Working as a consultant specializing in marketing agency profitability, I often encounter a recurring issue. Agency leaders claim to be busier than ever, yet their cash flow doesn’t reflect this success. It’s not uncommon for agencies to reach this point of stagnation where they have mastered client acquisition but struggle with generating cash flow and maintaining profitability. This article will guide you through the most insightful agency metrics I’ve employed to assist clients in enhancing profitability, monitoring their advancement, and refining their strategies. For each metric, I’ll explain its meaning, significance, calculation method, and the target benchmark.

The five essential agency metrics

- Utilization rate

- Gross margin

- Average billable rate

- Scoping accuracy

- Overhead percent

Download the State of the Digital Marketing Agency Report to see how 300 of your agency peers think about services, pricing, and upcoming challenges.

5 agency metrics that will boost your profitability

Numerous methods exist to evaluate a marketing agency’s operational and financial effectiveness. The five agency metrics highlighted here are most effective at identifying the most significant obstacles and areas of loss.

1. Utilization rate

For agencies with an internal team handling client work, the utilization rate is the primary and most fundamental metric to monitor for profitability.

What is utilization rate?

Employees who interact with clients can divide their work hours into billable and non-billable hours. Billable hours are dedicated to client projects or direct client interaction, while non-billable hours encompass activities not directly related to clients, such as internal projects and meetings. Utilization represents the percentage of your employees’ total time that is billable. To enhance your agency’s profitability, ensure your team has ample client work to maintain a certain threshold of billable hours.

Why is utilization rate important?

Understanding your utilization rate prevents situations where you’re paying salaries without generating corresponding revenue. If your team isn’t fully engaged, optimizing profitability becomes less relevant, as time saved through increased efficiency cannot be allocated to other revenue-generating opportunities. If your agency primarily relies on contractors or external partners for client work, utilization might be less of a concern. This is because you don’t pay contractors when the agency isn’t busy. While your contribution or gross margins might be lower, maintaining a flexible workforce could be advantageous until you establish a consistent client acquisition funnel and channels.

How do you calculate utilization rate?

To calculate the utilization rate, use the following formula: Gross capacity / Billable hours = Utilization rate

- Gross capacity: The total available billable hours (typically, 40 hours per week for 52 weeks, totaling 2080 hours annually, excluding time off).

- Billable hours: The time spent on client-related work, regardless of billing method (hourly or otherwise).

Utilization benchmarks

On a weekly basis, aim for a utilization rate of 75% to 90% for your core production team (designers, developers, copywriters, etc.).

Annually, your production team should strive for a utilization rate between 65% and 80%.

With utilization exceeding 65% and efficient revenue generation, your business should achieve healthy margins (more on this later).

Ready to scale your agency’s growth? Get the 6 Absolute Best Strategies to Grow Your Digital Marketing Agency.

2. Gross margin

Digital marketing agencies typically track revenue efficiency using two primary methods: gross margin and average billable rate. We’ll examine the pros and cons of each to help you determine the best metric for measuring and enhancing your agency’s profitability. Let’s begin with gross margin, the first metric for assessing revenue efficiency.

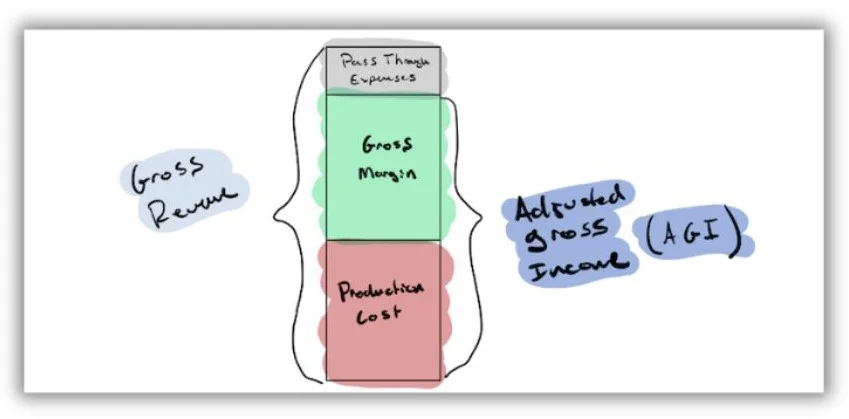

What is gross margin?

Gross margin is a well-established method for determining production profitability. It involves calculating the profit margin per client or project by subtracting time and material costs from client payments.

While generally more precise, this method can be more expensive and time-consuming as it usually involves accounting software. Without frequent bookkeeping, you may only be able to review it retrospectively.

While generally more precise, this method can be more expensive and time-consuming as it usually involves accounting software. Without frequent bookkeeping, you may only be able to review it retrospectively.

Who should use gross margin?

I recommend the gross margin metric for established agencies with a bookkeeper providing biweekly or weekly updates and those working extensively with contractors.

