“Everyone knows getting people interested in insurance is crazy expensive.” – Old Proverb.

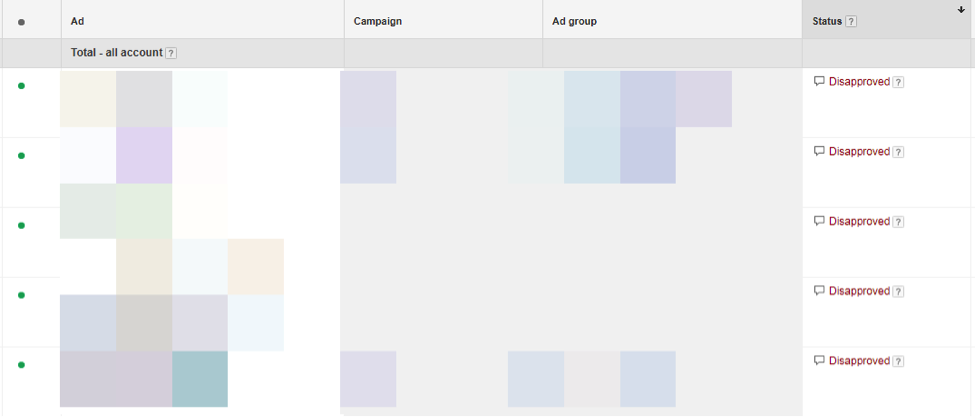

It’s not just the cost; managing Google Ads (formerly AdWords) for insurance is a headache, whether it’s your account or a client’s. While some marketers brag about easily snagging leads, many Google Ads agencies struggle with restrictions, sky-high costs, and picky customers.

Some strategies are off-limits depending on the type of insurance leads you want, frustrating both you and your clients (especially the screamers). It’s a whole drama.

What if I told you there are ways to spend less and get more insurance leads – the good kind? I bet you’re nodding, and it’s about to get even better… There are tons of ways to make Google Ads work for insurance marketing. And by a ton, I mean 5 (for today). Call them hacks or magic tricks, let’s dive in.

Insurance Marketing Tip #1: Beat Pricey Clicks with RLSA

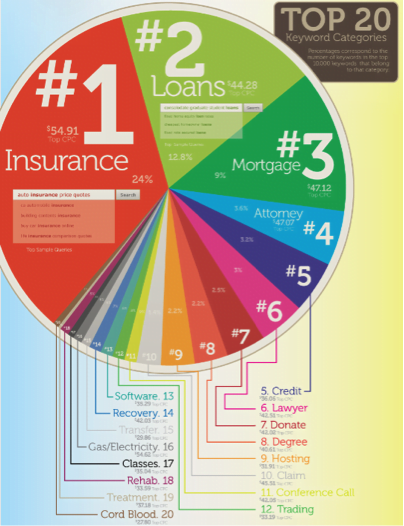

Boom! Seriously, insurance keywords are crazy expensive, no matter what type of insurance (health, car, home, etc.) your clients offer. I don’t need to tell you that, but who doesn’t enjoy a little “told ya so” moment?

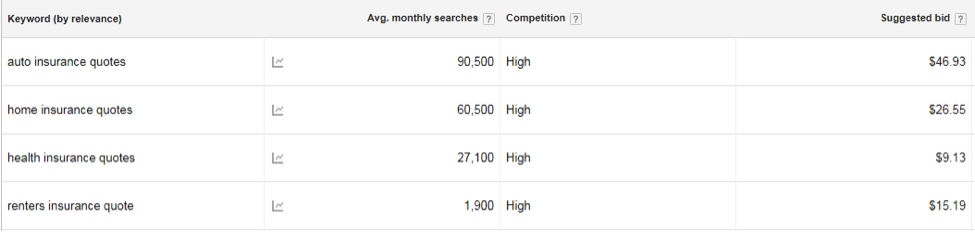

Ouch. Thank goodness for RLSA. RLSA (Remarketing Lists for Search Ads) lets you adjust bids on search ads when someone from your remarketing list searches for your keywords. Easy, right? This is gold for pricey industries because you can bid higher when you have an edge. Let’s say someone visits your site for a health insurance quote.

