In times like the COVID-19 pandemic, if your physical store is forced to close, your production halts due to supply chain disruptions, or you simply can’t fulfill orders, your incoming cash flow takes a severe hit, potentially pushing you into a state of negative cash flow. This means your business is spending more than it’s earning, with expenses like salaries, rent, marketing, and other costs exceeding your income. While this is a serious issue, it’s not uncommon. Research indicates that even during economic boom times, 82% of small businesses that fold do so due to cash flow issues.

Intuit released its State of Payroll in early 2020, with a focus on small business cash flow. Therefore, focusing on achieving positive cash flow in the current market is crucial for your business’s survival and future. To guide you in bolstering your cash flow, we’ll delve into three fundamental principles:

- Cost reduction

- Prioritizing cash generation

- Team empowerment We’ll examine how each principle contributes to effective cash flow management, along with practical examples to implement in your business today.

1. Minimize Expenses

As a small business owner, reassessing your finances was likely a top priority from the get-go, especially if you sought a PPP loan. However, continuous financial review is vital in these times. If you haven’t already, or if downsizing necessitates a fresh look, here are some immediate steps to take.

Identify and Analyze Costs to Strategize Cuts

Let’s clarify the difference between fixed and variable costs.

Often, easier to cut variable costs than it is fixed costs, making them the initial target for reduction. Explore cheaper shipping alternatives or consider temporarily replacing sales commissions with other incentives. Think creatively about transforming fixed costs into variable ones. When in doubt, draw inspiration from entrepreneur Brad Emerson’s approach during the Great Recession – he slashed non-essential expenses like maintenance, computer costs, and even air conditioning. Now is the time for lean operations. If you’re new to scrutinizing expenses for cuts, resources like the SBA’s free worksheet and Entrepreneur’s break-even calculator can guide you.

Seek Assistance with Honesty and Empathy

Remember, our economy operates as an interconnected system. Your suppliers and landlords rely on your business’s success. Therefore, open communication is key. If rent payments pose a challenge, have a transparent, virtual face-to-face meeting with your landlord. Be upfront about your immediate needs and potential future requirements. If you can manage rent now but foresee difficulties in two months, don’t jeopardize future assistance by seeking unnecessary relief. Allow your landlord to support tenants facing immediate hardship. This not only preserves your access to future assistance when you truly need it but also safeguards your business’s integrity in the long run.

Explore Alternative Financing Options

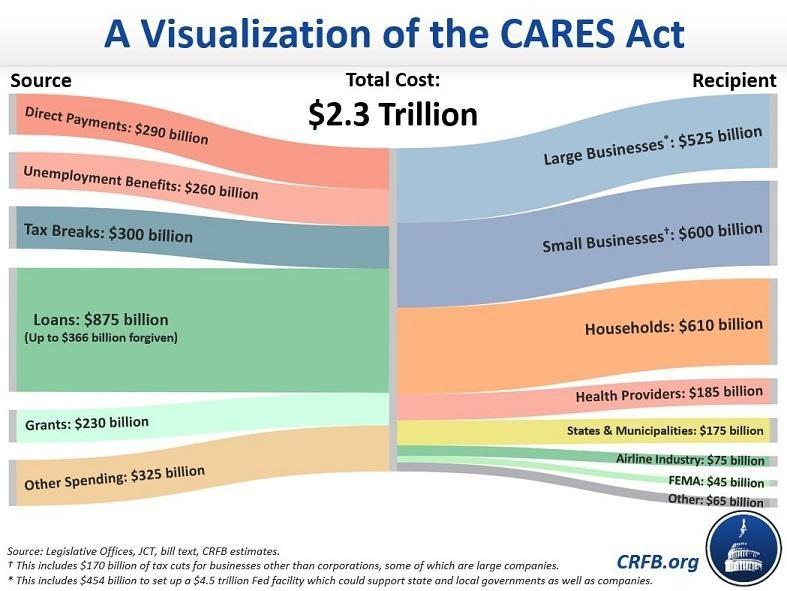

From the CARES Act’s emergency funding to grants from corporations like Facebook and Google, and local donation-based funds, there’s likely a suitable funding solution for your business. While taking on a loan might feel drastic, it can be the difference between rebuilding from scratch during a recession and maintaining a solid foundation.

Consider exploring the SBA’s catalogue of resources and Inc.’s helpful list for potential small business loans and grants, and contact your local government to inquire about available programs.

Remember, Everyone is Facing Challenges

Now’s the perfect time to review outstanding invoices. While this task may seem tedious in good times, a thoroughly necessary one now. Contact clients or partners with overdue payments and initiate a compassionate and honest dialogue. Provide them the space to discuss their own situation and needs. If feasible, consider extending payment deadlines for those who require it. If not, utilize this opportunity to encourage timely payments, benefiting your balance sheet.

2. Prioritize Cash Generation over Profitability

Profit represents total sales minus the cost of production (variable costs). Profit doesn’t equal positive cash flow and right now, cash flow is paramount.