Why is gross margin important?

Consistently achieving gross margins within this range indicates efficient delivery systems for profitable scaling, enabling you to finance your agency’s growth through cash flow.

How do you calculate gross margin?

Calculate gross margin using the following formula: Adjusted gross income – (COGS/Labor costs) = Gross margin Gross margin / Adjusted gross income = Gross margin %

- Adjusted gross income (AGI): Revenue remaining for the agency after deducting pass-through expenses (ad spend, print budgets, equipment rentals, etc.).

- COGS and labor costs: Costs associated with personnel assigned to the project, including internal staff and external contractors. To determine the employee cost per hour for internal team members, divide their salary plus benefits by their gross capacity (usually 2080 hours per year for most employees: 40 hours x 52 weeks).

Gross margin benchmarks

For a highly profitable and scalable agency, aim for a gross margin of 50-70% per client or project. This should result in an agency-wide margin of 40-60% annually, providing a buffer for standard overhead expenses and unforeseen slow times without compromising net profitability. One effective way to enhance efficiency and improve gross margin is by utilizing AI marketing tools designed for agencies.

3. Average billable rate (ABR)

Average billable rate offers a simpler and more accessible way to assess revenue efficiency and compare the profitability of different clients or projects.

What is ABR?

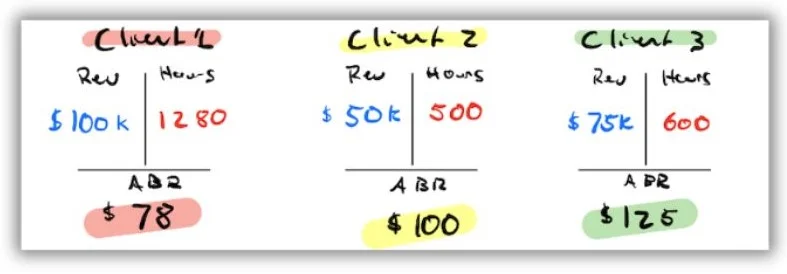

ABR helps determine the average hourly rate earned based on the time taken to generate revenue. Although slightly less accurate, this method is quicker and simpler to calculate, eliminating the need for a bookkeeper or accountant.

Who should use ABR?

I recommend the ABR metric for smaller agencies starting with metric tracking and those working primarily with in-house staff rather than contractors.

Why is ABR important?

Similar to gross margin, achieving ABR goals enables profitable growth. ABR serves as a quick check on both client profitability and service delivery efficiency.

How do you calculate ABR?

Use the following formula to calculate average billable rate: Adjusted gross income / Hours worked = ABR

- Adjusted gross income (AGI): Revenue remaining for the agency after covering pass-through expenses such as ad spend, print budgets, and equipment rentals.

- Hours worked: The total time dedicated by your team to complete the client’s work.

ABR benchmarks

The target for average billable rate aligns with gross margin. Aim for a margin of 50-70% when considering the average hourly cost of production labor. Typically, this translates to an average billable rate approximately 2.5 times your average employee cost per hour or the rates paid to contractors. For instance, if the hourly cost of labor is $50, target an average billable rate of $125 (2.5 x $50, equivalent to a 60% gross margin).

4. Scoping accuracy

The inherent risk of any service-based business lies in the fact that many critical functions rely on daily assumptions made during the work scoping process.

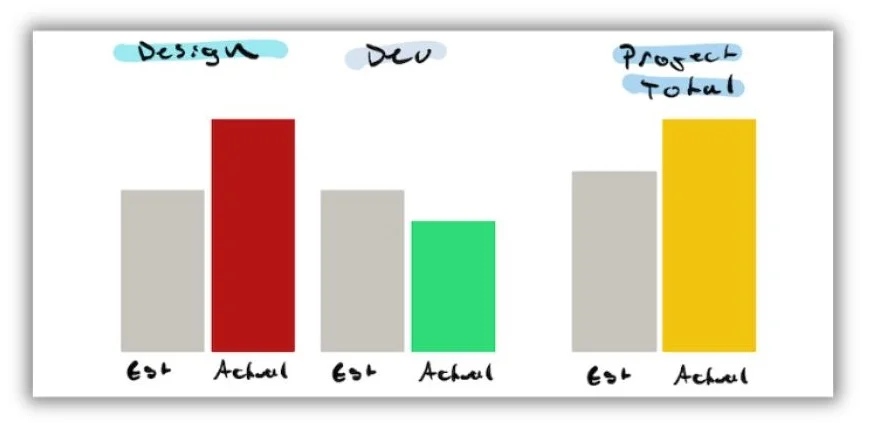

What is scoping accuracy?

Determining pricing, hiring decisions, resource allocation, and team assignments all depend on our understanding of what’s needed to deliver the promised client deliverables—the scope of work.

Why is scoping accuracy important?