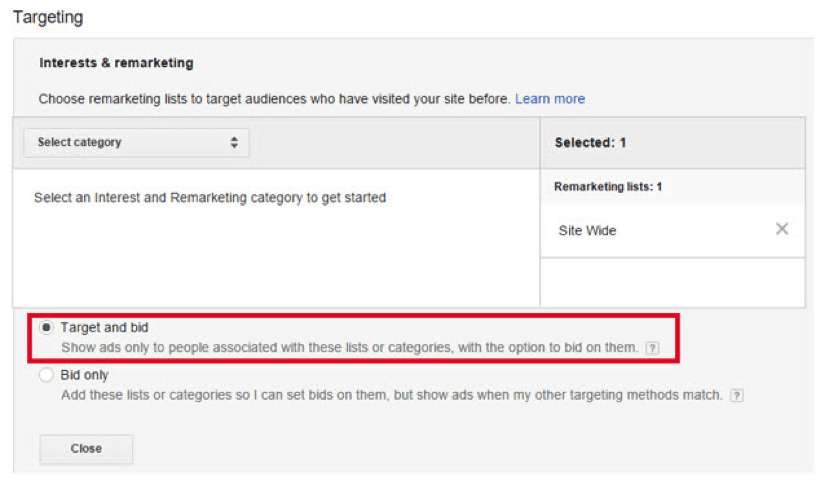

They start the process but leave. You’re thinking, “I’ll just retarget them on display ads until they come back.” Smart, but I have something better. They might still want a quote, but browsing the web is different from searching “car insurance quote boston” multiple times. They’re probably ready to buy (who “window shops” for insurance?). Suddenly, paying $20+ for a click seems reasonable. Here’s another RLSA trick: the “target and bid” feature. Usually, RLSA just adjusts bids, but this makes sure you only appear when someone from a specific remarketing list searches for your keywords.

This lets you use display ads and cheaper keywords to bring people to your site (adding them to remarketing lists), then target them with higher bids on those expensive keywords without wasting money on less interested traffic. You’ll get fewer impressions, but they’ll be more valuable.

Insurance Marketing Tip #2: Use Emotions to Stand Out

Brand recognition matters everywhere, right? You want the iconic red can, not just any cola. Insurance is the same. Those geniuses behind Flo, the Gecko, and that mayhem guy protect their brands. So unless you’re affiliated, you can’t use their names in your Google Ads. Bad idea.

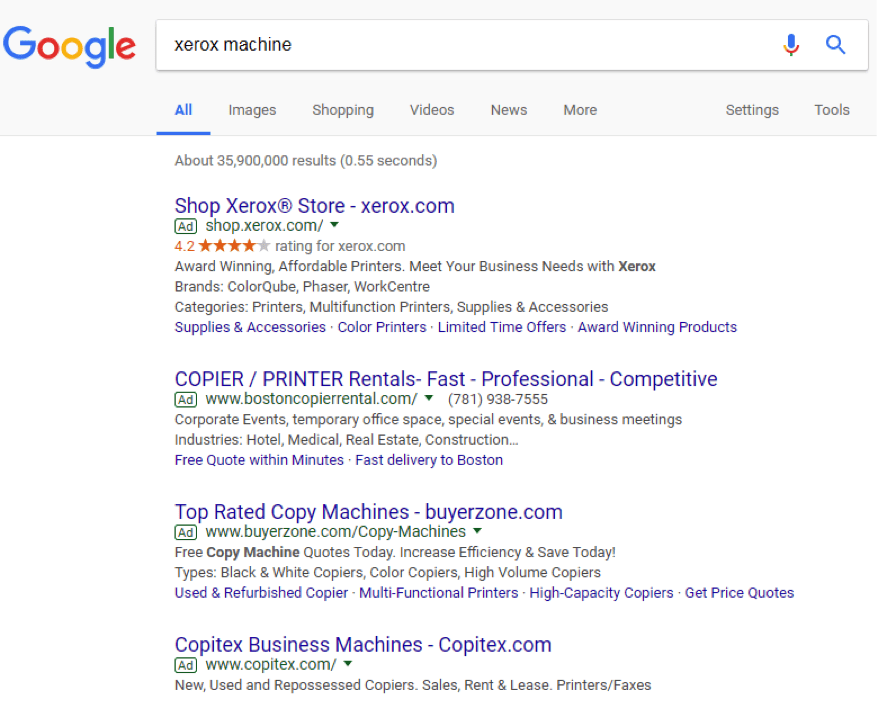

Bidding on [blue cross blue shield health insurance quote] when you’re not BCBS is tough. Even if an insurer lets your client sell their policies, they won’t let you use their brand name in your ads. This makes high Quality Scores nearly impossible and makes you invisible online. Here’s an example from another industry…

