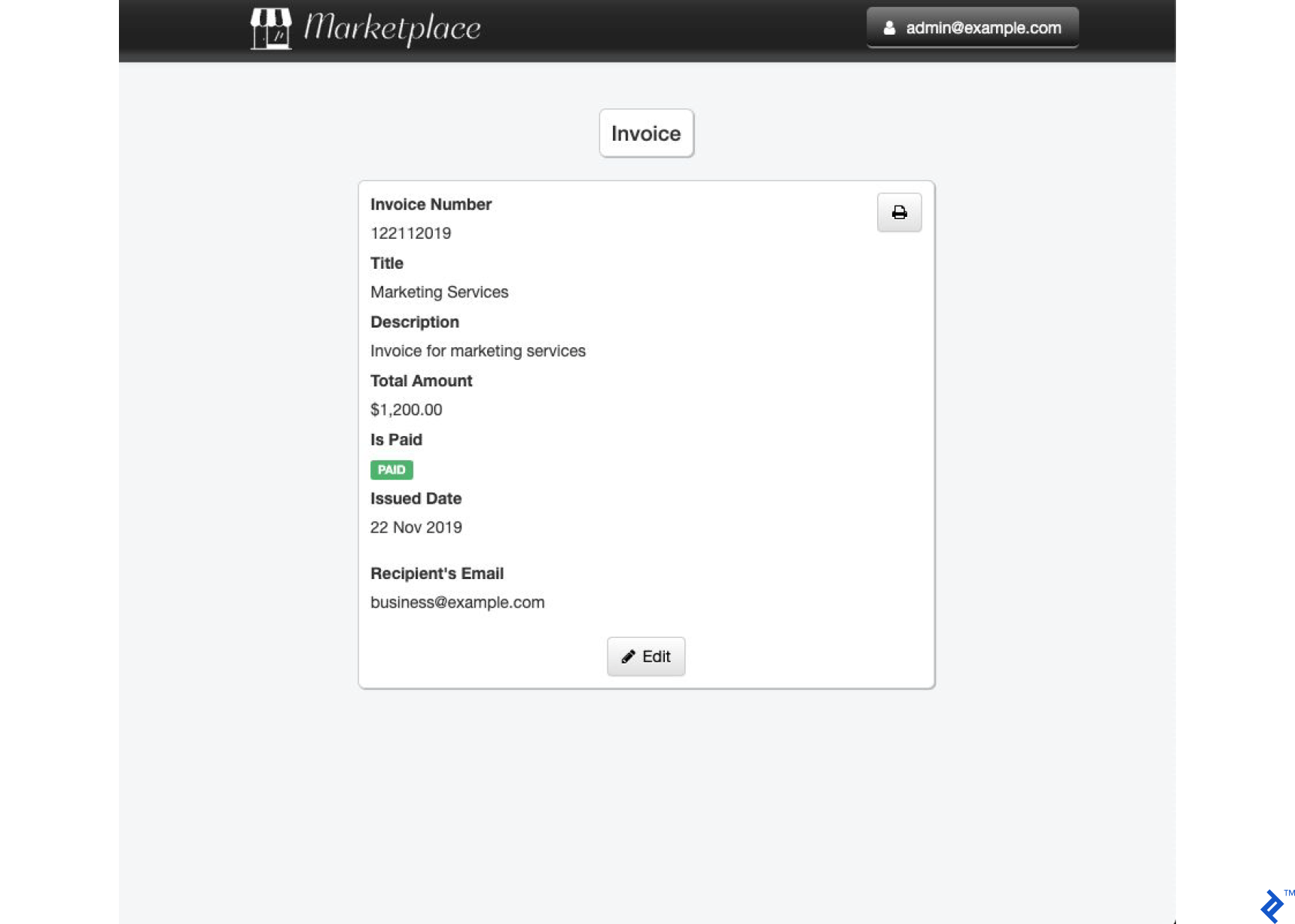

Paid Invoice

Paid invoices display a clear green status label, with payment options removed to prevent duplicates.

