Thinking about handling taxes or finances often brings to mind feelings of stress and frustration. Finance isn’t exactly seen as the most exciting field – it’s a necessity for responsible adults, but not a particularly glamorous topic. This lack of inherent interest is just one of the many hurdles that marketers and advertisers in the finance industry have to overcome.

Marketing a bank or financial company in today’s world comes with a unique set of obstacles. Lucas Jones from Decibel Insight points out that “financial marketers face the daily challenge of addressing 21st-century issues using processes largely stuck in the 20th century.” Beyond grappling with outdated systems, financial marketers struggle to build trust. Research from PwC reveals that a mere 32% of people trust banks! So, how can financial marketers overcome these challenges and thrive? One effective approach is to invest in a strategic Google Ads (formerly AdWords) strategy, ensuring their businesses are easily found in search results. Chris Panetta, Senior Paid Search Strategist at nexus-security, emphasizes this point, stating, “Search is absolutely essential for maintaining engagement with potential loan and mortgage customers.” Chris has spent the past five years spearheading Google Ads strategies for over 30 organizations in the financial and banking sectors, ranging from payday and specialized loans to mortgages and traditional banking. He possesses a deep understanding of this market. I recently had the opportunity to delve into the key takeaways Chris has gathered over his extensive career. So, without further ado, let’s explore his eight top tips to help financial businesses stand out using Google Ads.

#1. Craft Distinctive Offers and Calls-to-Action

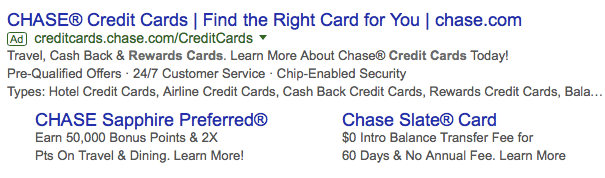

In a sea of competition, how can financial marketers make their mark on the search engine results pages (SERPs)? Chris recommends showcasing unique perks within ad copy. He advises, “Focus on benefits like ‘free airline miles’ and create distinctive offers and calls to action.” So, what makes your business special? Perhaps you offer a complimentary hour-long financial consultation to new clients? Or maybe you don’t charge annual fees and provide significantly more cash back than competitors in your niche? Jot down your most appealing perks and incorporate them into your ad copy. Utilize features like ad extensions to showcase even more offers. Take a look at the excellent example from Chase Bank below.

They manage to pack all these benefits into just one AdWords ad!

- Cash back and rewards

- Pre-qualified offers

- 24/7 customer service

- Chip-enabled rewards

- 50,000 bonus points

- 2X points on Travel and Dining

- $0 intro balance transfer free for 60 days

- No annual fee Quite impressive!

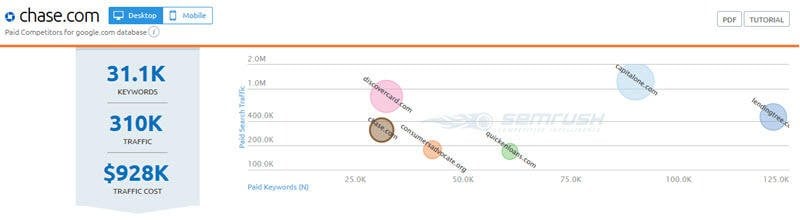

#2. Prioritize Targeting Competitors

In finance, ignoring the competition is not an option. Why? Because sales cycles in the banking industry tend to be lengthy. Remember our discussion about building trust? Prospects take their time, and a significant portion of that time is spent comparing different providers. Rather than letting competitors lure away these valuable prospects, financial businesses need to outmaneuver them on the SERPs. This involves allocating a portion of the advertising budget to bid on competitor keywords.

Chris revealed that one of his current financial clients allocates a staggering 75% of their monthly spend to competitive targeting. He emphasizes, “Winning over these prospects requires outdoing the competition in both visibility and pricing.” For those unfamiliar with competitive bidding on Google, this helpful post offers valuable dos and don’ts.

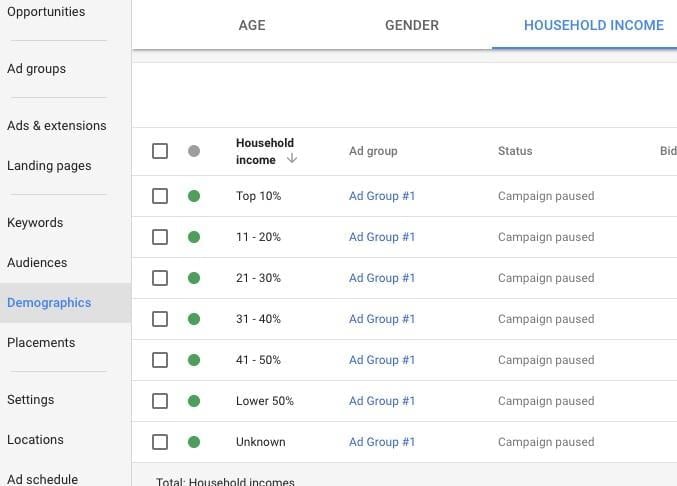

#3. Utilize Demographic and Income Targeting

Historically, aligning an ad with user intent on Google Ads has been somewhat challenging, despite keyword match types and negative keywords. This likely prompted Google’s September 2016 announcement, granting advertisers greater control over audience targeting. Similar to platforms like Facebook and Twitter, advertisers can now refine their audience based on factors like age, gender, and parental status.