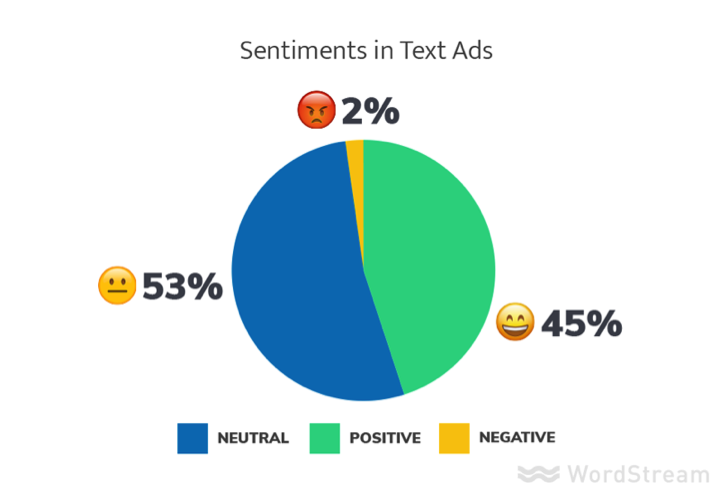

Those lower-ranked ads can’t use “Xerox” even though it’s often used for copiers. But their boring ads don’t help either. They all look the same, just expensive background noise. What if they used emotion (positive or negative) to spice things up? We analyzed top-performing Google Ads and found that 45% used positive sentiment.

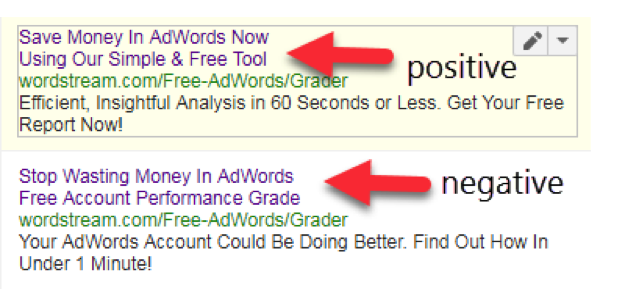

What does that look like? Like this!

These ads target brand keywords we can’t use, but they work because they’re not just “PPC Blah Blah Blah PPC.” They use emotion. Think about the insurance your client sells and how people feel when they need it. Frame it positively and negatively (testing helps!), and stand out! Even if people don’t buy, a click lets you retarget them.

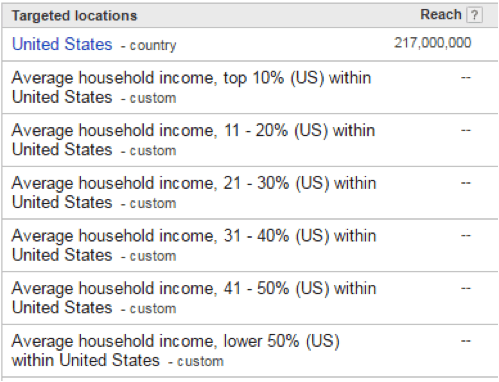

Insurance Marketing Tip #3: Target the Right Income Levels

Let’s be real:

- People without boats don’t buy boat insurance.

- Billionaires don’t buy $10k burial policies.

- You won’t sell variable life insurance to a broke 26-year-old (hi mom!). Point is, many people aren’t right for your clients’ insurance. Income targeting focuses spending where it’s most effective. It’s like using RLSA to target expensive keywords only after someone visits your site. If you can target areas with specific income levels, you avoid wasted impressions. This isn’t ideal for car insurance, but if your clients’ customers have a certain income, use that.

The best part? Combine income targeting with RLSA for even better results. It’s what marketers call “living the dream.”

Insurance Marketing Tip #4: Use Demographics to Craft Ads

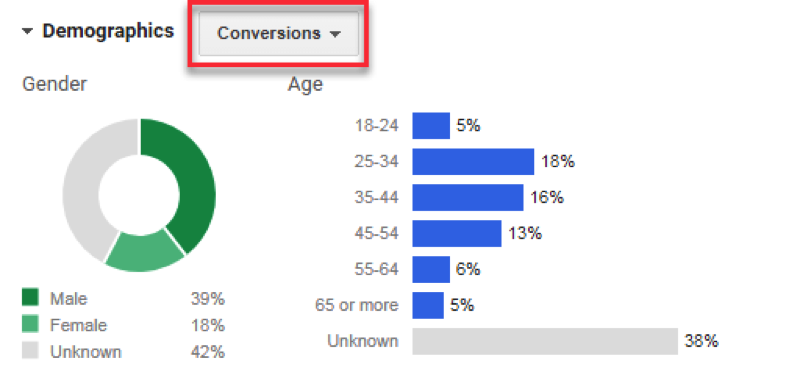

Knowing your ideal customer is key to maximizing Google Ads spending for insurance. The “Audiences” tab is usually for adjusting bids by gender and age. But it’s also great for creative ideas.