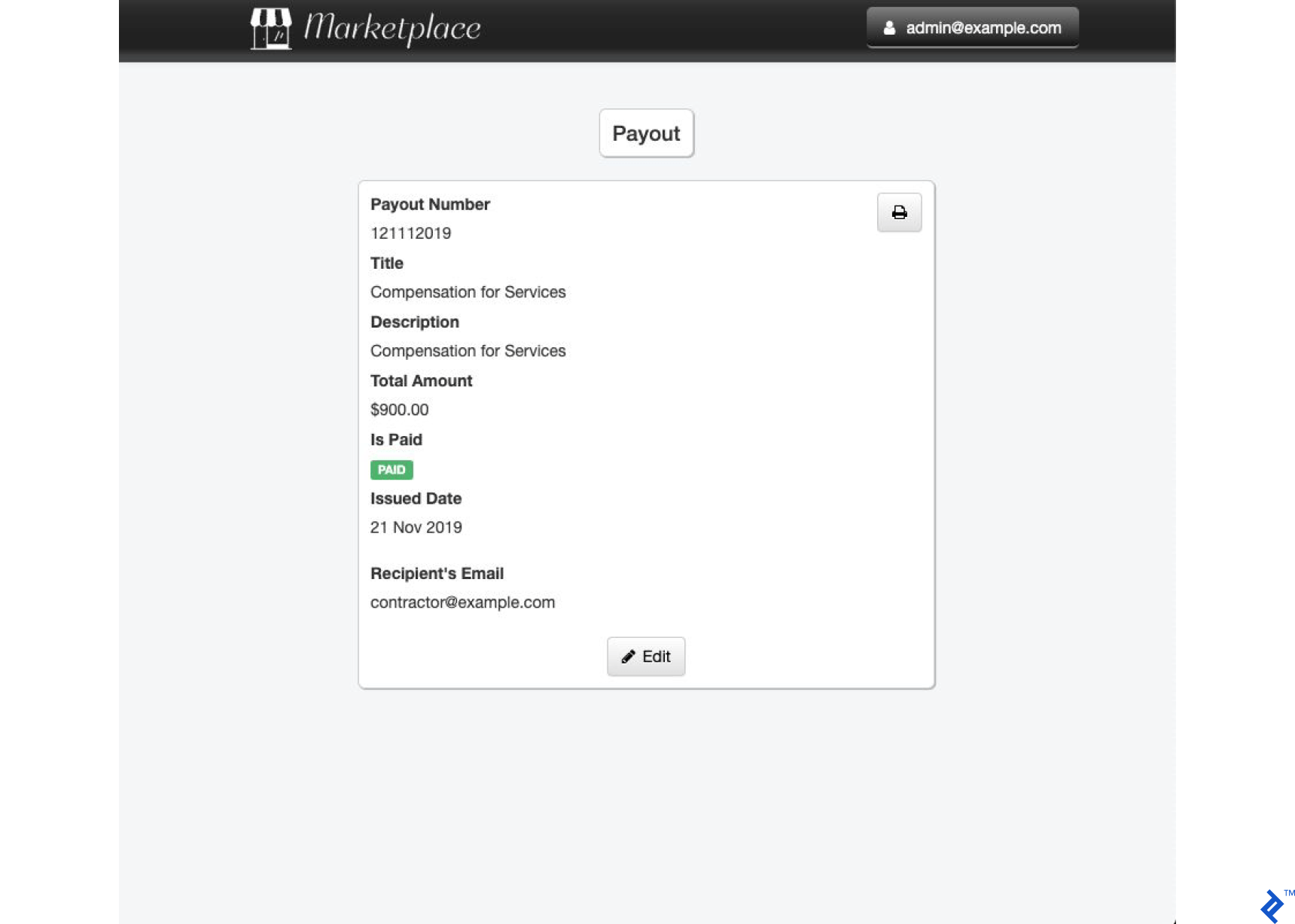

Paid Payout

Similar to invoices, paid payouts feature a status indicator and visible transaction data.