Chris believes financial marketers should absolutely leverage this feature. “I consistently use demographic and income targeting to connect with individuals in management positions,” he states. This feature allows for bid adjustments based on specific audiences or the exclusion of irrelevant demographics to zero in on desired age groups and income levels. Avoid wasting resources on unlikely customers and leverage these tools to pinpoint more qualified leads. Learn more about income targeting here.

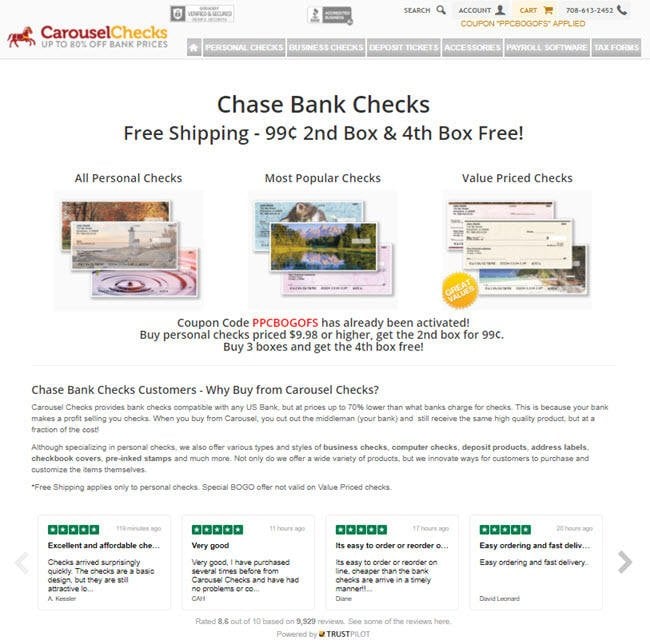

#4. Personalize Your Landing Pages

Having custom landing pages for your ads might seem obvious, yet busy marketers often overlook this crucial step. While understandable, dedicating time to create tailored landing pages based on ad groups and keywords can significantly impact lead conversion rates. Think back to a time when you searched for something on Google and landed on an unhelpful page. Did you continue browsing that website? Likely not – you probably clicked the back button and tried a different ad.

“Relevance is paramount,” Chris stresses. “Create dedicated pages for each product – for instance, separate pages for business checks, business manual checks, and business laser checks.”

#5. Utilize All Available Call Features

Call-only campaigns, call extensions, mobile bid adjustments, and call tracking are just a few Google Ads features that financial marketers should prioritize. Phone calls are integral to this industry, and phone leads often convert into sales more readily. “Phone calls are essential!” Chris exclaims. “My client values phone calls as they typically yield higher conversion rates and higher value transactions compared to website conversions.” Here’s a breakdown of the options mentioned earlier:

- Call-only campaigns: In these campaigns, bids and payments are geared towards generating calls instead of website visits. Strategies for call-only campaigns differ from regular search campaigns. This post provides valuable insights for success with call-only campaigns.

- Call extensions: Call extensions differ from call-only campaigns in that users still have the option to visit the website, but with the added convenience of a call extension. These extensions can be scheduled to appear only during business hours, ensuring calls are answered, which is a great feature.

- Mobile bid adjustments: Cell phones are the primary devices for making calls. Fortunately, Google allows for mobile bid adjustments, enabling businesses to bid higher on mobile traffic and generate more calls.

- Call tracking: Tracking calls is crucial for understanding ROI. For more on call tracking, refer to this post.

Optimizing campaigns for phone calls might seem like extra effort, but the payoff in increased call volume will be well worth it.

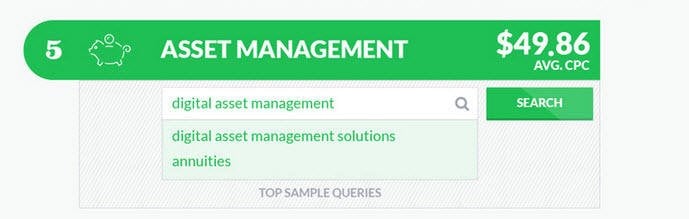

#6. Be Prepared to Invest

Advertising requires a budget, and in the financial sector, that budget might need to be larger than average. The reason? Financial keywords are highly competitive, and businesses in this industry are often willing to spend more for better ad placement. Ads below the fold receive significantly less attention, and being on the second page is even worse. Chris explained that CPCs in this industry are significantly higher, which presents a challenge. He cautions, “Don’t expect success with a small budget. Depending on your niche, CPCs can range from five to one hundred dollars.”