Scaling our agency and team profitably becomes challenging without feedback on the accuracy of our assumptions. Therefore, implementing a feedback loop is crucial for evaluating the validity of our pricing assumptions.

How do you calculate scoping accuracy?

Calculating scoping accuracy is straightforward using the following formula: Estimated time and cost / Actual time & cost = Scoping accuracy (%)

- Estimated time and cost: The projected time and money required to complete the work.

- Actual time and cost: The actual time and money spent on completing the work. This is usually categorized into “buckets” such as design, development, and project management. For more insights and to avoid common agency pitfalls in this area, refer to my guide on choosing the correct structure for your estimates and actuals.

Scoping accuracy benchmarks

An acceptable margin of error is within 20% of the projected budget, with exceeding the budget being a greater concern. However, at scale, strive for a consistent margin of error below 10%. This should become attainable over time as you gather more data and implement processes to bridge the gap between assumptions and reality, effectively creating your own agency profitability flywheel..

5. Overhead percent

Once you have a grasp of utilization, earning efficiency, and scoping accuracy, your agency will be significantly ahead of the competition. You’ll experience greater stability, reduced cash flow concerns, and a clearer path for growth planning. The final step in fine-tuning your agency’s profitability is managing overhead spending—ensuring it’s balanced with your income.

What is overhead percent?

Overhead costs encompass expenses that support your agency’s operations but are not directly linked to creating a specific product or service. These are the ongoing, essential costs of running your business that do not generate direct revenue. The three main overhead categories we’ll cover are administrative, facilities, and sales & marketing. Overhead percent represents the proportion of your adjusted gross income allocated to overhead expenses.

Why is overhead percent important?

Staying within the acceptable ranges for each area allows you to meet your agency’s needs based on its size while maintaining healthy profit margins. During periods of rapid growth, you may find yourself spending ahead of your current scale. For example, you might secure a larger office space than currently needed in anticipation of future hiring. This is acceptable as long as such investments are made strategically and with a plan to eventually align expenses with your income.

How do you calculate overhead percent?

The percentages for each overhead category may vary depending on your accountant’s guidance on classifying expenses that fall into “grey areas.” To calculate overhead percent, use the following formula: Overhead spending / Adjusted gross income = Overhead %

- Overhead spend: Any expense related to administration, facilities, or sales and marketing (further explained below).

- Adjusted gross income (AGI): The remaining revenue after deducting pass-through expenses such as ad spend, print budgets, and equipment rentals.

Overhead percent benchmarks

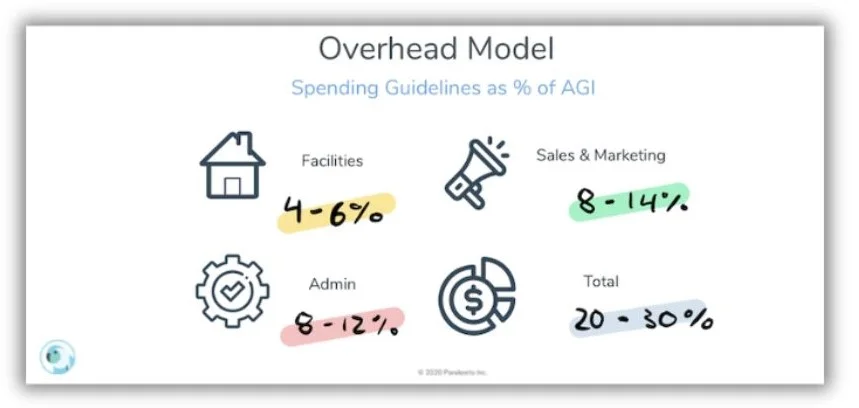

As a general guideline, total overhead spending should constitute approximately 20-30% of your adjusted gross income (AGI). Pay attention to these three primary categories within overhead:

- Administrative expenses: These include accounting, legal fees, receptionist costs, and a portion or all of the director’s or owner’s salary. The target for administrative expenses should be 8-12%.

- Facilities expenses: These cover costs associated with providing a suitable work environment for your team, such as rent, parking, and utilities. Aim for facilities expenses to be around 4-6%.

- Sales and Marketing expenses: These include expenses related to acquiring new business, including marketing spend, sales software, and salaries for the sales and marketing team. Target 8-14% for sales and marketing expenses.

These agency metrics will have a big impact on your profitability

The key takeaway is that even small steps in measuring these simple metrics can significantly impact your profitability. My experience working with numerous agencies has shown that many struggle with this aspect. By implementing even reviewing of these measures, you can differentiate your agency from competitors and position yourself for long-term success. The peace of mind that comes with healthy cash flow, efficient systems, clear financial data, and visibility into your progress can make running your agency much more manageable and enjoyable for both you and your team. Let us demonstrate how we can help increase your agency’s profitability and enhance the results you deliver to clients.