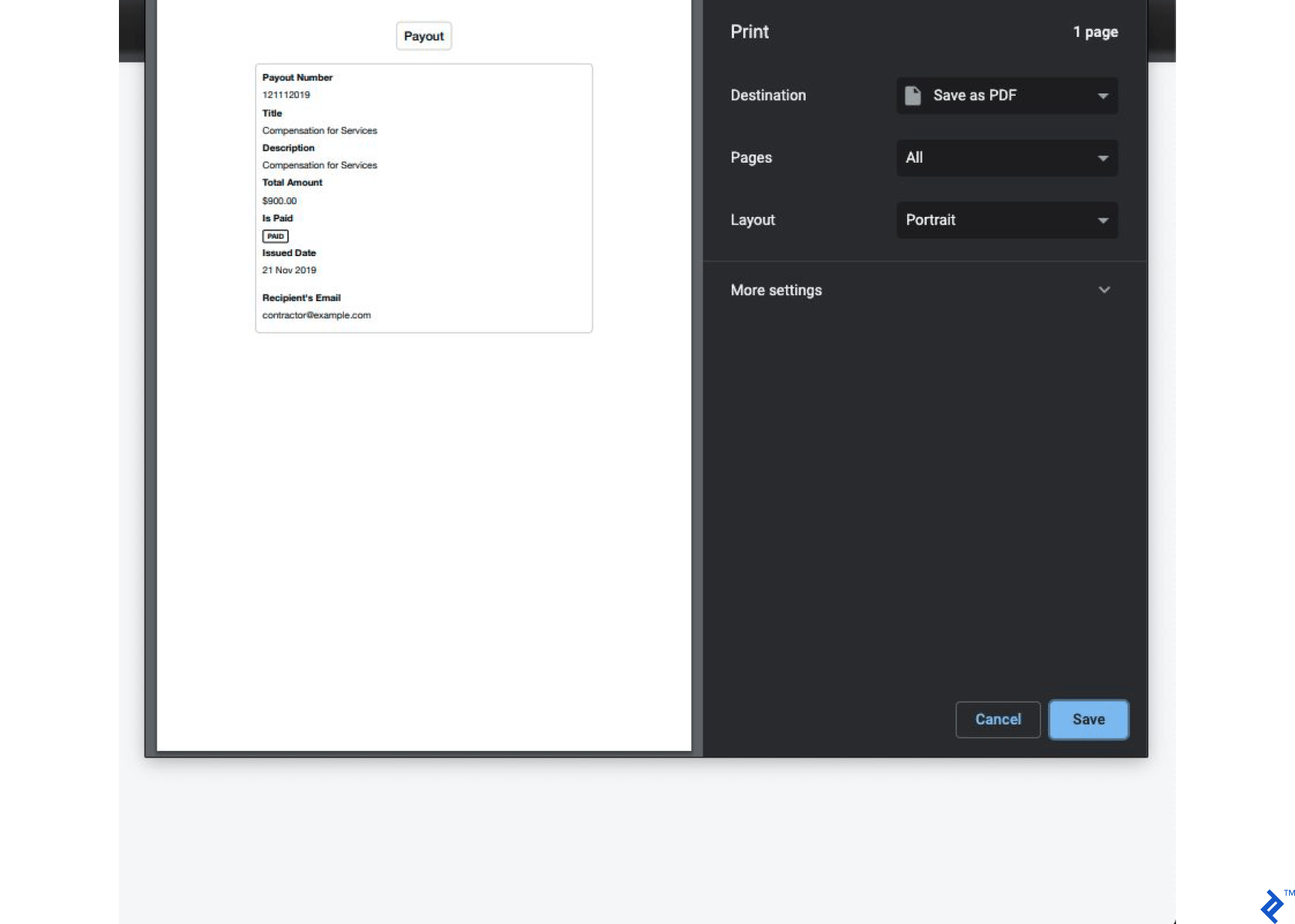

Payout Printout

Payout printouts serve documentation purposes.

The Code

Built using TypeScript for scalability, the application supports development and production modes. Production mode utilizes multiple threads for optimal core usage.

Data is managed using MongoDB, a popular NoSQL document database solution.

The UI leverages Bootstrap and SCSS for styling.

Both client- and server-side code adhere to a modular architecture, as described in “Creating Truly Modular Code with No Dependencies,” promoting maintainability and reusability.

Detailed information for deployment and further development is available in the project’s readme file.

Summary

Online marketplaces offer a streamlined and secure shopping experience, leading to their widespread adoption. Two primary models, broker and distributor, provide different approaches to facilitating transactions.

The choice of payment processor depends on the target market and specific business needs. While a bank account might suffice in certain cases, international or global operations require broader payment options.

This article provides a basic implementation guide for building online marketplaces. Hopefully, this information proves valuable for aspiring entrepreneurs and contributes to their business growth.