Finance and banking keywords are among the most expensive in Google Ads. On a positive note, new clients typically generate enough revenue to justify acquisition costs. The following tip can help manage your budget and ensure a positive ROI before making significant expenditures.

#7. Start Slowly with Search Campaigns

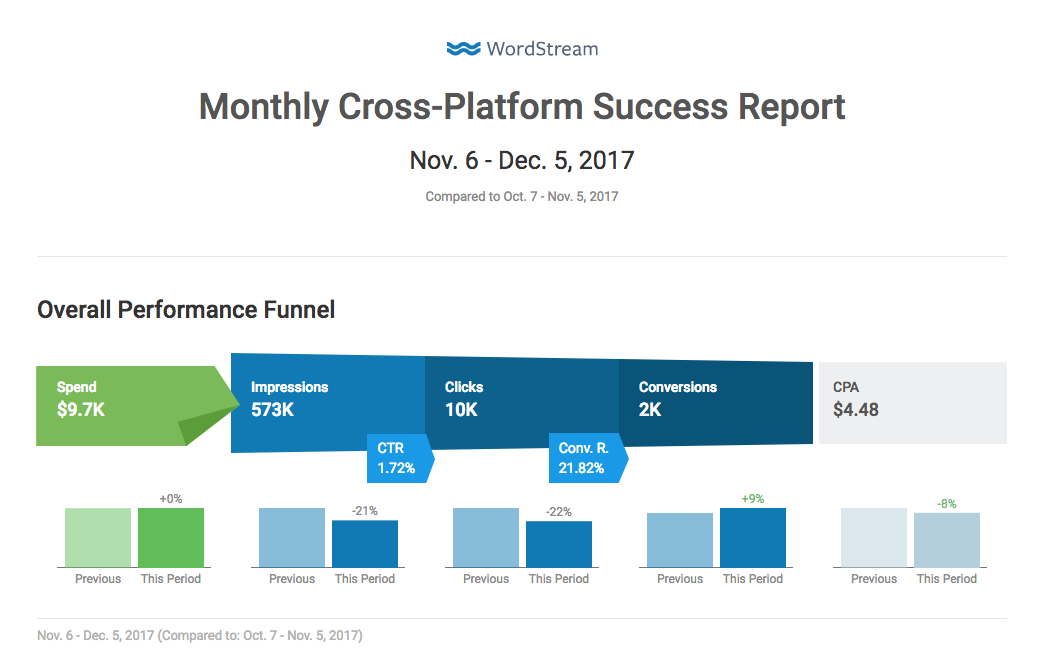

Whether you’re new to Google Ads or a seasoned user, running successful campaigns is crucial. Chris recommends a gradual approach to accurately measure results and allocate budget where it yields the highest ROI. “Begin with one to three campaigns and scale spending within those campaigns,” he advises. “With a limited budget, avoid spreading it too thin. Identify a core group of four to ten keywords and aim to dominate the impression share for those keywords.”

This strategy not only prevents wasted spending but also enables effective growth and performance measurement.

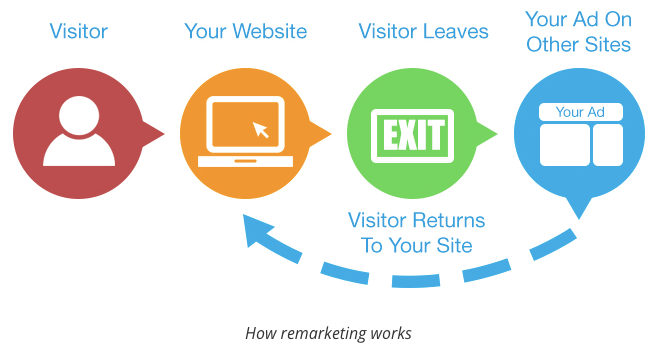

#8. Remarketing Is Key!

Remarketing involves gently reminding potential customers about your services by reappearing on their screens after they’ve shown initial interest. While it might sound intrusive, remarketing is a common practice, and it can be highly effective. This audience has already searched for and expressed interest in your products or services, indicating they are in the market and familiar with your brand – they might just need a nudge.

There are several reasons why remarketing is crucial in the banking and financial industry. Firstly, it’s a competitive landscape, making it essential to remind leads why they should choose you. Secondly, longer sales cycles come into play… “The average sales cycle for home loans and mortgages is six months, and during that time, potential customers will go through multiple research phases,” Chris explains. “Staying top-of-mind through search, remarketing, and RLSA is crucial to ensure they ultimately choose your client over competitors.” If you’re new to remarketing, this comprehensive guide can help you get started. Financial marketers are known for their financial acumen, so use these tips to make informed advertising decisions and maximize your ROI.