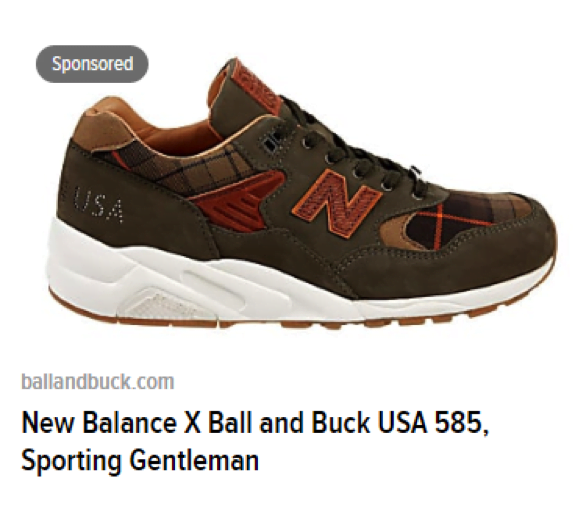

The trick is changing from “clicks” to “conversions” (clicks are useful for testing ad copy). If most renters insurance buyers are men aged 25-34 (like above), your copy and visuals should be different from, say, homeowner’s insurance in a wealthy area. For example, if your target is middle-aged women, you probably wouldn’t use an ad like this…

Risqué? Maybe. But this type of ad can backfire if it doesn’t fit your audience. This applies to all advertising, especially when keywords cost over $50 per click.

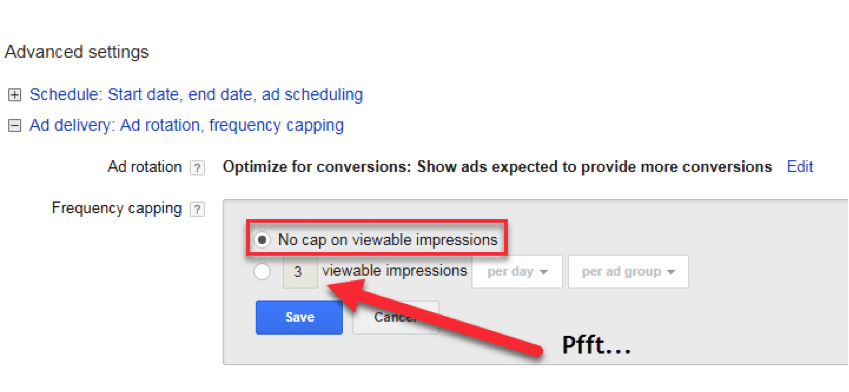

Insurance Marketing Tip #5: Forget Frequency Capping (Briefly!)

(This pains me to say. Anything for you guys.) I love frequency capping because I’m a consumer. Seeing the same shoes or sandwich follow me online for weeks is annoying.

I usually limit remarketing ads to 3 impressions per day per campaign. But rules are made to be broken.

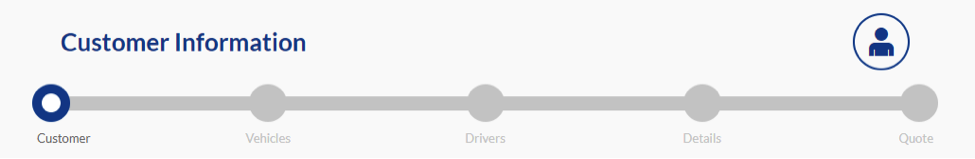

Think about it: someone just searched for “car insurance quote” and clicked your client’s ad. They either need car insurance or want to switch. That’s pure intent. When I wanted car insurance, I did the same. The first ad was Geico, so I clicked. After entering my zip code, I landed on a page asking for more info with a cool slider.

The quotes weren’t good enough, so I left. And then it began…

That orange dude and his friend, Mr. Fancy Coffee…

They’re still following me. I’ll never click. But if my rates go up or I have a bad customer service experience, how could I not spend 15 minutes trying to save money?