Shifting focus from profit to cash flow can be a mental hurdle, but if you’ve already tackled immediate cash flow improvements like cutting variable costs, many profit-generating activities can be adapted or prioritized for cash generation. For instance, many brick-and-mortar businesses are promoting e-gift cards. While not a novel revenue stream, gift cards aren’t usually heavily marketed except as a last-minute holiday push. Currently, pivoting to emphasize gift cards is a simple, low-cost strategy to generate immediate cash without incurring production costs. Consider these additional ideas:

Offer Exclusive Discounts to Existing Customers

Acquiring new customers is always more expensive than driving sales from prior or existing customers. In the current climate, with unemployment, spending hesitancy, and millions working remotely, converting new business is more challenging than ever. However, if you’re a consumer brand, your existing customers likely have pent-up demand. Strategic discounts, timed appropriately with a compelling “exclusive” message, can boost sales, generate cash, and cultivate customer loyalty. Plus, selling off inventory can help reduce rental or storage costs.

Repurpose Products or Services for Consumers

Many products cater to businesses with office spaces (like furniture) or reach consumers through intermediaries (like Target). Challenge your marketing team to brainstorm rebranding ideas and create a basic landing page to directly target consumers. For example, HUNGRY@Home, typically serving corporate events, now focuses on preparing and delivering safe, healthy, and affordable family meals directly to homes.

HUNGRY@Home’s offering.

Adapt Offerings for Improved Margins

If possible, tailor your offerings to the evolving needs of post-pandemic customers. Focus on products or services that provide high-profit margins, economies of scale, and reliable payment collection methods. Let’s break down these aspects:

- High-profit margin: Prioritize products or services with a high selling price and relatively low production costs. A Zoom subscription is affordable, so leverage your team’s diverse skills to deliver value virtually. One example: My local dance studio studio now conducts online classes and even hosts a virtual “Dance Mixology” class with a teacher to promote a sponsorship campaign. Aside from his salary, Zoom subscription, and potentially bartending tools, the only additional cost is ingredients.

- Economies of scale: Many restaurants are adapting menus to feature family-style meals (like HUNGRY@Home) or offering limited options. Bulk purchasing always saves money, so if you can adjust your offerings to accommodate this with limited supplies, your cash flow will benefit.

- Reliable payment collection: Minimize reliance on invoicing. Implement online checkout for immediate credit card payments before delivering value, even for digital or virtual products. Explore subscription models; with current circumstances, customers who value your offerings might appreciate the convenience.

Identify and Fill a Local Niche

As Shopify highlights, with Amazon prioritizing essentials, local businesses can fill the gap by providing swift, contactless delivery for items like books, summer apparel, home repair tools, and other non-essential but helpful products.

Experiment with offering these to existing customers at a discount, free or reduced delivery fees, or other promotions to gauge demand and maximize cash flow.

3. Empower Your Team with Transparency

The phrase “We’re all in this together” is ubiquitous for a reason. It applies to safeguarding vulnerable neighbors and ensuring your small business’s survival. As a leader, now’s not the time for isolation. Step up and lead by empowering your employees. How? Start by being transparent about your business metrics and goals. While establishing a shared objective fosters unity and pride in ordinary times, you might hesitate to share metrics during a crisis, especially if initial goals are no longer feasible. However, being open about the actions needed to stay afloat – particularly cash flow objectives – demonstrates trust in your employees and empowers them to contribute.

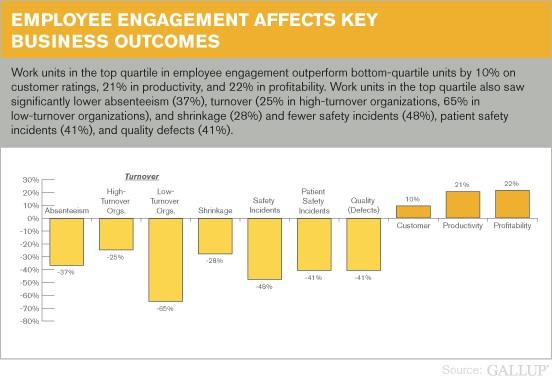

Transparency and openness to new ideas can also enhance employee engagement, a positive for any business. Empowerment also involves ensuring everyone understands the metrics. Explain the P&L and balance sheet. Clarify the difference between profit and positive cash flow, and why the latter is currently crucial. Crucially, ensure everyone understands their individual impact on the business. My previous employer visualized cash flow with a chart where we each placed post-it notes representing our tasks, illustrating how our work influenced the business. This provided a tangible understanding of our contributions. Replicate this virtually with a shared document. Encourage immediate feedback on improving cash flow, emphasizing that all ideas are valuable and everyone’s role is vital. By investing time in educating and empowering your team, you’re fostering resilience and unlocking their creativity and motivation to tackle challenges head-on. Because, truly, we are all in this together.

Managing Cash Flow is Familiar Territory—That’s Good News

Whether this crisis is your first or not, it’s not the first time small businesses have faced such uncertainty. Lessons from 2008, whether about cash flow or other business skills, remain relevant. As you work on improving cash flow, remember what worked previously and seek insights from colleagues and partners. Connect with other small business owners and inquire about their 2008 experiences. Read about the journeys of the experiences of Brad Emerson and others. Explore responses not just within your industry, but also in related sectors. Involve your entire team: create a shared document to record successful and unsuccessful strategies. Review and discuss these findings as a group. The solution to your cash flow challenges might emerge simply by asking a fellow entrepreneur a few questions.